A 23-page research paper reveals the number 1 method Hedge Funds use to beat the market:

Time Series Momentum

This is how: 🧵

Time Series Momentum

This is how: 🧵

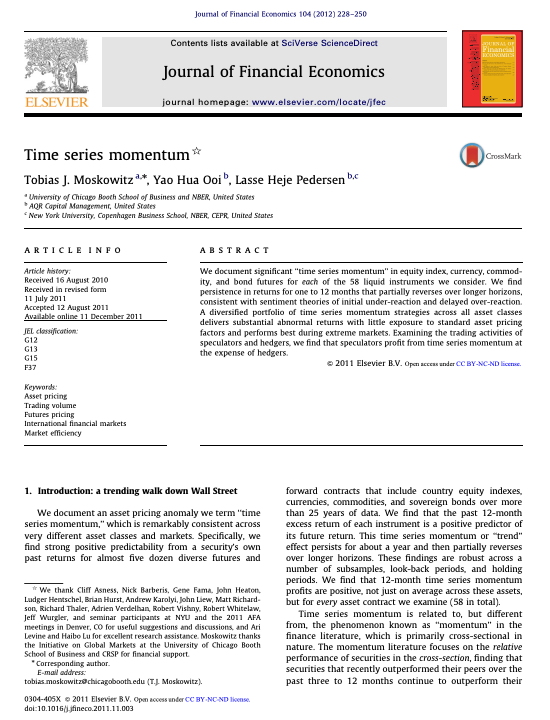

1. What Is Time Series Momentum?

Time Series Momentum (TSMOM) bets on trends continuing. If a stock’s up, buy more; if down, sell. A 2011 study of 58 assets proved it works!

Time Series Momentum (TSMOM) bets on trends continuing. If a stock’s up, buy more; if down, sell. A 2011 study of 58 assets proved it works!

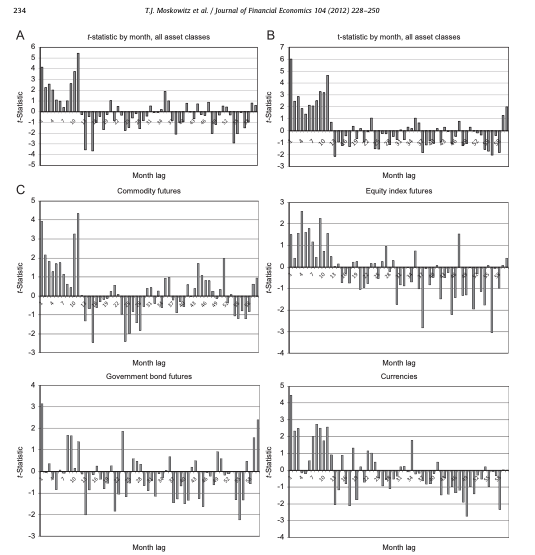

2. The Data Behind the Strategy

The TSMOM paper analyzed equities, currencies & more. T-stats showed consistent profits across 1-month lookbacks!

The TSMOM paper analyzed equities, currencies & more. T-stats showed consistent profits across 1-month lookbacks!

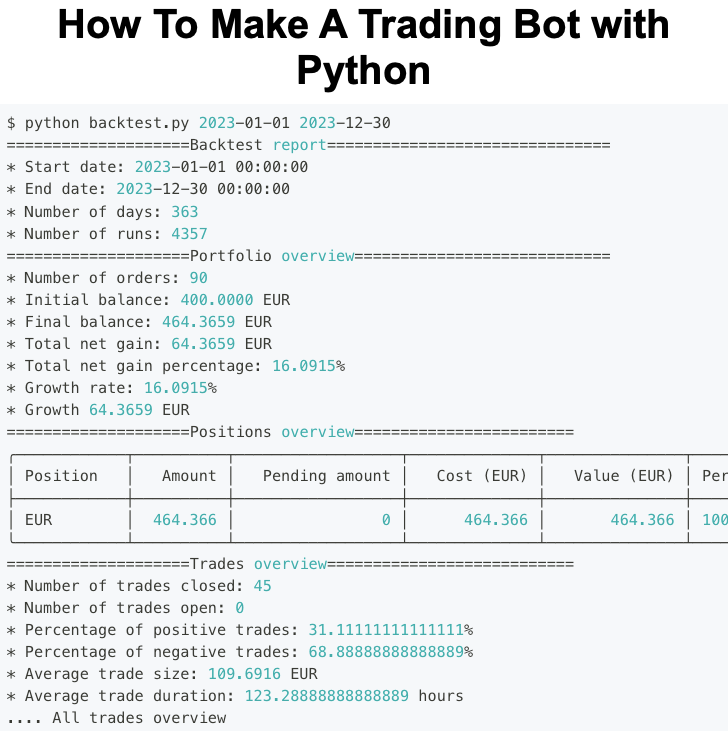

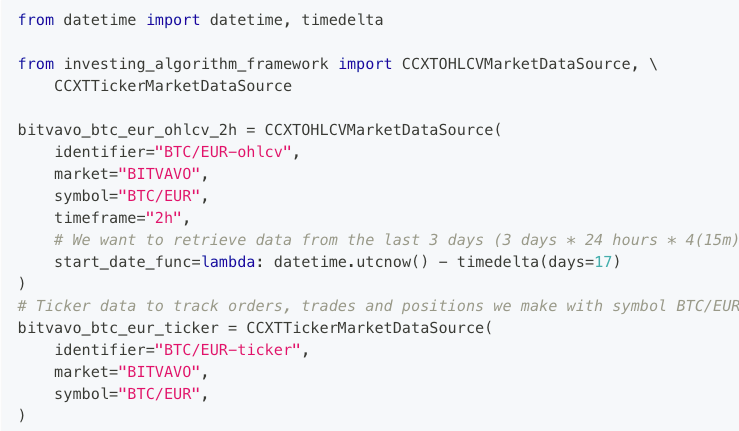

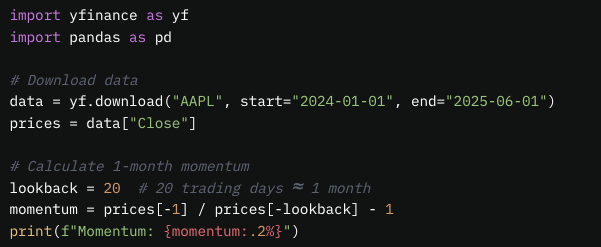

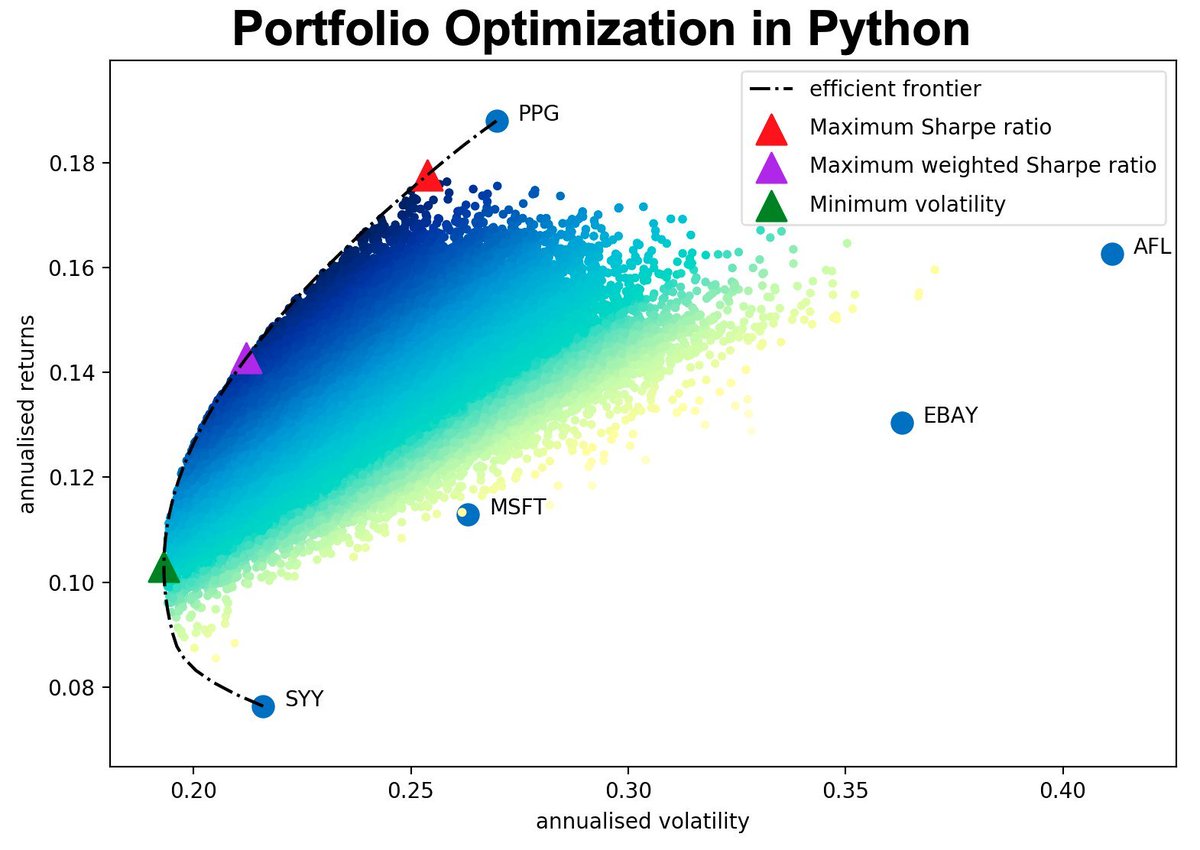

3. Coding TSMOM with Python

Code TSMOM in Python:

- Use yfinance to get data

- Then momentum = price[-1] / price[-20] - 1.

Positive? Buy

Negative? Sell

Code TSMOM in Python:

- Use yfinance to get data

- Then momentum = price[-1] / price[-20] - 1.

Positive? Buy

Negative? Sell

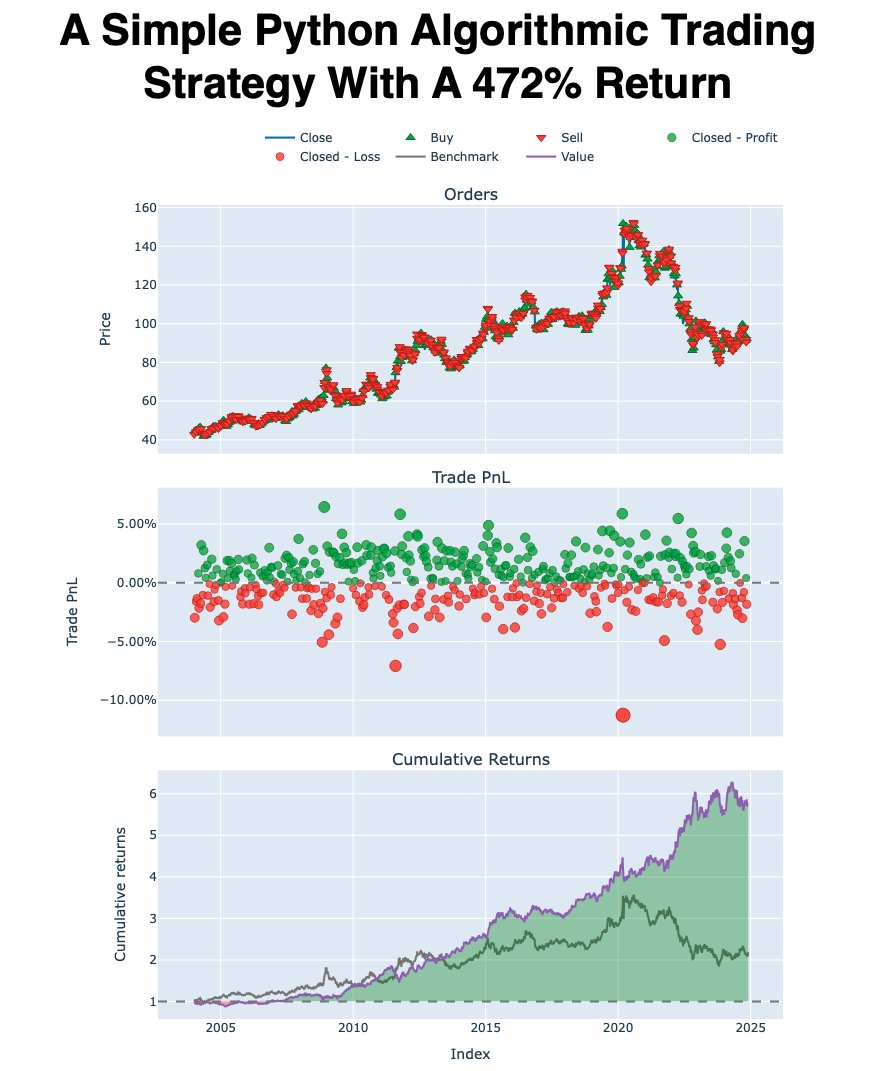

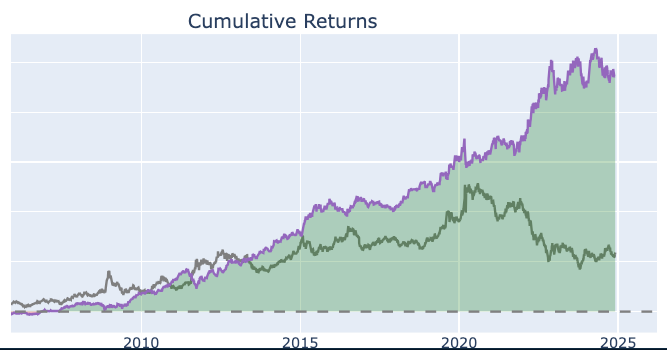

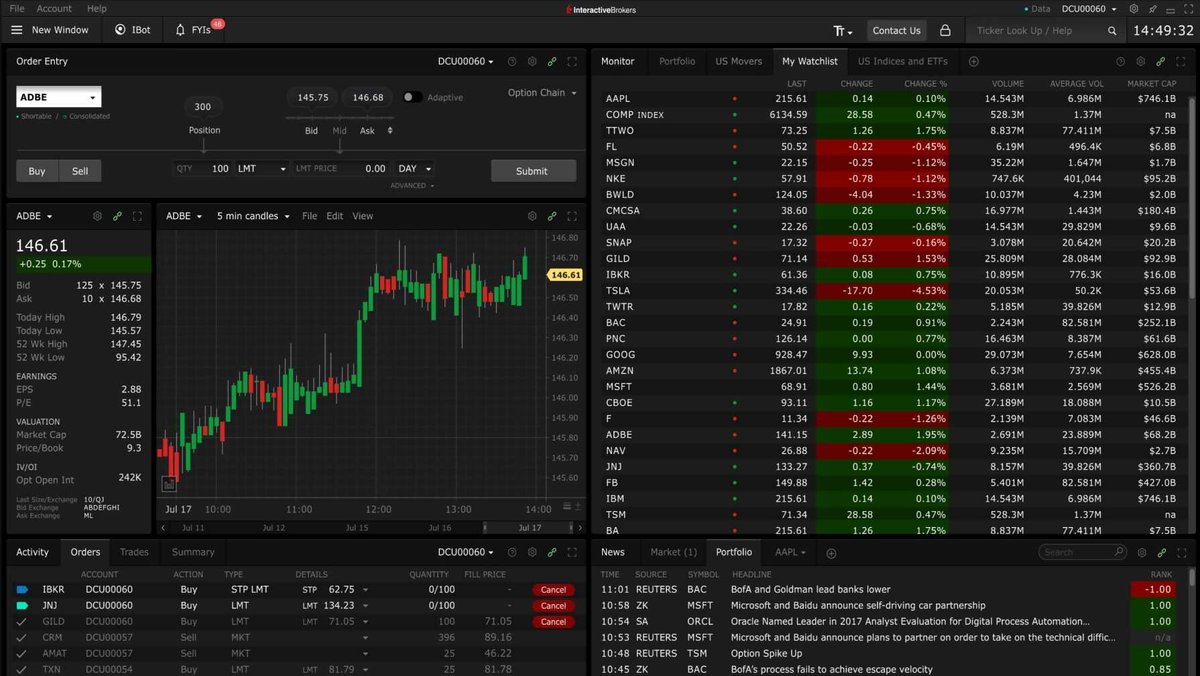

4. Real-World Performance

TSMOM outperforms passive investing.

We're using a modified version of TSMOM in our Hedge Fund.

One backtest shows 3500% return vs 450% S&P500.

TSMOM outperforms passive investing.

We're using a modified version of TSMOM in our Hedge Fund.

One backtest shows 3500% return vs 450% S&P500.

We are using TSMOM in our hedge fund.

And we'd like to share exactly how it works.

Want to see how we built our hedge fund in Python?

Then join us for our free training:

And we'd like to share exactly how it works.

Want to see how we built our hedge fund in Python?

Then join us for our free training:

🚨 FREE Python Algo Trading Workshop: Learn how we built our hedge fund

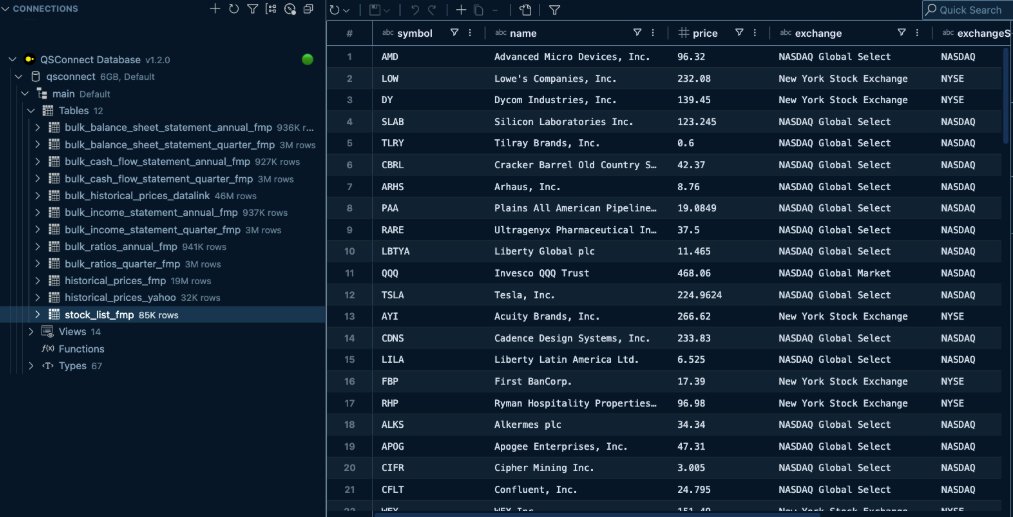

• QSConnect: Build your quant research database

• QSResearch: Research and run machine learning strategies

• Omega: Automate trade execution with Python

👉 Get the system: learn.quantscience.io/become-a-pro-q…

• QSConnect: Build your quant research database

• QSResearch: Research and run machine learning strategies

• Omega: Automate trade execution with Python

👉 Get the system: learn.quantscience.io/become-a-pro-q…

That's a wrap! Over the next 24 days, I'm sharing my top 24 algorithmic trading concepts to help you get started.

If you enjoyed this thread:

1. Follow me @quantscience_ for more of these

2. RT the tweet below to share this thread with your audience

If you enjoyed this thread:

1. Follow me @quantscience_ for more of these

2. RT the tweet below to share this thread with your audience

https://twitter.com/1683526993059430411/status/2015412680757067981

• • •

Missing some Tweet in this thread? You can try to

force a refresh