Been thinking about implications of AI disruption on investing. When incumbents fall and new upstarts emerge, stocks usually don’t go from 100 to 0 or vice versa overnight - they get there over time, forming strong trends.

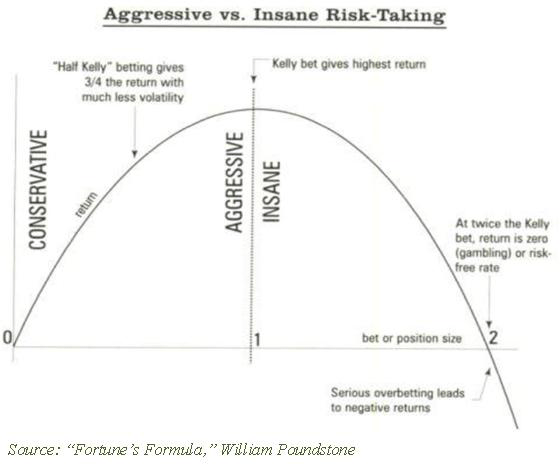

Momentum investors who win on trends caused by real fundamentals take their profits to chase fake trends too. Dumb money that got lucky can’t tell the difference but now they have enough capital to really move things.

Investors eventually catch on and the inefficiency of gradual one-way moves start giving way to more sudden, sharper moves. Megacaps jumping 10-20% a day and entire sectors (e.g. semis, software) move with speed that shock investors who lived in an age of relative stability.

Quality/moat investing is often a bet on stability. The ideal environment for many of these companies is one where the world changes slowly so they easily stay on top and print money decade after decade. Moats won’t defend your castle anymore when someone invents bomber planes.

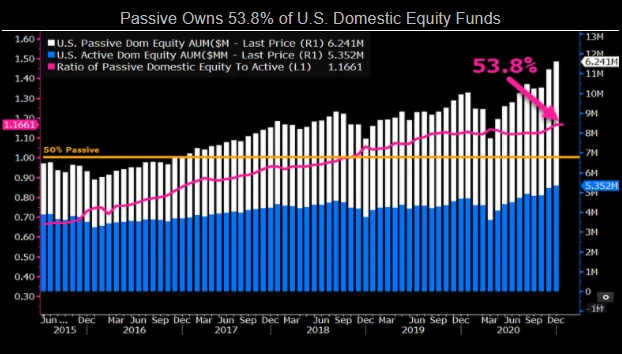

Many investors, myself included, feel like things are getting increasingly “weird” in the market. But if it’s due to AI (and indexing and options) and they keep growing, it’s dangerous to rely on backtests/experience based on a world of stability that doesn’t exist anymore.

• • •

Missing some Tweet in this thread? You can try to

force a refresh