1/

China’s silver market just sent another message —

the physical world is tightening, not loosening.

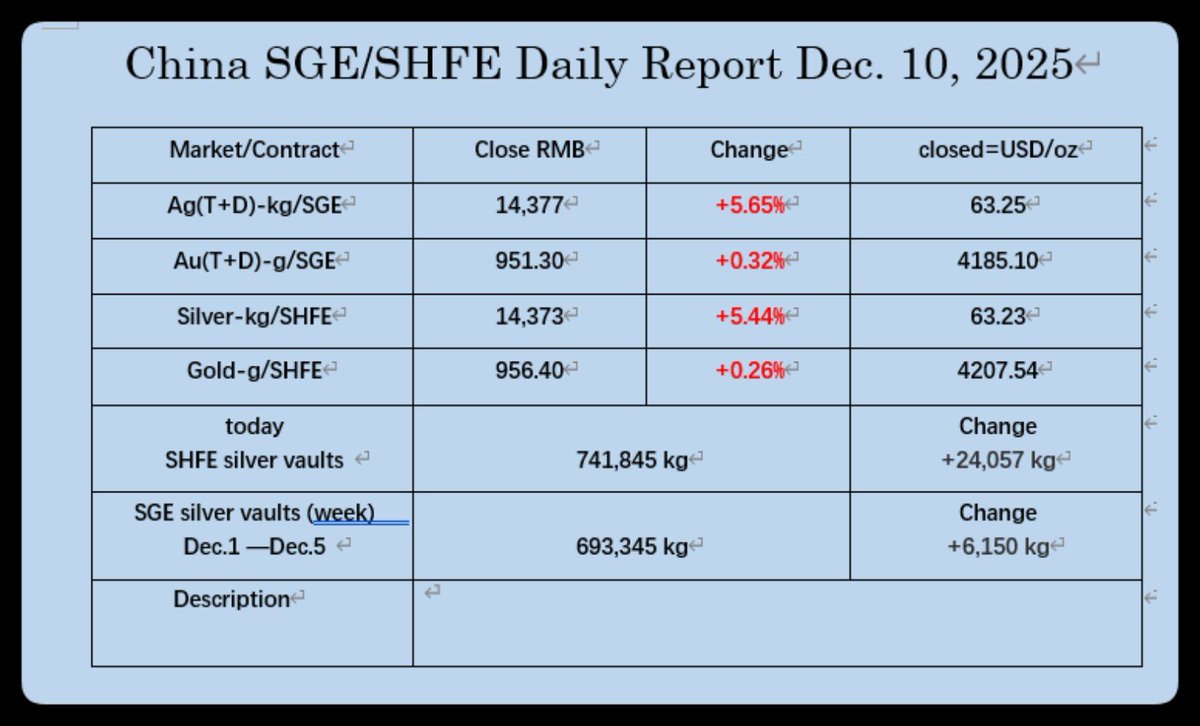

Both SGE and SHFE closed the week higher:

SGE silver: +1.12%

SHFE silver: +2.06%

Price in USD: ** ~$60/oz**

When both markets rise together, it’s usually one thing:

➡️ Real demand. Real metal. Real pressure.

China’s silver market just sent another message —

the physical world is tightening, not loosening.

Both SGE and SHFE closed the week higher:

SGE silver: +1.12%

SHFE silver: +2.06%

Price in USD: ** ~$60/oz**

When both markets rise together, it’s usually one thing:

➡️ Real demand. Real metal. Real pressure.

2/

Just look at the vaults:

SHFE silver vaults

Dec 5: 687,956 kg

Dec 8: 699,291 kg

A small +11,335 kg bounce —

after a massive –28,680 kg weekly draw just days before.

This is classic supply-tightness behavior:

➡️ Big outflows

➡️ Tiny inflows

➡️ Price keeps rising

The vaults are rebuilding nothing.

They’re barely breathing.

Just look at the vaults:

SHFE silver vaults

Dec 5: 687,956 kg

Dec 8: 699,291 kg

A small +11,335 kg bounce —

after a massive –28,680 kg weekly draw just days before.

This is classic supply-tightness behavior:

➡️ Big outflows

➡️ Tiny inflows

➡️ Price keeps rising

The vaults are rebuilding nothing.

They’re barely breathing.

3/

And the SGE weekly vault numbers?

This week: missing / delayed.

Historically, that almost always means two things:

1) Volatility

2) A strong weekly move — usually a large outflow

Last week’s draw was nearly –29 tons.

If this week is similar or even larger, it will surface soon — and the price action is already hinting in that direction.

And the SGE weekly vault numbers?

This week: missing / delayed.

Historically, that almost always means two things:

1) Volatility

2) A strong weekly move — usually a large outflow

Last week’s draw was nearly –29 tons.

If this week is similar or even larger, it will surface soon — and the price action is already hinting in that direction.

4/

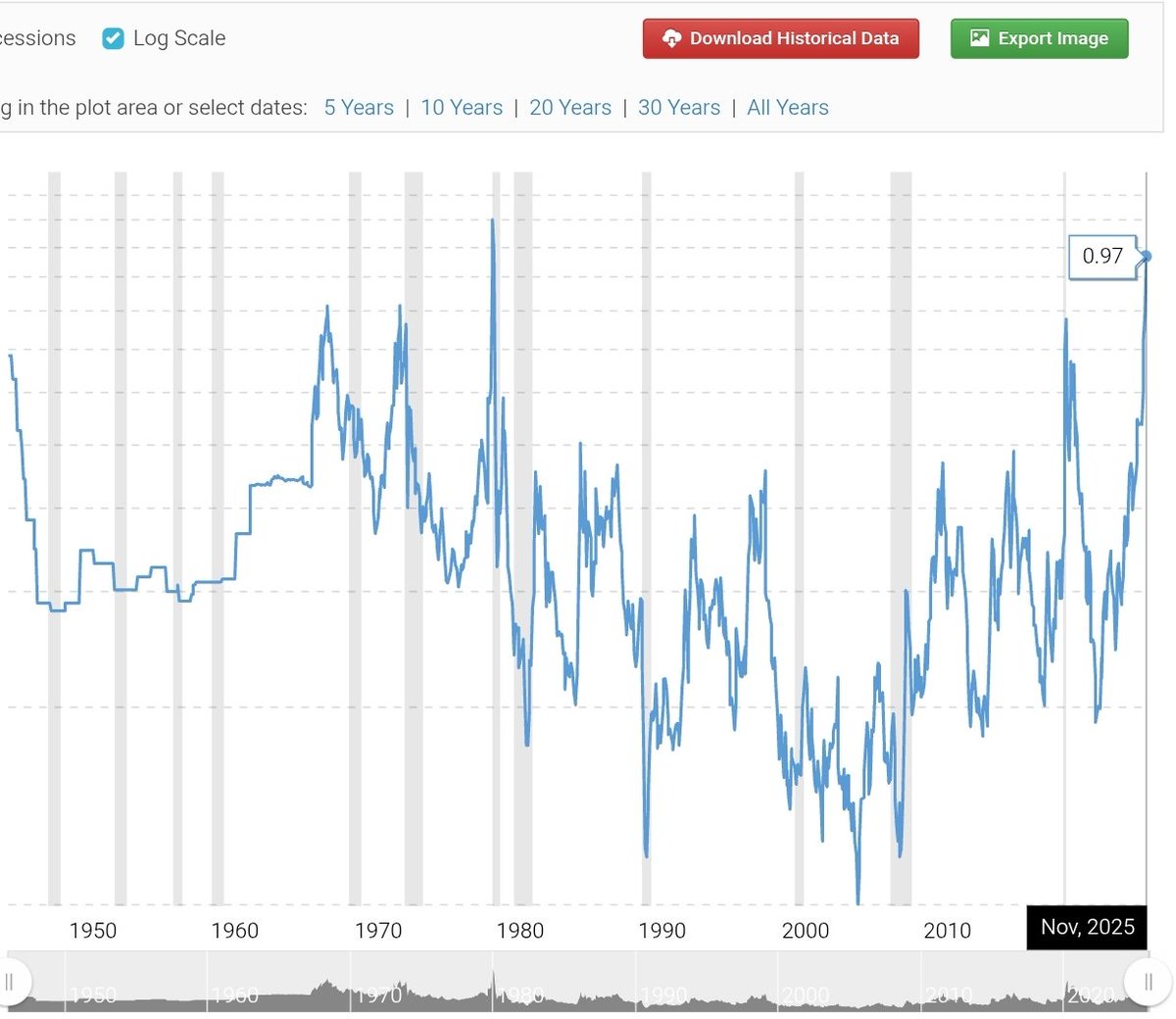

Meanwhile the global picture hasn’t changed:

China imports are still at record volumes

India keeps absorbing tens of millions of ounces

Western ETFs keep bleeding

Miners are not increasing production

Industrial demand refuses to slow

This isn’t a bear market.

This is a slow-motion squeeze.

A squeeze that only shows itself at the end.

Meanwhile the global picture hasn’t changed:

China imports are still at record volumes

India keeps absorbing tens of millions of ounces

Western ETFs keep bleeding

Miners are not increasing production

Industrial demand refuses to slow

This isn’t a bear market.

This is a slow-motion squeeze.

A squeeze that only shows itself at the end.

5/

For stackers, the message is simple:

- Asia is pricing physical.

- The West is pricing paper.

- And the gap keeps widening.

When China pays $60+ for real metal,

you don’t ask “Is silver undervalued?”

You ask:

“How long until the West catches up?”

Stay focused.

Stay calm.

Stay stacking. 🥈🔥

#Silver #PhysicalSilver #SilverSqueeze #Stackers

For stackers, the message is simple:

- Asia is pricing physical.

- The West is pricing paper.

- And the gap keeps widening.

When China pays $60+ for real metal,

you don’t ask “Is silver undervalued?”

You ask:

“How long until the West catches up?”

Stay focused.

Stay calm.

Stay stacking. 🥈🔥

#Silver #PhysicalSilver #SilverSqueeze #Stackers

Here’s what the Western paper markets are doing right now:

Despite the missing SGE weekly vault data — and despite China pricing physical silver above $60 —

COMEX and CFD silver are trading in a tight, nervous range around $58–59.

Lots of micro-volatility.

No real direction.

Low conviction.

This is exactly what you expect when:

Asia pulls physical higher

Paper tries to suppress volatility

Liquidity thins out

And the real move hasn’t started yet

The charts show hesitation.

The fundamentals show pressure.

And pressure always wins.

Stackers understand the difference. 🥈🔥

Despite the missing SGE weekly vault data — and despite China pricing physical silver above $60 —

COMEX and CFD silver are trading in a tight, nervous range around $58–59.

Lots of micro-volatility.

No real direction.

Low conviction.

This is exactly what you expect when:

Asia pulls physical higher

Paper tries to suppress volatility

Liquidity thins out

And the real move hasn’t started yet

The charts show hesitation.

The fundamentals show pressure.

And pressure always wins.

Stackers understand the difference. 🥈🔥

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh