🧵 THREAD: Trump’s Tariff Playbook works for stocks — but breaks on Silver 🥈

https://twitter.com/KobeissiLetter/status/2012614240465486327

1️⃣

The Kobeissi Letter just laid out President Trump’s exact tariff playbook.

They’re right about how markets react.

But they miss what breaks when tariffs become structural.

Stocks trade headlines.

Silver trades reality.

The Kobeissi Letter just laid out President Trump’s exact tariff playbook.

They’re right about how markets react.

But they miss what breaks when tariffs become structural.

Stocks trade headlines.

Silver trades reality.

2️⃣

Yes — Trump’s tariff playbook is real:

• Weekend threats

• Delayed implementation

• Emotional selloffs

• Relief rallies

• “Deal coming” narrative

This has worked repeatedly for equities.

But silver is not an equity.

Yes — Trump’s tariff playbook is real:

• Weekend threats

• Delayed implementation

• Emotional selloffs

• Relief rallies

• “Deal coming” narrative

This has worked repeatedly for equities.

But silver is not an equity.

3️⃣

Here’s the key mistake:

Kobeissi assumes tariffs are episodic noise that fades.

For physical metals, tariffs don’t need to go live to do damage.

The threat alone changes behavior.

Industry doesn’t wait for tweets.

They secure supply.

Here’s the key mistake:

Kobeissi assumes tariffs are episodic noise that fades.

For physical metals, tariffs don’t need to go live to do damage.

The threat alone changes behavior.

Industry doesn’t wait for tweets.

They secure supply.

4️⃣

Stocks react to sentiment.

Silver reacts to logistics.

Tariff threats cause:

• Forward buying

• Inventory hoarding

• Contract repricing

• Regional premiums

None of that reverses with a “talks progressing” headline.

Stocks react to sentiment.

Silver reacts to logistics.

Tariff threats cause:

• Forward buying

• Inventory hoarding

• Contract repricing

• Regional premiums

None of that reverses with a “talks progressing” headline.

5️⃣

This time is different — and Kobeissi even hints at it.

China trade disputes = export rules.

Greenland = strategic territory + Arctic control + raw materials.

That’s not a trade spat.

That’s geopolitics entering supply chains.

This time is different — and Kobeissi even hints at it.

China trade disputes = export rules.

Greenland = strategic territory + Arctic control + raw materials.

That’s not a trade spat.

That’s geopolitics entering supply chains.

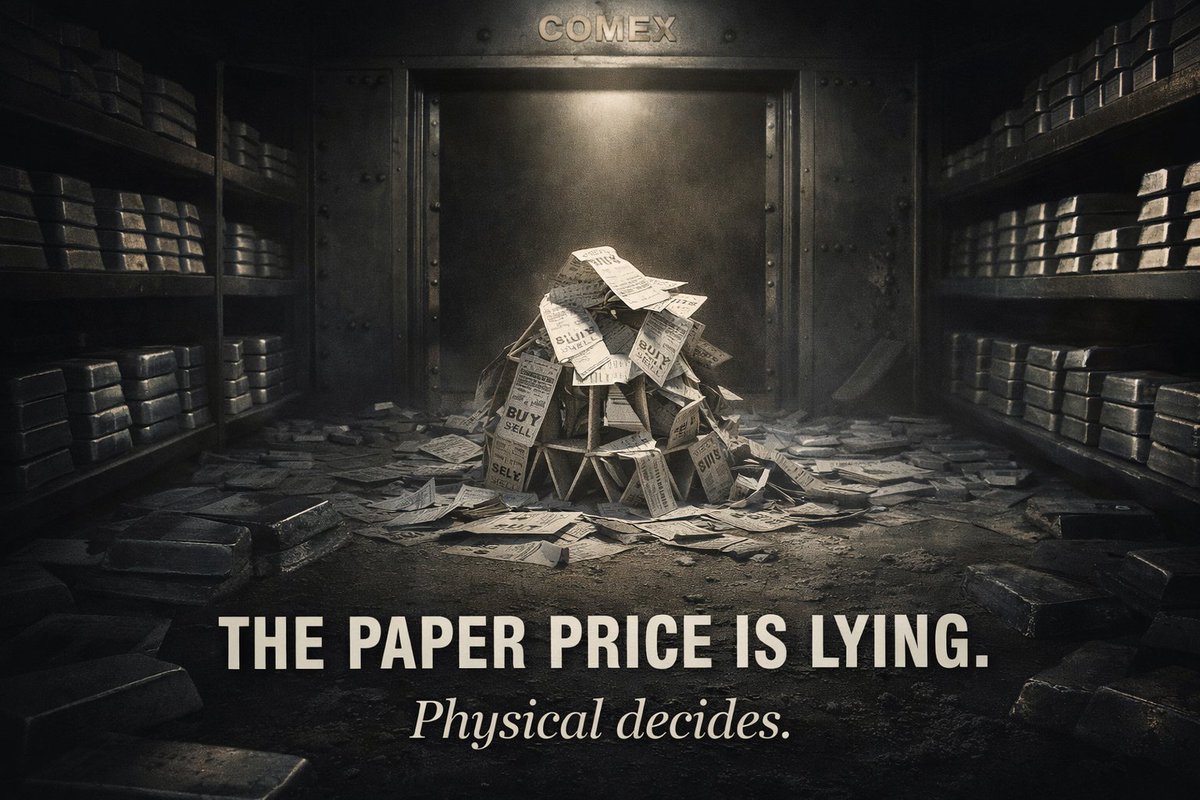

7️⃣

Paper silver can still play the volatility game.

COMEX can still print volume.

But physical silver responds structurally, not emotionally.

That’s why:

• Paper price ≠ real-world price

• Premiums widen before charts move

• Delivery stress appears before “confirmation”

Paper silver can still play the volatility game.

COMEX can still print volume.

But physical silver responds structurally, not emotionally.

That’s why:

• Paper price ≠ real-world price

• Premiums widen before charts move

• Delivery stress appears before “confirmation”

8️⃣

The tariff playbook creates repeat volatility.

Repeat volatility creates repeat hedging.

Repeat hedging creates permanent demand.

That’s where Kobeissi’s model breaks.

You can fade headlines in stocks.

You can’t fade supply chain stress.

The tariff playbook creates repeat volatility.

Repeat volatility creates repeat hedging.

Repeat hedging creates permanent demand.

That’s where Kobeissi’s model breaks.

You can fade headlines in stocks.

You can’t fade supply chain stress.

9️⃣

This is why silver doesn’t spike immediately.

It tightens quietly.

By the time the narrative flips bullish:

• Metal is already spoken for

• Delivery queues are longer

• Paper shorts are trapped in structure, not sentiment

This is why silver doesn’t spike immediately.

It tightens quietly.

By the time the narrative flips bullish:

• Metal is already spoken for

• Delivery queues are longer

• Paper shorts are trapped in structure, not sentiment

🔟 Conclusion

Kobeissi explains how to trade the noise.

Silver exposes what happens when the noise becomes policy.

When tariffs turn into leverage, silver stops trading headlines — and starts pricing risk.

#Silver #PhysicalSilver #Tariffs #TradeWar

Kobeissi explains how to trade the noise.

Silver exposes what happens when the noise becomes policy.

When tariffs turn into leverage, silver stops trading headlines — and starts pricing risk.

#Silver #PhysicalSilver #Tariffs #TradeWar

This feels like a bigger game.

Europe is already fragile — tariffs won’t hurt the U.S. first, they’ll accelerate Europe’s stress.

And ironically, this pressure helps silver break free from paper manipulation.

When systems strain, physical reality always wins. 🥈

Europe is already fragile — tariffs won’t hurt the U.S. first, they’ll accelerate Europe’s stress.

And ironically, this pressure helps silver break free from paper manipulation.

When systems strain, physical reality always wins. 🥈

• • •

Missing some Tweet in this thread? You can try to

force a refresh