You’re not as rational as you think

Smart people make dumb decisions all the time

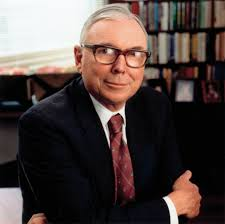

Charlie Munger explained why, and how to fix it

Here's a thread on The Psychology of Human Misjudgement:

Smart people make dumb decisions all the time

Charlie Munger explained why, and how to fix it

Here's a thread on The Psychology of Human Misjudgement:

Charlie Munger spent decades studying why smart people make bad decisions.

He identified 24 standard causes of human misjudgement.

Let’s break down the most important ones:

He identified 24 standard causes of human misjudgement.

Let’s break down the most important ones:

1. Incentive Bias

People do what they're rewarded to do.

Not what’s right. Yes, even you.

Never underestimate how powerful incentives are.

People do what they're rewarded to do.

Not what’s right. Yes, even you.

Never underestimate how powerful incentives are.

2. Denial

When reality hurts, we lie to ourselves.

"It's not that bad."

"It can't be true."

This leads to bad decisions and slow reactions.

When reality hurts, we lie to ourselves.

"It's not that bad."

"It can't be true."

This leads to bad decisions and slow reactions.

3. Consistency Bias

Once you take a stand, you defend it, even if it’s wrong.

Especially if you said it out loud.

Why? Because changing your mind feels like admitting you were stupid.

Once you take a stand, you defend it, even if it’s wrong.

Especially if you said it out loud.

Why? Because changing your mind feels like admitting you were stupid.

4. Social Proof

We copy what others do, especially in uncertain situations.

Example: In the 1960s, dozens of people watched a woman being murdered and no one helped.

Why? Everyone else was just watching. So they did too.

We copy what others do, especially in uncertain situations.

Example: In the 1960s, dozens of people watched a woman being murdered and no one helped.

Why? Everyone else was just watching. So they did too.

5. Authority Bias

If a person in power says something, we follow.

Even if it’s clearly wrong.

Like when co-pilots let planes crash because they didn’t question the pilot.

If a person in power says something, we follow.

Even if it’s clearly wrong.

Like when co-pilots let planes crash because they didn’t question the pilot.

6. Liking Bias

We believe and trust people we like.

Even if they’re lying. Even if they’re wrong.

Same goes for disliking, we reject ideas from people we don’t like.

We believe and trust people we like.

Even if they’re lying. Even if they’re wrong.

Same goes for disliking, we reject ideas from people we don’t like.

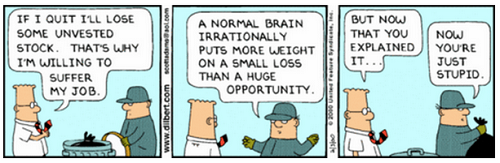

7. Deprival Super Reaction

Losing something hurts more than gaining it.

Think about the outrage over “New Coke.”

Even a tiny loss can trigger massive overreactions.

Losing something hurts more than gaining it.

Think about the outrage over “New Coke.”

Even a tiny loss can trigger massive overreactions.

8. Gambling and Variable Rewards

Random rewards (like slot machines) are more addictive than regular ones.

Your brain gets hooked on “maybe next time.”

This drives gambling, trading, and addictive apps.

Random rewards (like slot machines) are more addictive than regular ones.

Your brain gets hooked on “maybe next time.”

This drives gambling, trading, and addictive apps.

9. Reciprocation

If someone gives us something, we feel the need to return the favor.

Even if we don’t want to.

Marketers use this all the time.

If someone gives us something, we feel the need to return the favor.

Even if we don’t want to.

Marketers use this all the time.

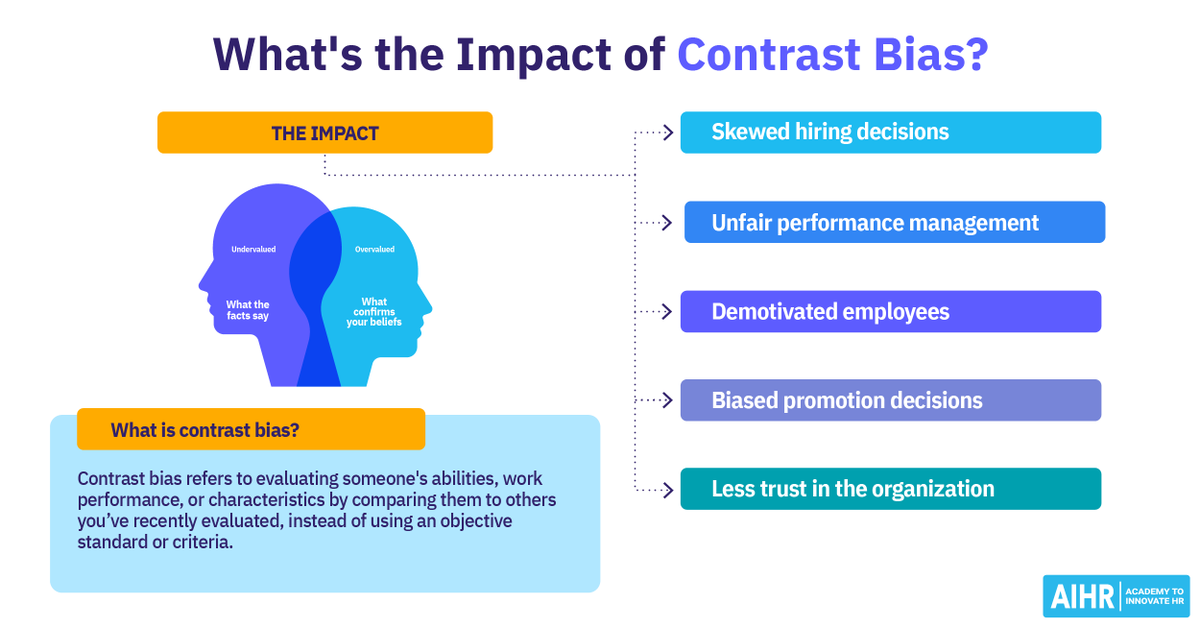

10. Contrast Bias

Your brain compares things, not measures them.

A $500 watch feels cheap…

…if you just looked at a $5,000 Rolex.

Your brain compares things, not measures them.

A $500 watch feels cheap…

…if you just looked at a $5,000 Rolex.

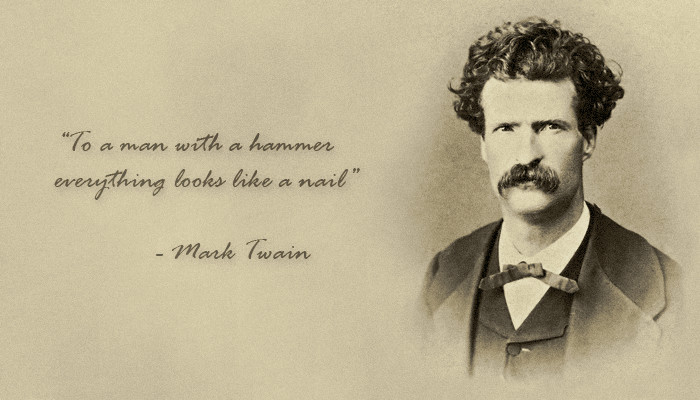

11. “Man with a Hammer” Syndrome

If you only know one tool, everything looks like a nail.

Psychologists overuse psychology.

Economists overuse math.

Be careful not to become that guy.

If you only know one tool, everything looks like a nail.

Psychologists overuse psychology.

Economists overuse math.

Be careful not to become that guy.

12. Multiple Biases Combine

The worst mistakes happen when biases combine.

Think: social proof + incentives + denial = corporate disasters.

Munger calls these “Lollapalooza effects.”

The worst mistakes happen when biases combine.

Think: social proof + incentives + denial = corporate disasters.

Munger calls these “Lollapalooza effects.”

13. Final lesson

You can’t delete these flaws.

They’re built into your brain.

But if you understand them, you can avoid being tricked, especially by yourself.

You can’t delete these flaws.

They’re built into your brain.

But if you understand them, you can avoid being tricked, especially by yourself.

That’s how Munger stayed sharp for 99 years.

You can get the full transcript of this legendary speech here: compounding-quality.kit.com/e155b49206

You can get the full transcript of this legendary speech here: compounding-quality.kit.com/e155b49206

• • •

Missing some Tweet in this thread? You can try to

force a refresh