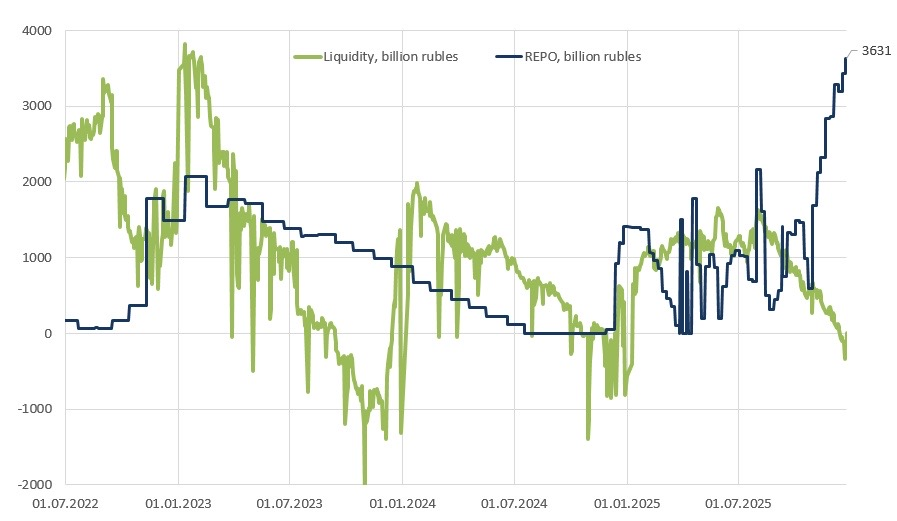

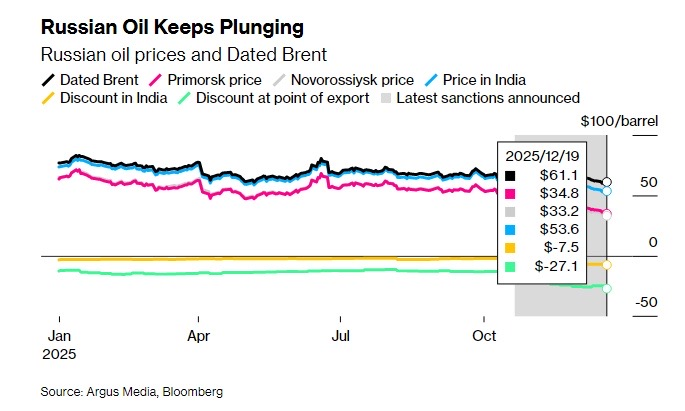

🧵1/10: Since the last thread, several things have shifted at once. Liquidity is tighter, REPO use is higher, household stress is clearer, and fiscal pressure is rising. The system is still working, but on thinner margins.

📷: @evgen1232007

📷: @evgen1232007

https://twitter.com/OAlexanderDK/status/2005010032128352259

2/10: REPO has crossed an important line. It no longer spikes and fades. It keeps stepping higher and staying there. Recent auctions near ₽4.7tn show banks now rely on the central bank as a permanent funding source.

3/10: At the same time, net system liquidity has fallen deeper into negative territory. This means REPO is replacing lost deposits, not smoothing temporary gaps. That makes the system more fragile.

4/10: Government financing has worsened. OFZ issuance is rising, but the cash raised lags the volume issued. The shift to revenue-based targets is a quiet admission of stress.

https://x.com/OAlexanderDK/status/2005010085538562306

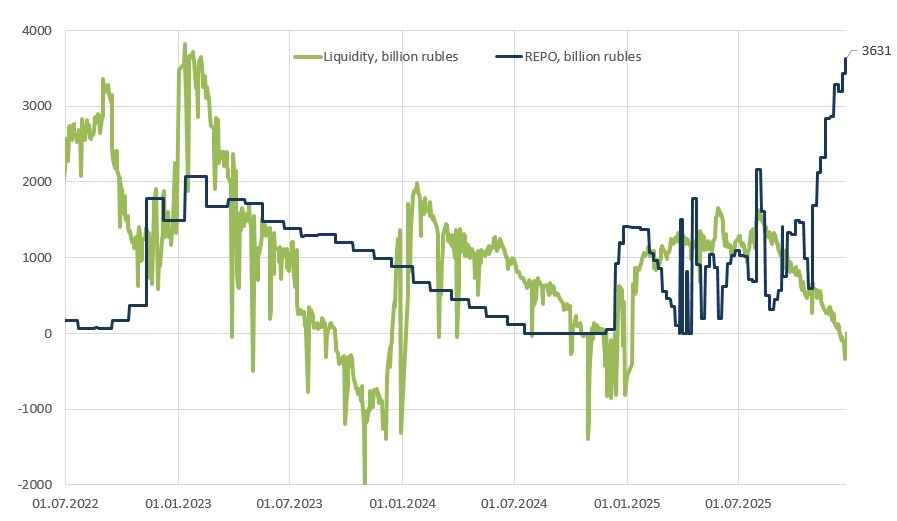

5/10: Oil conditions have deteriorated further. Discounts widened to roughly $30–35 per barrel, and exporters now need tax breaks just to stay afloat. This is a structural hit to budget revenues.

6/10: The fiscal response is tightening, not easing. VAT and excises rise, SME relief is cut, and state company dividends to the budget may fall by around 40%. The revenue base is narrowing.

https://x.com/OAlexanderDK/status/2005589589638209823

7/10: New household data confirms the strain. SberIndex shows real consumption flat to negative once inflation is adjusted. Discretionary spending is falling, and withdrawals accelerated into year-end.

https://x.com/evgen1232007/status/2005917732693319716

8/10: Despite all this, the ruble is held near 78 to the dollar. That’s a policy choice to avoid inflation and bank stress, not a sign of strength. It shows how little room policymakers have. Devaluing would increase oil revenues, but would likely hurt confidence in the system

9/10: Compared to the original thread, buffers are thinner and confidence matters more. The economy still functions, but it is far more sensitive to shocks than it was even a few months ago.

10/10: Conclusion: Since the last thread, risks have continued to increase across liquidity, households, and the budget. Russia’s economy still hasn’t broken, but the margin for error is now very small.

One major shock will travel fast.

One major shock will travel fast.

• • •

Missing some Tweet in this thread? You can try to

force a refresh