🚨 Photonics 101: A Simple Guide for Investors

$POET $LITE $COHR $ALMU $MRVL

My goal here is to teach the fundamentals

Here is a clean and simple map of what photonics does, how the optical stack works, and where each company fits.

Share and save this thread! 🧵

$AAOI $TSEM $GFS $CIEN $AVGO $ANET $FN $GLW $SMTC $MTSI $NVDA $AIXA

$POET $LITE $COHR $ALMU $MRVL

My goal here is to teach the fundamentals

Here is a clean and simple map of what photonics does, how the optical stack works, and where each company fits.

Share and save this thread! 🧵

$AAOI $TSEM $GFS $CIEN $AVGO $ANET $FN $GLW $SMTC $MTSI $NVDA $AIXA

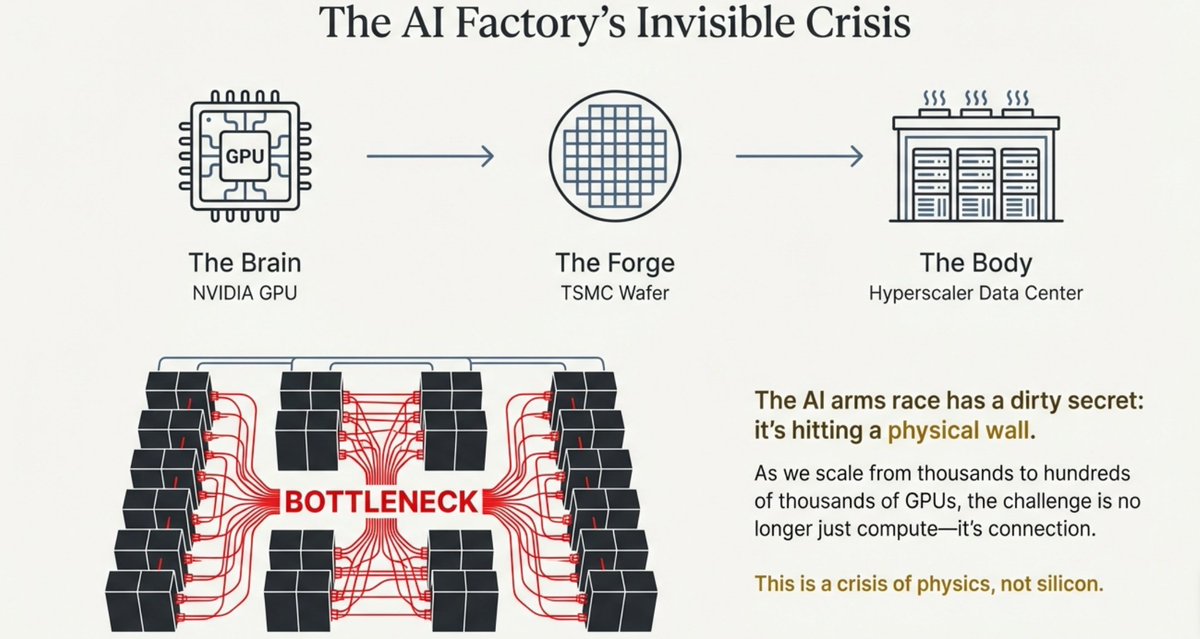

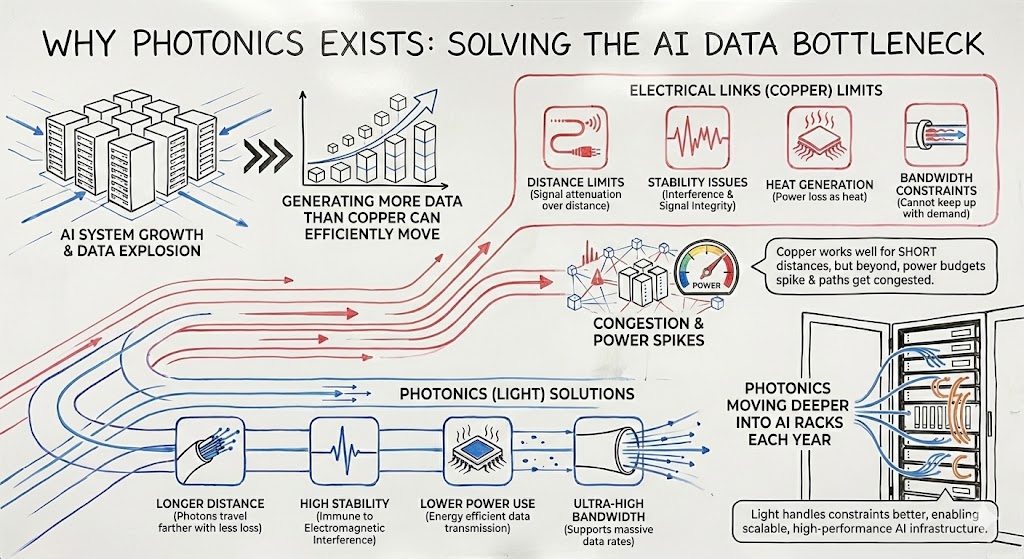

Why photonics exists...

As AI systems grow, they generate more data than copper can move efficiently.

Electrical links hit limits tied to distance, stability, heat, and bandwidth.

These limits show up quickly inside modern clusters.

Copper works well across short distances, but beyond that, power budgets spike and network paths get congested.

Light handles these constraints better because photons travel farther with less loss and lower power use.

This is why photonics is moving deeper into AI racks each year.

As AI systems grow, they generate more data than copper can move efficiently.

Electrical links hit limits tied to distance, stability, heat, and bandwidth.

These limits show up quickly inside modern clusters.

Copper works well across short distances, but beyond that, power budgets spike and network paths get congested.

Light handles these constraints better because photons travel farther with less loss and lower power use.

This is why photonics is moving deeper into AI racks each year.

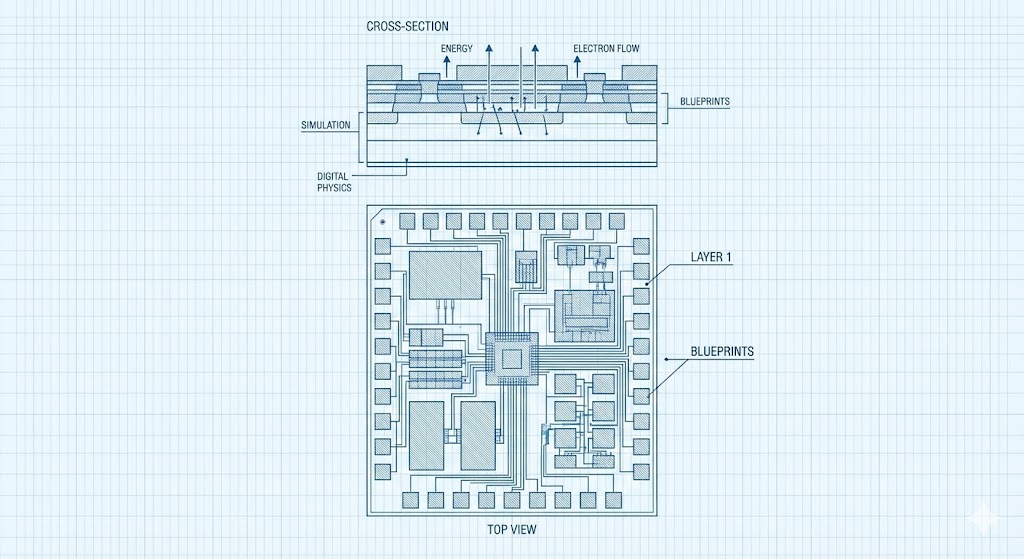

How the photonics stack works...

Photonics is a sequence of steps:

Create the light

Convert data into light

Package it

Move it through fiber

Route it

Manufacture it at scale.

Every company mentioned in earnings calls or industry updates fits somewhere in this chain.

That’s why multiple companies accelerate at the same time

They all serve the same physics-driven trend.

Think of this thread as the map.

Photonics is a sequence of steps:

Create the light

Convert data into light

Package it

Move it through fiber

Route it

Manufacture it at scale.

Every company mentioned in earnings calls or industry updates fits somewhere in this chain.

That’s why multiple companies accelerate at the same time

They all serve the same physics-driven trend.

Think of this thread as the map.

LIGHT SOURCES (where the light begins)

$LITE $MTSI $AIXA $ALMU $COHR

Coherent supplies lasers used for long-reach datacenter links where stability and distance matter.

These devices must remain stable across temperature swings, aging, and continuous load.

They anchor regional and metro optical transport systems.

Coherent’s roadmap closely follows rising cloud and AI bandwidth requirements.

$LITE

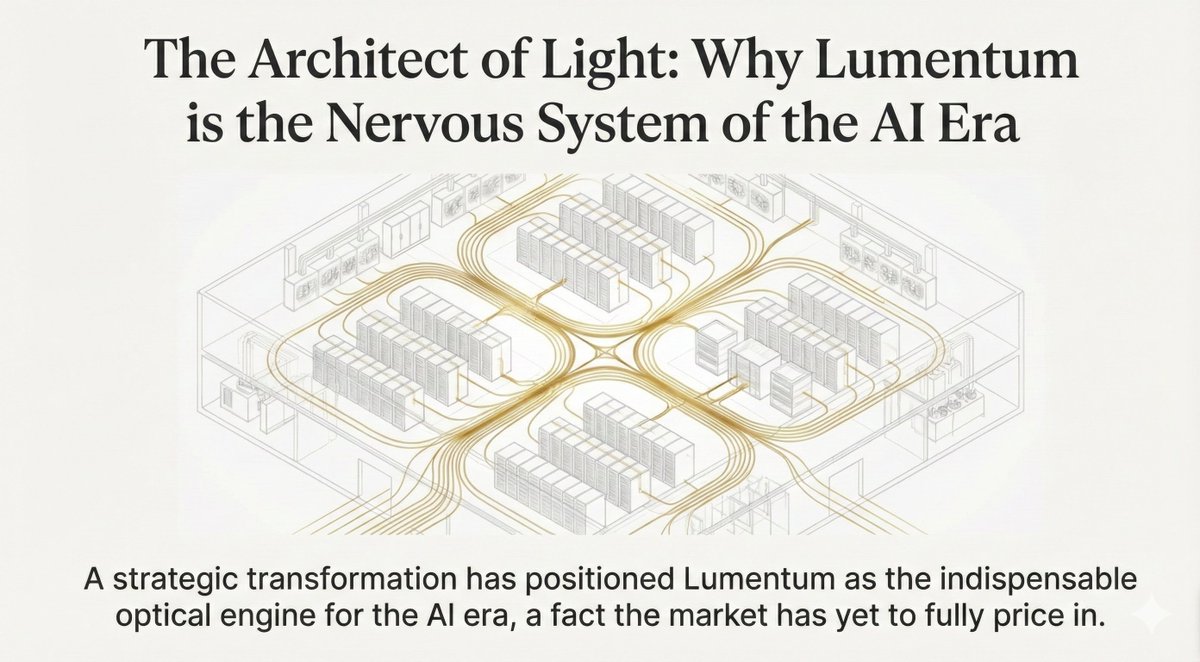

Lumentum provides lasers used inside many high-volume short-reach optical modules.

Their refresh cycles often match hyperscaler upgrade patterns.

Laser efficiency influences module heat, power, and lifetime.

Lumentum’s laser capabilities help set the upper bound for next-gen transceivers.

$MTSI

MACOM builds the electronics that drive and stabilize laser output.

These chips shape noise, reach, and overall signal quality.

Reliable laser control becomes increasingly important at 800G and 1.6T.

MACOM’s components often determine whether a module meets strict hyperscaler specs.

$AIXA

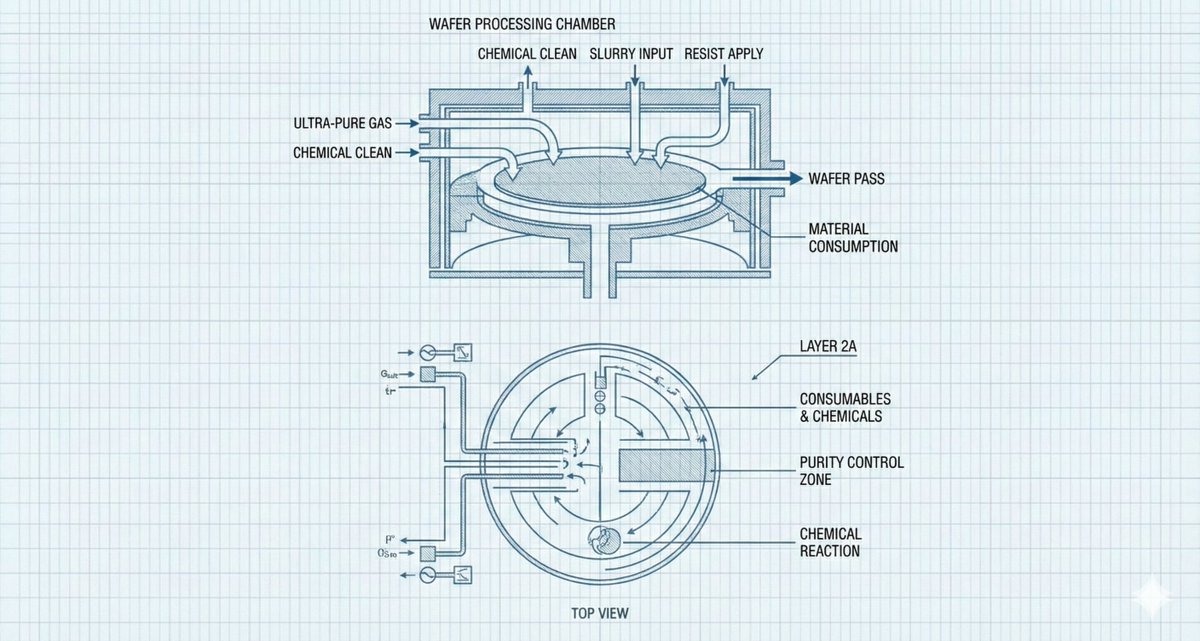

Aixtron produces the MOCVD tools used to grow the III-V materials required for lasers and detectors.

Material quality defines efficiency, yield, and long-term stability.

Their tools sit at the upstream foundation of the photonics supply chain.

Aixtron enables the material growth needed to support rising optical demand.

$ALMU

Aeluma works to produce III-V photonic devices on larger wafer sizes.

Most lasers are still made on 3–4 inch wafers, limiting supply.

Scaling to 6 inches lowers cost and increases output.

Their platform aligns with the industry goal of expanding laser manufacturing capacity.

$LITE $MTSI $AIXA $ALMU $COHR

Coherent supplies lasers used for long-reach datacenter links where stability and distance matter.

These devices must remain stable across temperature swings, aging, and continuous load.

They anchor regional and metro optical transport systems.

Coherent’s roadmap closely follows rising cloud and AI bandwidth requirements.

$LITE

Lumentum provides lasers used inside many high-volume short-reach optical modules.

Their refresh cycles often match hyperscaler upgrade patterns.

Laser efficiency influences module heat, power, and lifetime.

Lumentum’s laser capabilities help set the upper bound for next-gen transceivers.

$MTSI

MACOM builds the electronics that drive and stabilize laser output.

These chips shape noise, reach, and overall signal quality.

Reliable laser control becomes increasingly important at 800G and 1.6T.

MACOM’s components often determine whether a module meets strict hyperscaler specs.

$AIXA

Aixtron produces the MOCVD tools used to grow the III-V materials required for lasers and detectors.

Material quality defines efficiency, yield, and long-term stability.

Their tools sit at the upstream foundation of the photonics supply chain.

Aixtron enables the material growth needed to support rising optical demand.

$ALMU

Aeluma works to produce III-V photonic devices on larger wafer sizes.

Most lasers are still made on 3–4 inch wafers, limiting supply.

Scaling to 6 inches lowers cost and increases output.

Their platform aligns with the industry goal of expanding laser manufacturing capacity.

OPTICAL ENGINES (convert electrical data into light)

$POET

POET builds optical engines that integrate multiple photonic functions at wafer scale.

Removing alignment steps cuts cost and simplifies manufacturing.

Their approach supports external light sources and flexible module designs.

POET aims to make optical engines easier to scale as AI racks grow more optical.

$MRVL

Marvell is integrating photonics directly into networking silicon.

Shorter electrical paths reduce heat and power in dense systems.

Their acquisitions reflect a long-term commitment to optical fabrics.

Marvell’s roadmap aligns with the shift toward high-radix, optics-heavy clusters.

Celestial AI -

Celestial developed a photonic fabric to move data along optimized light paths.

This reduces electrical congestion across large AI systems.

Marvell acquired them to accelerate optical integration.

Celestial’s architecture shows how optical fabrics can reshape AI system design.

Ayar Labs -

Ayar Labs builds in-package optical I/O placed directly beside compute silicon.

This reduces the distance electrical signals travel before becoming photons.

It improves latency and power efficiency as GPU density increases.

Ayar targets one of the tightest bottlenecks inside modern AI hardware.

$POET

POET builds optical engines that integrate multiple photonic functions at wafer scale.

Removing alignment steps cuts cost and simplifies manufacturing.

Their approach supports external light sources and flexible module designs.

POET aims to make optical engines easier to scale as AI racks grow more optical.

$MRVL

Marvell is integrating photonics directly into networking silicon.

Shorter electrical paths reduce heat and power in dense systems.

Their acquisitions reflect a long-term commitment to optical fabrics.

Marvell’s roadmap aligns with the shift toward high-radix, optics-heavy clusters.

Celestial AI -

Celestial developed a photonic fabric to move data along optimized light paths.

This reduces electrical congestion across large AI systems.

Marvell acquired them to accelerate optical integration.

Celestial’s architecture shows how optical fabrics can reshape AI system design.

Ayar Labs -

Ayar Labs builds in-package optical I/O placed directly beside compute silicon.

This reduces the distance electrical signals travel before becoming photons.

It improves latency and power efficiency as GPU density increases.

Ayar targets one of the tightest bottlenecks inside modern AI hardware.

TRANSCEIVERS (send light between racks)

$COHR $AAOI $CIEN $FN $LITE

Lumentum ships many of the 800G and emerging 1.6T modules powering today’s AI clusters.

They also build optical switches that reduce hop count and congestion.

Their scale gives them early visibility into hyperscaler demand.

Lumentum’s transceiver roadmap aligns directly with rising port density per rack.

$COHR

Coherent builds the long-distance ZR and ZR+ coherent optics used for metro and regional datacenter connectivity.

These modules deliver high bandwidth over extended distances with low error rates.

They support distributed compute environments across cities or regions.

Coherent’s coherent layer grows in importance as AI models operate across multiple sites.

$AAOI

Applied Optoelectronics is scaling U.S. manufacturing of 800G modules and preparing its roadmap for higher-speed designs, including 1.6T.

Management reports they are in the final stages of 800G qualification with multiple hyperscale customers, which reflects growing interest in domestic optical supply.

Their U.S. footprint helps diversify where high-speed modules are built.

AAOI aligns with the broader push for resilient, localized optical manufacturing.

$CIEN

Ciena provides optical systems used across metro, long-haul, and cloud environments.

These routes carry distributed AI workloads and heavy east-west traffic.

Their platforms are built for the highest-capacity transport links.

Ciena’s systems underpin the growth of geographically distributed AI training.

$FN

Fabrinet assembles optical modules for companies including $NVDA, $LITE, and $COHR.

They specialize in high-precision optical alignment where yield is challenging.

Their throughput often reflects real-time demand across the industry.

Fabrinet’s vantage point gives early insight into hyperscaler procurement trends.

$COHR $AAOI $CIEN $FN $LITE

Lumentum ships many of the 800G and emerging 1.6T modules powering today’s AI clusters.

They also build optical switches that reduce hop count and congestion.

Their scale gives them early visibility into hyperscaler demand.

Lumentum’s transceiver roadmap aligns directly with rising port density per rack.

$COHR

Coherent builds the long-distance ZR and ZR+ coherent optics used for metro and regional datacenter connectivity.

These modules deliver high bandwidth over extended distances with low error rates.

They support distributed compute environments across cities or regions.

Coherent’s coherent layer grows in importance as AI models operate across multiple sites.

$AAOI

Applied Optoelectronics is scaling U.S. manufacturing of 800G modules and preparing its roadmap for higher-speed designs, including 1.6T.

Management reports they are in the final stages of 800G qualification with multiple hyperscale customers, which reflects growing interest in domestic optical supply.

Their U.S. footprint helps diversify where high-speed modules are built.

AAOI aligns with the broader push for resilient, localized optical manufacturing.

$CIEN

Ciena provides optical systems used across metro, long-haul, and cloud environments.

These routes carry distributed AI workloads and heavy east-west traffic.

Their platforms are built for the highest-capacity transport links.

Ciena’s systems underpin the growth of geographically distributed AI training.

$FN

Fabrinet assembles optical modules for companies including $NVDA, $LITE, and $COHR.

They specialize in high-precision optical alignment where yield is challenging.

Their throughput often reflects real-time demand across the industry.

Fabrinet’s vantage point gives early insight into hyperscaler procurement trends.

FIBER + PHYSICAL LAYER

$GLW

Corning supplies the fiber and connectors that move optical signals through racks and datacenters.

AI systems require significantly higher fiber density than traditional cloud servers.

Better fiber reduces signal loss and supports higher bandwidth.

Corning enables the physical build-out of modern optical networks.

$GLW

Corning supplies the fiber and connectors that move optical signals through racks and datacenters.

AI systems require significantly higher fiber density than traditional cloud servers.

Better fiber reduces signal loss and supports higher bandwidth.

Corning enables the physical build-out of modern optical networks.

ANALOG + DRIVERS $MTSI $SMTC

Semtech builds drivers and TIAs that shape, amplify, and detect optical signals.

These chips maintain signal integrity at extremely high speeds.

Driver design often sets the upper bandwidth limit for modules.

Semtech’s analog components support reliable operation as speeds continue to rise.

$MTSI

MACOM produces high-speed analog ICs for advanced optical modules.

These components influence power consumption and link stability under load.

Good analog design improves reach and lowers error rates.

MACOM’s analog layer is essential for next-generation optical performance.

Semtech builds drivers and TIAs that shape, amplify, and detect optical signals.

These chips maintain signal integrity at extremely high speeds.

Driver design often sets the upper bandwidth limit for modules.

Semtech’s analog components support reliable operation as speeds continue to rise.

$MTSI

MACOM produces high-speed analog ICs for advanced optical modules.

These components influence power consumption and link stability under load.

Good analog design improves reach and lowers error rates.

MACOM’s analog layer is essential for next-generation optical performance.

FOUNDRY + MANUFACTURING

$FN $GFS $AIXA $POET $FN $TSEM

Tower manufactures silicon-photonics wafers for multiple companies.

Their specialty processes allow firms to prototype and scale without owning a fab.

Manufacturing access remains a bottleneck in photonics.

Tower gives companies a path to bring photonic devices to market efficiently.

$GFS

GlobalFoundries is one of the volume leaders in silicon-photonics manufacturing.

Many fabless photonics and optical-engine companies rely on their capacity.

They support large-scale, repeatable production across multiple customer programs.

GFS is one of the most important manufacturing anchors in the optical supply chain.

$AIXA

Aixtron produces tools that grow the III-V materials required for lasers and detectors.

Material quality influences efficiency and yield throughout the stack.

Their tools form an upstream foundation for photonics manufacturing.

Aixtron enables scaling of the compounds that lasers fundamentally rely on.

$FN

Fabrinet appears here again due to its role in high-precision assembly.

Optical alignment is complex, and their expertise boosts yield across modules.

They handle some of the most difficult manufacturing steps.

Fabrinet’s importance rises as designs move toward 1.6T and beyond.

$POET

POET also fits into this layer because their platform simplifies optical engine packaging.

Wafer-scale integration removes many difficult alignment steps.

This reduces cost and accelerates time-to-market.

POET’s approach helps remove major bottlenecks in scaling optical devices.

$FN $GFS $AIXA $POET $FN $TSEM

Tower manufactures silicon-photonics wafers for multiple companies.

Their specialty processes allow firms to prototype and scale without owning a fab.

Manufacturing access remains a bottleneck in photonics.

Tower gives companies a path to bring photonic devices to market efficiently.

$GFS

GlobalFoundries is one of the volume leaders in silicon-photonics manufacturing.

Many fabless photonics and optical-engine companies rely on their capacity.

They support large-scale, repeatable production across multiple customer programs.

GFS is one of the most important manufacturing anchors in the optical supply chain.

$AIXA

Aixtron produces tools that grow the III-V materials required for lasers and detectors.

Material quality influences efficiency and yield throughout the stack.

Their tools form an upstream foundation for photonics manufacturing.

Aixtron enables scaling of the compounds that lasers fundamentally rely on.

$FN

Fabrinet appears here again due to its role in high-precision assembly.

Optical alignment is complex, and their expertise boosts yield across modules.

They handle some of the most difficult manufacturing steps.

Fabrinet’s importance rises as designs move toward 1.6T and beyond.

$POET

POET also fits into this layer because their platform simplifies optical engine packaging.

Wafer-scale integration removes many difficult alignment steps.

This reduces cost and accelerates time-to-market.

POET’s approach helps remove major bottlenecks in scaling optical devices.

SYSTEMS + NETWORKING

$NVDA $ANET $MRVL $AVGO

Broadcom supplies switch silicon and optical DSPs that anchor modern datacenter networks.

Their chips define bandwidth expectations for each new optical generation.

They heavily influence network architecture across hyperscaler deployments.

Broadcom’s roadmap is one of the clearest signals for future cluster design.

$ANET

Arista builds Ethernet-based networking systems for clusters ranging from small deployments to 100k-GPU scale.

Their platforms emphasize consistent bisection bandwidth across fabrics.

Cluster-level performance depends heavily on this architecture.

Arista ensures GPU clusters can communicate efficiently at scale.

$MRVL

Marvell participates across both electrical and optical fabrics.

Their switches connect accelerators, servers, and storage.

Optical integration is expanding their role in next-generation clusters.

Marvell’s portfolio evolves alongside the shift toward optics-first networks.

$NVDA

NVIDIA develops the high-bandwidth links that tie GPUs together.

As models scale, communication becomes a primary bottleneck.

Optics influence how large GPU clusters can grow.

NVIDIA’s networking layer is becoming as important as its compute layer.

$NVDA $ANET $MRVL $AVGO

Broadcom supplies switch silicon and optical DSPs that anchor modern datacenter networks.

Their chips define bandwidth expectations for each new optical generation.

They heavily influence network architecture across hyperscaler deployments.

Broadcom’s roadmap is one of the clearest signals for future cluster design.

$ANET

Arista builds Ethernet-based networking systems for clusters ranging from small deployments to 100k-GPU scale.

Their platforms emphasize consistent bisection bandwidth across fabrics.

Cluster-level performance depends heavily on this architecture.

Arista ensures GPU clusters can communicate efficiently at scale.

$MRVL

Marvell participates across both electrical and optical fabrics.

Their switches connect accelerators, servers, and storage.

Optical integration is expanding their role in next-generation clusters.

Marvell’s portfolio evolves alongside the shift toward optics-first networks.

$NVDA

NVIDIA develops the high-bandwidth links that tie GPUs together.

As models scale, communication becomes a primary bottleneck.

Optics influence how large GPU clusters can grow.

NVIDIA’s networking layer is becoming as important as its compute layer.

A simple principle to remember

Photons travel meters with minimal loss.

Electrons traveling at high speeds often struggle after centimeters.

This difference shapes how modern AI systems are built.

Many limits in AI come from how systems move data, not how they compute.

Power, distance, and bandwidth pressures point toward deeper optical adoption.

This is why so many companies across this stack are showing momentum at the same time.

They all serve the same transition toward a more optical, scalable AI infrastructure.

Save this thread

And use it as a reference for understanding the architecture behind the next decade of AI.

Photons travel meters with minimal loss.

Electrons traveling at high speeds often struggle after centimeters.

This difference shapes how modern AI systems are built.

Many limits in AI come from how systems move data, not how they compute.

Power, distance, and bandwidth pressures point toward deeper optical adoption.

This is why so many companies across this stack are showing momentum at the same time.

They all serve the same transition toward a more optical, scalable AI infrastructure.

Save this thread

And use it as a reference for understanding the architecture behind the next decade of AI.

• • •

Missing some Tweet in this thread? You can try to

force a refresh