The Venezuela plot thickens:

While Venezuela holds 303 BILLION barrels of oil reserves, much of this is HEAVY crude oil.

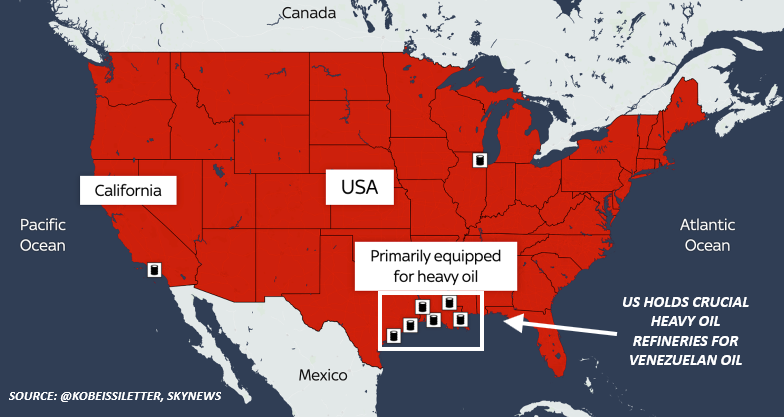

Texas and Louisiana also *happen* to have 6 of the LARGEST HEAVY crude oil refineries in the world.

What does this mean? Let us explain.

(a thread)

While Venezuela holds 303 BILLION barrels of oil reserves, much of this is HEAVY crude oil.

Texas and Louisiana also *happen* to have 6 of the LARGEST HEAVY crude oil refineries in the world.

What does this mean? Let us explain.

(a thread)

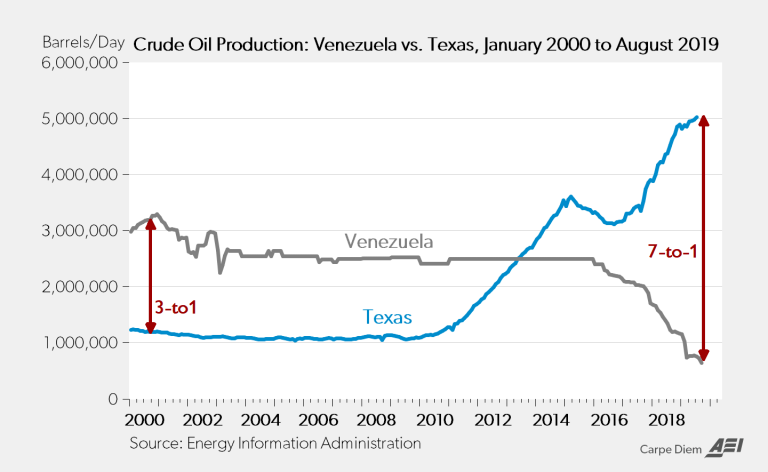

In the early 2000s, Venezuela was a MUCH larger oil producer than the US.

In fact, Venezuela produced 3 TIMES as much oil, at nearly 3.3 million barrels per day.

By 2020, Venezuela's production had declined to just 900K/day, while the US hit 5 million/day.

This is key.

In fact, Venezuela produced 3 TIMES as much oil, at nearly 3.3 million barrels per day.

By 2020, Venezuela's production had declined to just 900K/day, while the US hit 5 million/day.

This is key.

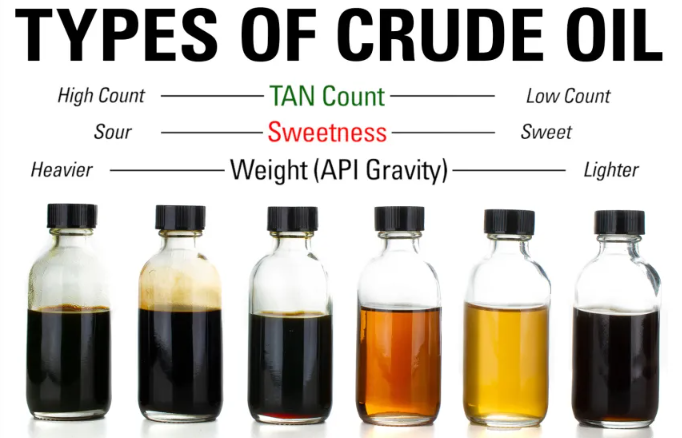

First, Venezuela has been heavily sanctioned by the US for years.

This resulted in old infrastructure, hindering the ability to extract HEAVY crude oil.

Heavy oil is far more expensive to extract than light crude.

This requires advanced techniques like steam injection.

This resulted in old infrastructure, hindering the ability to extract HEAVY crude oil.

Heavy oil is far more expensive to extract than light crude.

This requires advanced techniques like steam injection.

The image below helps to better understand.

The leftmost vial shows heavy crude oil which is often a goo-like mixture.

As you move to the right, the crude oil becomes lighter and much easier to process.

But, here's exactly why this is a crucial point for the US.

The leftmost vial shows heavy crude oil which is often a goo-like mixture.

As you move to the right, the crude oil becomes lighter and much easier to process.

But, here's exactly why this is a crucial point for the US.

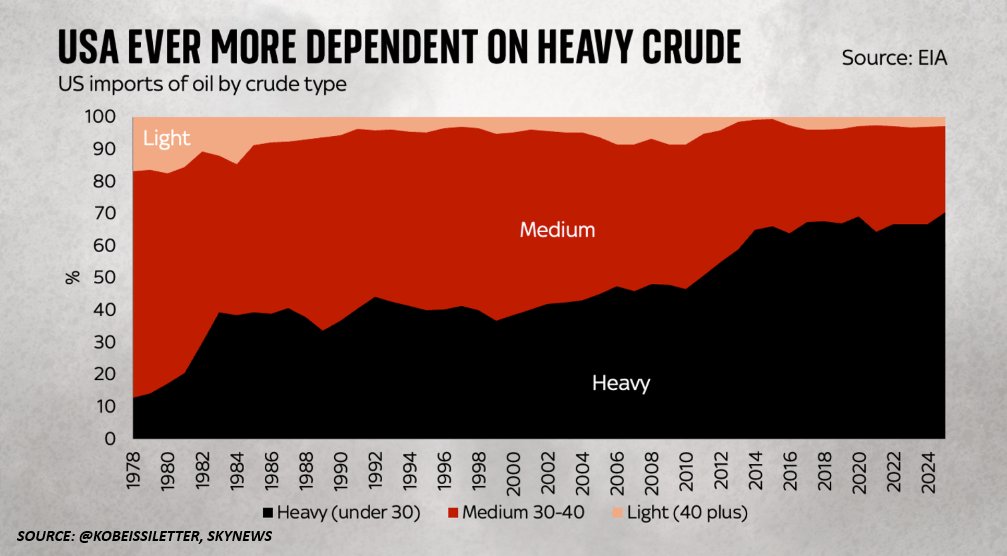

The US has become incredibly dependent on heavy crude oil.

In 1980, just 10-20% of US crude oil imports were heavy crude oil.

Today, the MAJORITY of US crude oil imports are heavy crude oil, at ~70%.

The US wants more heavy crude and Venezuela has BILLIONS of barrels of it.

In 1980, just 10-20% of US crude oil imports were heavy crude oil.

Today, the MAJORITY of US crude oil imports are heavy crude oil, at ~70%.

The US wants more heavy crude and Venezuela has BILLIONS of barrels of it.

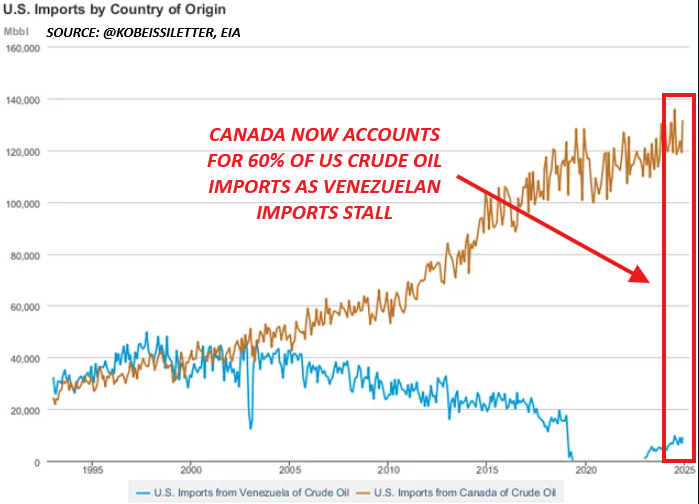

Now, take a look at crude oil imports to the US:

Canada's share of imports has surged from ~15% to ~60% of US imports.

Meanwhile, Venezuela's imports to the US have effectively stalled.

If the US can restore these imports, it would be HIGHLY profitable for the US government.

Canada's share of imports has surged from ~15% to ~60% of US imports.

Meanwhile, Venezuela's imports to the US have effectively stalled.

If the US can restore these imports, it would be HIGHLY profitable for the US government.

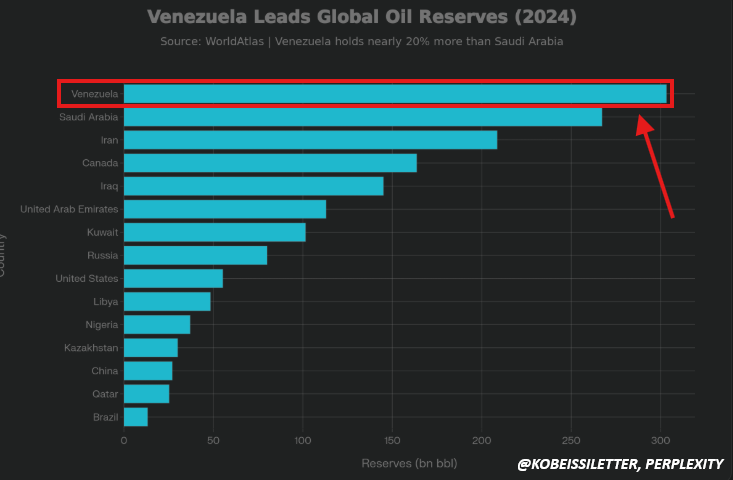

Currently, Venezuela holds more oil reserves than any other country in the world.

They even hold 20% more oil reserves than Saudi Arabia.

What's the "best" way to restore these massive heavy crude oil imports to the US?

Take control of the country's oil reserves.

They even hold 20% more oil reserves than Saudi Arabia.

What's the "best" way to restore these massive heavy crude oil imports to the US?

Take control of the country's oil reserves.

Yesterday, President Trump explicitly said it:

"We are going to have our very large US oil companies go in, spend billions of dollars, fix the broken oil infrastructure and start making money."

Trump also said the US will "sell large amounts of oil" pumped from Venezuela.

"We are going to have our very large US oil companies go in, spend billions of dollars, fix the broken oil infrastructure and start making money."

Trump also said the US will "sell large amounts of oil" pumped from Venezuela.

And, it becomes even more strategic for the US.

Aside from Venezuela, Russia has some of the largest HEAVY crude oil reserves in the world.

Tapping into Venezuela's heavy crude oil reserves effectively further weakens Russia's influence.

This is also a geopolitical move.

Aside from Venezuela, Russia has some of the largest HEAVY crude oil reserves in the world.

Tapping into Venezuela's heavy crude oil reserves effectively further weakens Russia's influence.

This is also a geopolitical move.

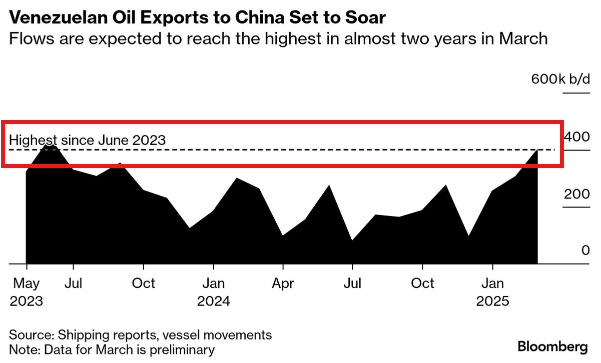

To top it all off, China is the largest buyer of Venezuelan oil.

This accounts for ~5% of China's total annual oil imports.

As the US gains control of Venezuela, this gives President Trump even more control over China.

Trump said he would sell some of this oil to China.

This accounts for ~5% of China's total annual oil imports.

As the US gains control of Venezuela, this gives President Trump even more control over China.

Trump said he would sell some of this oil to China.

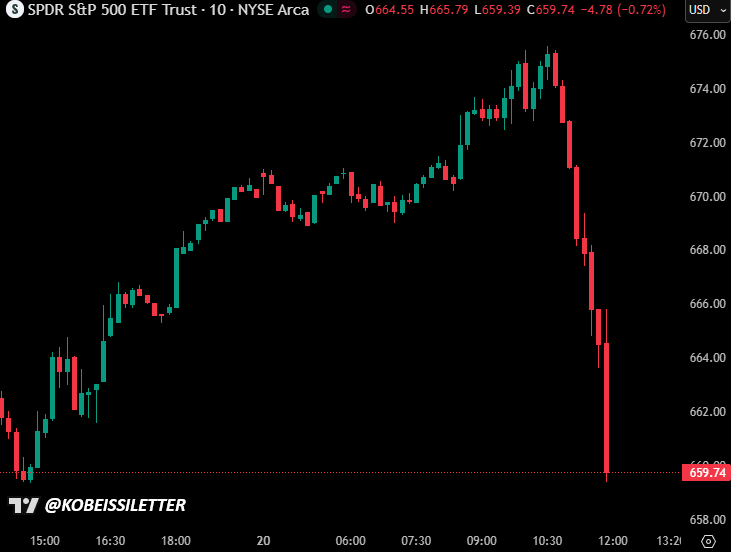

This weekend's events in Venezuela will have major effects on the global economy.

The macroeconomy is shifting and stocks, commodities, bonds, and crypto will move.

Want to receive our premium analysis?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

The macroeconomy is shifting and stocks, commodities, bonds, and crypto will move.

Want to receive our premium analysis?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

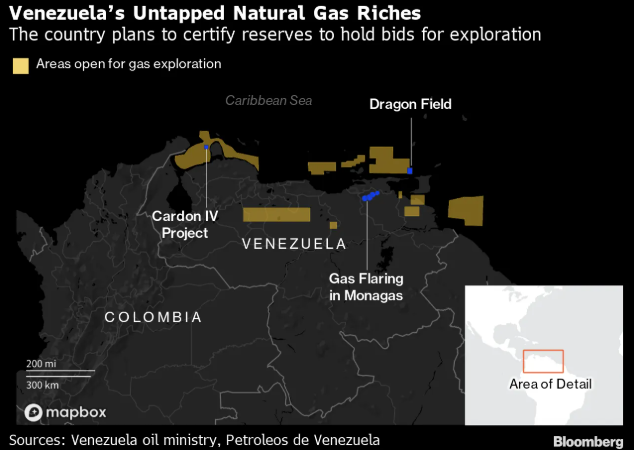

Lastly, Venezuela's economic impact goes well beyond oil.

They hold 200 TRILLION cubic feet of natural gas reserves, and many are unexplored.

The economic implications of this weekend's events are massive.

Follow us @KobeissiLetter for real time analysis as this develops.

They hold 200 TRILLION cubic feet of natural gas reserves, and many are unexplored.

The economic implications of this weekend's events are massive.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh