Terrified of buying the top in Gold, Bitcoin, or the Nasdaq? But afraid of missing the next leg up?

You aren't alone. This is the "Trader's Dilemma."

The solution isn't a crystal ball. It is a system.

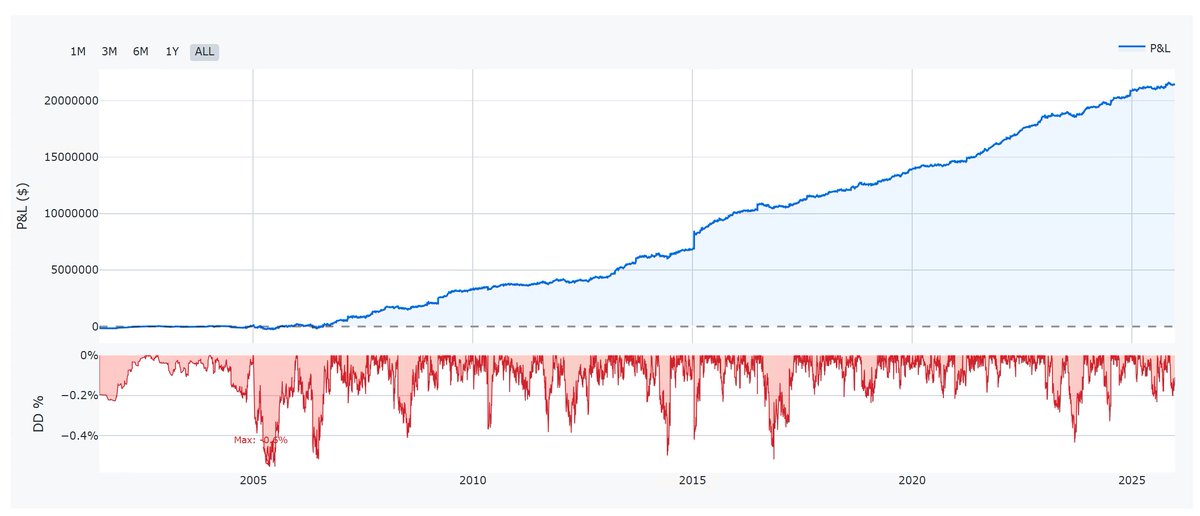

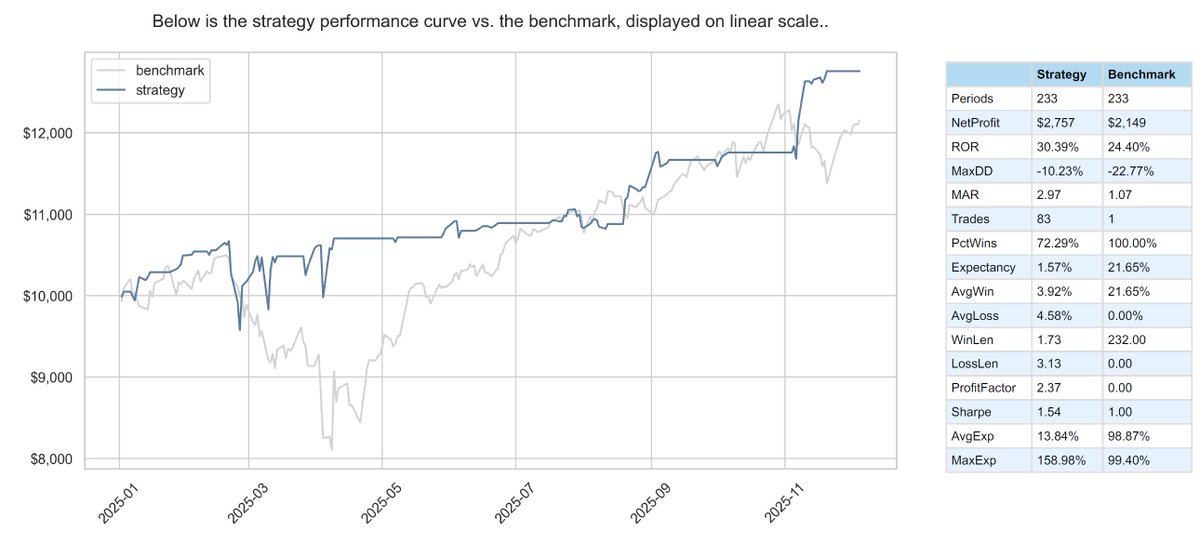

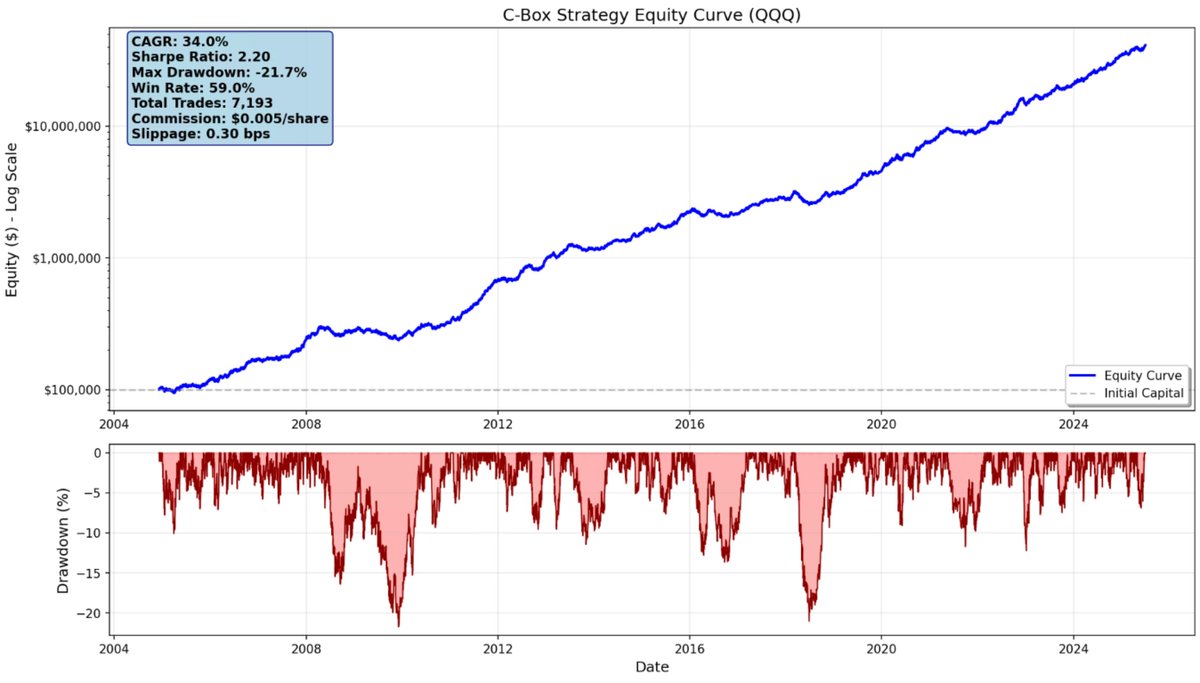

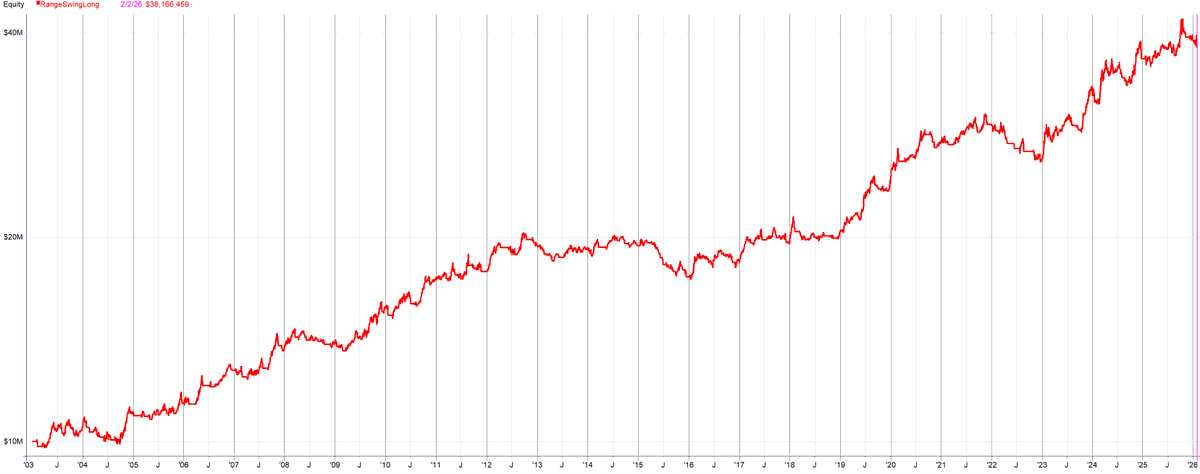

Here is a robust framework catching "fat tails" while keeping Max Drawdown to just -15%.

Full logic below 🧵

You aren't alone. This is the "Trader's Dilemma."

The solution isn't a crystal ball. It is a system.

Here is a robust framework catching "fat tails" while keeping Max Drawdown to just -15%.

Full logic below 🧵

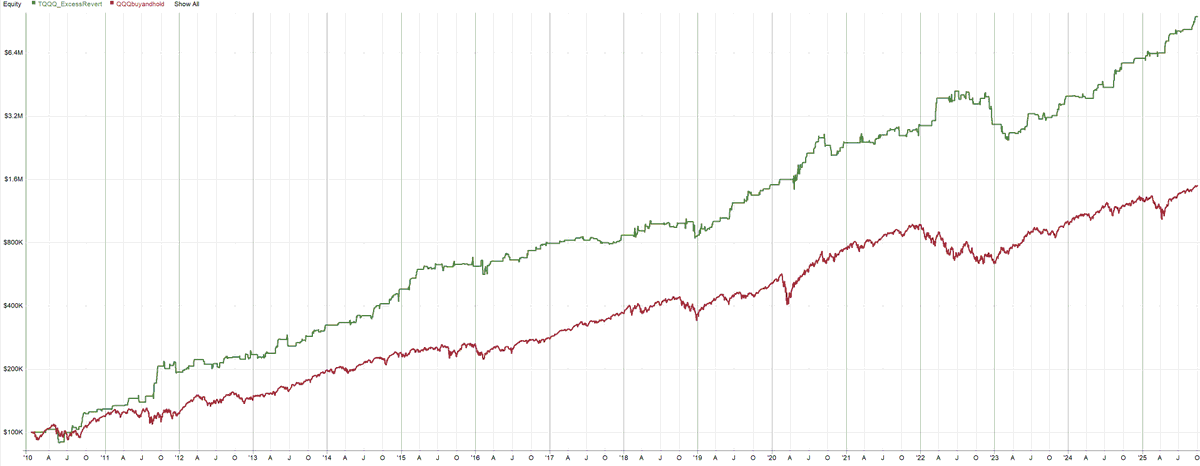

1/ The Philosophy

We are trading a classic Trend Following architecture. Assets: Gold ($GC), Nasdaq ($NQ), Micro Bitcoin ($MBT).

Why these three?

- High Volatility

- Hard Trends

- Low Correlation

We don't guess when they move. We set a trap and wait for price to trigger it.

We are trading a classic Trend Following architecture. Assets: Gold ($GC), Nasdaq ($NQ), Micro Bitcoin ($MBT).

Why these three?

- High Volatility

- Hard Trends

- Low Correlation

We don't guess when they move. We set a trap and wait for price to trigger it.

2/ The Setup

Simple systems are robust systems. This approach is time-tested.

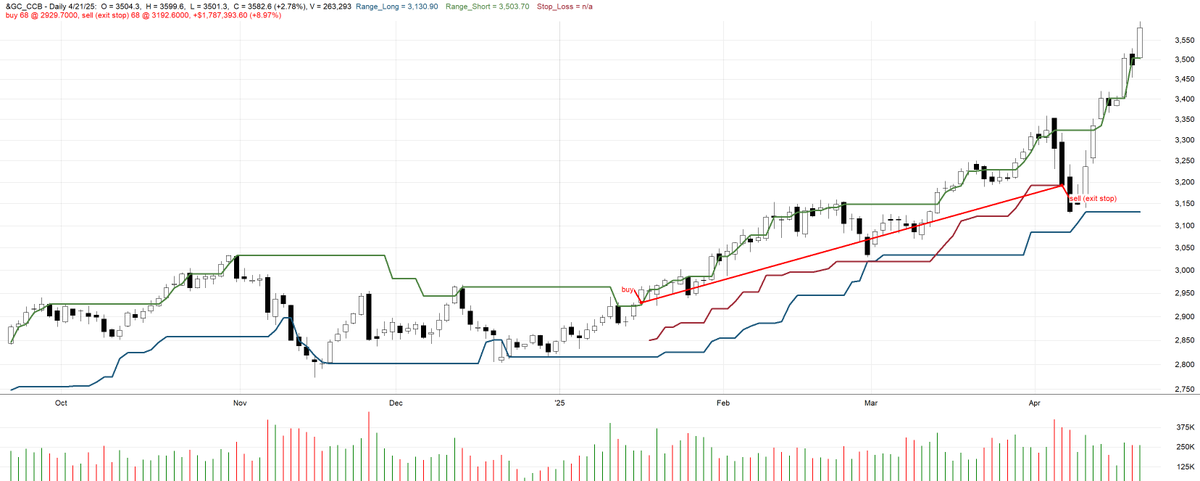

We combine a Donchian Channel (Trend) with a Chandelier Stop (Risk).

The Rules:

• Timeframe: Daily

• Trend Filter: 20-Day Donchian

• Volatility: 5-Day ATR

ENTRY (The Breakout): IF Close > Highest High (20 days) THEN Buy Long.

Simple systems are robust systems. This approach is time-tested.

We combine a Donchian Channel (Trend) with a Chandelier Stop (Risk).

The Rules:

• Timeframe: Daily

• Trend Filter: 20-Day Donchian

• Volatility: 5-Day ATR

ENTRY (The Breakout): IF Close > Highest High (20 days) THEN Buy Long.

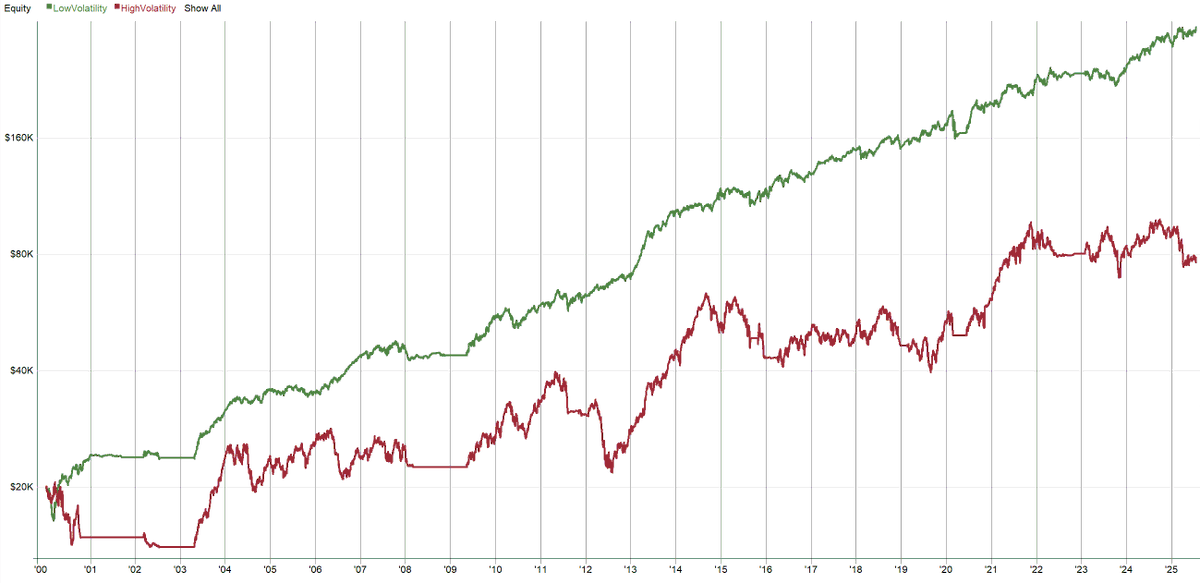

3/ Risk Management

This is where you survive.

POSITION SIZING (Volatility Targeting): We risk 2% of equity per trade.

• Stop Distance = 3 * ATR(5)

• Size = (Account * 0.02) / Stop Distance

The Insight: If Volatility (ATR) goes UP, our Position Size goes DOWN. We equalise risk across Bitcoin and Gold.

This is where you survive.

POSITION SIZING (Volatility Targeting): We risk 2% of equity per trade.

• Stop Distance = 3 * ATR(5)

• Size = (Account * 0.02) / Stop Distance

The Insight: If Volatility (ATR) goes UP, our Position Size goes DOWN. We equalise risk across Bitcoin and Gold.

4/ The Exit (Two-Stage Mechanism)

We use two exits:

A. Protective Stop (The Shield): Trail a stop at Highest High - (3 * ATR). Saves us if a breakout fails instantly.

B. Technical Exit (The Signal): Sell if Close < Lowest Low (20 days). Confirms the trend is actually over.

We use two exits:

A. Protective Stop (The Shield): Trail a stop at Highest High - (3 * ATR). Saves us if a breakout fails instantly.

B. Technical Exit (The Signal): Sell if Close < Lowest Low (20 days). Confirms the trend is actually over.

5/ The Hardest Part: Psychology

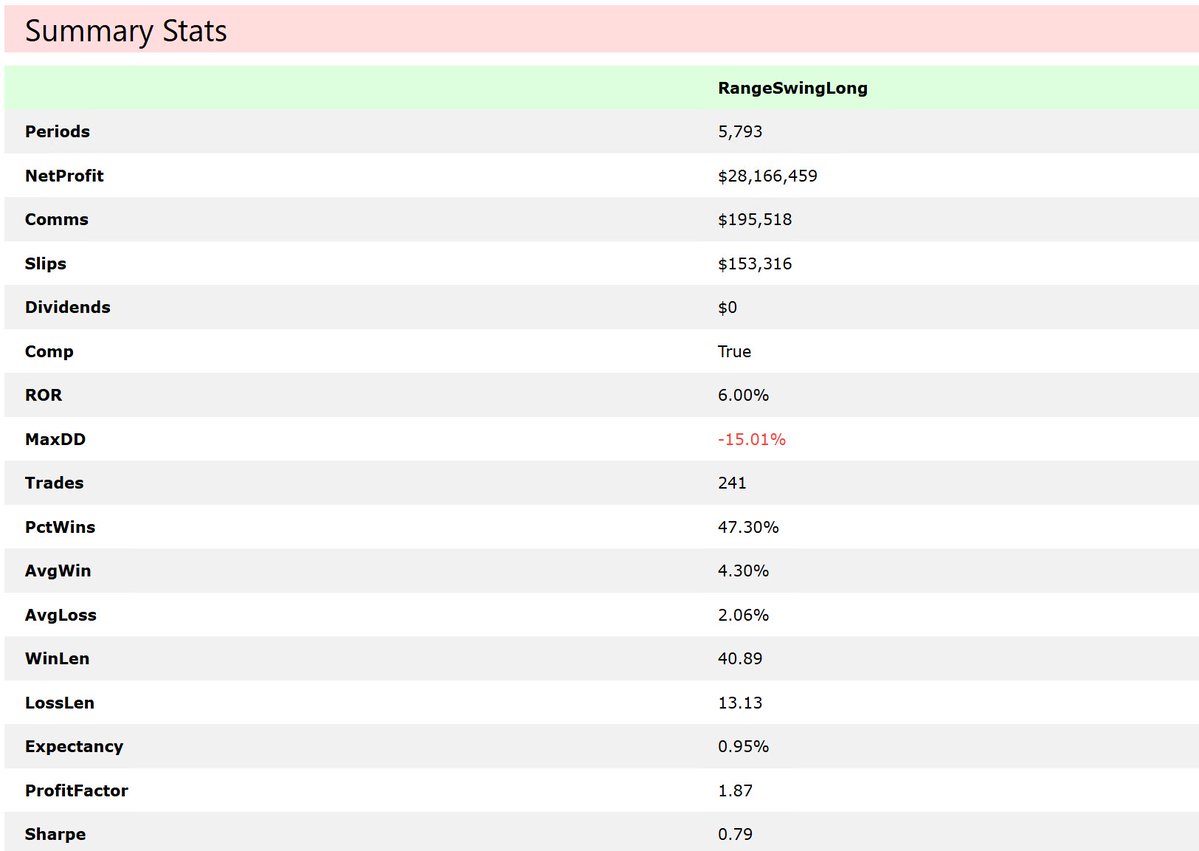

Look at the stats:

• Win Rate: 47.3%

• Avg Win: 4.30%

• Avg Loss: 2.06%

We are wrong more often than right.

But trading a system is psychologically easier than guessing tops and bottoms. You stop fighting the market and start executing the plan.

Look at the stats:

• Win Rate: 47.3%

• Avg Win: 4.30%

• Avg Loss: 2.06%

We are wrong more often than right.

But trading a system is psychologically easier than guessing tops and bottoms. You stop fighting the market and start executing the plan.

6/ Next Steps

Stop trying to time the exact bottom. You will miss. Start measuring the breakout.

Systematic execution > Emotional guessing.

Note: This is a foundational framework, not a "black box" solution. But it beats discretionary guessing every time.

Tools used: RealTest & Norgate Data.

If you found value in this breakdown:

- Retweet the first tweet to share the alpha.

- Follow me for more systematic trading deep dives.

Stop trying to time the exact bottom. You will miss. Start measuring the breakout.

Systematic execution > Emotional guessing.

Note: This is a foundational framework, not a "black box" solution. But it beats discretionary guessing every time.

Tools used: RealTest & Norgate Data.

If you found value in this breakdown:

- Retweet the first tweet to share the alpha.

- Follow me for more systematic trading deep dives.

• • •

Missing some Tweet in this thread? You can try to

force a refresh