Deep dive $HUM.AX Humm Group Limited 🧵number 3: what are we playing for + event trade setup

👇👇

DYODD. Not advice. Recall I own 29mm shares ($21mm AUD) so I have skin in the game.

👇👇

DYODD. Not advice. Recall I own 29mm shares ($21mm AUD) so I have skin in the game.

https://twitter.com/puppyeh1/status/2010312370460180738

There are really only two outcomes re $HUM.AX: the Convenors (me+CSAM) win and complete board renewal; or the Convenors lose and Abercrombie remains Chair.

What happens if we win?

What happens if we win?

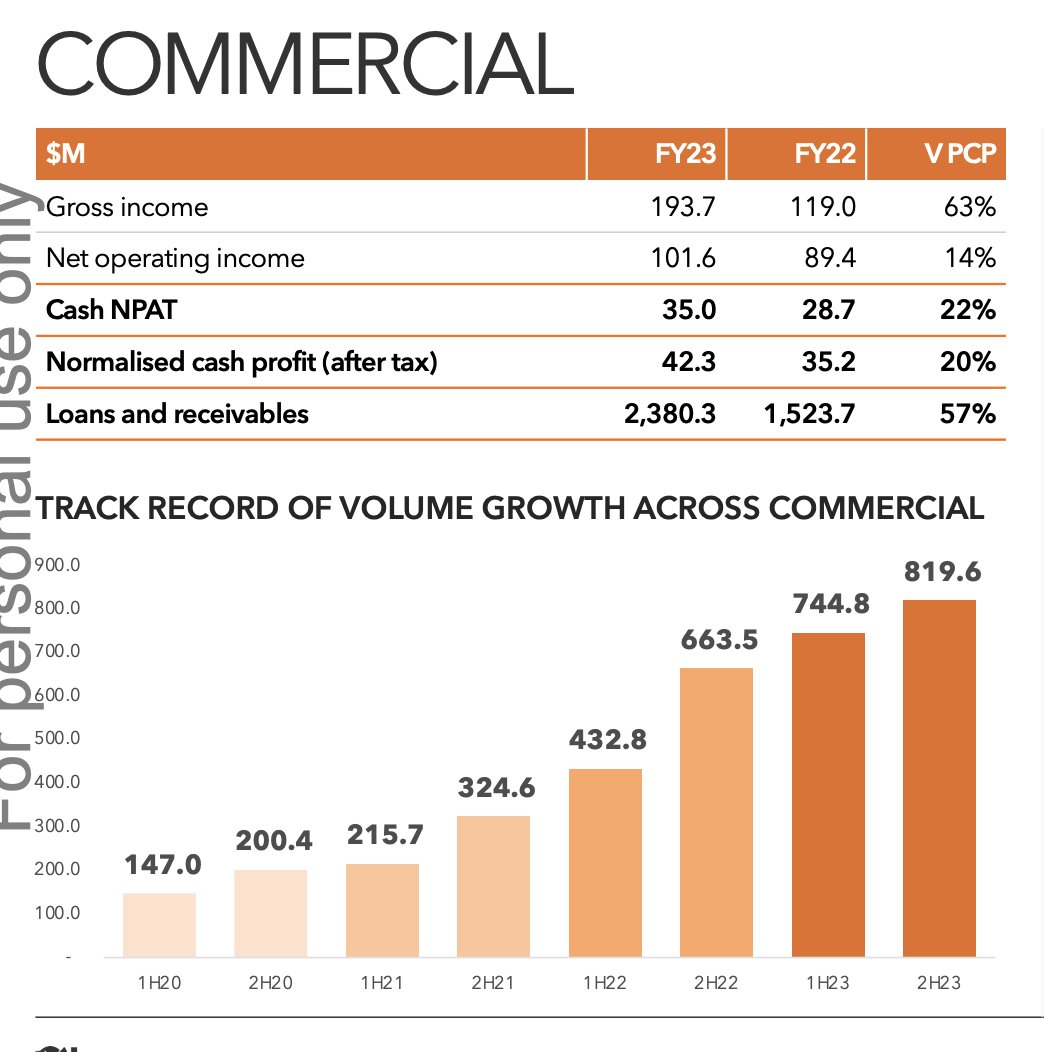

The stock is cheap, recall, for two reasons - a big governance discount, and a bloated cash position/underutilized balance sheet.

If we win fixing the governance issue is a fait accompli. Abercrombie will be gone. Compliant directors will be gone. We will add a further 1-2…

If we win fixing the governance issue is a fait accompli. Abercrombie will be gone. Compliant directors will be gone. We will add a further 1-2…

Highly qualified independent directors to upskill the BoD. We will also reconstitute the Board committees and strongly consider bringing the CEO onto the Board.

Essentially we will install best governance practices for a listed entity and simply manage the business in the…

Essentially we will install best governance practices for a listed entity and simply manage the business in the…

…ordinary course.

Fixing capital allocation is not rocket science either and can be accomplished in the near term. We have articulated:

- $15mm capital return via special div

- 10% buyback over 12mos (about $35mm)

- clarified div policy paying majority of underlying earnings..

Fixing capital allocation is not rocket science either and can be accomplished in the near term. We have articulated:

- $15mm capital return via special div

- 10% buyback over 12mos (about $35mm)

- clarified div policy paying majority of underlying earnings..

…as divs to shareholders. To us this means 75%+ of underlying cash earnings, obvi subject to board review.

Ofc we will also review and likely shut the loss making Canadian operations; run a full strategic review of the biz; and a review into governance behaviors of the BoD…

Ofc we will also review and likely shut the loss making Canadian operations; run a full strategic review of the biz; and a review into governance behaviors of the BoD…

Over the last 12mos.

Doing all this will all the biz to move forward, with a clean slate and appropriate cap structure, and free and clear of the governance issues that have plagued the co.

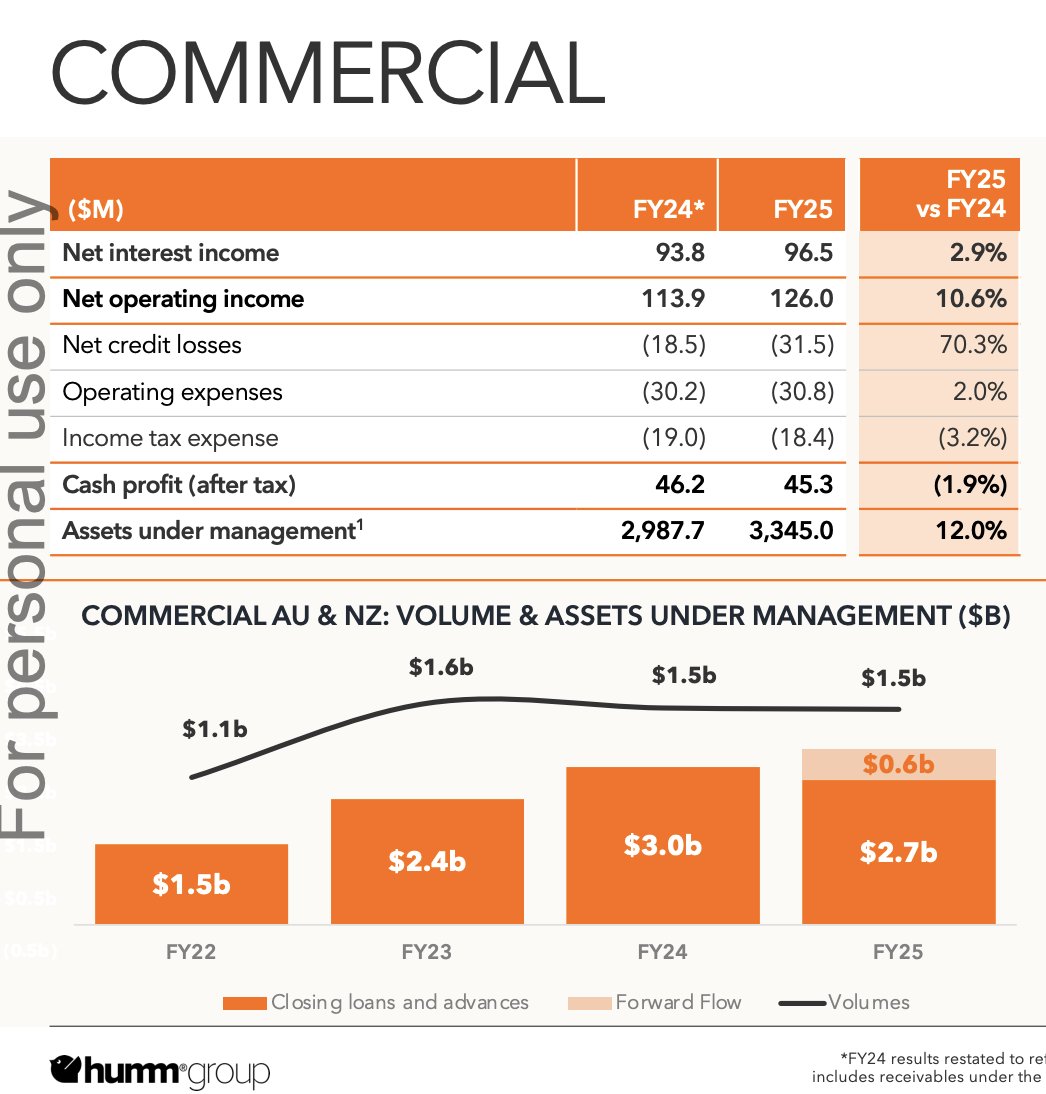

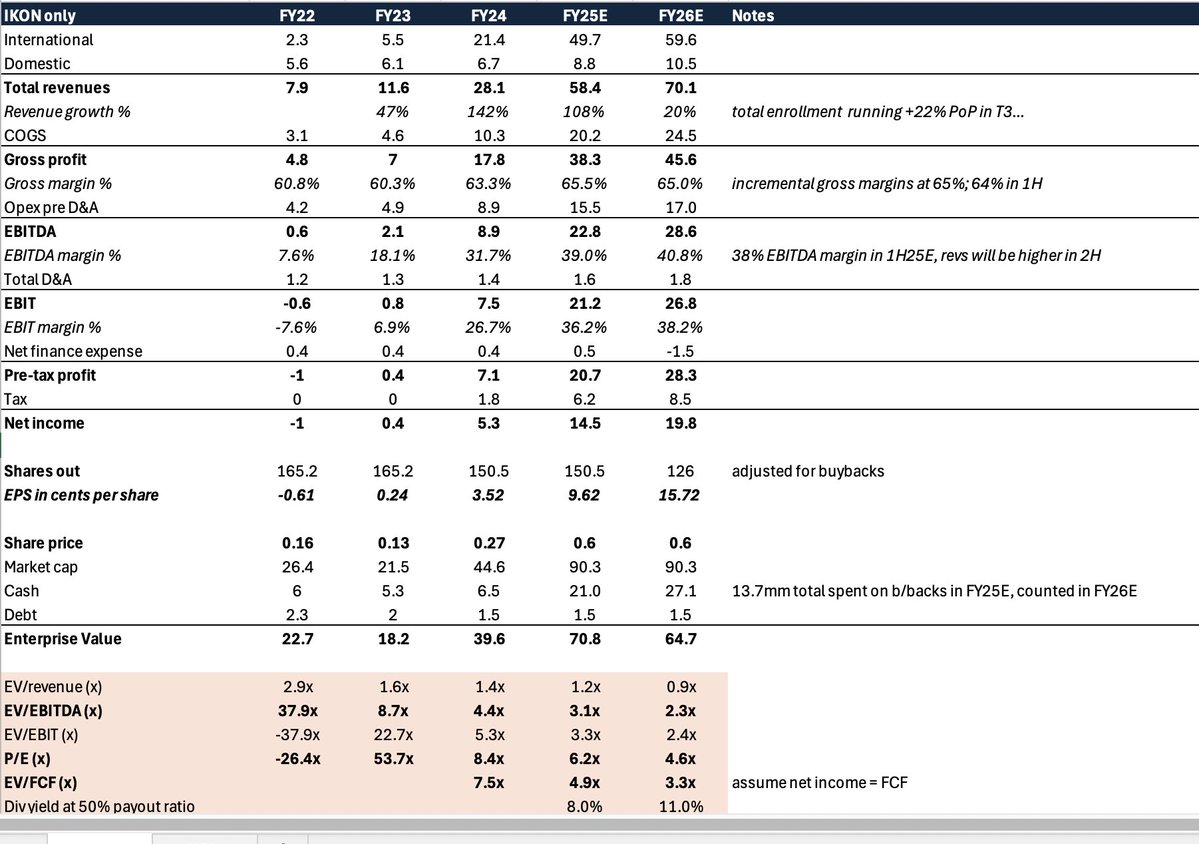

As prev explained, peers all generally trade at 7-8% div yield and 10-12% P/E…

Doing all this will all the biz to move forward, with a clean slate and appropriate cap structure, and free and clear of the governance issues that have plagued the co.

As prev explained, peers all generally trade at 7-8% div yield and 10-12% P/E…

Meaning if we simply do these simple things, no reason $HUM.AX shouldn’t rerate to the peer group.

On that basis a win for us suggests a $1.1-$1.3 stock (as we deliver). Pretty decent.

On that basis a win for us suggests a $1.1-$1.3 stock (as we deliver). Pretty decent.

But what happens if we lose?

The attraction here is there a “heads I win big, tails I win small” element given the third party bid from $CCP.AX Credit Corp.

This is tbf an NBIO right now but they specifically articulated TWO different

The attraction here is there a “heads I win big, tails I win small” element given the third party bid from $CCP.AX Credit Corp.

This is tbf an NBIO right now but they specifically articulated TWO different

T/O structures - one st 77c for 100% ownership (ie with AA on board) and one at 72c for 50.1% ownership (ie assuming AA holds out).

Naturally those prices are still insufficient but the interest, and structure, are workable even if the Convenors lose.

Naturally those prices are still insufficient but the interest, and structure, are workable even if the Convenors lose.

This is because even in the scenario we lose - which I do not at all contemplate but is possible - I believe the vote will be incredibly close (just a few %). Meaning if we then turn around and embrace $CCP.AX

And publicly declare support for that bid rather than AA continued control - which obviously we would - then $CCP.AX would likely get 50% in a hostile bid…

…which in turn means AA would be in a similarly bad (or worse) situation as if we had won and he was off the Board (since he’d have lost control).

In that scenario, then, given the closeness of the vote, it’s not clear to me how AA isn’t forced into a sale, to $CCP.AX

In that scenario, then, given the closeness of the vote, it’s not clear to me how AA isn’t forced into a sale, to $CCP.AX

Or another third party.

Another scenario is to simply acquire a few more % of the co, and go again via EGM. Naturally if the vote is only a percent or two (which i think it would be as only way he can win) this becomes further likely.

Another scenario is to simply acquire a few more % of the co, and go again via EGM. Naturally if the vote is only a percent or two (which i think it would be as only way he can win) this becomes further likely.

That is to say - this is both reflexive; and a quasi-arb. The more the market supports the Convenors, the more likely the Convenors win (big upside) OR the vote is close enough to force either a win via sale to third party, either as minority (break even or small win); or as full sale (big upside).

In sum, it is hard to see how AA comes through this challenge, in any scenario, in control of $HUM.AX. And hence any of the multiple pathways present as attractive outcomes for minorities.

Long $HUM.AX. Meeting is Feb 19. Please ensure to continue to vote any and all shares you own or acquire in the next 3 weeks! 🙏

Long $HUM.AX. Meeting is Feb 19. Please ensure to continue to vote any and all shares you own or acquire in the next 3 weeks! 🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh