New decision from CA Court of Appeal on the fee-shifting provisions of AB 1633 has big implications for NIMBYs' incentive to challenge housing approvals under CEQA & beyond.

This one belongs in a Law of Abundance casebook.

🧵/24

law.justia.com/cases/californ…

This one belongs in a Law of Abundance casebook.

🧵/24

law.justia.com/cases/californ…

Context: As part of the 1970s revolution in admin law, states & the federal gov't actively encouraged self-appointed "private attorneys general" to sue, via attorneys' fee bounties.

/2

/2

Asymmetric fee-shifting provisions were written into scores of public laws: If a plaintiff challenging a gov't decision wins, the gov't has to pay for the plaintiff's attorney; if the plaintiff loses, they don't have to pay for the gov's attorney.

/3

/3

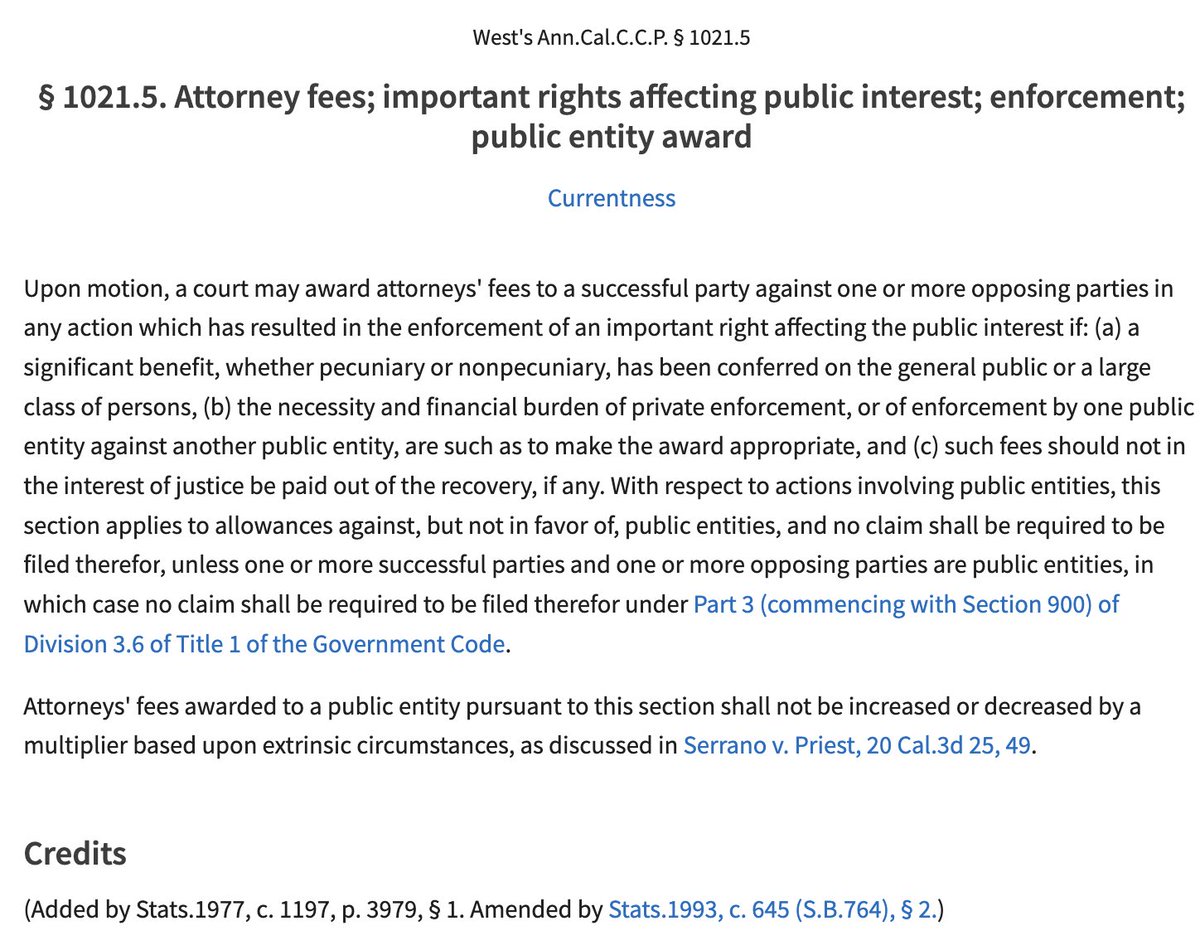

In the Law of Aquarius Era (h/t @nicholas_bagley), California added an all-purpose fee shifting provision to its Code of Civil Procedure.

CCP 1021.5 authorizes fees for prevailing plaintiffs in any case enforcing "an important right affecting the public interest."

/4

CCP 1021.5 authorizes fees for prevailing plaintiffs in any case enforcing "an important right affecting the public interest."

/4

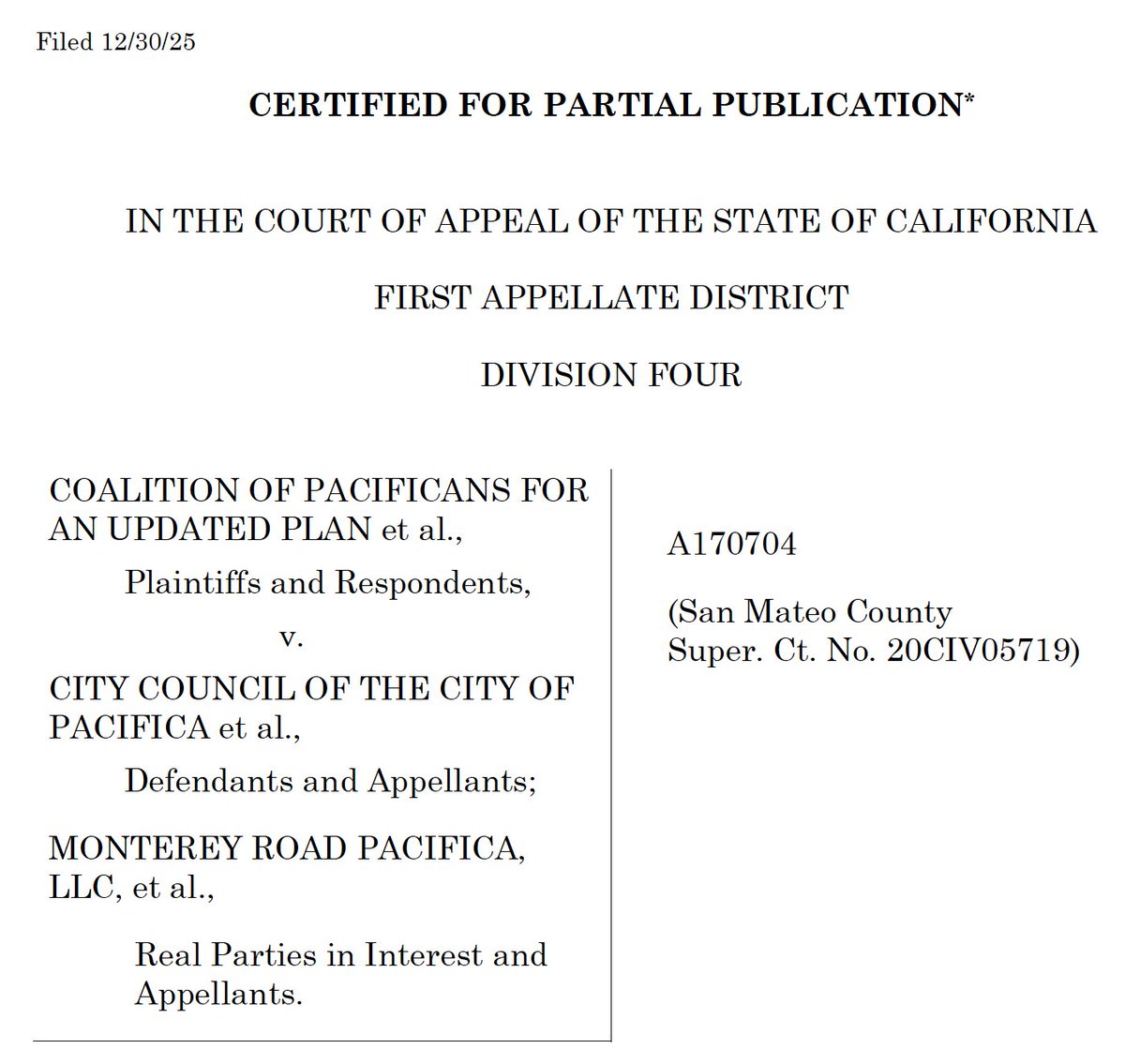

CCP 1021.5 became the engine that powers CEQA litigation. The facts of the new case, Coalitions of Pacificans v. City of Pacifica, illustrate its might.

/5

/5

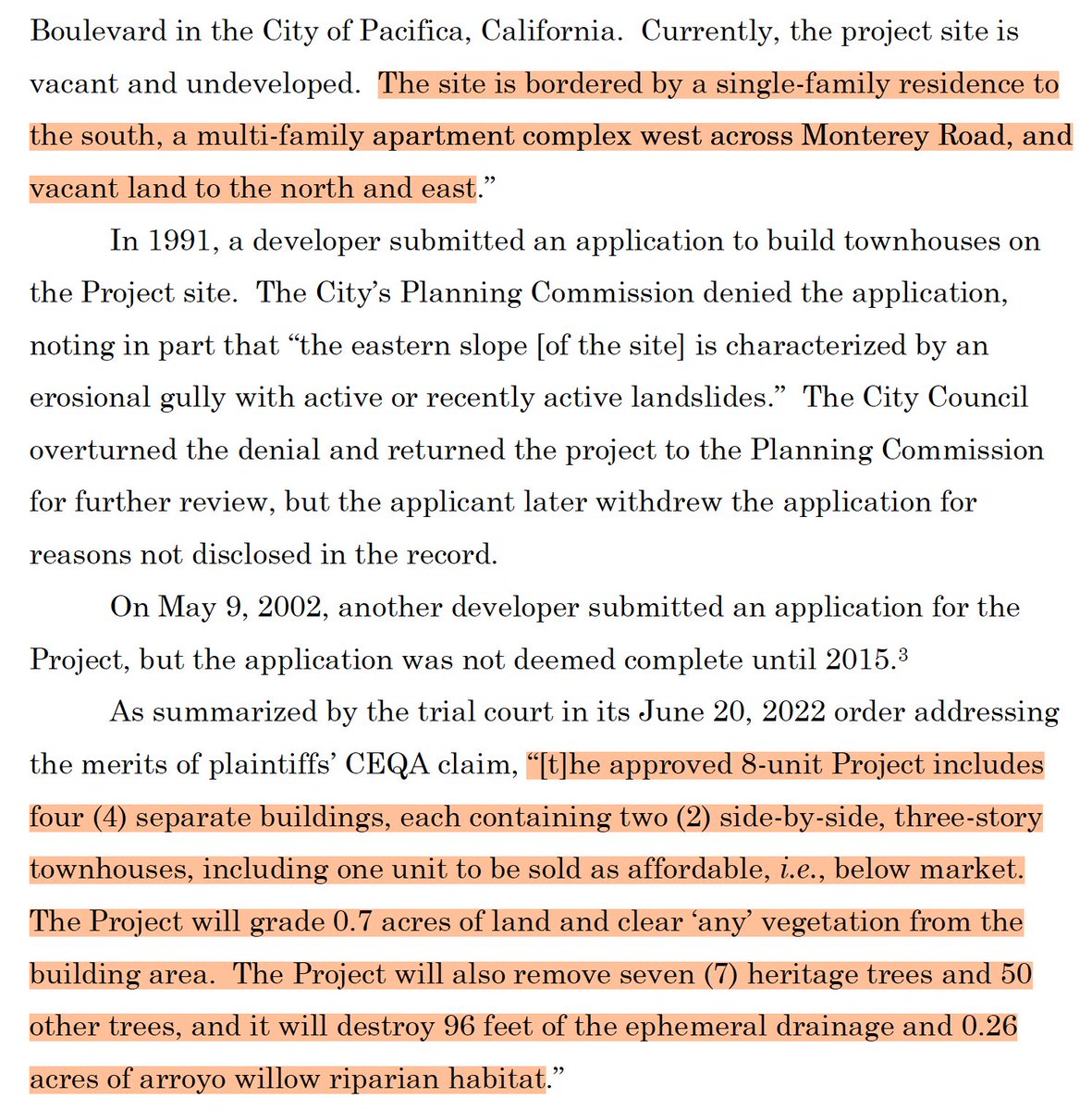

The plaintiffs challenged the city's decision to prepare a "mitigated negative declaration," rather than a full EIR, for an 8-unit housing project that complies w/ city's general plan & zoning.

(Keep in mind that the GP and zoning were previously adopted w/ CEQA reviews.)

/6

(Keep in mind that the GP and zoning were previously adopted w/ CEQA reviews.)

/6

The city's decision to prepare a MND was risky, however, b/c the standard of review is *very* favorable to plaintiffs seeking a full EIR.

To prevail, they need only demonstrate that there's a "fair argument" that the project "might" have some significant enviro impact.

/7

To prevail, they need only demonstrate that there's a "fair argument" that the project "might" have some significant enviro impact.

/7

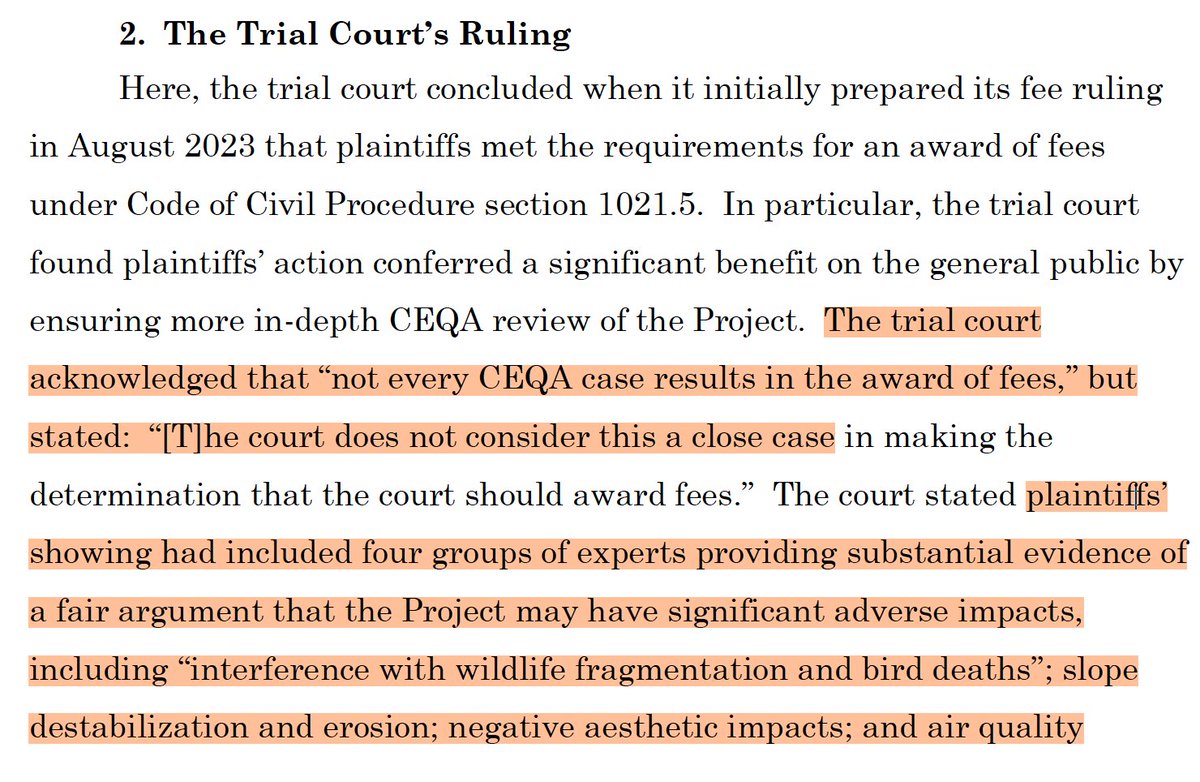

Sure enough, neighbors who didn't like the project sued.

They had four experts testify about potential wildlife fragmentation, bird deaths, erosion, negative aesthetic impacts, and air quality impacts.

That established a "fair argument" about possible impacts. Game up.

/8

They had four experts testify about potential wildlife fragmentation, bird deaths, erosion, negative aesthetic impacts, and air quality impacts.

That established a "fair argument" about possible impacts. Game up.

/8

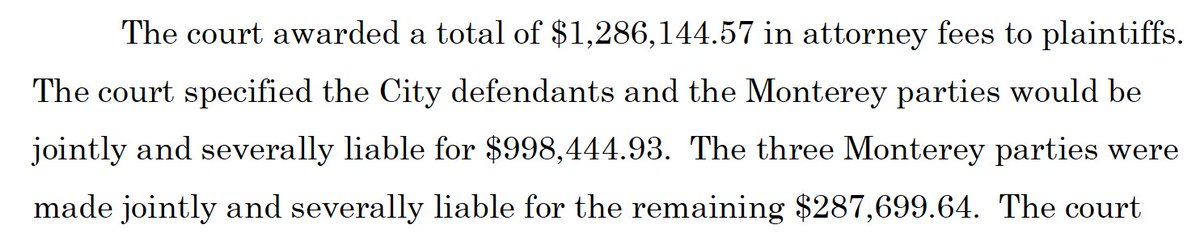

Without finding that the project would *actually* harm the env't in any substantial way (the site adjoins existing housing developments on two sides), the court awarded ***$1.29 million*** to the plaintiffs' attorney.

That's $150,000 per housing unit delayed!

/9

That's $150,000 per housing unit delayed!

/9

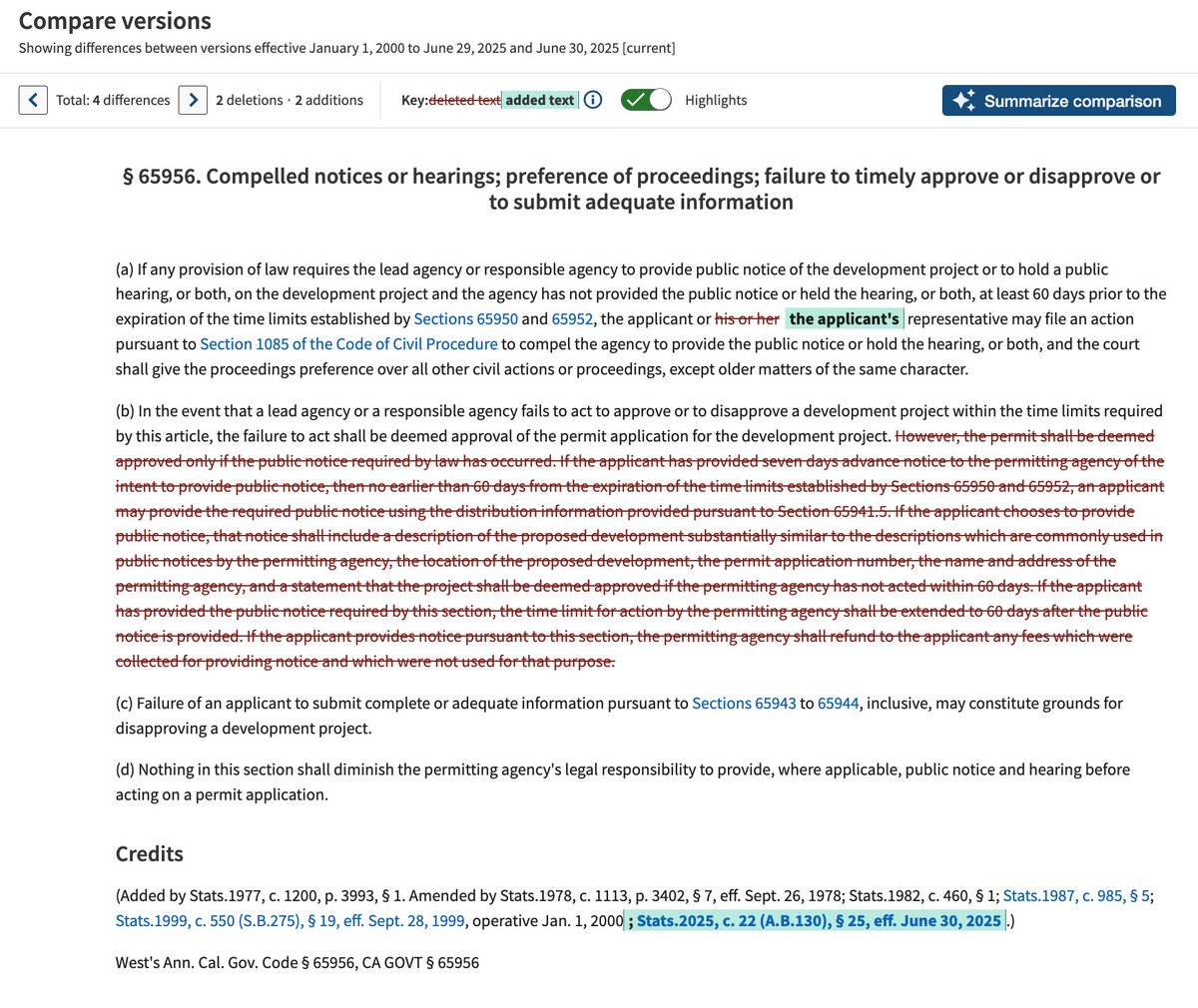

But the decision came with an asterisk. Shortly before the court's entry of the fee-award judgment, AB 1633 took effect.

/10

/10

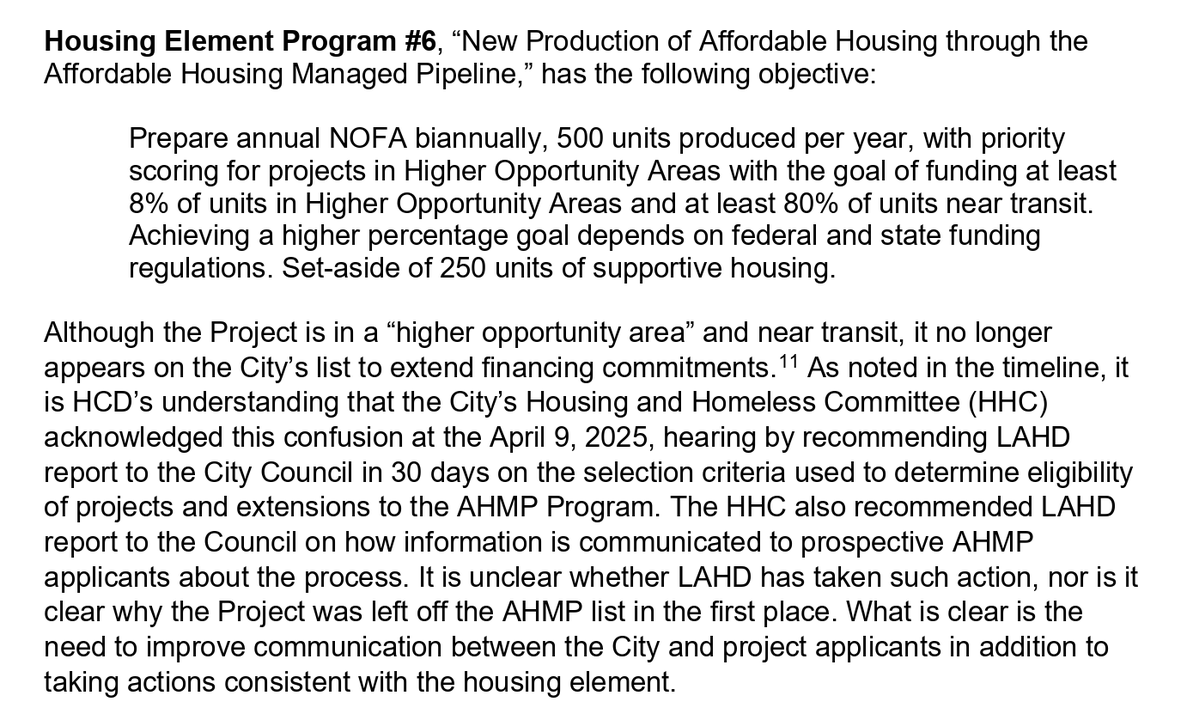

AB 1633 provides a cause of action, through the HAA, against cities that deny or unreasonably delay CEQA clearances for certain infill housing projects.

It also addresses cities' "damned if we approve it, damned if we don't" bind, by recalibrating fee-shifting norms.

/11

It also addresses cities' "damned if we approve it, damned if we don't" bind, by recalibrating fee-shifting norms.

/11

For the dense-infill projects that AB 1633 protects, a developer who successfully challenge a CEQA delay gets attorneys' fees only if they show that the city acted in bad faith.

/12

/12

Conversely, in case where a city approves a qualifying dense-infill project and opponents sue and win, AB 1633 declares that an award of fees to the prevailing plaintiff is "rarely, if ever appropriate."

/13

/13

AB 1633 also includes general language stating that in any case where a plaintiff successfully challenges the approval of a housing development project, a court shall give "due weight" to the policies of the HAA in deciding whether to award fees under CCP 1021.5.

/14

/14

In this case, the Pacifica project wasn't dense enough to qualify for the strong protections of AB 1633, so only the "due weight" proviso was implicated.

The trial court acknowledged this proviso but...

/15

The trial court acknowledged this proviso but...

/15

found that the project didn't substantially advance the policies of the HAA b/c:

- 8 units is nothing vis-a-vis an estimated statewide shortage of 2 million homes

- Pacifica "isn't an urban area" so building more housing there wouldn't further CA's policy favoring infill

/16

- 8 units is nothing vis-a-vis an estimated statewide shortage of 2 million homes

- Pacifica "isn't an urban area" so building more housing there wouldn't further CA's policy favoring infill

/16

The Court of Appeal reversed. It instructed that, in giving "due weight" to policies of the HAA, trial courts should:

- judge the significance of a project's size relative to city's RHNA and rate of housing production, not the statewide shortage

/17

- judge the significance of a project's size relative to city's RHNA and rate of housing production, not the statewide shortage

/17

- determine whether a project coheres w/ state policy favoring development in existing urbanized areas by looking at project's surroundings, not by declaring a city "not urban"

/18

/18

- not blindly infer from plaintiffs' CEQA win that the "suitability of the site for housing" factor under AB 1633 cuts in favor of an award of fees to the CEQA plaintiff

(Why not? B/c the CEQA win only establishes a debater's "fair argument" about impacts.)

/19

(Why not? B/c the CEQA win only establishes a debater's "fair argument" about impacts.)

/19

This holding is really important!

It's a signal that to get fees, CEQA attorneys will probably have to show that the housing project they're fighting presents a real, substantial risk of serious enviro harm, especially if the project includes a lot of units or is infill.

/20

It's a signal that to get fees, CEQA attorneys will probably have to show that the housing project they're fighting presents a real, substantial risk of serious enviro harm, especially if the project includes a lot of units or is infill.

/20

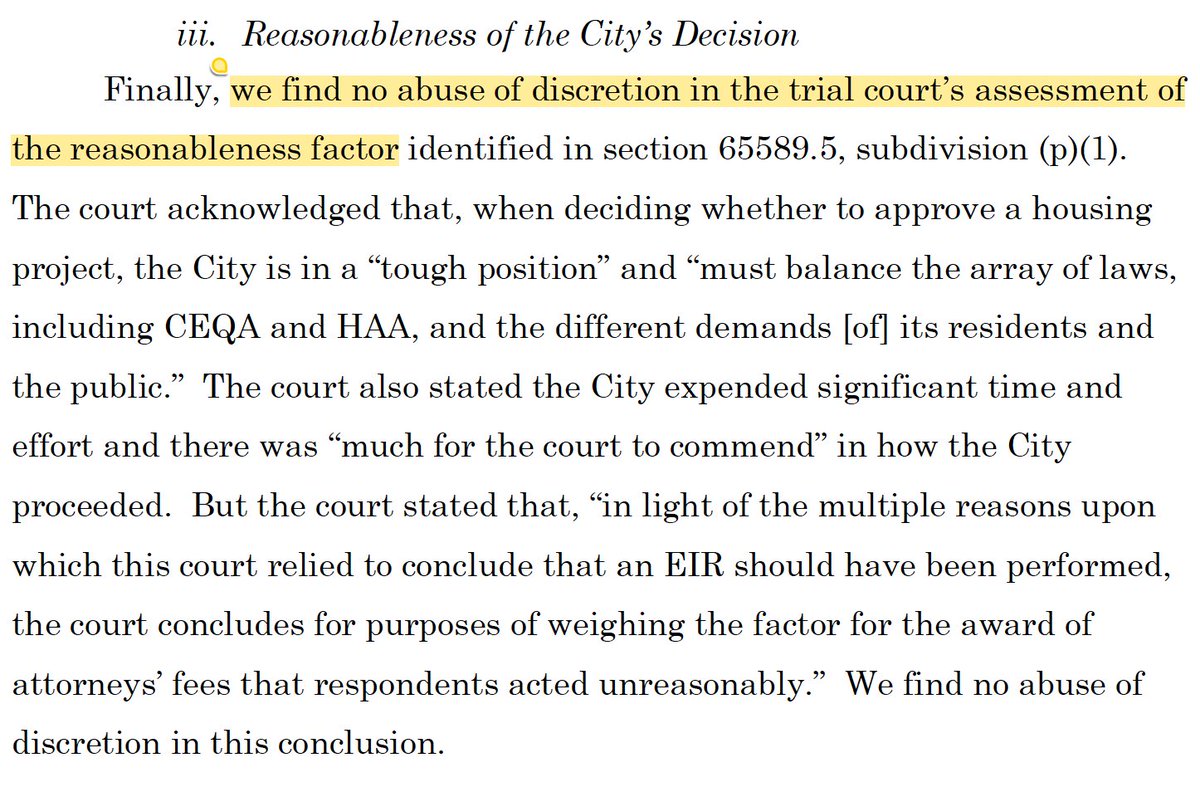

While I disagree with the court's handing of the final "due weight" factor under AB 1633 (the reasonableness of the city's decision), this is a very thoughtful, well-executed opinion.

And it throttles down the CEQA motor, a lot.

/21

And it throttles down the CEQA motor, a lot.

/21

Incidentally, the author of the opinion, Justice Streeter, was also on the panel that decided the seminal "HAA for the YIMBY era" case, California Renters v. City of San Mateo (2021).

/22

/22

And the CEQA attorney whom the opinion divests of $1.3m is none other than Richard Drury, who led the charge against AB 1633.

Guess he saw what was coming!

(Here's his plea for a gubernatorial veto: )

/23

Guess he saw what was coming!

(Here's his plea for a gubernatorial veto: )

/23

Disclosure: AB 1633 was spurred by one of my papers (w/ the great @TDuncheon) and I provided pro-bono advice to the bill's author, @PhilTing.

/end

/end

https://x.com/CSElmendorf/status/1712376261463724069

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh