1/ A lot of old & silver miner stocks just hit limit down. That’s not a signal of weak metal. That’s a signal of forced selling and paper stress.

2/

Here’s the part that actually matters 👇

Major Chinese banks report that available gold bar vaults have been reset to ZERO.

Zero.

Not “low.”

Not “tight.”

Zero.

Here’s the part that actually matters 👇

Major Chinese banks report that available gold bar vaults have been reset to ZERO.

Zero.

Not “low.”

Not “tight.”

Zero.

3/

Withdrawals are no longer instant.

A one-month advance booking is now required —

with no guarantee of delivery time.

That’s not normal market behavior.

That’s rationing.

Withdrawals are no longer instant.

A one-month advance booking is now required —

with no guarantee of delivery time.

That’s not normal market behavior.

That’s rationing.

4/

If gold were plentiful…

If supply were abundant…

If inventories were “fine”…

You wouldn’t need to wait a month

and still be told “maybe.”

If gold were plentiful…

If supply were abundant…

If inventories were “fine”…

You wouldn’t need to wait a month

and still be told “maybe.”

5/

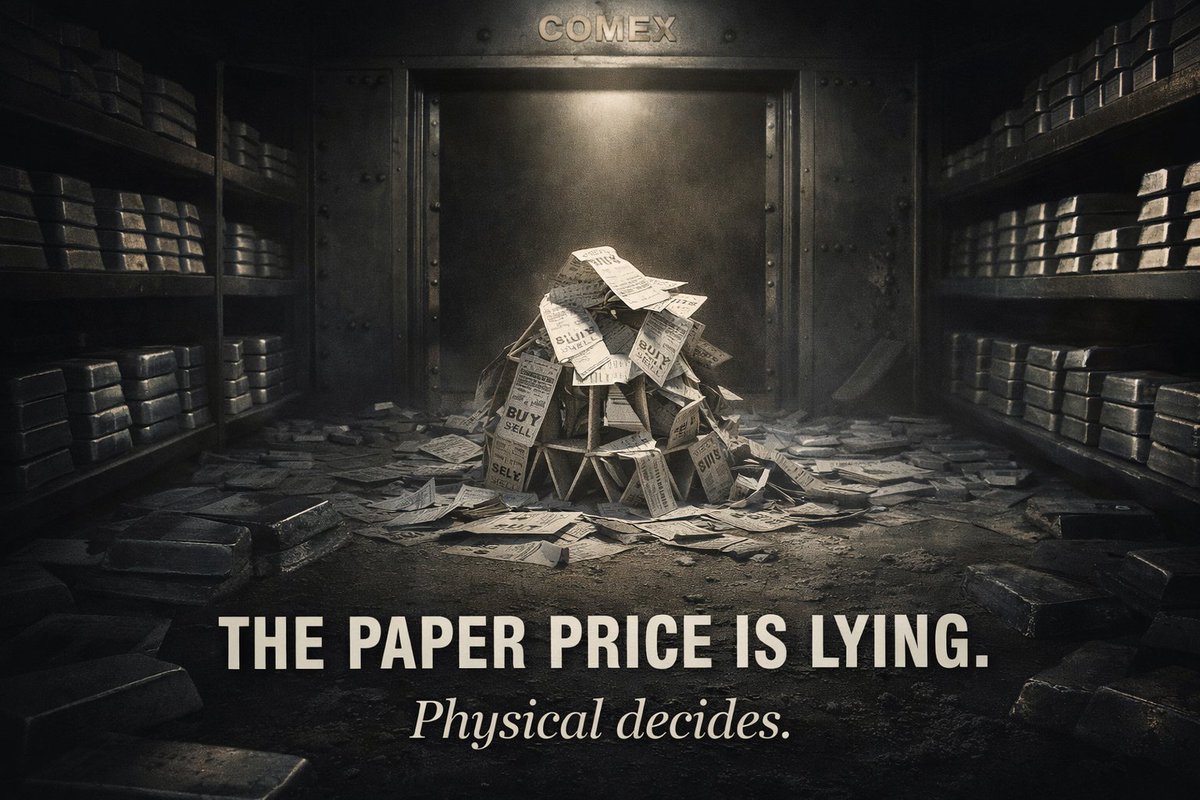

This is the split they don’t want you to see:

📉 Paper assets selling off

📉 Miner stocks crashing

📈 Physical metal becoming unavailable

Same market.

Two completely different realities.

This is the split they don’t want you to see:

📉 Paper assets selling off

📉 Miner stocks crashing

📈 Physical metal becoming unavailable

Same market.

Two completely different realities.

6/

When banks restrict withdrawals, it’s not because metal is worthless.

It’s because metal suddenly matters more than money.

Screens can show any price.

Vaults can only show what’s actually there.

When banks restrict withdrawals, it’s not because metal is worthless.

It’s because metal suddenly matters more than money.

Screens can show any price.

Vaults can only show what’s actually there.

7/

Paper holders panic first.

Physical holders wait calmly.

Why?

Because you can’t margin-call a coin in your hand.

Paper holders panic first.

Physical holders wait calmly.

Why?

Because you can’t margin-call a coin in your hand.

8/

Stacking physical metal isn’t about timing tops or bottoms.

It’s about owning something that doesn’t need permission to exist.

Stacking physical metal isn’t about timing tops or bottoms.

It’s about owning something that doesn’t need permission to exist.

9/

Every time delivery gets delayed…

Every time vaults go “temporarily unavailable”…

Every time paper sells while metal vanishes…

Your thesis gets stronger.

Every time delivery gets delayed…

Every time vaults go “temporarily unavailable”…

Every time paper sells while metal vanishes…

Your thesis gets stronger.

10/

This is why stackers don’t chase noise.

We watch flows.

We watch availability.

We watch who’s locking the vault doors.

This is why stackers don’t chase noise.

We watch flows.

We watch availability.

We watch who’s locking the vault doors.

11/

Paper can be printed.

Contracts can be rolled.

Excuses can be made.

Physical metal?

It either exists — or it doesn’t.

Paper can be printed.

Contracts can be rolled.

Excuses can be made.

Physical metal?

It either exists — or it doesn’t.

12/

Stay patient.

Stay disciplined.

Keep stacking real metal.

Because when access disappears,

price is just the last thing to catch up.

#Silver #Gold #PhysicalMetal #Stackers #SoundMoney #RealAssets

Stay patient.

Stay disciplined.

Keep stacking real metal.

Because when access disappears,

price is just the last thing to catch up.

#Silver #Gold #PhysicalMetal #Stackers #SoundMoney #RealAssets

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh