Ok, it is clear what happened in the October trade data

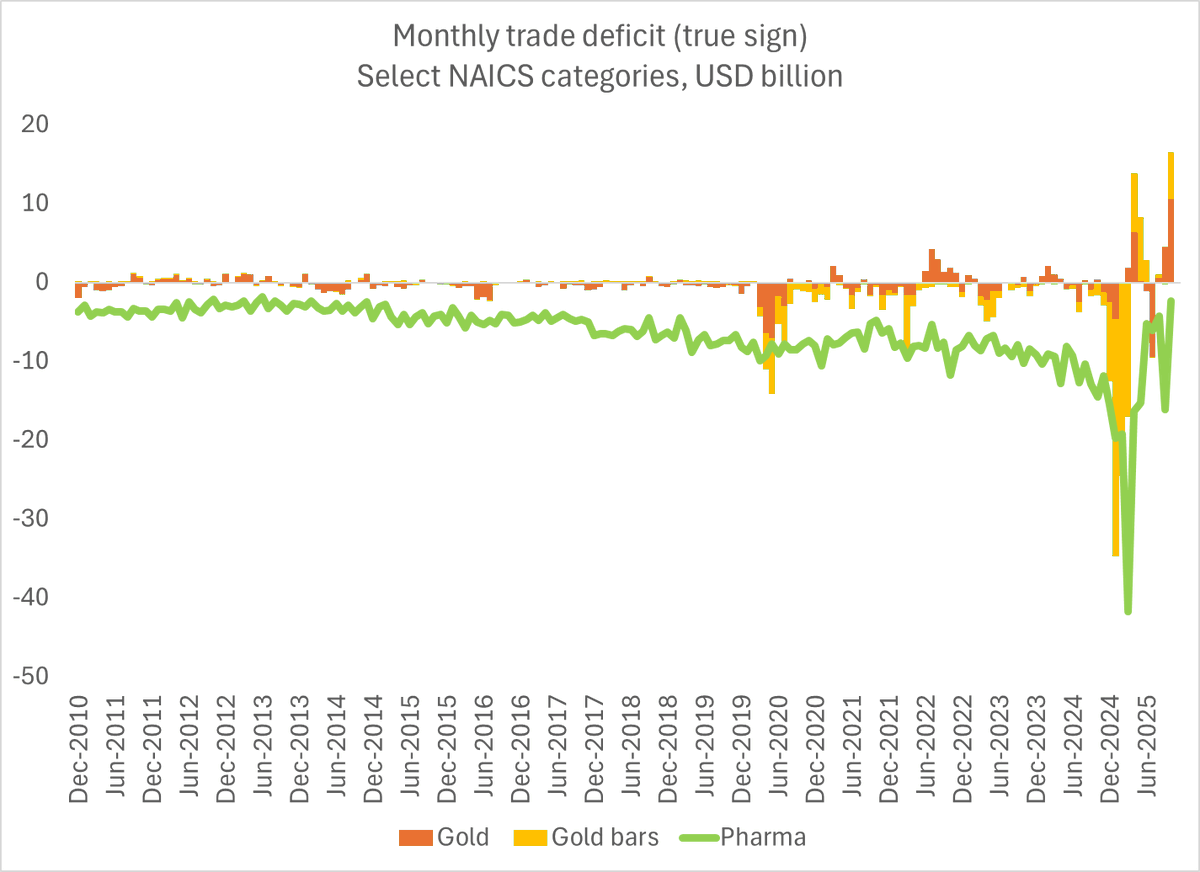

Imports of pharma collapsed, bring the pharma trade deficit WAY down (reversing the q1 front running); exports of gold soared, generating a big gold surplus

1/

Imports of pharma collapsed, bring the pharma trade deficit WAY down (reversing the q1 front running); exports of gold soared, generating a big gold surplus

1/

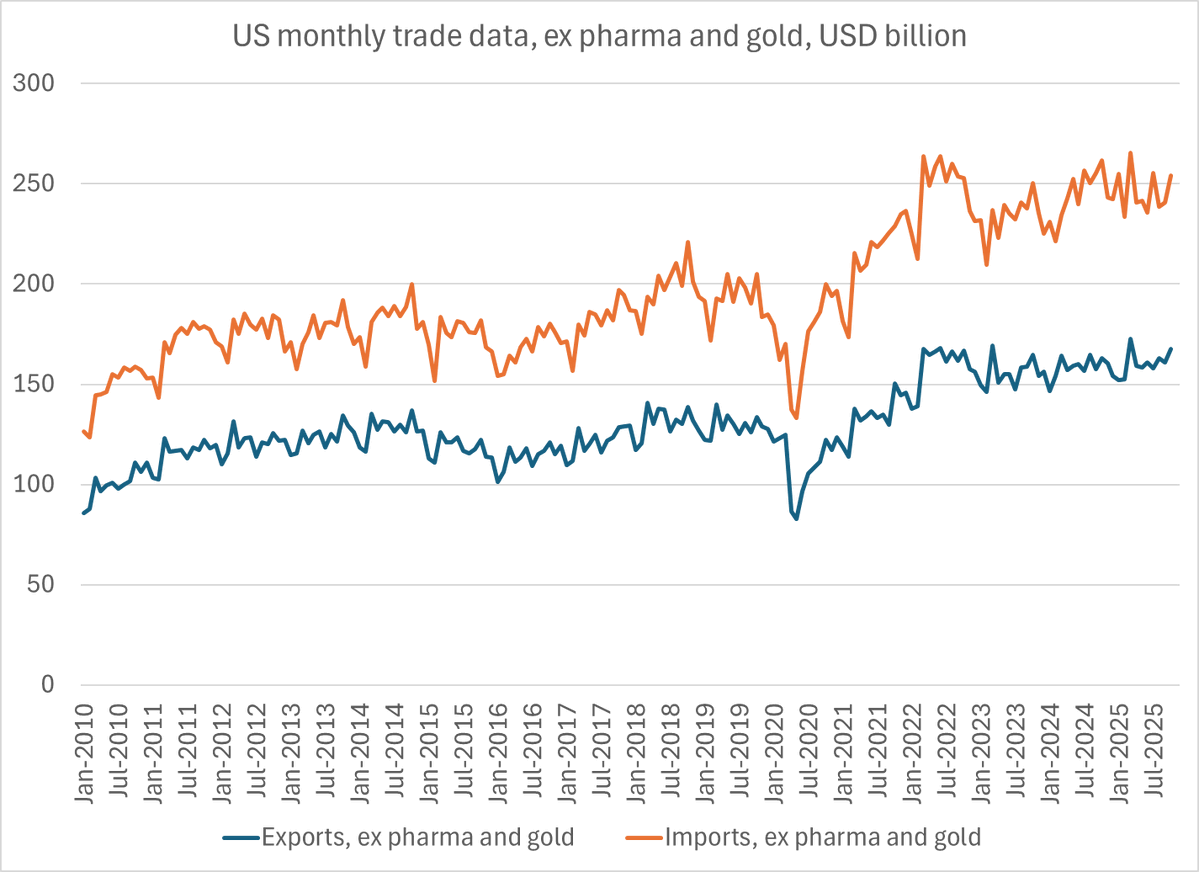

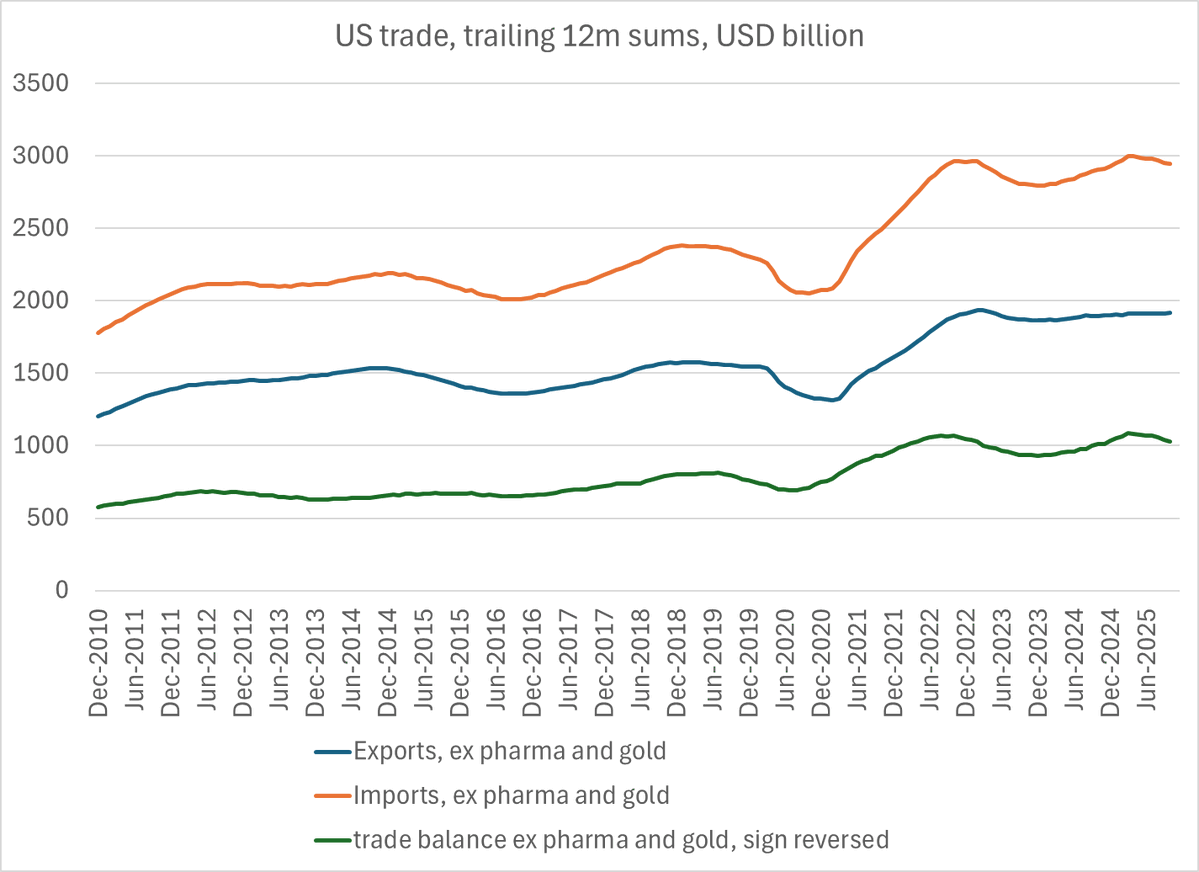

Net all the pharma noise out and imports remain flattish (up a bit in October v September) at a high level and exports are more or less flat too -- maybe there is a tiny upward trend since May but it is tiny

2/

2/

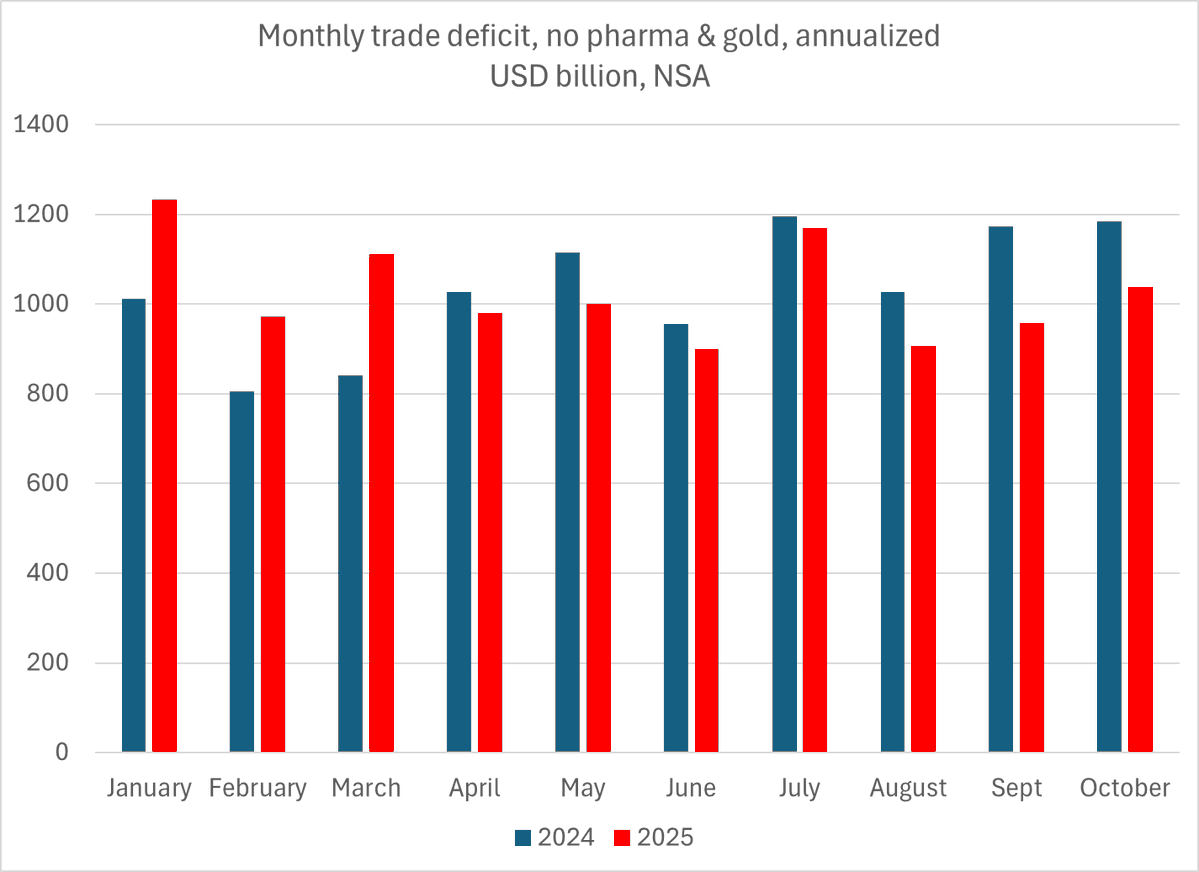

The no pharma or gold trade deficit is down a bit v 2025 (there was a bit of front running in other categories too -- see Jan v March) but actually up a bit v September

3/

3/

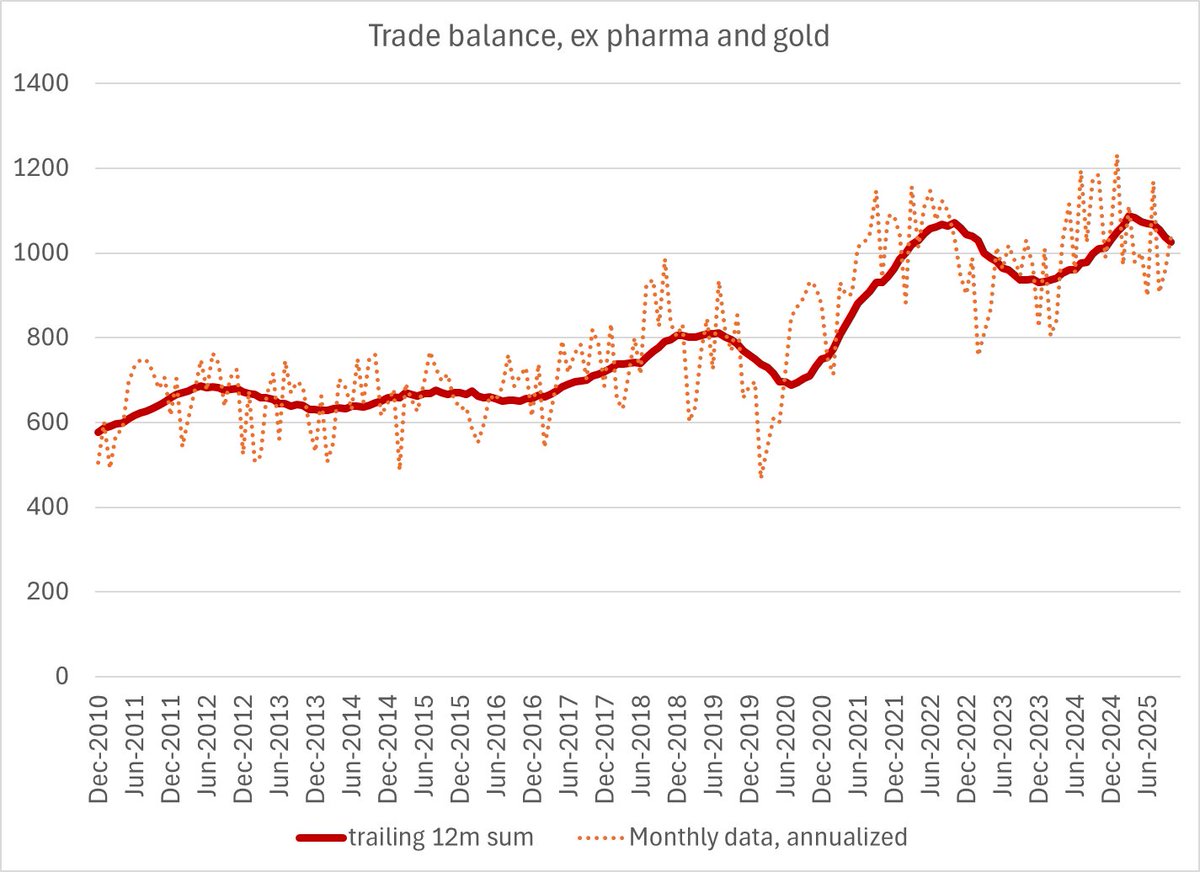

If the administration wanted to make a serious case that adjustment has started, they can show a down trend ex pharma and gold (pharma will still be up for the year tho, impacting the overall number) -- 2025 will likely be close to 2024 (peak in q1)

4/

4/

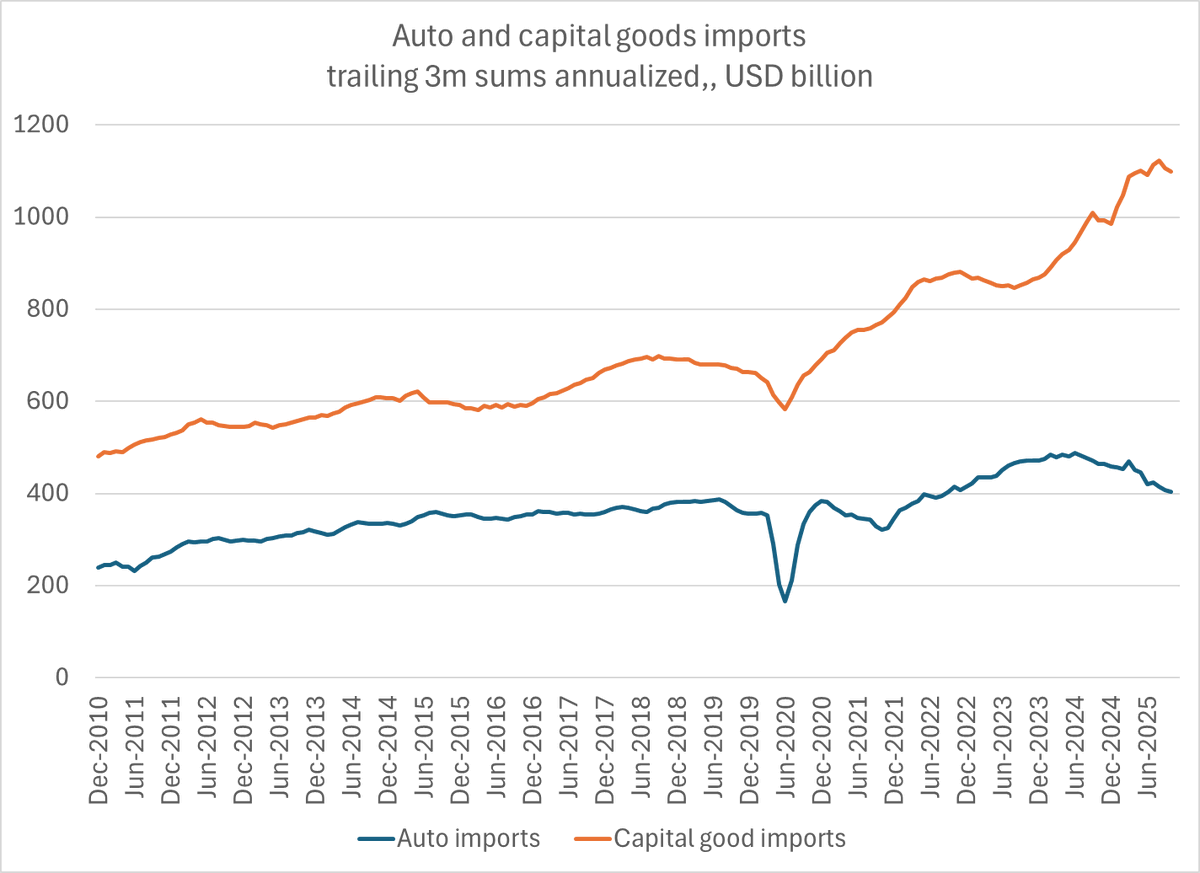

Auto imports remain weak (alas so it auto demand, there isn't a domestic auto boom) b/c of the tariffs (adjustment) --

I was expecting capital goods imports to rise in October on the AI investment boom/ more chip imports but it wasn't in the data. Expect it in November 5/

I was expecting capital goods imports to rise in October on the AI investment boom/ more chip imports but it wasn't in the data. Expect it in November 5/

Bottom line -- analysis of the US trade data right now requires a pharma and a gold (and probably an "all precious metals") adjustment

6/6

6/6

• • •

Missing some Tweet in this thread? You can try to

force a refresh