How to get URL link on X (Twitter) App

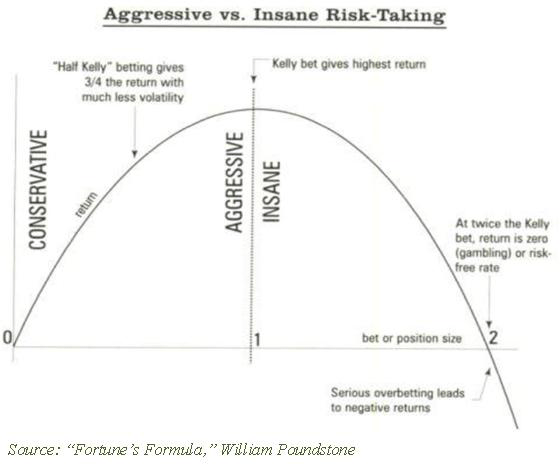

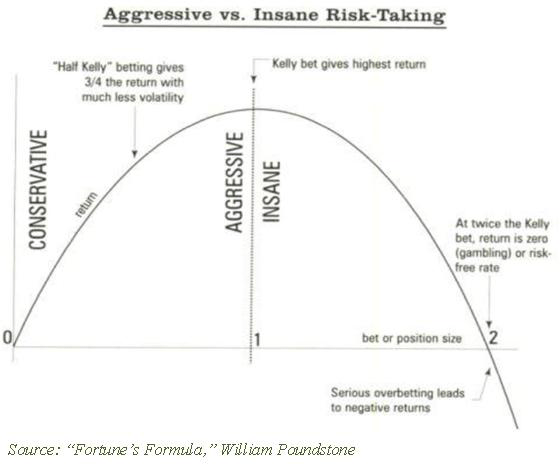

https://twitter.com/walt373/status/947171512355885056I think it's the same idea behind +/- gamma. Options are like strategies embedded in an instrument. Long calls = long stock and trading pro-trend, buying more as price goes up. Short put = long stock/trading counter-trend. If everyone's selling covered calls, calls will be cheap.

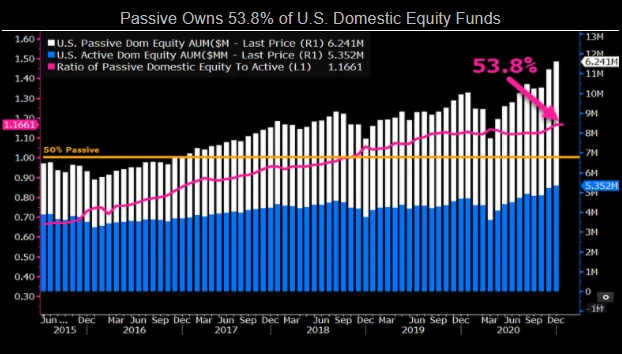

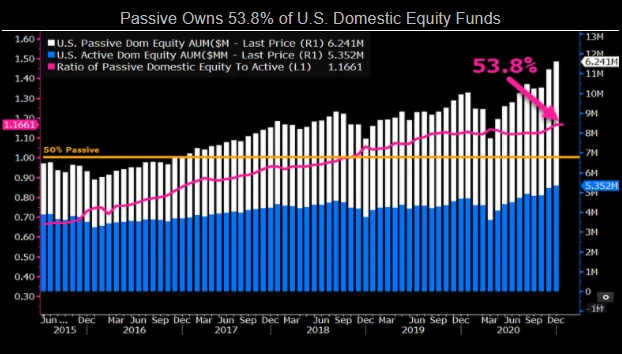

Market efficiency is created by active managers all trying to fairly value securities. Passive assumes the market is highly efficient and attempts to free-ride on it. But obviously this assumption will not hold if passive drives out the very agents enforcing it.

Market efficiency is created by active managers all trying to fairly value securities. Passive assumes the market is highly efficient and attempts to free-ride on it. But obviously this assumption will not hold if passive drives out the very agents enforcing it.

https://twitter.com/vitaliyk/status/1268869824106520576The original tweet pointed out how long it took for MSFT to regain its tech bubble high. What I find more remarkable is its performance since it stopped going sideways. Almost a straight line up and to the right.