The recent silver rally on CME/COMEX—roughly 25% in the prompt contract over ten days—has been widely attributed to “unprecedented” depletion of exchange stocks and forced conversion of futures into physical metal. A close examination of the actual data does not support this 1/

https://twitter.com/degiorgiod/status/2004856567477522706

narrative.

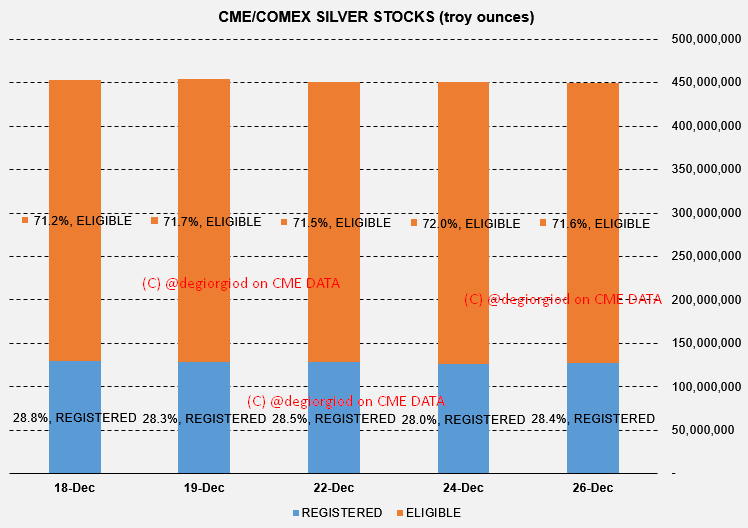

First, CME inventory figures show that total silver stocks remained broadly stable through the critical December delivery window. Registered stocks—the metal available for delivery—did not decline, while Eligible stocks fell modestly and orderly. This indicates 2/

First, CME inventory figures show that total silver stocks remained broadly stable through the critical December delivery window. Registered stocks—the metal available for delivery—did not decline, while Eligible stocks fell modestly and orderly. This indicates 2/

routine physical withdrawals and inventory management, not stress on the deliverable pool. Coverage ratios remained ample.

Second, delivery volumes in December () were elevated but not historically extreme, and they were absorbed without end-of-month 3/cmegroup.com/delivery_repor…

Second, delivery volumes in December () were elevated but not historically extreme, and they were absorbed without end-of-month 3/cmegroup.com/delivery_repor…

pressure on Registered inventories. Open interest stayed broadly stable, inconsistent with a forced delivery squeeze.

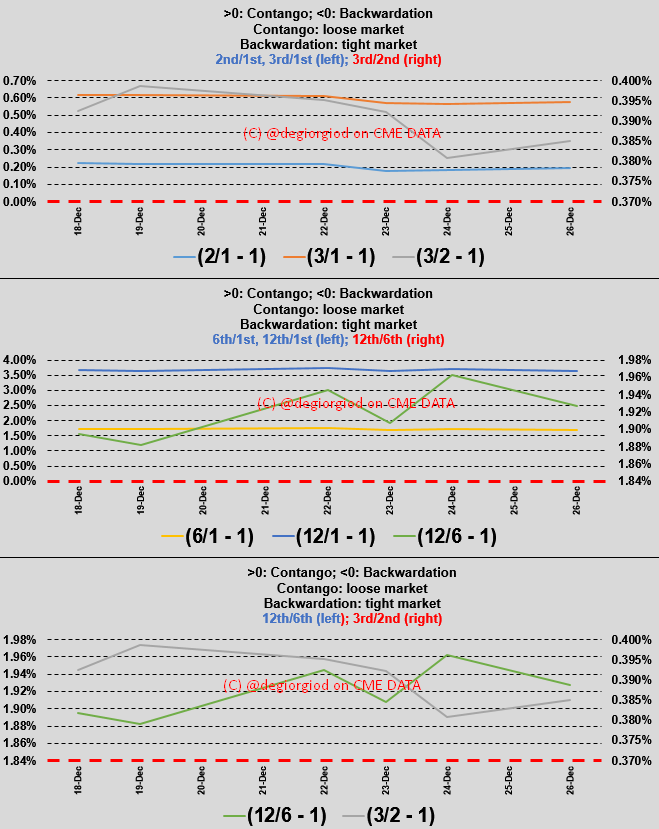

Third, and most decisively, the futures curve never signaled physical tightness. Throughout the rally, key time spreads (2nd/1st, 3rd/1st, 6th/1st, 12th/6th) 4/

Third, and most decisively, the futures curve never signaled physical tightness. Throughout the rally, key time spreads (2nd/1st, 3rd/1st, 6th/1st, 12th/6th) 4/

remained in contango. In fact, contango widened in the mid-to-back curve, especially the 12th/6th spread. In precious metals, genuine scarcity or delivery stress manifests first as front-end backwardation; its absence is diagnostic. 5/

Finally, CME margin increases during this period reflect volatility risk management, not inventory distress.

6/

6/

https://x.com/degiorgiod/status/2004856567477522706?s=20

Taken together, inventories, deliveries, open interest, and term structure all point to a macro- and positioning-driven rally—amplified by volatility and momentum—rather than one caused by COMEX stock depletion or forced physical delivery. /end

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh