Saudi Arabia's q3 current account numbers are out, and they -- unsurprisingly -- showed an ongoing deficit.

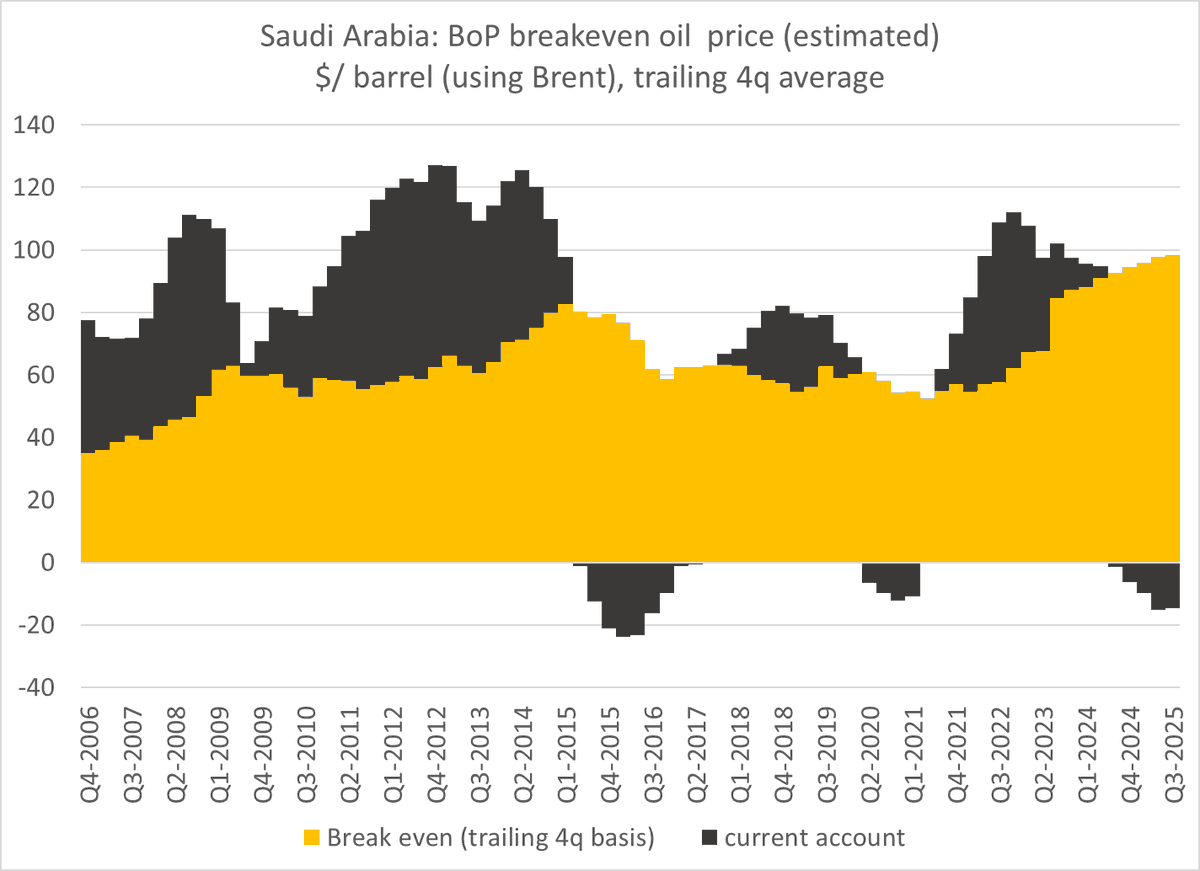

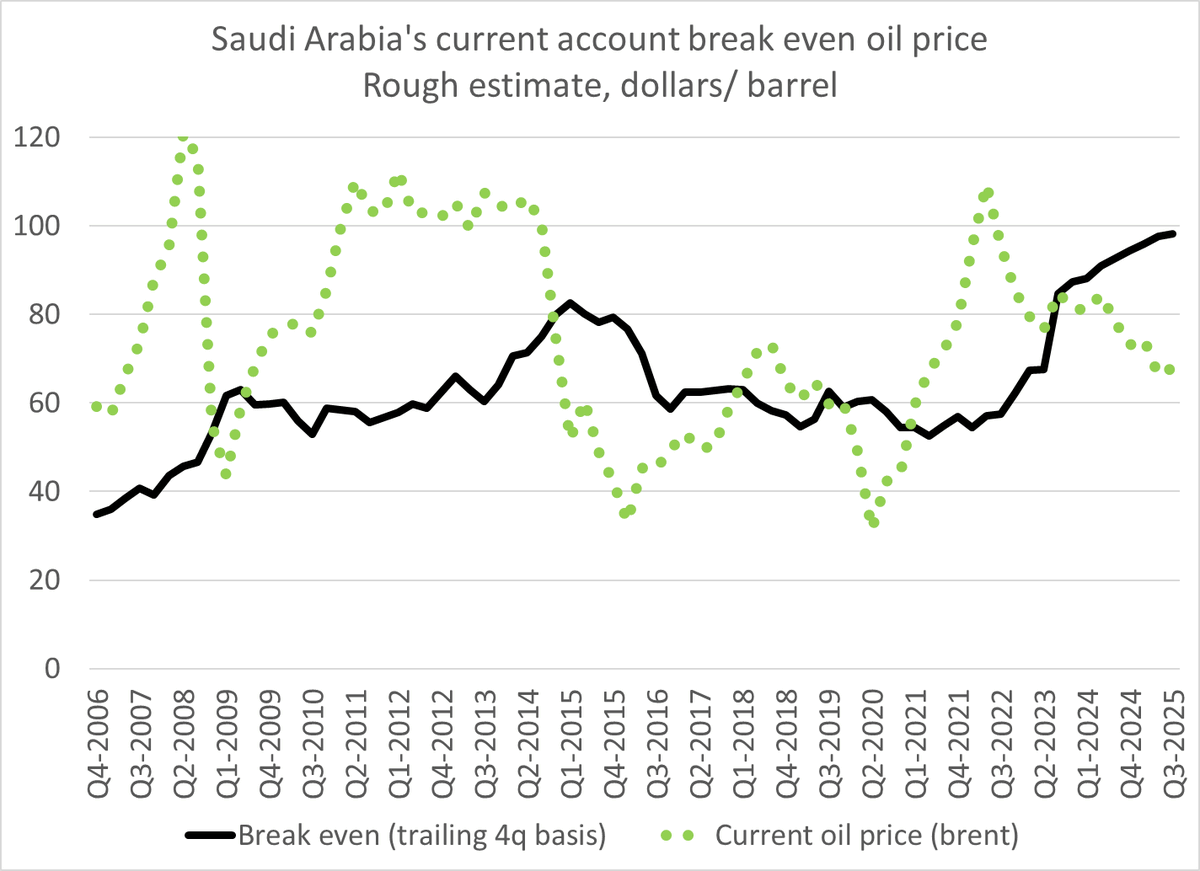

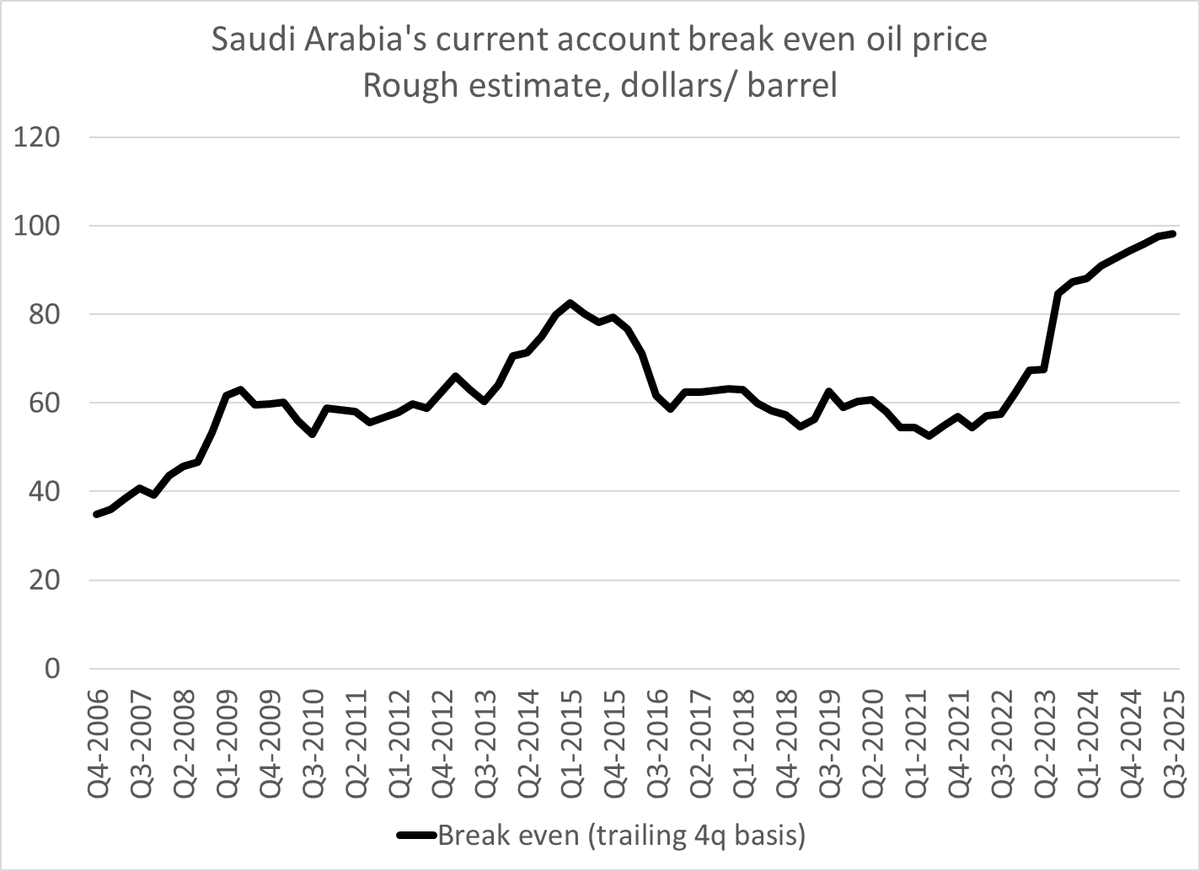

My rough estimate for Saudi Arabia's current account break even (the oil price that results in external balance) continues to be over $90 a barrel

1/x

My rough estimate for Saudi Arabia's current account break even (the oil price that results in external balance) continues to be over $90 a barrel

1/x

A reminder -- the external break even is calculating using reported oil export revenues, the non-oil current account, and net exports (my numbers there are dependent on getting regular updates from @Rory_Johnston )

2/

2/

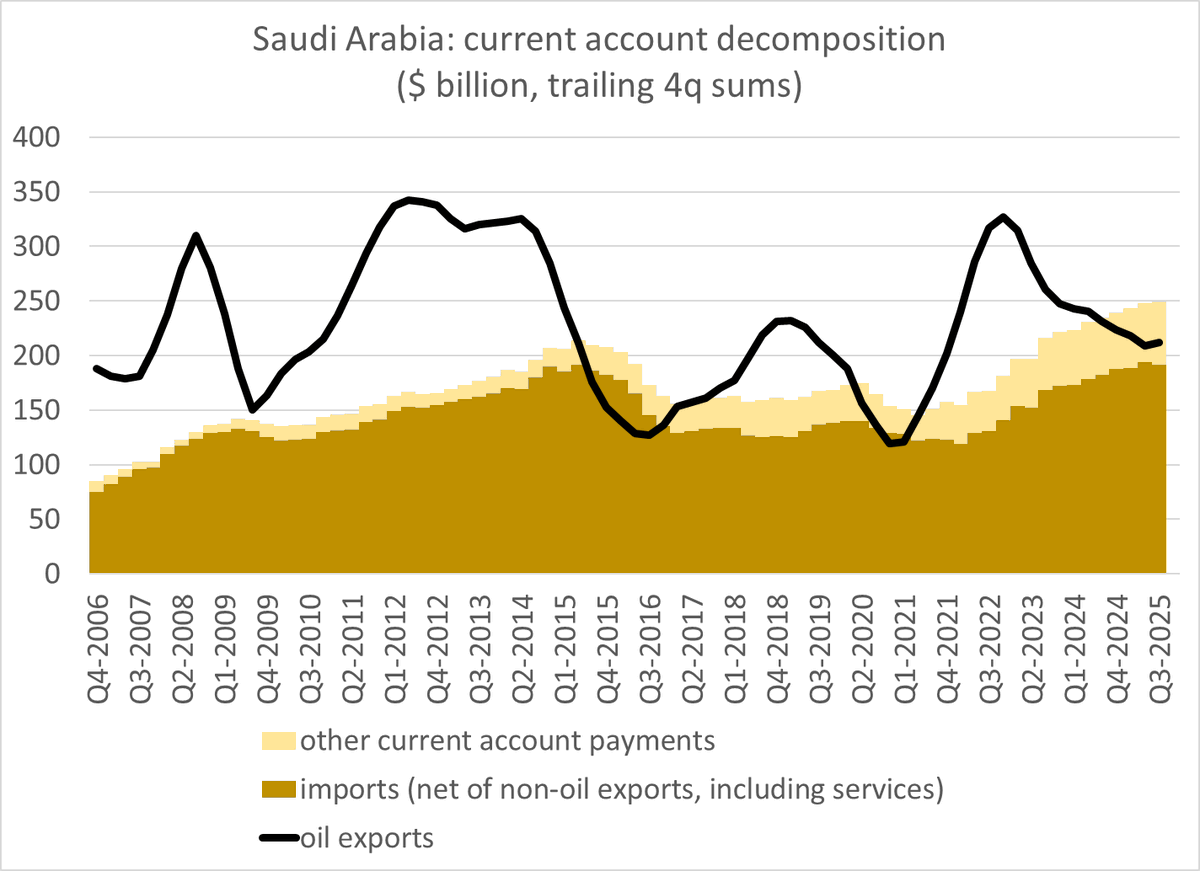

@Rory_Johnston i.e. Saudi Arabia needs $250 billion a year in export receipts from oil to balance its current account -- and that is much more than it gets with oil at ~ $60 a barrel

3/

3/

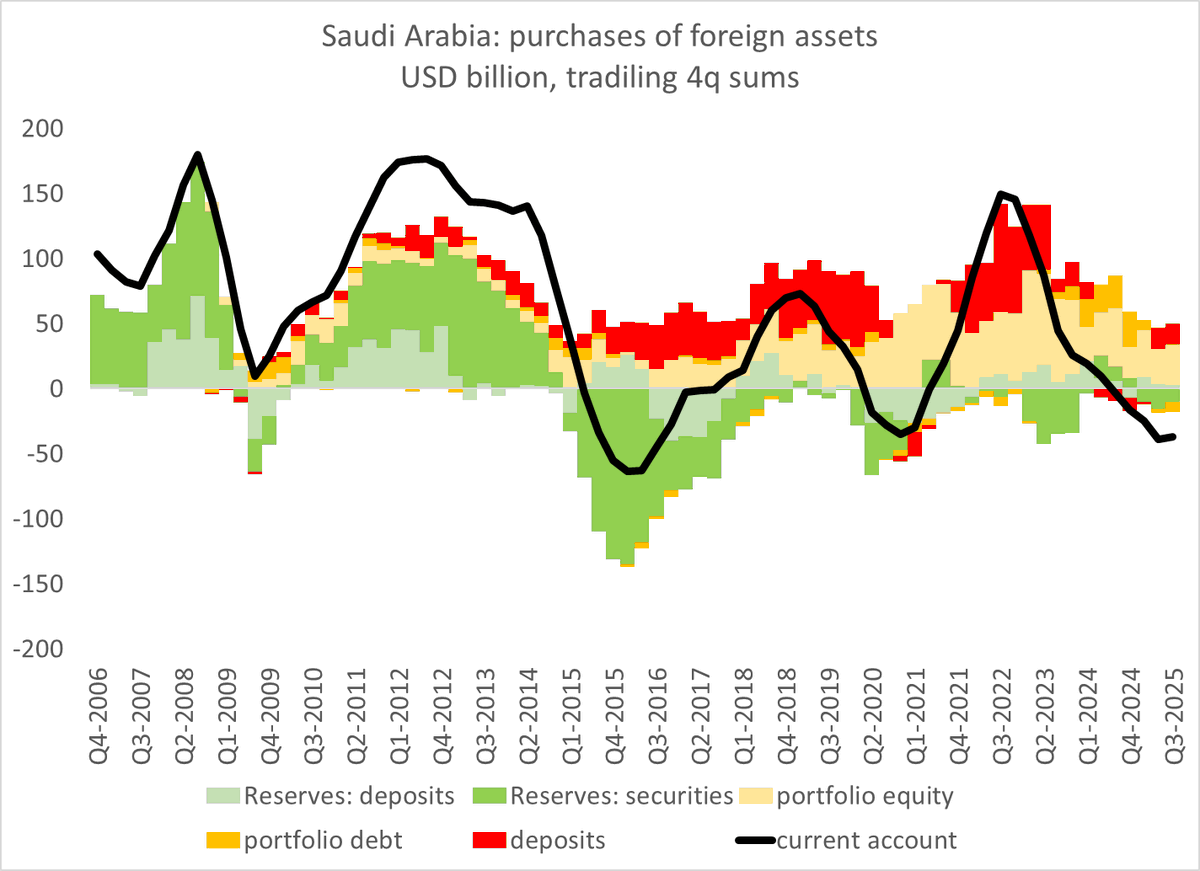

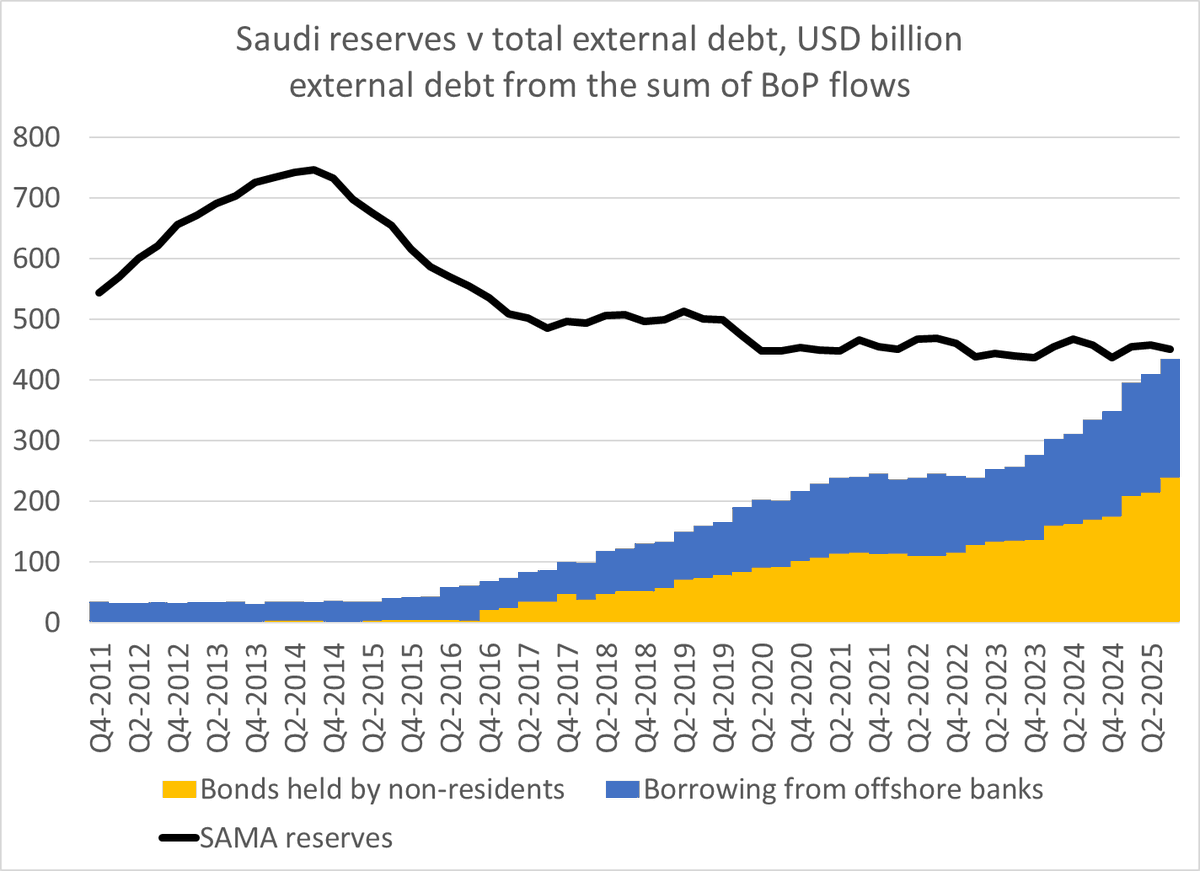

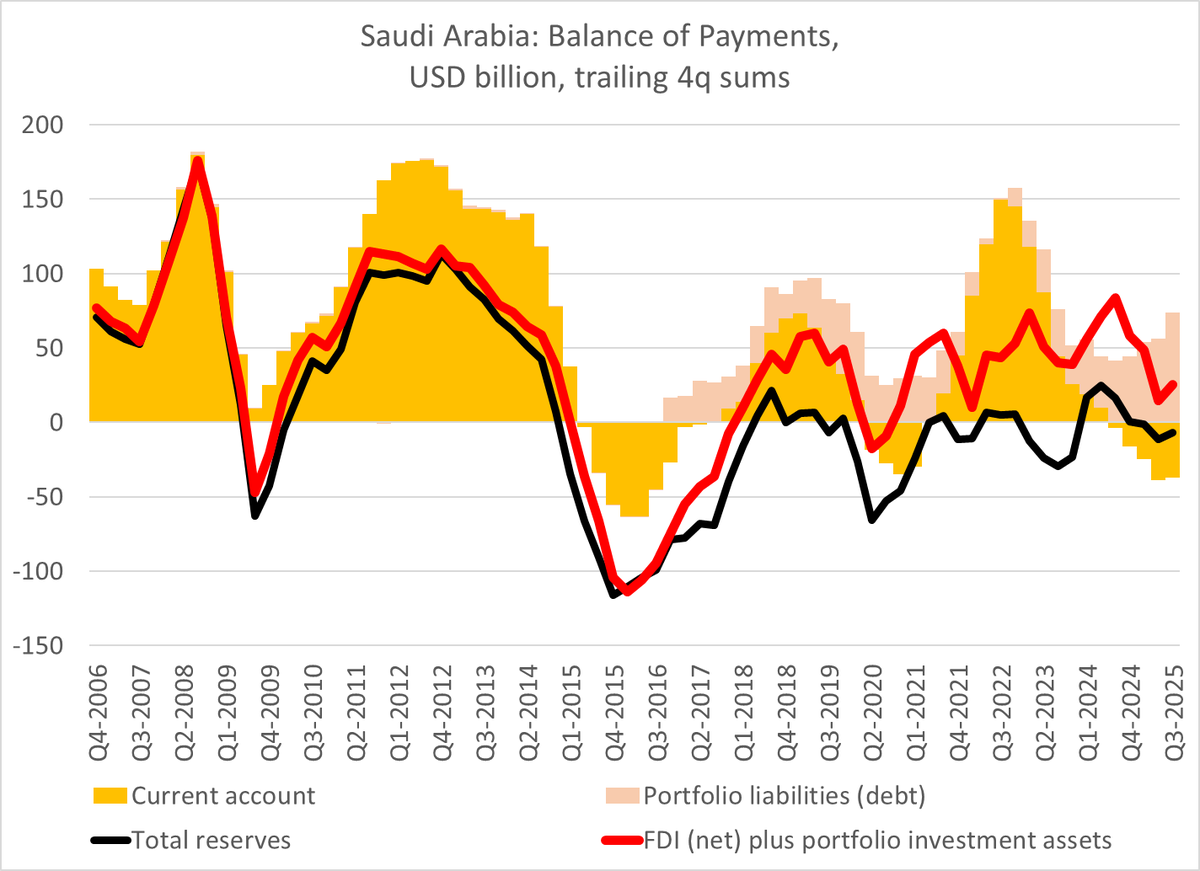

@Rory_Johnston There isn't yet any evidence that the Saudis (or MBS) are adjusting to current oil realities ... though the pace of external spending is growing a bit more slowly. The Saudis also continue to accumulate external assets even with a $40b current account deficit ...

4/

4/

@Rory_Johnston That is possible, of course, because the Saudis (the government, the PIF, Aramco ... ) are big borrowers -- placing bonds externally, taking out new bank loans, and so on ... external debt is poised to top reserves by end the of q4

5/

5/

@Rory_Johnston External borrowing from the market was over $70b over the last 4qs -- not a small sum

6/

6/

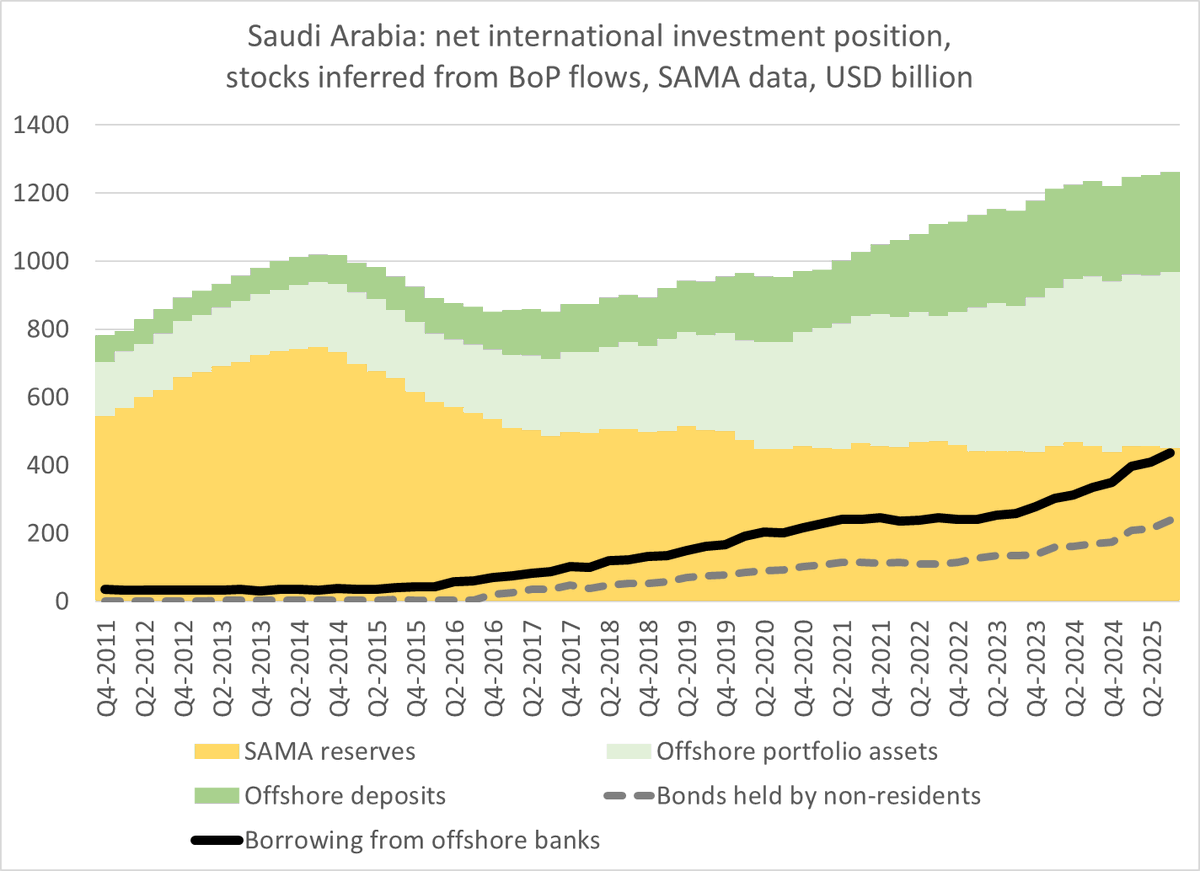

@Rory_Johnston To be sure, the Saudis have substantial non-reserve foreign assets; their aggregate external position is still solid ...

7/

7/

@Rory_Johnston But with a fiscal break even of ~ $100, a similar balance of payments break even, and rising external debt relative to reserves, I really don't understand why S&P upgraded Saudi Arabia last year ... its credit quality is getting worse not better

8/

spglobal.com/ratings/en/reg…

8/

spglobal.com/ratings/en/reg…

@Rory_Johnston I have given @IMFNews a hard time for ignoring balance of payments variables in their analysis of China (until recently) and in their market access debt sustainability analysis. But a lack of fluency in the balance of payments is now a more general problem

9/9

9/9

• • •

Missing some Tweet in this thread? You can try to

force a refresh