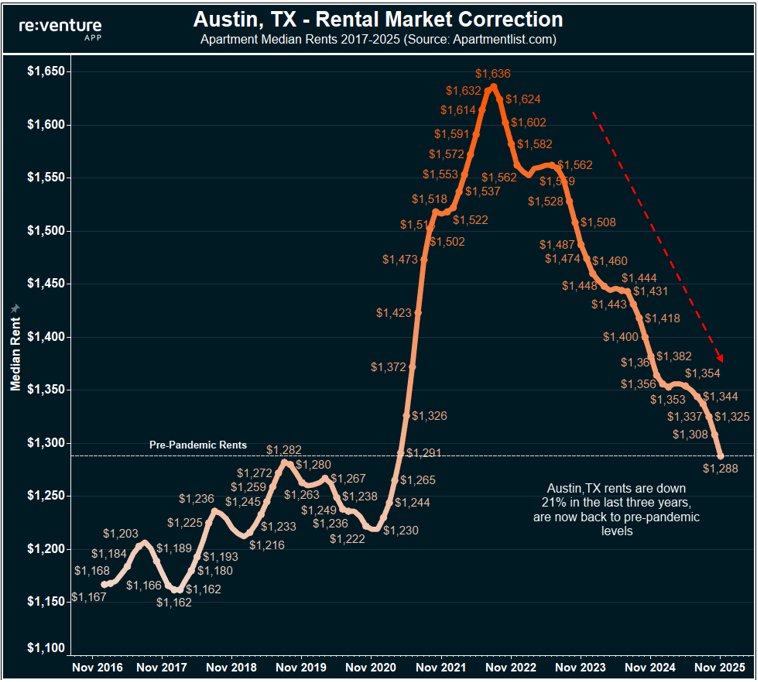

Austin TX is now back to pre-pandemic apartment rents.

Down 21% from peak in summer of 2022.

$1,636/month --> $1,288/month

(I'm now even seeing 2BRs in some apartments at sub-$1,000)

This rental correction is due to a sharp drop in migration/demand, combined with a surge of new apartment development.

At this point, Austin has its cheapest rents on record relative to income.

Down 21% from peak in summer of 2022.

$1,636/month --> $1,288/month

(I'm now even seeing 2BRs in some apartments at sub-$1,000)

This rental correction is due to a sharp drop in migration/demand, combined with a surge of new apartment development.

At this point, Austin has its cheapest rents on record relative to income.

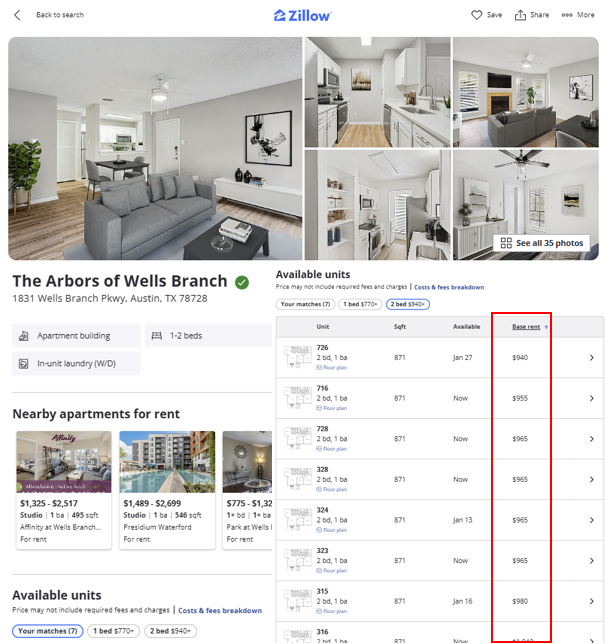

1) Here's an example of what's out there now.

2BRs going for $950.

This is a complex which is off I-35. A 9-minute drive to the Domain according to Google Maps.

$470 per bedroom.

2BRs going for $950.

This is a complex which is off I-35. A 9-minute drive to the Domain according to Google Maps.

$470 per bedroom.

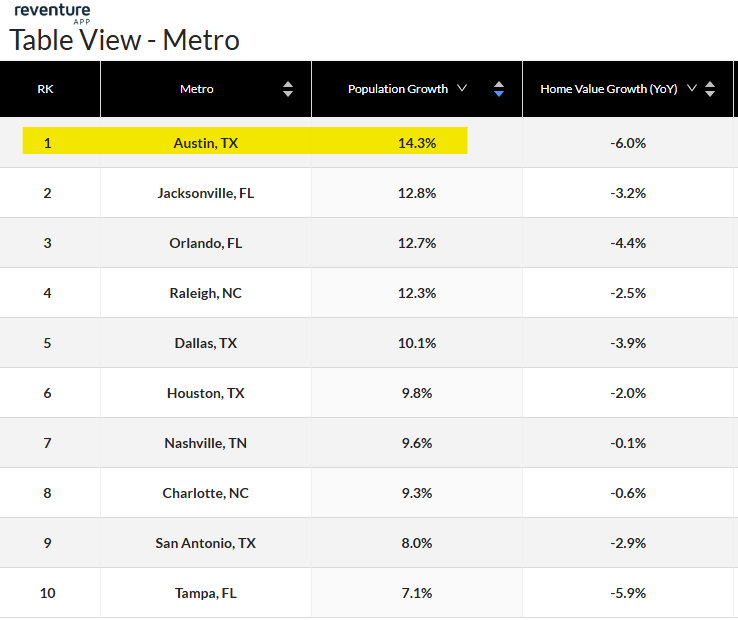

2) The miraculous thing about this is that Austin, despite the slowdown in migration, is still a demographic beast when it comes to growth.

It's 5-year population growth rate from 2019-2024 is 14.3%.

Which is easily #1 among other large metros.

(Note: it's interesting how every high population growth market during pandemic is now seeing declining values. The boom/bust cycle is real).

It's 5-year population growth rate from 2019-2024 is 14.3%.

Which is easily #1 among other large metros.

(Note: it's interesting how every high population growth market during pandemic is now seeing declining values. The boom/bust cycle is real).

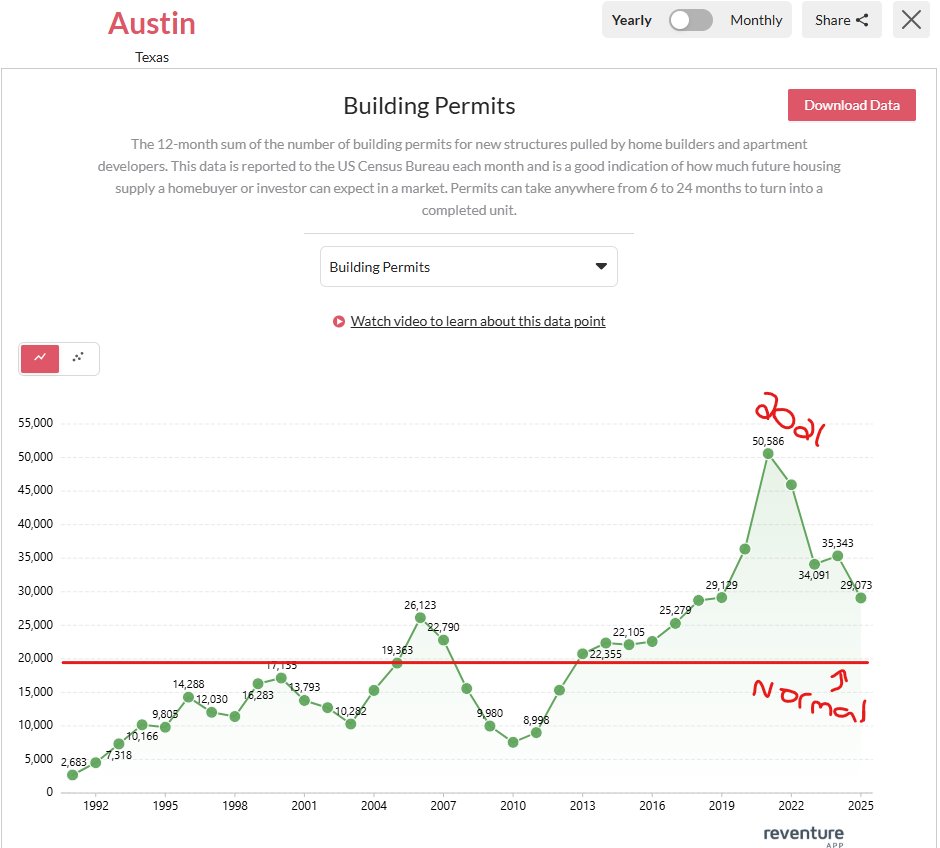

3) Now - why is this happening?

It's mainly due to a ridiculous amount of new supply from builders.

At the peak, in 2021, home builders pulled around 50,000 permits per year in Austin (single-family + multifamily).

This was nearly double the previous high, and was unprecedented.

This permit deluge is still resulting in completed projects today.

It's mainly due to a ridiculous amount of new supply from builders.

At the peak, in 2021, home builders pulled around 50,000 permits per year in Austin (single-family + multifamily).

This was nearly double the previous high, and was unprecedented.

This permit deluge is still resulting in completed projects today.

4) You can see how outrageous this was on this graph.

"normal" permitting levels in Austin are around 20,000 units per year, going back several decades.

But starting in mid-2010s the permitting picked up.

And then it exploded during the pandemic - over 50,000 in 2021 and around 45,000 in 2022.

And is still somewhat high today at 29,000. Builders keep permitting even though both prices and rents in Austin have plunged.

"normal" permitting levels in Austin are around 20,000 units per year, going back several decades.

But starting in mid-2010s the permitting picked up.

And then it exploded during the pandemic - over 50,000 in 2021 and around 45,000 in 2022.

And is still somewhat high today at 29,000. Builders keep permitting even though both prices and rents in Austin have plunged.

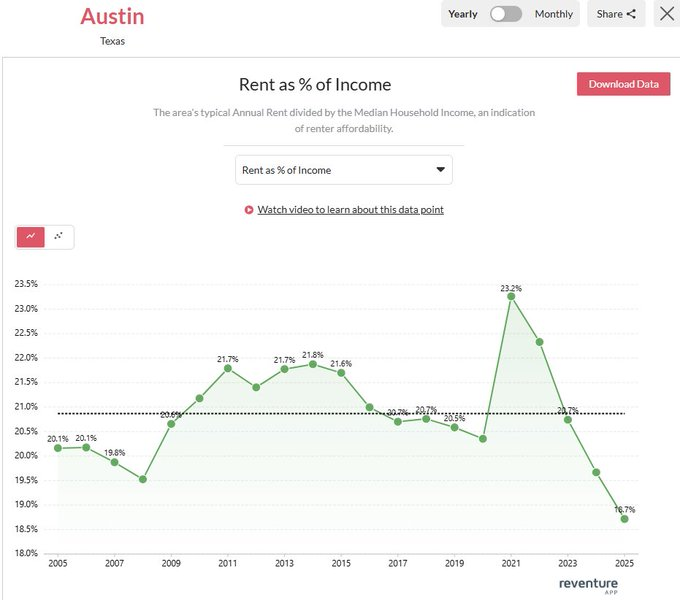

5) All in all - this is great news for Austin.

And I feel confident in forecasting that the metro will eventually regain its top mantle for migration in future years a result.

Literally - there is almost nowhere cheaper to rent in the U.S. when you factor in income levels.

And I feel confident in forecasting that the metro will eventually regain its top mantle for migration in future years a result.

Literally - there is almost nowhere cheaper to rent in the U.S. when you factor in income levels.

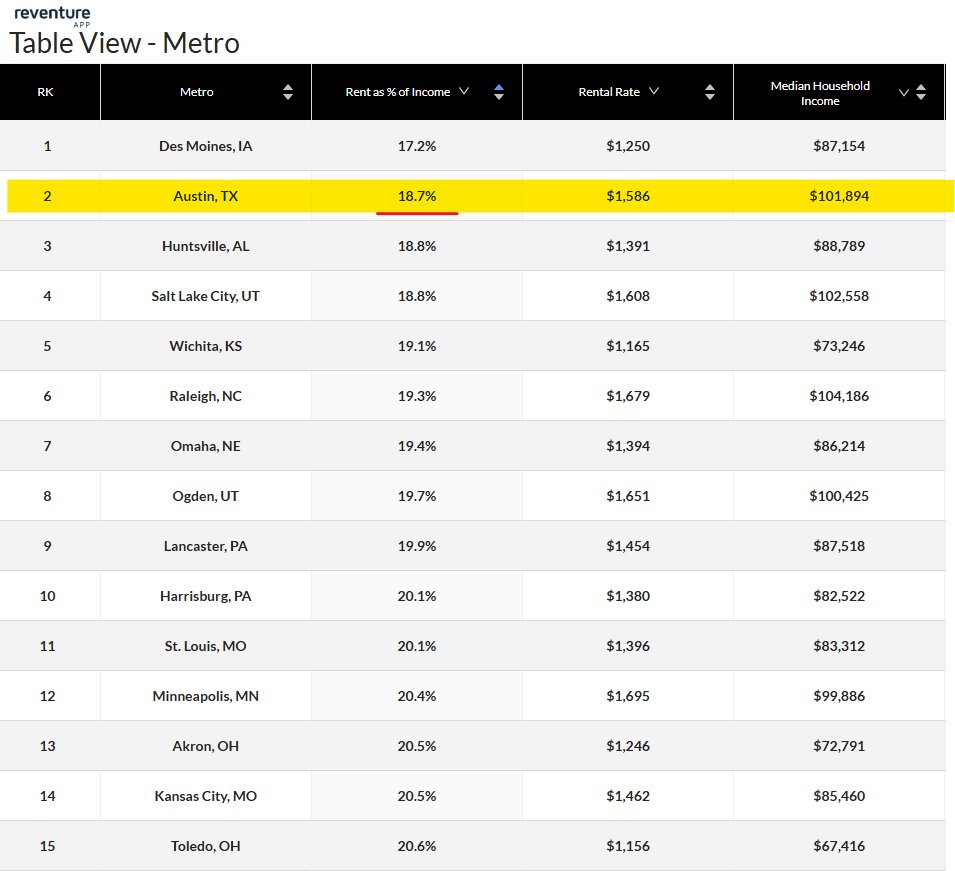

6) Austin's "Rent/Income" Ratio is now down to 18.7%.

Which is the lowest level on record, in Reventure's data set, going back to 2005.

Reventure calculates Rent/Income by combining data from Zillow and the US Census Bureau through time.

Currently, Zillow's monthly rent for Austin is $1,586, or $19,000 per year.

Meanwhile, area median income is $102,000.

Thus the 18.7% Rent/Income Ratio.

Which is the lowest level on record, in Reventure's data set, going back to 2005.

Reventure calculates Rent/Income by combining data from Zillow and the US Census Bureau through time.

Currently, Zillow's monthly rent for Austin is $1,586, or $19,000 per year.

Meanwhile, area median income is $102,000.

Thus the 18.7% Rent/Income Ratio.

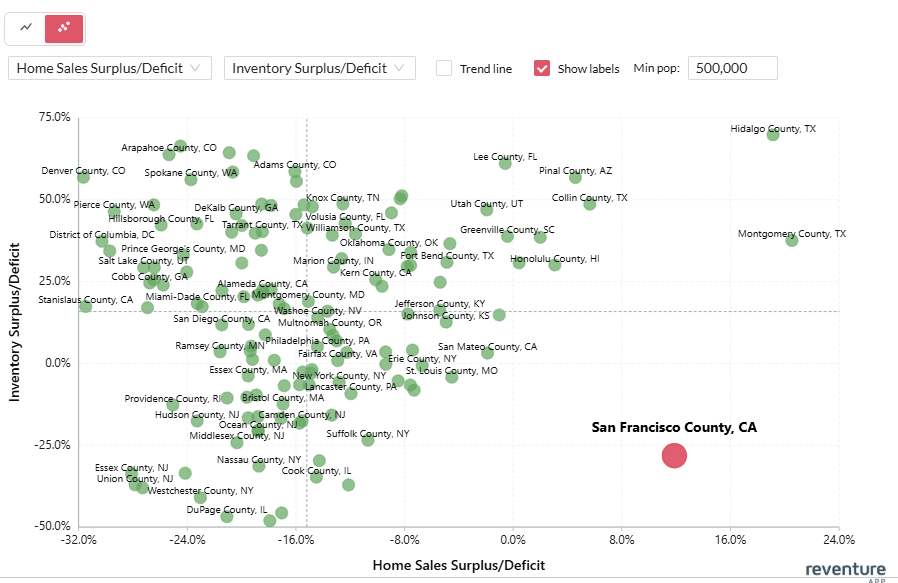

7) How cheap is a 18.7% rent/income ratio?

It's literally the 2nd cheapest in the U.S.

After Des Moines, Iowa.

It's literally the 2nd cheapest in the U.S.

After Des Moines, Iowa.

8) It's wild that Austin rents are now relatively cheaper than Rust Belt markets like Lancaster, Pa, St. Louis, MO, and Akron, OH.

Austin rents are priced like it's a no-growth Midwest town.

But it's a Sun Belt boomtown (in the long-term).

Austin rents are priced like it's a no-growth Midwest town.

But it's a Sun Belt boomtown (in the long-term).

9) Of course - prices in Austin are also dropping hard as well. Down 25% in a similar period.

Reventure thinks there's still some downside left for Austin's market in 2026.

But at some point, it will flip to a buy. To find out when, and to see the 12-month price forecast for your area, go to reventure.app and sign up for a premium account.

Reventure thinks there's still some downside left for Austin's market in 2026.

But at some point, it will flip to a buy. To find out when, and to see the 12-month price forecast for your area, go to reventure.app and sign up for a premium account.

• • •

Missing some Tweet in this thread? You can try to

force a refresh