There is a lot of talk -- not the least from the US Administration -- about the windfall from Venezuela's oil. It is worth doing a bit of (boring) quantification.

Bottom line: it isn't going to pay for everything ...

1/

Bottom line: it isn't going to pay for everything ...

1/

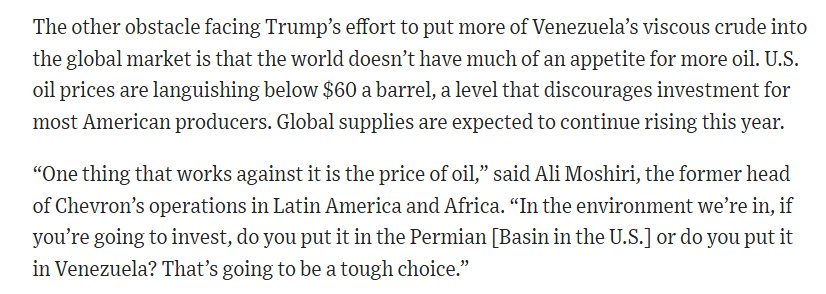

Venezuela's oil is heavy and sour, so it trades at a discount to sweet light.

2024 production was 0.9 mbd. Domestic consumption isn't zero. To generous, assume 0.75 mbd at day at $50 a barrel -- that generates $14 billion a year in exports.

2/

2024 production was 0.9 mbd. Domestic consumption isn't zero. To generous, assume 0.75 mbd at day at $50 a barrel -- that generates $14 billion a year in exports.

2/

Industry experts (@Big_Orrin ) think the upper bound on how much additional production could be generated if the international oil service giants came in to revitalize the fields is ~ 1 mbd, or a ~$18b

3/

3/

So an export revenue stream of over $30b (barring big swings in price) in a few years ...

A decent flow, but not a huge sum

(the long run maximum with a TON of new investment is perhaps 4 mbd, or Canada/ Iraq ... not Russia/ Saudi)

4/

wsj.com/business/energ…

A decent flow, but not a huge sum

(the long run maximum with a TON of new investment is perhaps 4 mbd, or Canada/ Iraq ... not Russia/ Saudi)

4/

wsj.com/business/energ…

But also consider all that has to be paid out of the oil revenue stream --

First, the oil majors and the oil service companies on their current production. They don't produce the oil for free ...

5/

First, the oil majors and the oil service companies on their current production. They don't produce the oil for free ...

5/

Second, most of Venezuela's imports, as its other (legitimate) exports are tiny -- and Venezuela's people will have higher expectations from US backed leader than from Maduro ...

6/

6/

Trump says he wants Venezuela to pay compensation (the ICSID awards? something more) for Venezuela's past nationalization of US assets -- that could eat up a lot of current export proceeds ...

7/

7/

It wouldn't be a total surprise if Trump wants Venezuela to pay for the cost of any new US bases in the area (speculating here ... ); it presumably doesn't want a new US presence to be a new drain on the US taxpayer (not very America first ...)

8/

8/

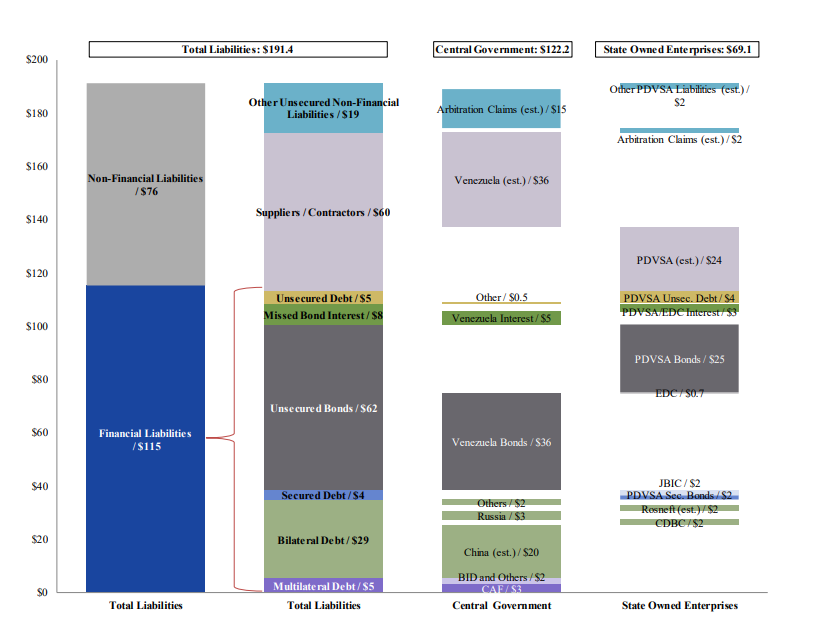

And of course Venezuela has a huge stock of unpaid debt -- GoV bonds, PDVSA bonds, Chinese claims etc.

The principal value of obvious claims is at least $100b, and there supplier credits outstanding + lots of past due interest

9/

The principal value of obvious claims is at least $100b, and there supplier credits outstanding + lots of past due interest

9/

The chart comes from a paper from Richard Cooper and Mark Walker (two distinguished lawyers with sovereign debt experience) from a few years ago -- am sure there there will be updates and new estimates

10/

papers.ssrn.com/sol3/papers.cf…

10/

papers.ssrn.com/sol3/papers.cf…

Point being that there isn't a near term oil revenue stream big enough to pay for current imports (which will go up if the US wants stability), past claims (expropriation compensation, unpaid debt) and the new investment needed to raise production substantially ...

11/

11/

As Mark Sobel has noted, the normal practice would be to have the IMF go in and start to sort out the external debts and put out a few numbers on near term imports to set out the fx available to pay off old claims (in a world where the IMF returns to thinking in BoP terms)

12/

12/

But the IMF is an international organization and it wouldn't (easily) embrace a rigged process where US oil companies get paid first and get preferential access to new oil concessions ...

13/

13/

So let's see how the Trump Administration proceeds when it discovers the limits on Venezuela's oil export proceeds -- and the reality that Venezuela will be cash constrained.

14/14

14/14

• • •

Missing some Tweet in this thread? You can try to

force a refresh