🧵 THREAD: China just pulled the emergency brake on silver leverage. Here’s why stackers should smile. 🪙🔥

1/

China just announced a MAJOR margin hike on precious metals futures.

Starting Jan 29, 2026, margin on silver (Ag T+D) jumps from 44% → 60%.

That’s not a tweak.

That’s a warning shot.

China just announced a MAJOR margin hike on precious metals futures.

Starting Jan 29, 2026, margin on silver (Ag T+D) jumps from 44% → 60%.

That’s not a tweak.

That’s a warning shot.

2/

When exchanges raise margin this aggressively, it means only one thing:

👉 Volatility is coming

👉 Risk is rising

👉 Leverage is being punished

Paper traders are about to feel it.

When exchanges raise margin this aggressively, it means only one thing:

👉 Volatility is coming

👉 Risk is rising

👉 Leverage is being punished

Paper traders are about to feel it.

3/

Higher margin = less leverage.

Less leverage = forced liquidations.

Forced liquidations = weak hands flushed out.

This is how exchanges clean the casino before the real move.

Higher margin = less leverage.

Less leverage = forced liquidations.

Forced liquidations = weak hands flushed out.

This is how exchanges clean the casino before the real move.

4/

Official excuse?

“Market volatility”

“Investor protection”

Real reason?

👉 The market is too tight

👉 Physical supply is stressed

👉 They don’t want defaults

Official excuse?

“Market volatility”

“Investor protection”

Real reason?

👉 The market is too tight

👉 Physical supply is stressed

👉 They don’t want defaults

5/

Notice something important:

This does NOT affect physical silver holders.

No margin calls.

No forced selling.

No liquidation risk.

Only paper players bleed here.

Notice something important:

This does NOT affect physical silver holders.

No margin calls.

No forced selling.

No liquidation risk.

Only paper players bleed here.

6/

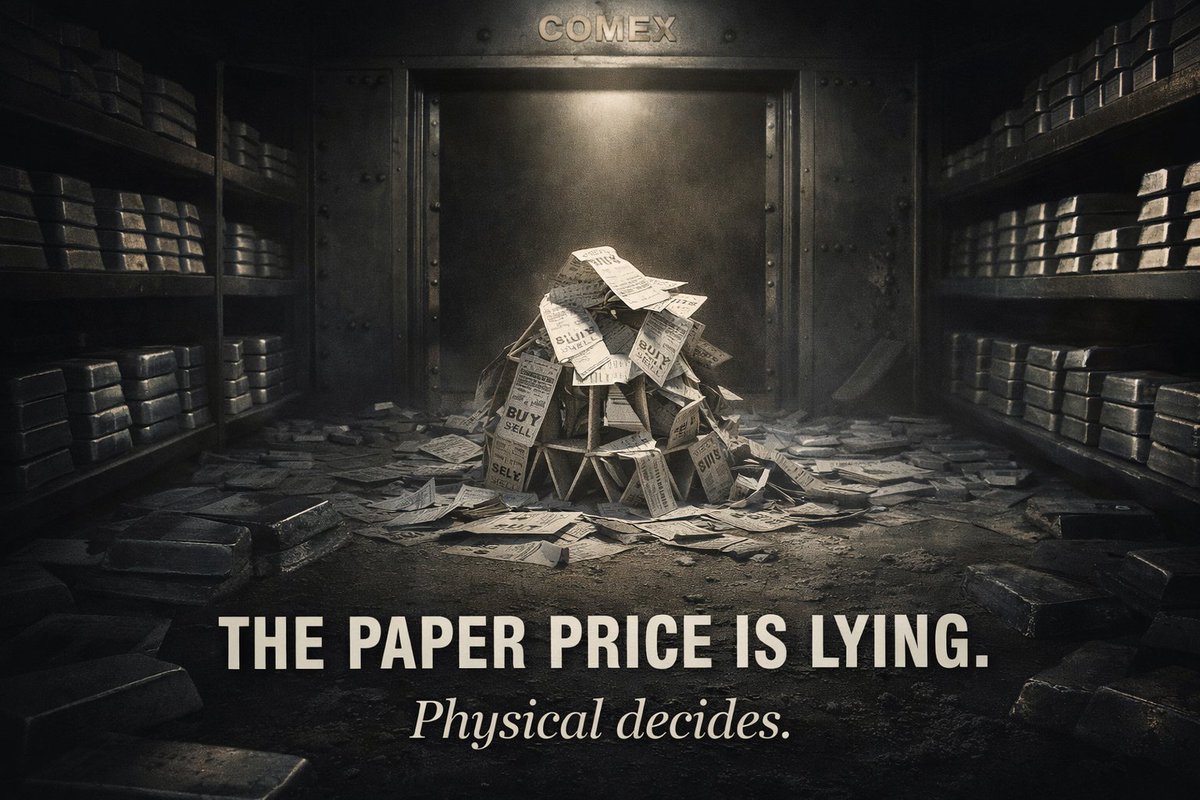

This is the difference between:

📄 Paper promises

vs

🪙 Metal in hand

One needs permission to exist.

The other doesn’t.

This is the difference between:

📄 Paper promises

vs

🪙 Metal in hand

One needs permission to exist.

The other doesn’t.

7/

China doesn’t raise margins when markets are calm.

They do it when pressure is building and control matters.

And they even warned:

👉 Further margin increases may follow.

Translation: buckle up.

China doesn’t raise margins when markets are calm.

They do it when pressure is building and control matters.

And they even warned:

👉 Further margin increases may follow.

Translation: buckle up.

8/

Every margin hike widens the crack between paper and physical.

Every rule change confirms the same truth:

Silver isn’t volatile —

👉 the system around it is.

Every margin hike widens the crack between paper and physical.

Every rule change confirms the same truth:

Silver isn’t volatile —

👉 the system around it is.

9/

Stackers don’t panic on margin hikes.

We don’t use leverage.

We don’t chase charts.

We accumulate reality.

Stackers don’t panic on margin hikes.

We don’t use leverage.

We don’t chase charts.

We accumulate reality.

10/

If you hold physical silver:

Relax.

If you trade paper silver:

Pray.

Same metal.

Very different outcomes.

If you hold physical silver:

Relax.

If you trade paper silver:

Pray.

Same metal.

Very different outcomes.

11/

This isn’t bearish.

This isn’t neutral.

This is structurally bullish for physical silver.

The tighter the rules, the closer we are.

This isn’t bearish.

This isn’t neutral.

This is structurally bullish for physical silver.

The tighter the rules, the closer we are.

12/

Stack quietly.

Hold patiently.

Let the paper system eat itself.

🪙 Silver doesn’t need leverage. It needs ownership.

#Silver #SilverStackers #PhysicalSilver #PaperVsPhysical #China #Ag #Commodities #Stackers

Stack quietly.

Hold patiently.

Let the paper system eat itself.

🪙 Silver doesn’t need leverage. It needs ownership.

#Silver #SilverStackers #PhysicalSilver #PaperVsPhysical #China #Ag #Commodities #Stackers

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh