🧵 THREAD: While Everyone Watches Crypto, Smart Money Moves to Silver

1️⃣

Something important is happening in the markets — and most investors are missing it.

While headlines stay focused on crypto, institutional money is quietly rotating.

Something important is happening in the markets — and most investors are missing it.

While headlines stay focused on crypto, institutional money is quietly rotating.

2️⃣

Bitcoin ETFs just saw ~$500M in outflows in a single week.

Over $3.5B left in November alone.

That’s not noise.

That’s intentional capital movement.

Bitcoin ETFs just saw ~$500M in outflows in a single week.

Over $3.5B left in November alone.

That’s not noise.

That’s intentional capital movement.

3️⃣

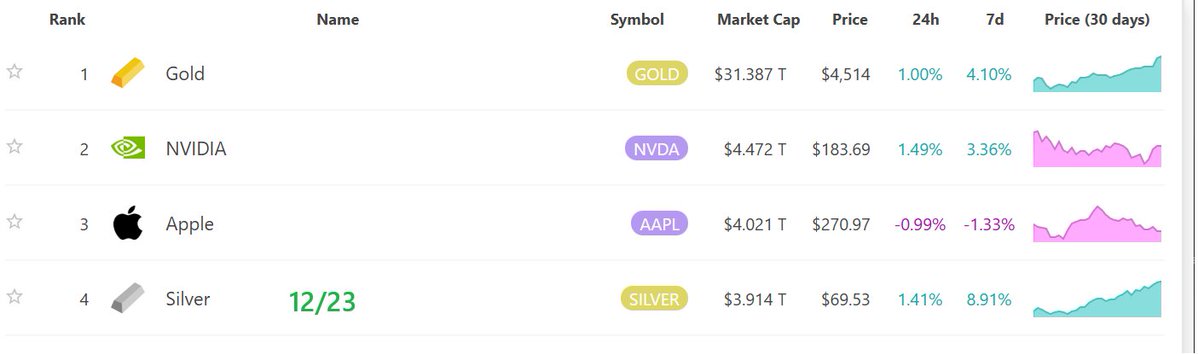

At the exact same time:

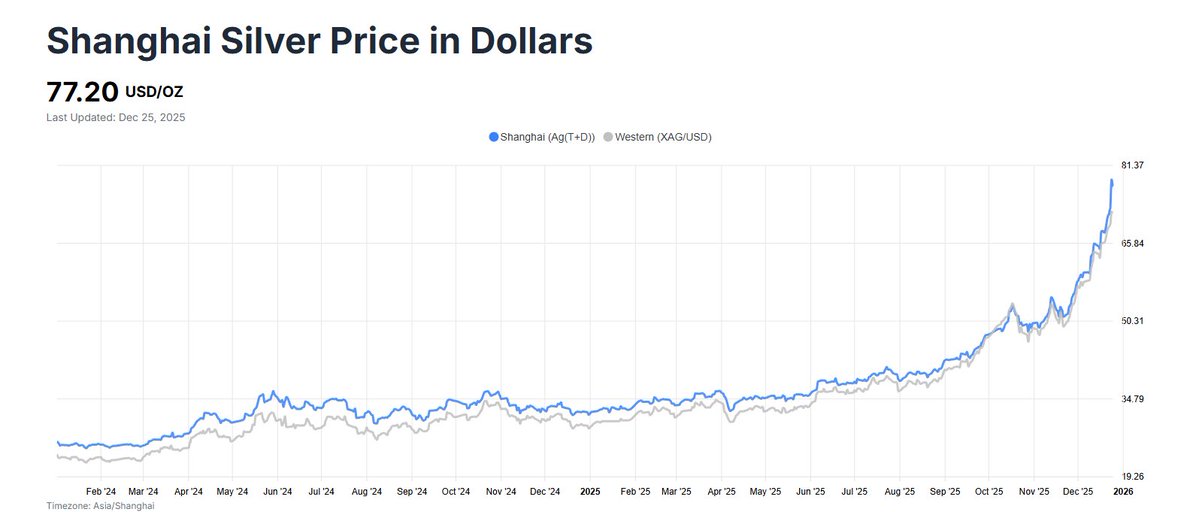

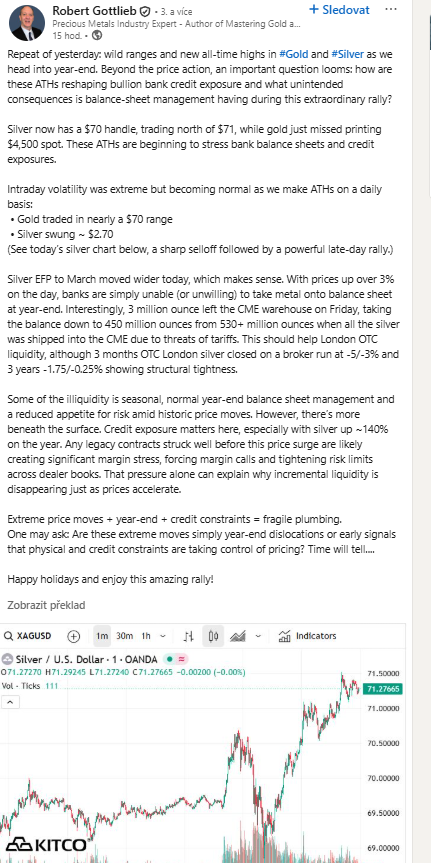

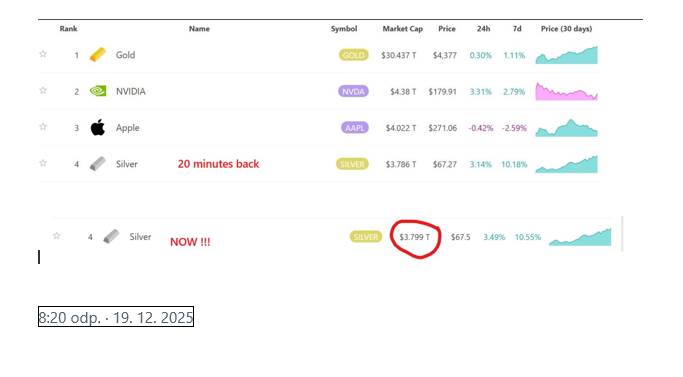

• Silver posts its strongest rally in over a decade

• Gold sits near all-time highs

This isn’t coincidence.

This is rotation.

At the exact same time:

• Silver posts its strongest rally in over a decade

• Gold sits near all-time highs

This isn’t coincidence.

This is rotation.

4️⃣

Key point most people miss:

This is not about one asset going up and another going down.

It’s about a shift in how risk and value are being priced.

Key point most people miss:

This is not about one asset going up and another going down.

It’s about a shift in how risk and value are being priced.

5️⃣

Major banks are adjusting expectations:

• JPMorgan talks about gold near $5,000

• Goldman Sachs around $4,900

These are not retail forecasts.

These are institutional models.

Major banks are adjusting expectations:

• JPMorgan talks about gold near $5,000

• Goldman Sachs around $4,900

These are not retail forecasts.

These are institutional models.

6️⃣

Central banks are buying gold at the fastest pace since the 1970s.

Not marginally more — structurally more.

This isn’t speculation.

It’s policy.

Central banks are buying gold at the fastest pace since the 1970s.

Not marginally more — structurally more.

This isn’t speculation.

It’s policy.

7️⃣

Meanwhile:

• Rates are coming down

• Real yields are compressing

• Debt levels keep rising

When cash stops working, hard assets re-enter the equation.

Meanwhile:

• Rates are coming down

• Real yields are compressing

• Debt levels keep rising

When cash stops working, hard assets re-enter the equation.

8️⃣

That’s where silver comes in.

Gold acts as insurance.

Silver acts as leverage.

Historically:

Gold +10% → Silver +15–20%

We’re seeing that dynamic again.

That’s where silver comes in.

Gold acts as insurance.

Silver acts as leverage.

Historically:

Gold +10% → Silver +15–20%

We’re seeing that dynamic again.

9️⃣

Gold ~+70% YTD.

Silver ~+140% YTD.

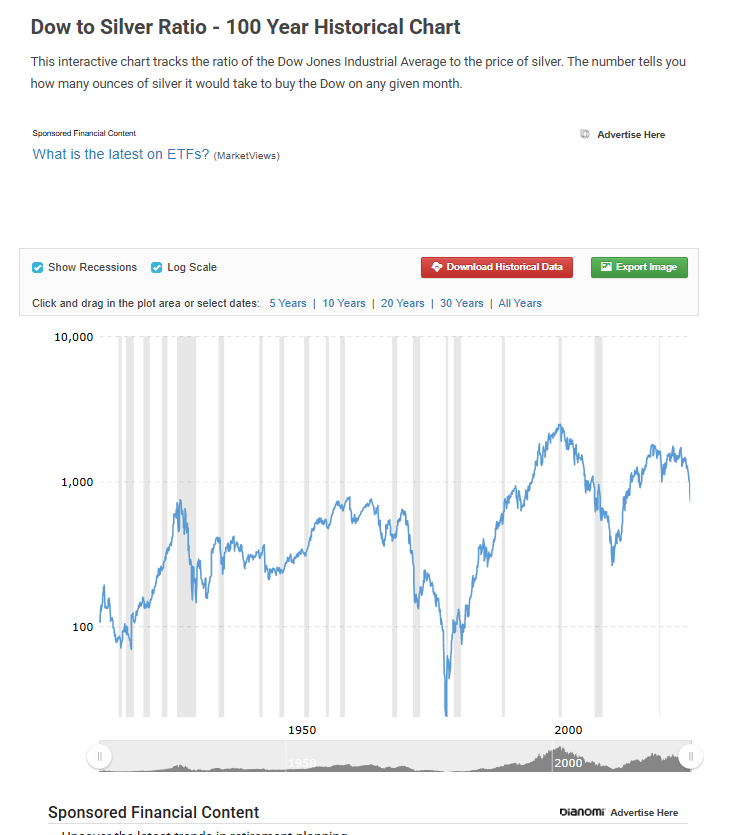

The gold-to-silver ratio is falling — and markets don’t do that randomly.

Gold ~+70% YTD.

Silver ~+140% YTD.

The gold-to-silver ratio is falling — and markets don’t do that randomly.

🔟

There’s another driver here:

Trust.

Crypto promised decentralization.

Instead we got ETFs, regulation, and dependence on “stable” intermediaries.

Institutions noticed.

There’s another driver here:

Trust.

Crypto promised decentralization.

Instead we got ETFs, regulation, and dependence on “stable” intermediaries.

Institutions noticed.

1️⃣1️⃣

Silver offers what crypto promised:

• no counterparty

• no software risk

• no off switch

Plus 5,000 years of monetary history.

Silver offers what crypto promised:

• no counterparty

• no software risk

• no off switch

Plus 5,000 years of monetary history.

1️⃣2️⃣

Add the industrial layer:

• solar

• EVs

• AI data centers

• 5G infrastructure

All require silver — and supply isn’t keeping up.

Add the industrial layer:

• solar

• EVs

• AI data centers

• 5G infrastructure

All require silver — and supply isn’t keeping up.

1️⃣3️⃣

Annual production ≈ 800M oz

Annual demand → approaching 1B oz

The gap is filled by inventories.

And those inventories are shrinking.

Annual production ≈ 800M oz

Annual demand → approaching 1B oz

The gap is filled by inventories.

And those inventories are shrinking.

1️⃣4️⃣

Crucial detail:

Most deficit models do not include crypto-to-metal rotation.

Yet the entire silver market is valued at only tens of billions.

Crucial detail:

Most deficit models do not include crypto-to-metal rotation.

Yet the entire silver market is valued at only tens of billions.

1️⃣5️⃣

If even a fraction of crypto capital rotates into silver,

the math becomes uncomfortable — fast.

Not for holders.

For latecomers.

If even a fraction of crypto capital rotates into silver,

the math becomes uncomfortable — fast.

Not for holders.

For latecomers.

1️⃣6️⃣

This isn’t a get-rich-quick trade.

It’s a structural shift.

Quiet phase first.

Acceleration later.

This isn’t a get-rich-quick trade.

It’s a structural shift.

Quiet phase first.

Acceleration later.

1️⃣7️⃣

History is consistent here:

When macro, technicals, supply/demand, and institutions align — something breaks.

History is consistent here:

When macro, technicals, supply/demand, and institutions align — something breaks.

1️⃣8️⃣

The question isn’t if something is happening.

It’s who understands it early — and who waits for headlines.

#Silver #PhysicalSilver #PreciousMetals #CapitalRotation #Macro

The question isn’t if something is happening.

It’s who understands it early — and who waits for headlines.

#Silver #PhysicalSilver #PreciousMetals #CapitalRotation #Macro

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh