The Silver Situation:

Silver prices are now up a MASSIVE +175% in 2025 and set to post an 8-month win streak for first time since 1980.

Gold and silver have added a combined +$16 TRILLION in market cap this year ALONE.

What is happening? Let us explain.

(a thread)

Silver prices are now up a MASSIVE +175% in 2025 and set to post an 8-month win streak for first time since 1980.

Gold and silver have added a combined +$16 TRILLION in market cap this year ALONE.

What is happening? Let us explain.

(a thread)

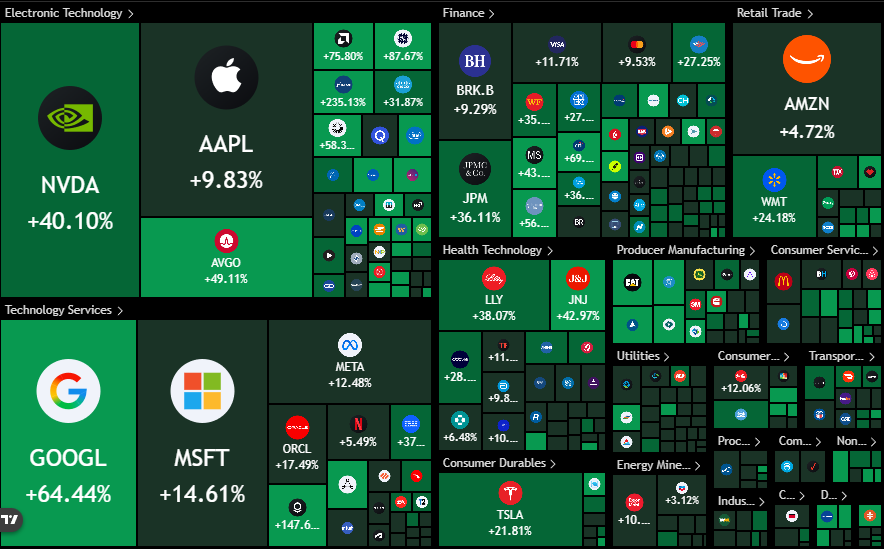

As you may know, our view for 2025 has been "own assets or be left behind."

This year, just about ALL assets have pushed higher.

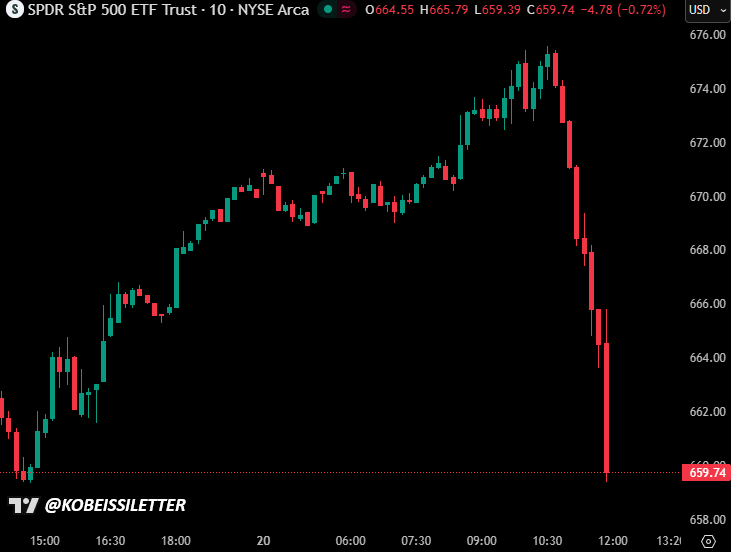

But, as of late, gold and silver are leading the charge, now up 4 and 8 TIMES as much as the S&P 500 YTD.

It all started with a weaker US Dollar.

This year, just about ALL assets have pushed higher.

But, as of late, gold and silver are leading the charge, now up 4 and 8 TIMES as much as the S&P 500 YTD.

It all started with a weaker US Dollar.

The US Dollar is currently down -9% YTD on track for its worst year since 2017.

As rate cuts kicked off, the US Dollar saw further weakness.

And, as President Trump's new Fed Chair is set to be announced, markets are pricing-in even more dovish Fed policy.

This is key.

As rate cuts kicked off, the US Dollar saw further weakness.

And, as President Trump's new Fed Chair is set to be announced, markets are pricing-in even more dovish Fed policy.

This is key.

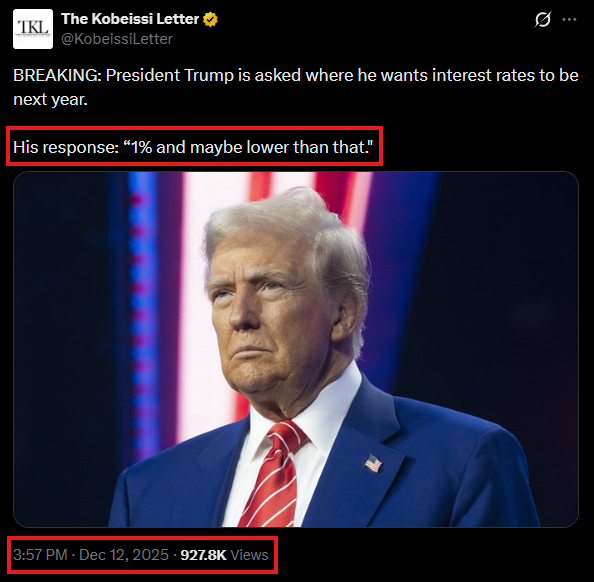

On December 12th, President Trump was asked where he wants interest rates to be with his new Fed Chair.

His response: “1% and maybe lower than that."

Silver prices are now up +41% this month, on track for the best month since December 1979.

Bond markets are even more telling.

His response: “1% and maybe lower than that."

Silver prices are now up +41% this month, on track for the best month since December 1979.

Bond markets are even more telling.

Since the Fed began cutting rates in Sept 2024, bonds have failed to rally.

In fact, popular bond tracking ETF, $TLT, is currently down -12% since then.

Why? Because long-term inflation expectations remain elevated.

This has CEMENTED gold and silver as the global safe havens.

In fact, popular bond tracking ETF, $TLT, is currently down -12% since then.

Why? Because long-term inflation expectations remain elevated.

This has CEMENTED gold and silver as the global safe havens.

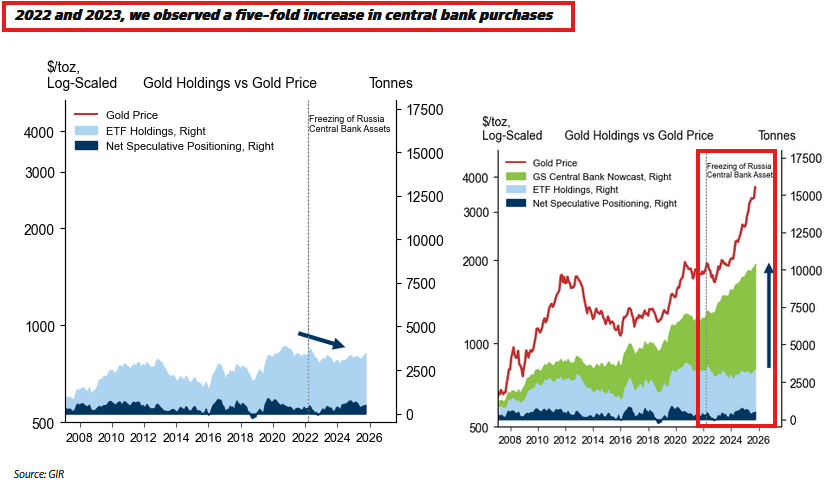

Meanwhile, central banks around the globe are buying unprecedented amounts of gold.

Between 2022 and 2023, Goldman Sachs saw a "five-fold increase" in central bank purchases.

In Q3 2025, the China's Central Bank gold purchases were 118 tonnes, up +39% MoM and +55% YoY.

Between 2022 and 2023, Goldman Sachs saw a "five-fold increase" in central bank purchases.

In Q3 2025, the China's Central Bank gold purchases were 118 tonnes, up +39% MoM and +55% YoY.

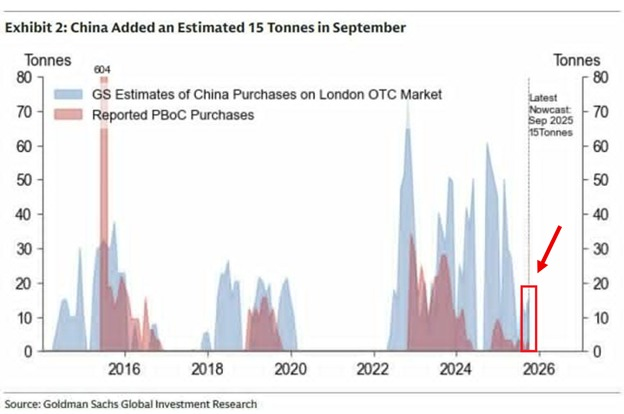

What's even more interesting is China is "hiding" these purchases.

China purchased +15 tonnes of gold in September, or ~10X more than officially reported, according to Goldman.

YTD, China’s reported gold purchases are +24 tonnes, but are actually likely closer to +240 tonnes.

China purchased +15 tonnes of gold in September, or ~10X more than officially reported, according to Goldman.

YTD, China’s reported gold purchases are +24 tonnes, but are actually likely closer to +240 tonnes.

Now, China is adding even more fuel to the fire:

Beginning on January 1st, China will implement new export controls requiring government licenses for all silver exports.

As a result, Shanghai silver prices are up to $85/oz, marking a ~$5/oz premium to spot prices in the US.

Beginning on January 1st, China will implement new export controls requiring government licenses for all silver exports.

As a result, Shanghai silver prices are up to $85/oz, marking a ~$5/oz premium to spot prices in the US.

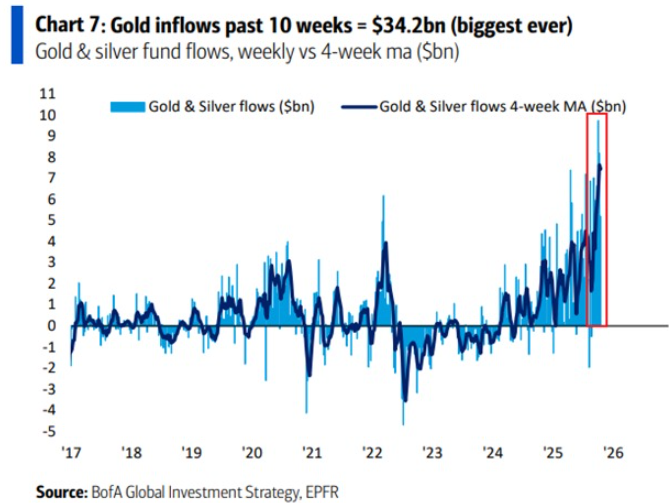

As the sentiment spreads, we are seeing record inflows into these assets.

Gold funds just saw +$34.2 billion in net inflows in just 10 weeks, the most ever recorded.

Money is flooding into precious metals at an unprecedented pace.

And now, everyone is wondering about crypto.

Gold funds just saw +$34.2 billion in net inflows in just 10 weeks, the most ever recorded.

Money is flooding into precious metals at an unprecedented pace.

And now, everyone is wondering about crypto.

While precious metals have seen a historic run, Bitcoin is now down -6% YTD.

After rising as much as +40% YTD into October, Bitcoin and broader crypto has collapsed.

In our view, this is a mechanical bear market driven by excessive leverage.

We think Bitcoin recovers in 2026.

After rising as much as +40% YTD into October, Bitcoin and broader crypto has collapsed.

In our view, this is a mechanical bear market driven by excessive leverage.

We think Bitcoin recovers in 2026.

As we head into 2026, we think capital markets will become even more tradable.

The macroeconomy is shifting and stocks, commodities, bonds, and crypto are moving.

Want to receive our premium analysis?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

The macroeconomy is shifting and stocks, commodities, bonds, and crypto are moving.

Want to receive our premium analysis?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

Ultimately, what we are seeing right now only further reinforces our view.

Even as asset prices soar, 60% of Americans think we are in a recession; the wealth divide is growing.

Own assets or be left behind.

Follow us @KobeissiLetter for real time analysis as this develops.

Even as asset prices soar, 60% of Americans think we are in a recession; the wealth divide is growing.

Own assets or be left behind.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh