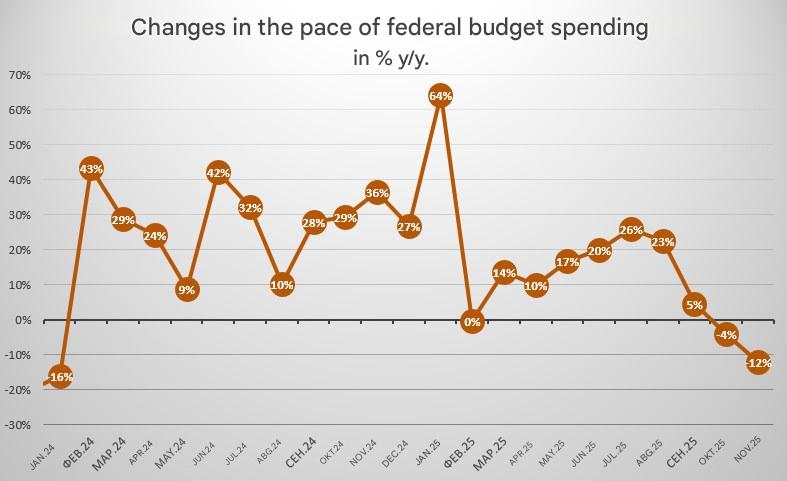

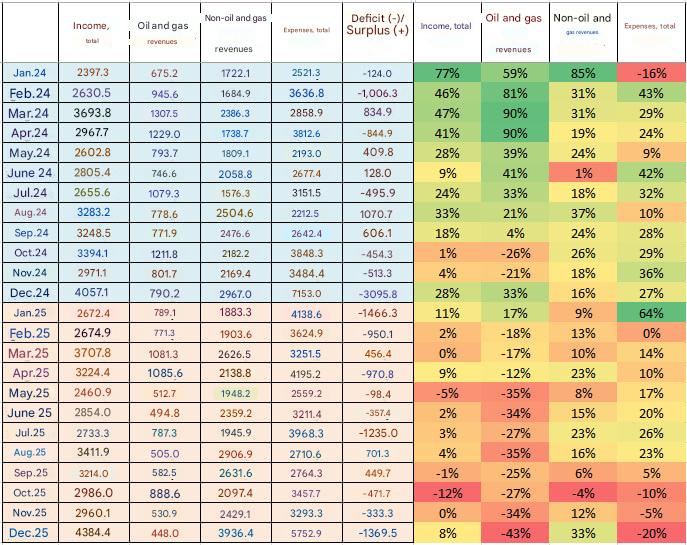

Russian Federation budget execution data for December has been released.

Revenue: +8%

Of which:

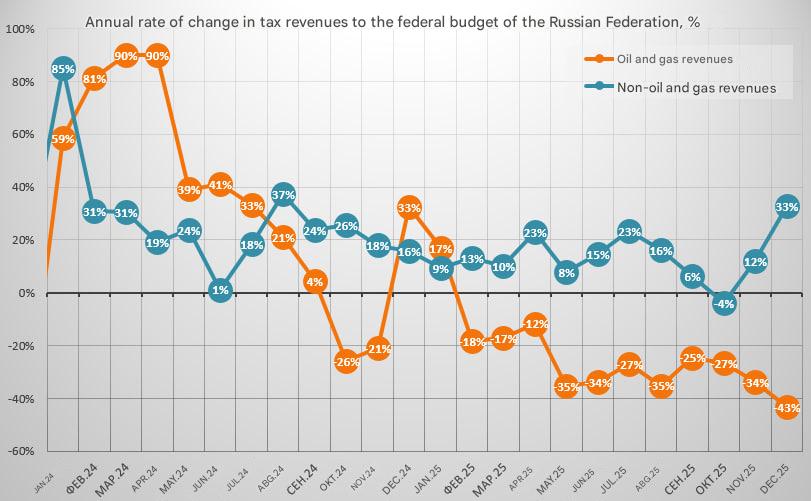

- Oil and gas: -43%

- Non-oil and gas: +33%

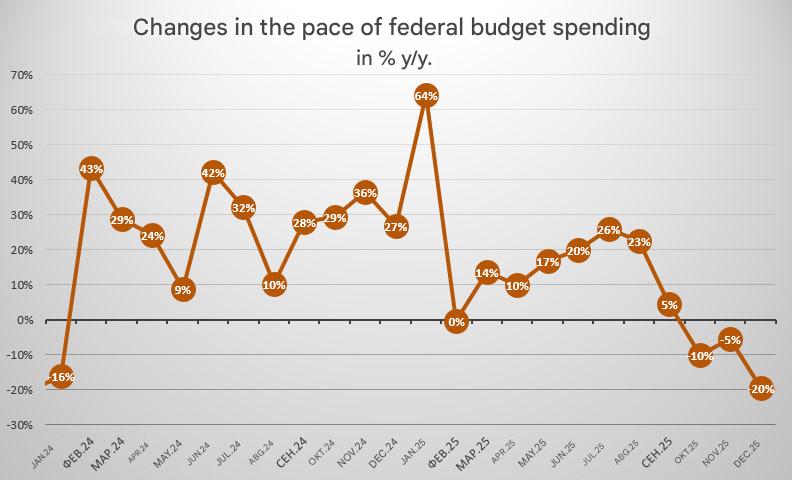

Expenses: -20%

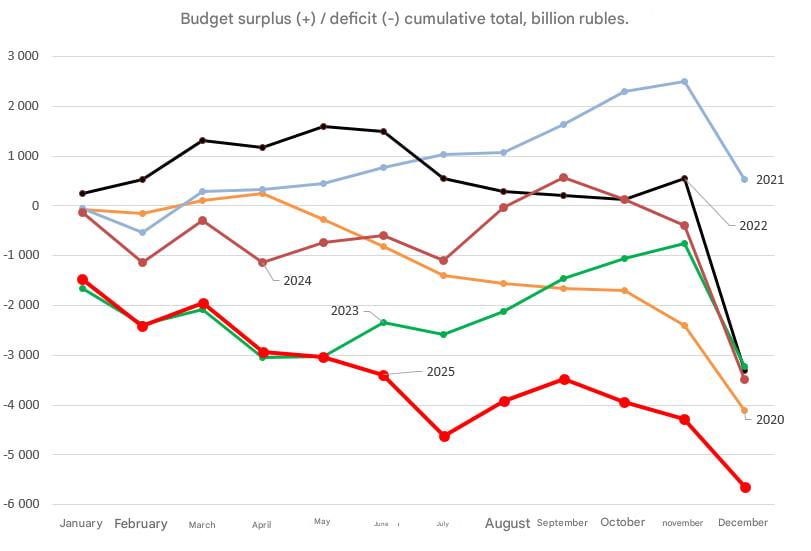

Deficit: (-1,369 billion rubles) Last December, there was a deficit (-3,095 billion rubles)

1/

Revenue: +8%

Of which:

- Oil and gas: -43%

- Non-oil and gas: +33%

Expenses: -20%

Deficit: (-1,369 billion rubles) Last December, there was a deficit (-3,095 billion rubles)

1/

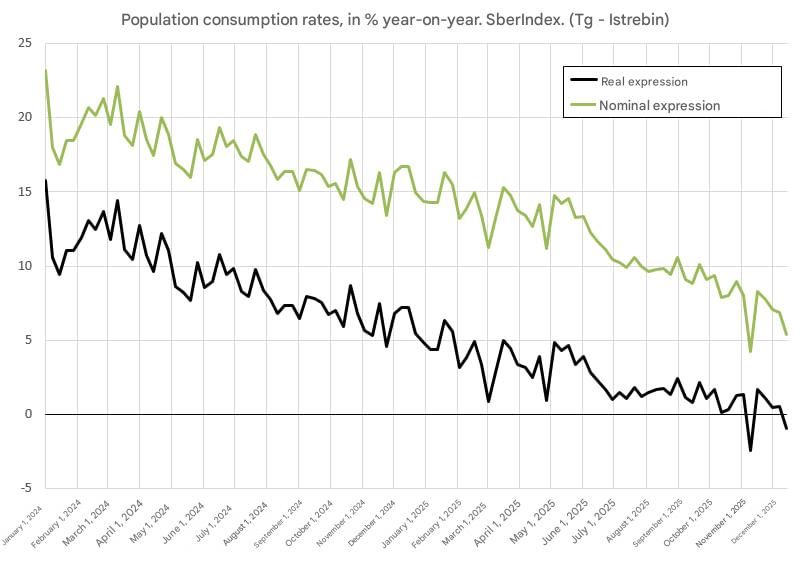

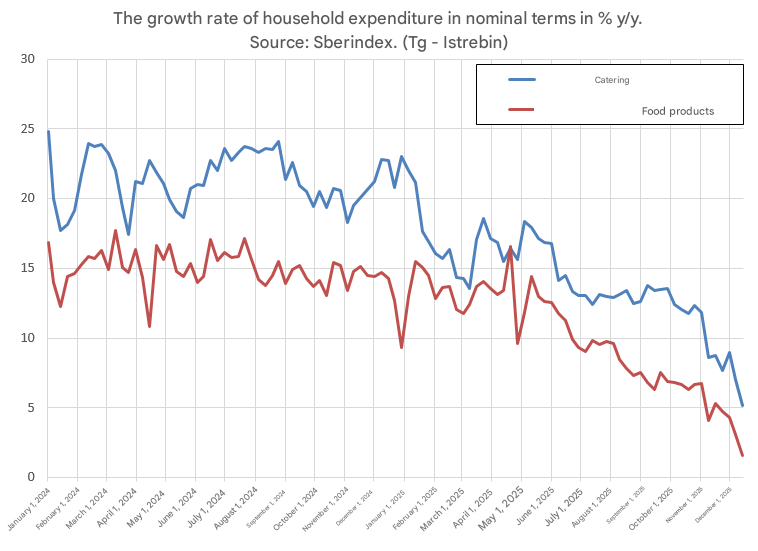

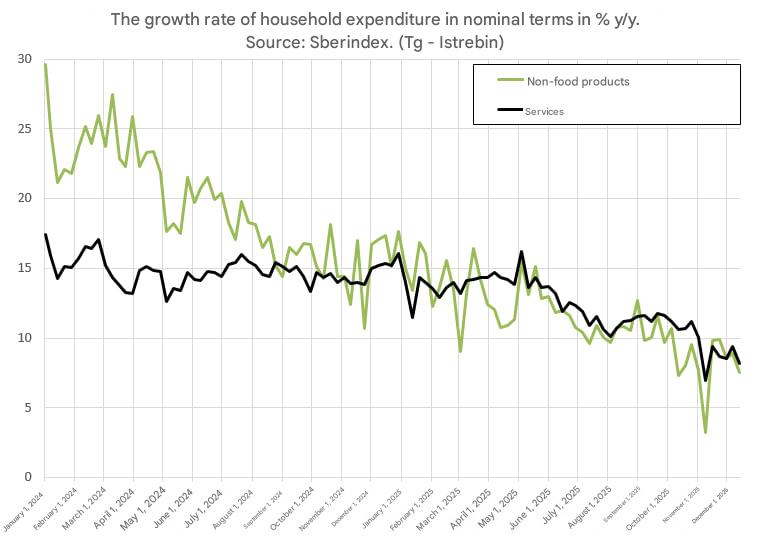

The most astonishing thing is that budget expenditures fell by 20% in December!!!!

This will lead to a significant slowdown in the entire economy!

2/

This will lead to a significant slowdown in the entire economy!

2/

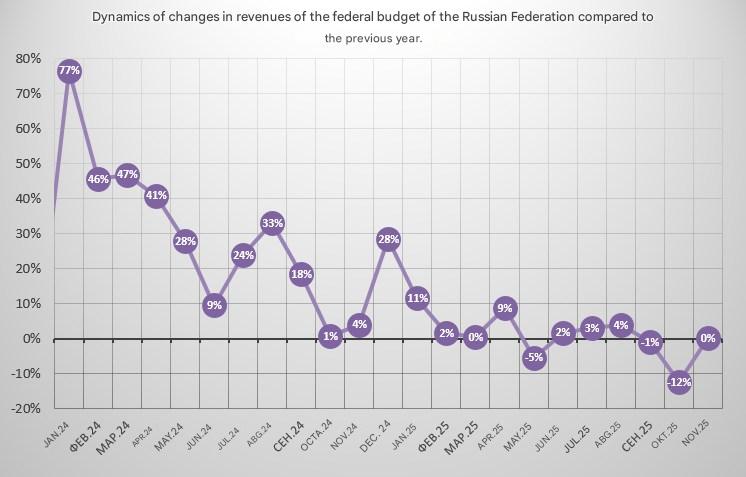

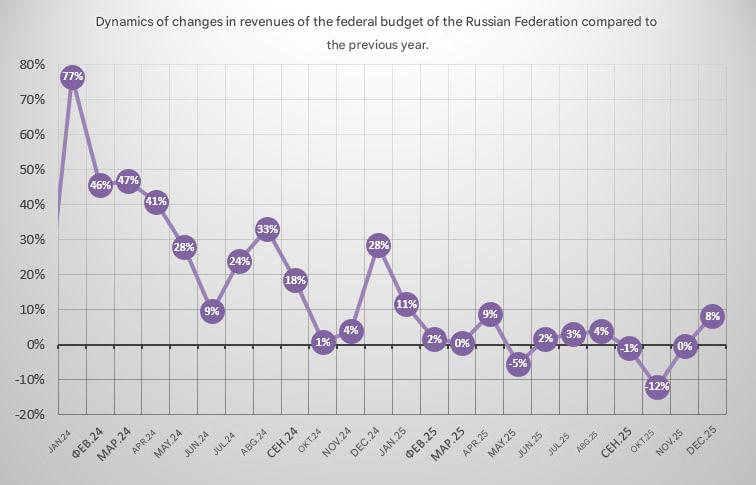

Budget revenues in December grew by 8% year-on-year.

I suspect they added some non-tax funds (fines, seizures, etc.) to the budget.

3/

I suspect they added some non-tax funds (fines, seizures, etc.) to the budget.

3/

Oil revenues fell by 43%, while non-oil revenues grew by 33%. This is nonsense. Tax revenues couldn't have grown so sharply. The Russians are lying.

4/

4/

Budget spending plummeted by 20% in December.

This is the largest collapse in two years!

The entire budgetary boost to the economy was neutralized!

But I suspect that large-scale spending has been postponed until January 2026.

5/

This is the largest collapse in two years!

The entire budgetary boost to the economy was neutralized!

But I suspect that large-scale spending has been postponed until January 2026.

5/

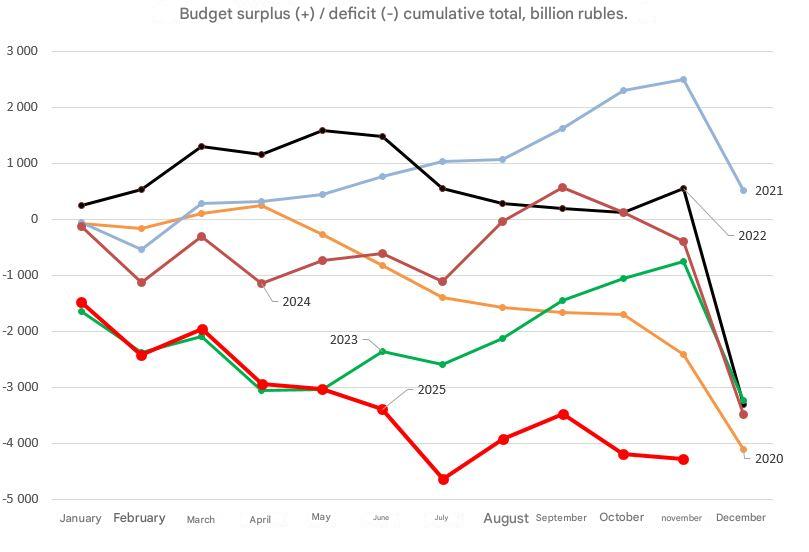

The budget deficit in December was 1369 billion rubles, significantly less than the deficit in December 2024, which was 3095 billion rubles.

6/

6/

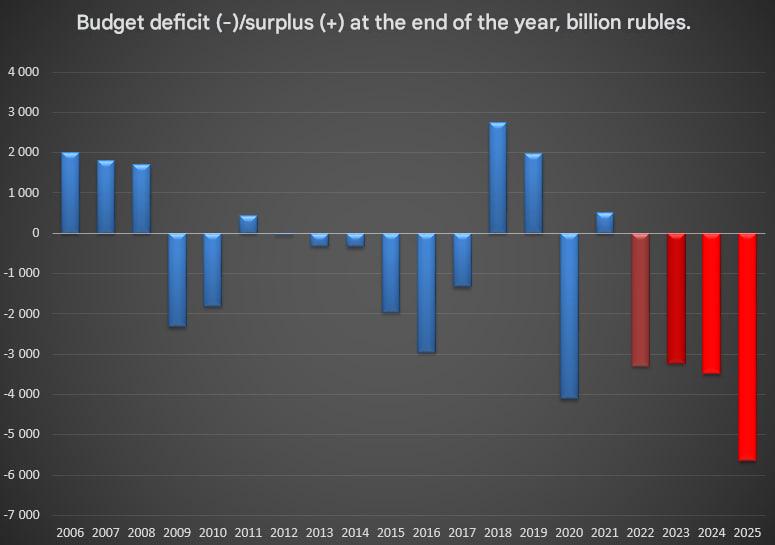

By the end of 2025, the budget deficit had grown by 62% to 5,645 billion rubles, despite the fact that they had cut spending in December by 20%.

The budget is simply falling apart!

7/

The budget is simply falling apart!

7/

• • •

Missing some Tweet in this thread? You can try to

force a refresh