🚨Federal Bank-Has it found the right balance?

Led by the KVS Manian,

Federal Bank is diversifying away from Gold loans into a complete bank now!

The bank reported a superb set of numbers yesterday,

A thread🧵on the business of Federal Bank & what lies ahead?

Let's go👇

Led by the KVS Manian,

Federal Bank is diversifying away from Gold loans into a complete bank now!

The bank reported a superb set of numbers yesterday,

A thread🧵on the business of Federal Bank & what lies ahead?

Let's go👇

What is happening?

After disappointing the investors for 5 years

Federal Bank has finally started to report record profits.

Lets analyse the business of Federal Bank

After disappointing the investors for 5 years

Federal Bank has finally started to report record profits.

Lets analyse the business of Federal Bank

On of the biggest Assets,

KVS Manian has join Federal bank!

Shri. KVS Manian joins Federal Bank after an illustrious career spanning over two and a half decades at Kotak Mahindra Bank Ltd. During his tenure at Kotak, he played a pivotal role in the bank’s transformation from a Non-Banking Financial Company (NBFC) to one of India’s leading private sector banks.

His leadership was instrumental in driving the growth and profitability of Kotak’s Corporate, Institutional, and Investment Banking, as well as Wealth Management divisions.

KVS Manian has join Federal bank!

Shri. KVS Manian joins Federal Bank after an illustrious career spanning over two and a half decades at Kotak Mahindra Bank Ltd. During his tenure at Kotak, he played a pivotal role in the bank’s transformation from a Non-Banking Financial Company (NBFC) to one of India’s leading private sector banks.

His leadership was instrumental in driving the growth and profitability of Kotak’s Corporate, Institutional, and Investment Banking, as well as Wealth Management divisions.

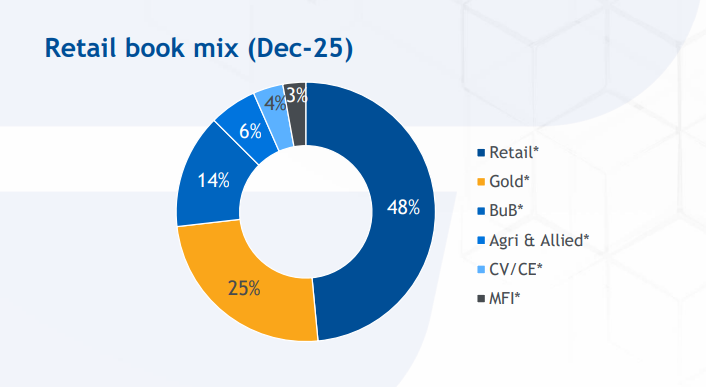

Federal Bank:-

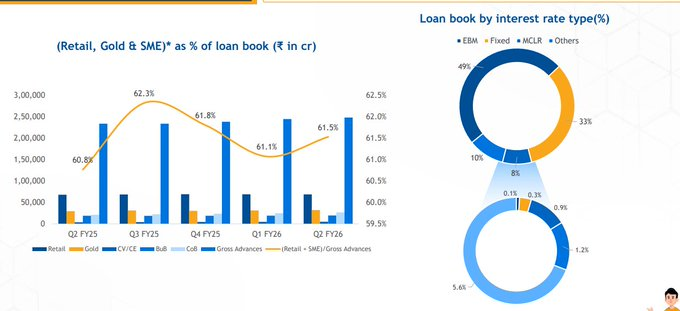

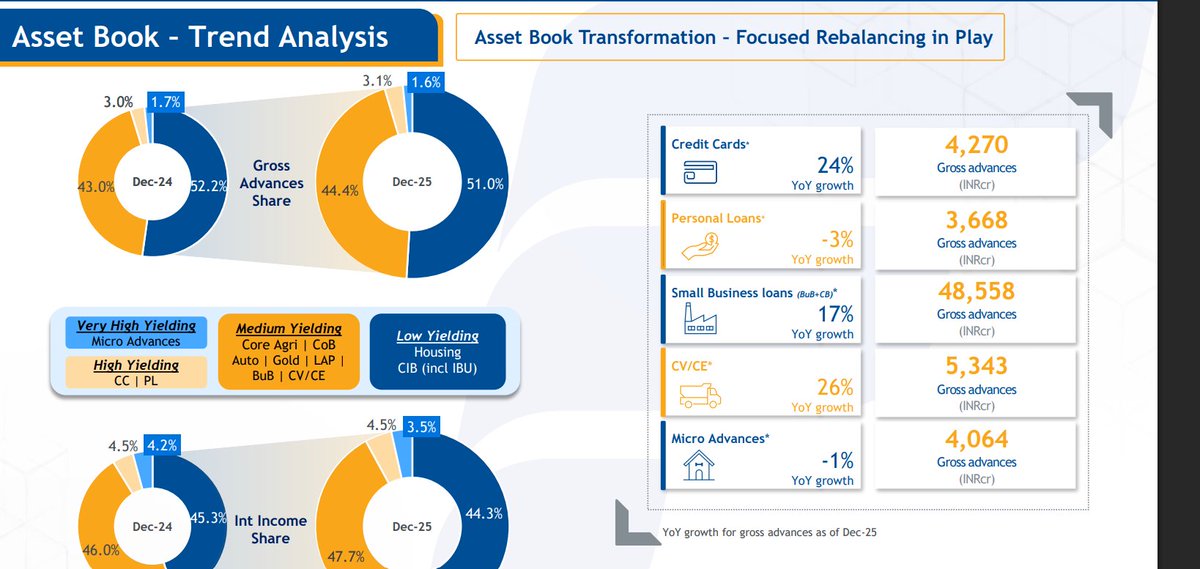

A predominantly south based bank with most of its book oriented towards the retail side of the business

A predominantly south based bank with most of its book oriented towards the retail side of the business

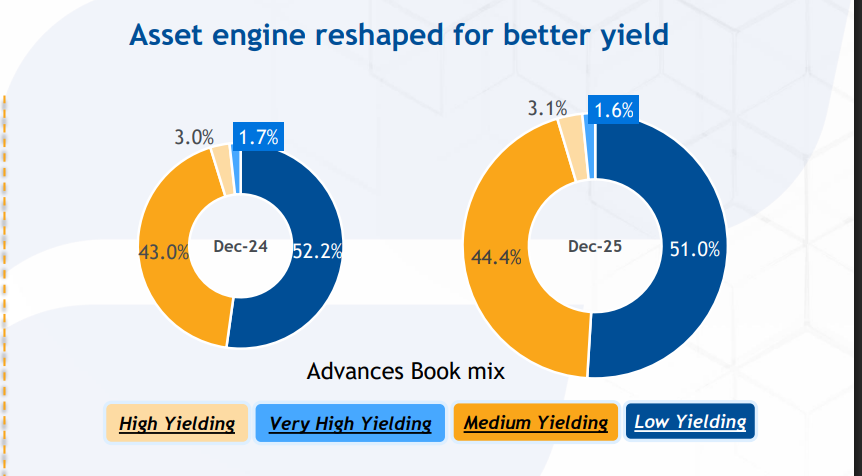

The bank is now trying to get a mix of low and high-yielding assets!

This will balance the risks and optimize the returns

This will balance the risks and optimize the returns

The banks is particularly aggressive in gold loans as people in south India hold ample amount of gold

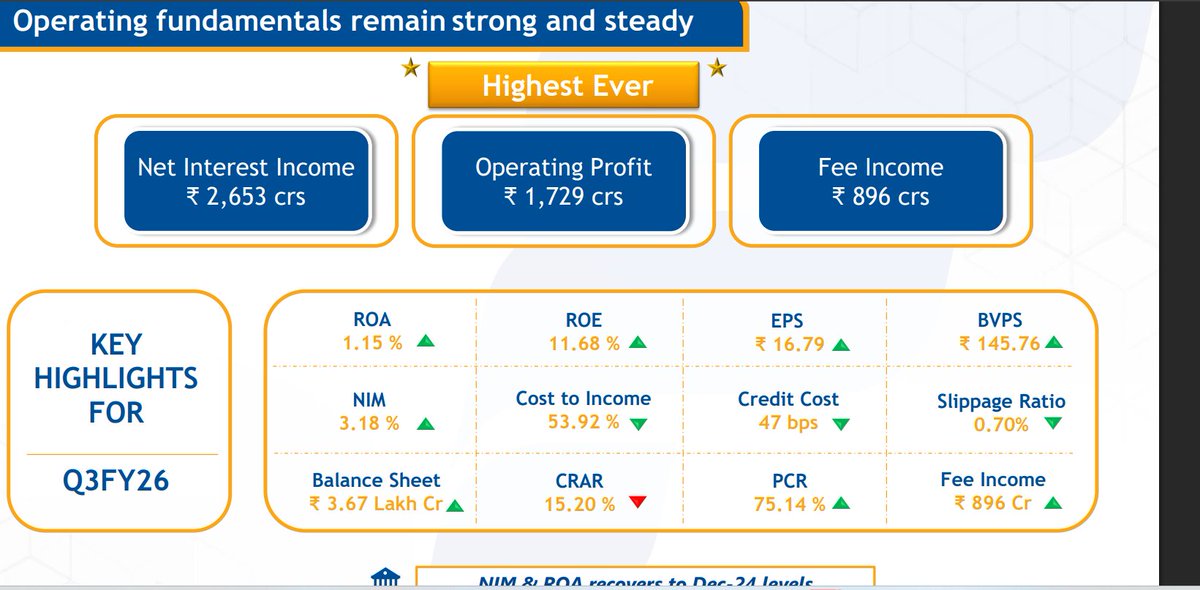

How is the bank performing now?

Federal Bank:-

🏦Loan growth at 9%

🏦Deposit growth at 15%

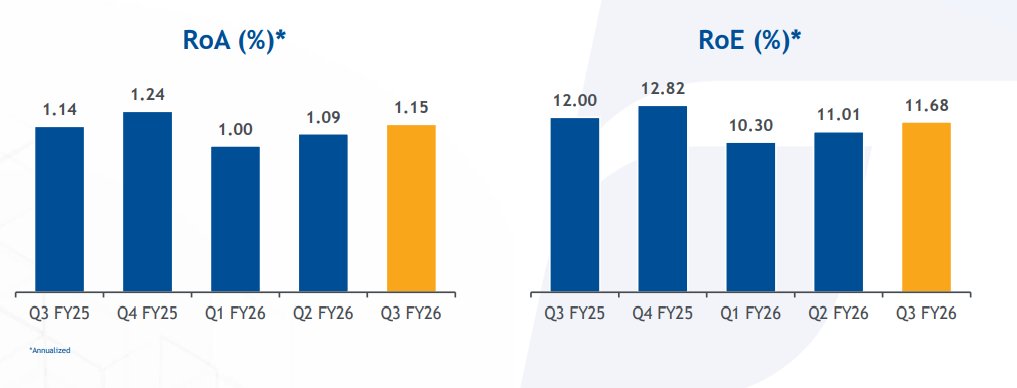

🏦RoA at 1.15%

🏦NPAs decline

🏦PCR at 75.14%

As steady as it can get

Federal Bank:-

🏦Loan growth at 9%

🏦Deposit growth at 15%

🏦RoA at 1.15%

🏦NPAs decline

🏦PCR at 75.14%

As steady as it can get

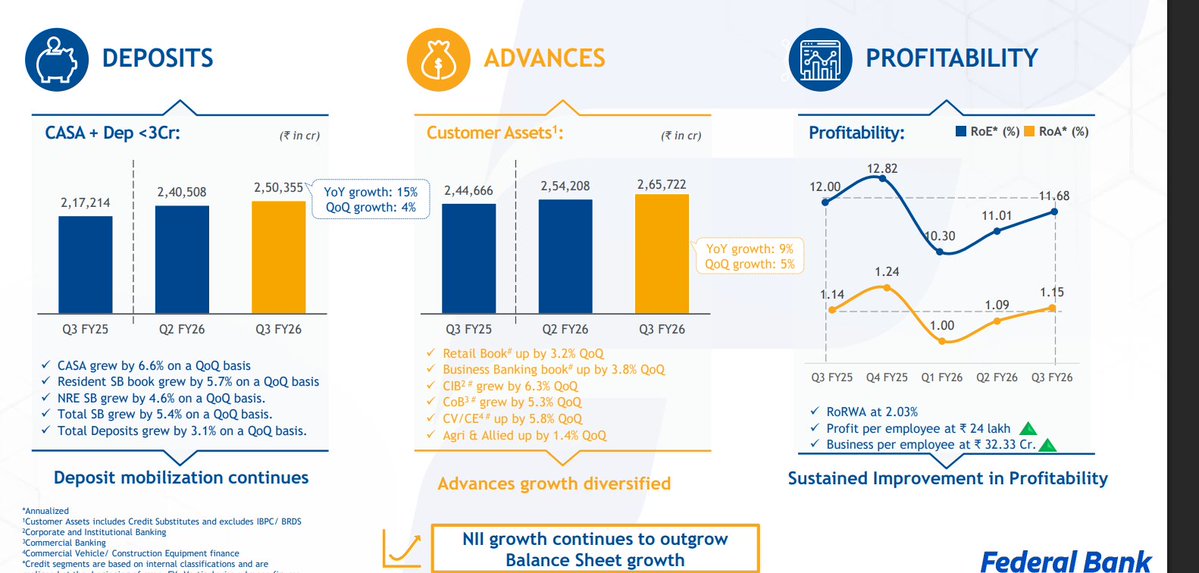

Steady ramp up of high quality deposits:-

Federal is known not to pay high costs for its deposits.

Still the deposits are growing nicely at 15%

Federal is known not to pay high costs for its deposits.

Still the deposits are growing nicely at 15%

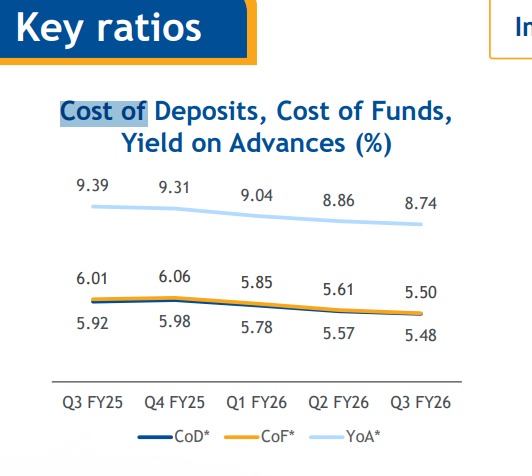

Cost of funds:-

As with all smaller banks the cost of deposits for Federal Bank is at 5.50%.

Higher than the larger peers

As with all smaller banks the cost of deposits for Federal Bank is at 5.50%.

Higher than the larger peers

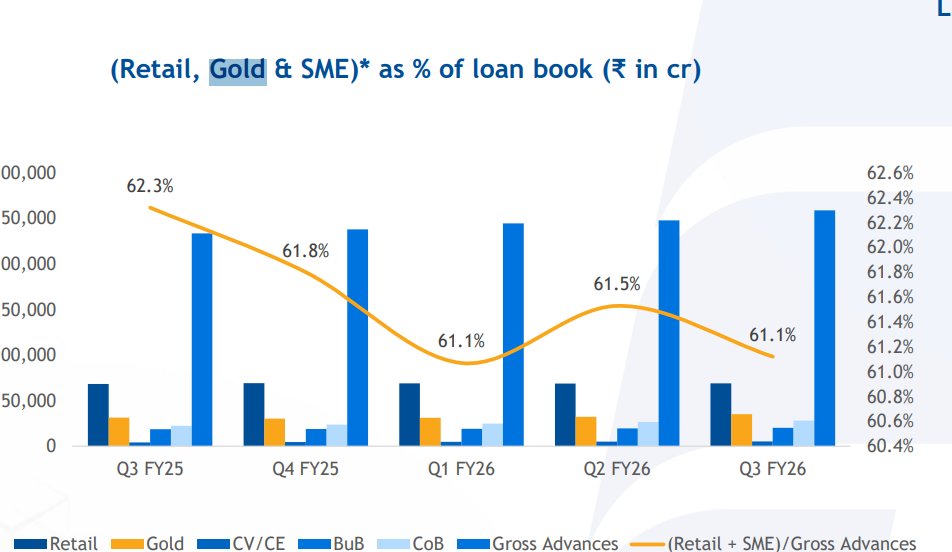

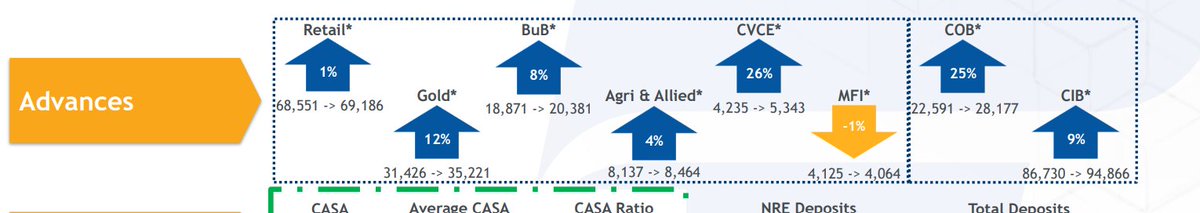

Loan growth:-

Loan growth was slower as at 9%

Gold loan growth at 12% and is a big portfolio at 35221cr

Loan growth was slower as at 9%

Gold loan growth at 12% and is a big portfolio at 35221cr

As the Credit cycle moves up

The bank is growing very fast on the unsecured loan side of it.

This is feeding into the record high profitability of the bank

The bank is growing very fast on the unsecured loan side of it.

This is feeding into the record high profitability of the bank

Asset quality:-

NPAs are at a record low

Slippages are also low

The bank has strong provision coverag

NPAs are at a record low

Slippages are also low

The bank has strong provision coverag

Record high RoA and RoE

The bank has now reported record high RoEs on the back of strong credit growth and low NPAs

The bank has now reported record high RoEs on the back of strong credit growth and low NPAs

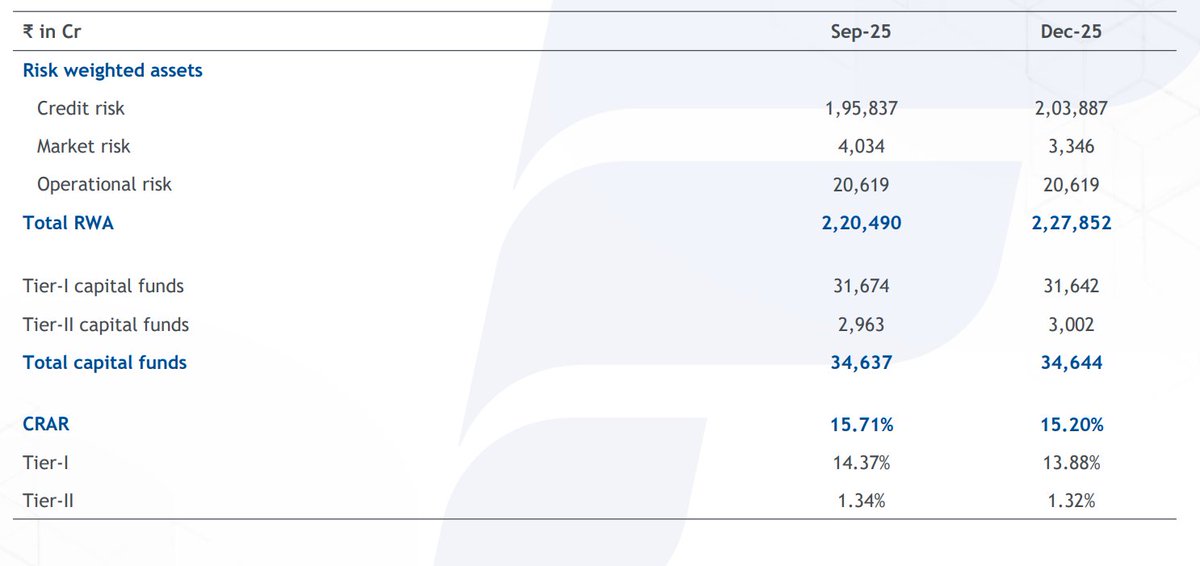

Capital Adequacy:-

The company has a strong capital adequacy of 15.20%

TIER-1 ratio is at 13.81%

The bank has now embarked on a capital raise

The company has a strong capital adequacy of 15.20%

TIER-1 ratio is at 13.81%

The bank has now embarked on a capital raise

So what is the way ahead?

Federal bank has guided for a rational 18-20% growth

The bank maintains the RoA and RoE guidence

Record high profits should continue

Federal bank has guided for a rational 18-20% growth

The bank maintains the RoA and RoE guidence

Record high profits should continue

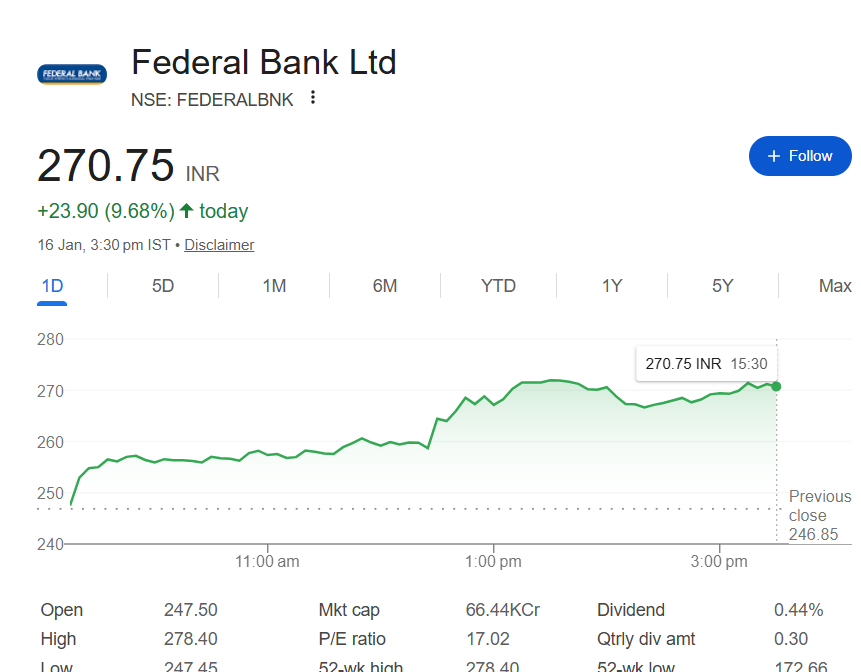

Valuation:-

Federal Bank has a book value of rs 145

The stock trades at 1.86x P/Bx

While this is cheaper than all peer banks

It is expensive wrt the historical valuation of federal bank

Federal Bank has a book value of rs 145

The stock trades at 1.86x P/Bx

While this is cheaper than all peer banks

It is expensive wrt the historical valuation of federal bank

So what is the way forward?

Federal Bank has done pretty well over this credit upcycle.

It is enjoying the fruits of tremendous work done by Shayam Srinivasan and team

The Profitability ratio are all at the peak and doing tremendously well.

Federal Bank has done pretty well over this credit upcycle.

It is enjoying the fruits of tremendous work done by Shayam Srinivasan and team

The Profitability ratio are all at the peak and doing tremendously well.

The ferocious credit upcycle is also a major contributor to the performance of Federal Bank

As NPAs emerge, Federal bank must demonstrate the ability to stay resilient.

IF federal bank maintains the consistency in performance the multiples can sustain

As NPAs emerge, Federal bank must demonstrate the ability to stay resilient.

IF federal bank maintains the consistency in performance the multiples can sustain

• • •

Missing some Tweet in this thread? You can try to

force a refresh