🔥 THREAD: The Silver–Oil Ratio Just Hit Its 2nd Highest Level in History — And Nobody Seems to Understand What This Means

(Read this before you sleep… if you still can.)

(Read this before you sleep… if you still can.)

1/

Something insane is happening in the commodity world.

Not in gold.

Not in copper.

Not in oil.

➡️ In SILVER.

And it’s flashing a warning signal we haven’t seen in decades.

Something insane is happening in the commodity world.

Not in gold.

Not in copper.

Not in oil.

➡️ In SILVER.

And it’s flashing a warning signal we haven’t seen in decades.

2/

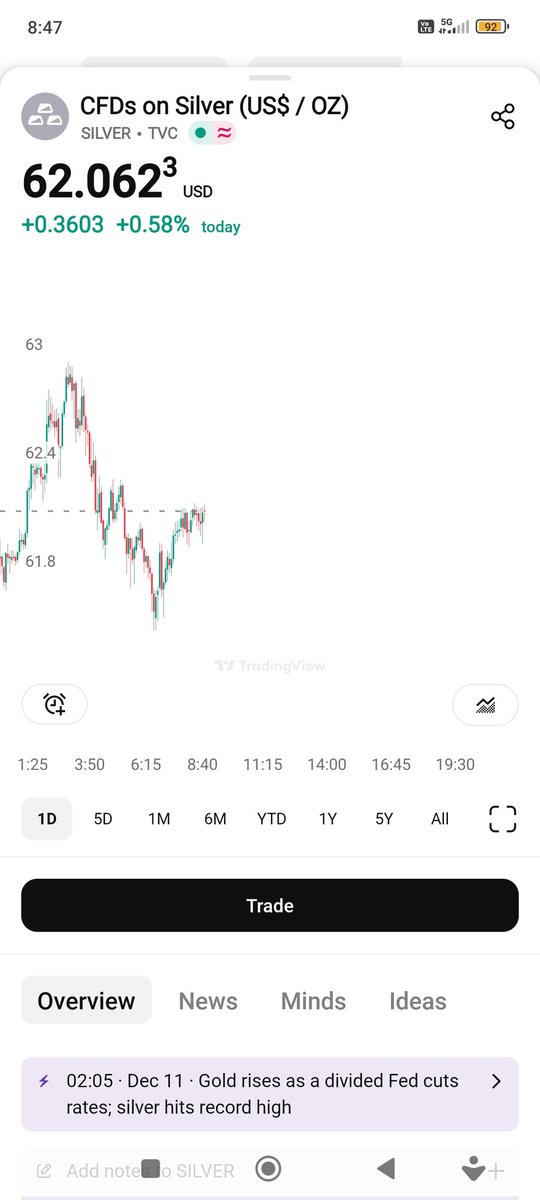

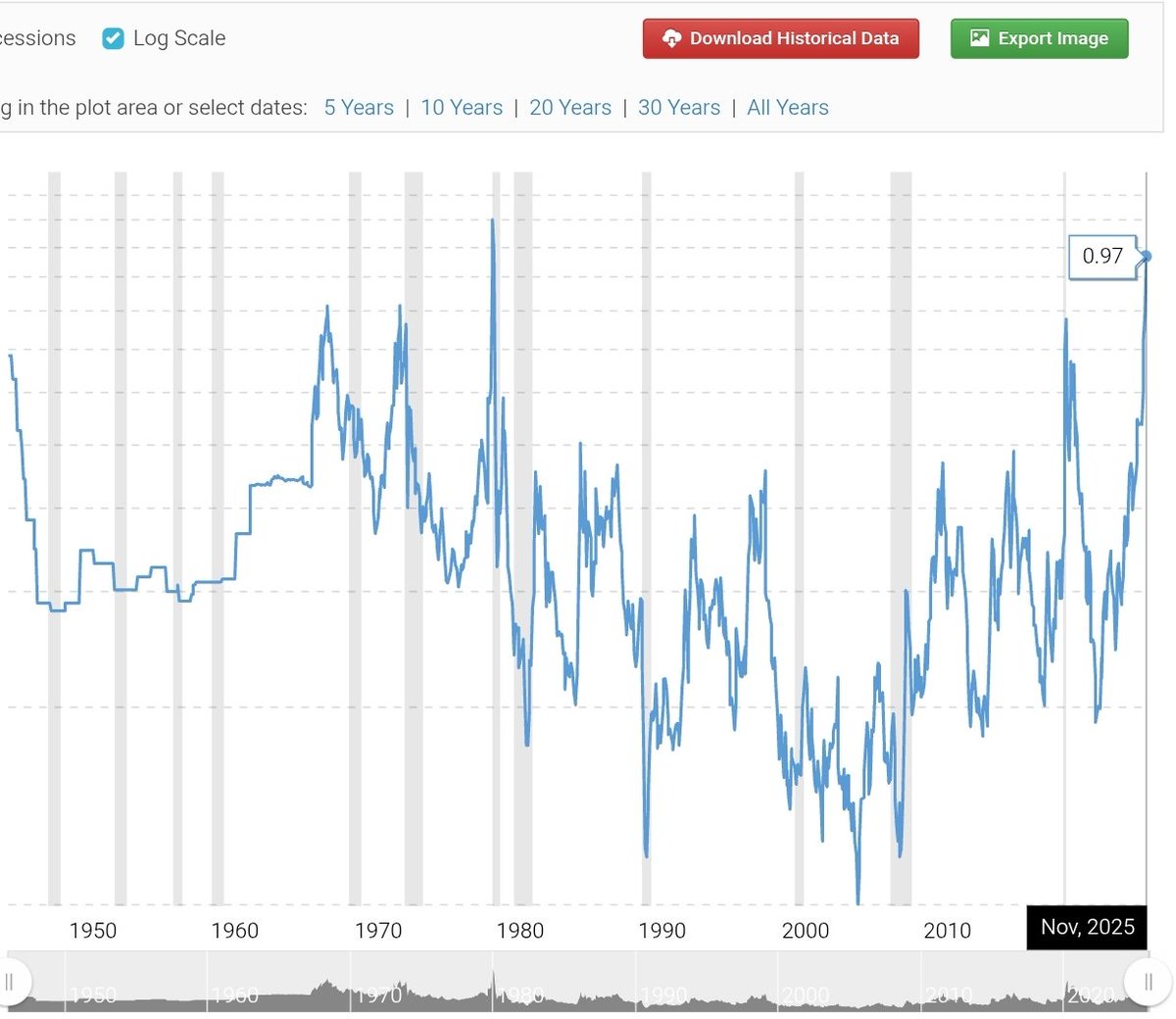

The silver-to-oil ratio—how many barrels of oil 1 oz of silver can buy—just spiked to the 2nd highest level in modern history.

Let that sink in:

🥈 One ounce of silver buys more energy than almost any time since WWII.

The silver-to-oil ratio—how many barrels of oil 1 oz of silver can buy—just spiked to the 2nd highest level in modern history.

Let that sink in:

🥈 One ounce of silver buys more energy than almost any time since WWII.

3/

This ratio only explodes during SYSTEMIC turning points:

• 1970s stagflation

• 1980 Hunt brothers squeeze

• 2008 crisis

• 2020 crash

Today?

No stagflation shock.

No crisis.

No panic.

And yet the ratio is screaming.

This ratio only explodes during SYSTEMIC turning points:

• 1970s stagflation

• 1980 Hunt brothers squeeze

• 2008 crisis

• 2020 crash

Today?

No stagflation shock.

No crisis.

No panic.

And yet the ratio is screaming.

4/

Why?

Because the market is quietly admitting something:

➡️ Silver is becoming more strategically important than oil.

Energy is the bloodstream.

Silver is the nervous system.

One can be replaced.

The other CANNOT.

Why?

Because the market is quietly admitting something:

➡️ Silver is becoming more strategically important than oil.

Energy is the bloodstream.

Silver is the nervous system.

One can be replaced.

The other CANNOT.

5/

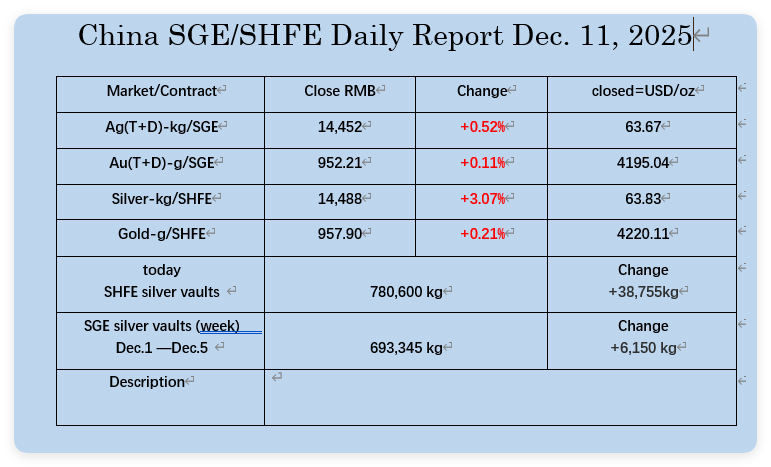

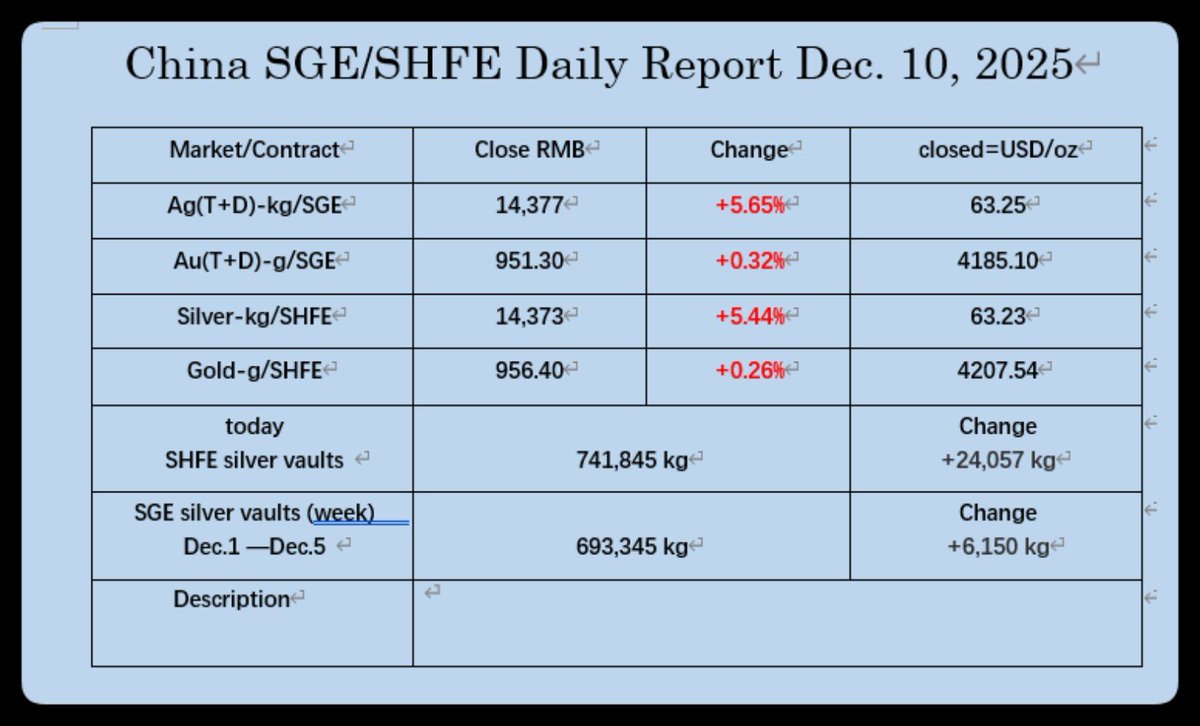

Look at the fundamentals:

• Solar demand = record

• EV demand = record

• Semiconductor demand = record

• Medical + industrial use = record

• Mine CAPEX = worst in 15 years

• 75% of supply = by-product

• Inventories = vanishing

• East = absorbing every physical ounce

Look at the fundamentals:

• Solar demand = record

• EV demand = record

• Semiconductor demand = record

• Medical + industrial use = record

• Mine CAPEX = worst in 15 years

• 75% of supply = by-product

• Inventories = vanishing

• East = absorbing every physical ounce

6/

If 1 oz of silver buys more barrels of oil than at any time since the 1970s…

…that means one thing:

➡️ The world has TOO LITTLE SILVER.

Not on COMEX.

Not in ETFs.

In the REAL WORLD.

If 1 oz of silver buys more barrels of oil than at any time since the 1970s…

…that means one thing:

➡️ The world has TOO LITTLE SILVER.

Not on COMEX.

Not in ETFs.

In the REAL WORLD.

7/

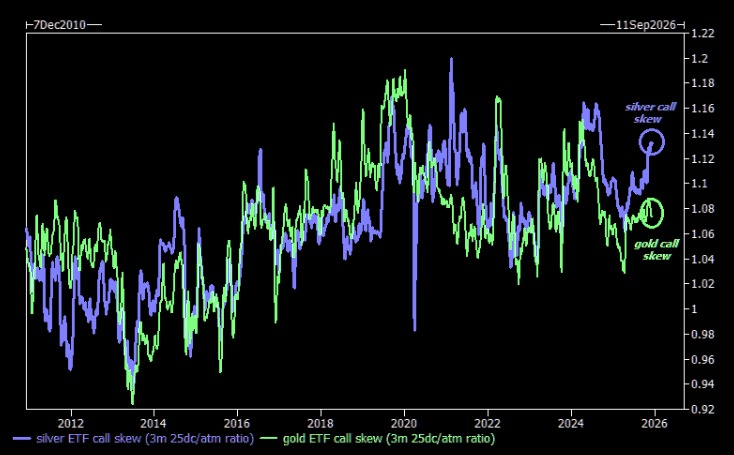

And here’s the killer:

Every previous spike in the silver–oil ratio was followed by a massive move in silver.

Not sometimes.

Not occasionally.

EVERY. SINGLE. TIME.

And here’s the killer:

Every previous spike in the silver–oil ratio was followed by a massive move in silver.

Not sometimes.

Not occasionally.

EVERY. SINGLE. TIME.

8/

People talk about “undervaluation” like it’s a meme.

But this?

This isn’t a meme.

This is the hardest industrial signal since the 1970s telling you:

🥈 Silver is dramatically mispriced.

🛢️ Energy is cheap relative to silver.

🌍 The system is shifting.

People talk about “undervaluation” like it’s a meme.

But this?

This isn’t a meme.

This is the hardest industrial signal since the 1970s telling you:

🥈 Silver is dramatically mispriced.

🛢️ Energy is cheap relative to silver.

🌍 The system is shifting.

9/

If you think this ends quietly, you’re dreaming.

Markets don’t ignore signals like this.

Not when the metal with the tightest physical deficit in the entire G7 supply chain is outperforming ENERGY itself.

If you think this ends quietly, you’re dreaming.

Markets don’t ignore signals like this.

Not when the metal with the tightest physical deficit in the entire G7 supply chain is outperforming ENERGY itself.

10/

The silver–oil ratio is whispering a truth the mainstream refuses to say out loud:

➡️ Silver is no longer a precious metal.

It’s a strategic resource.

And the world is running out of it.

The silver–oil ratio is whispering a truth the mainstream refuses to say out loud:

➡️ Silver is no longer a precious metal.

It’s a strategic resource.

And the world is running out of it.

11/

Sleep on this if you can.

Most won’t.

#silver #oil #commodities #energy #markets #inflation #macro #investing

Sleep on this if you can.

Most won’t.

#silver #oil #commodities #energy #markets #inflation #macro #investing

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh