Systematic trader, fund manager. Web: https://t.co/Qga9clOPid

How to get URL link on X (Twitter) App

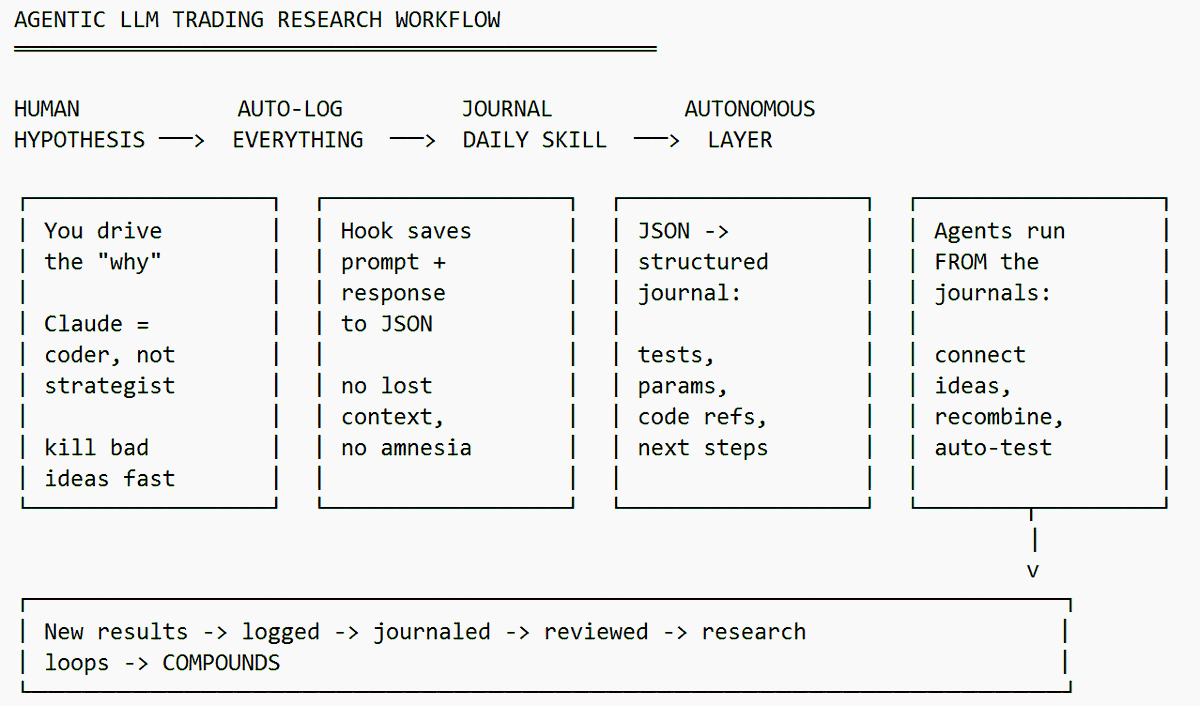

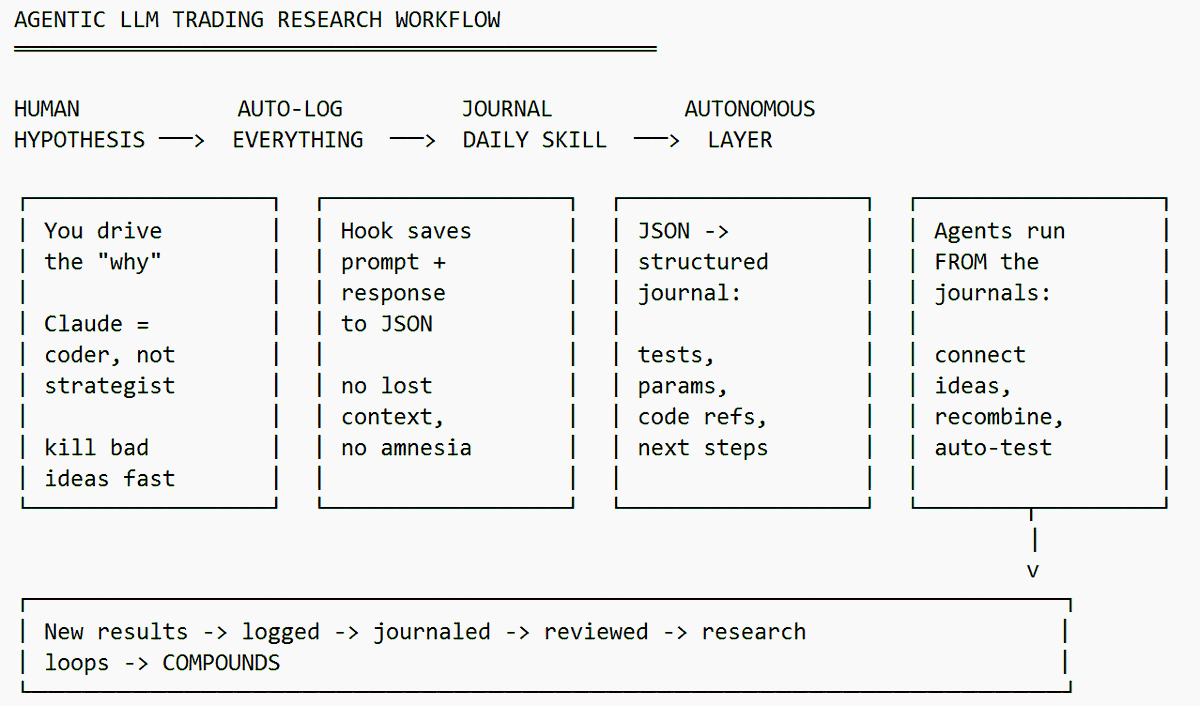

Step 1 - Primary research stays human-driven.

Step 1 - Primary research stays human-driven.

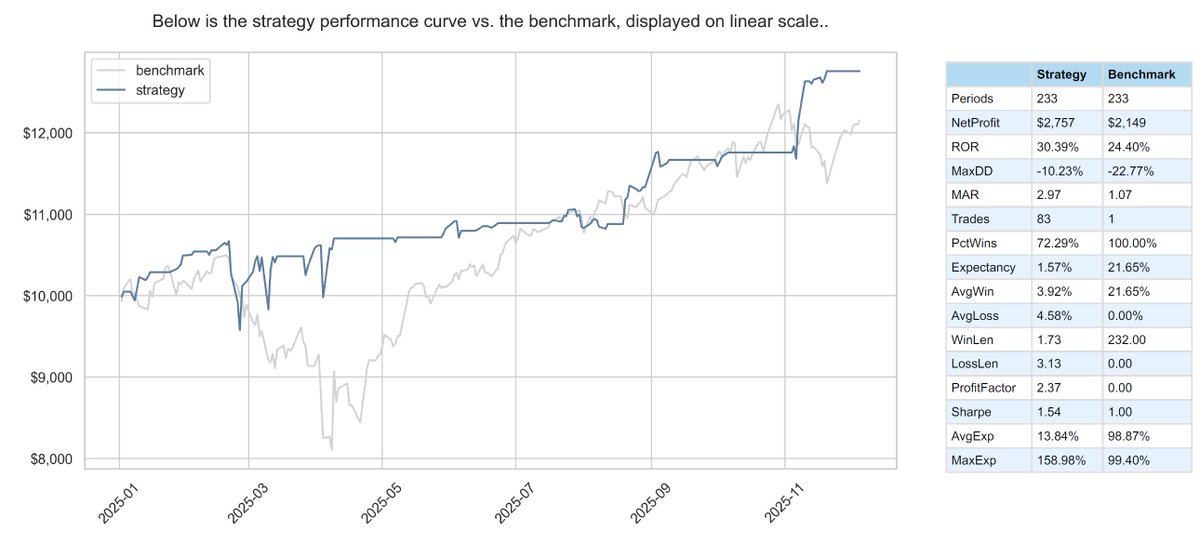

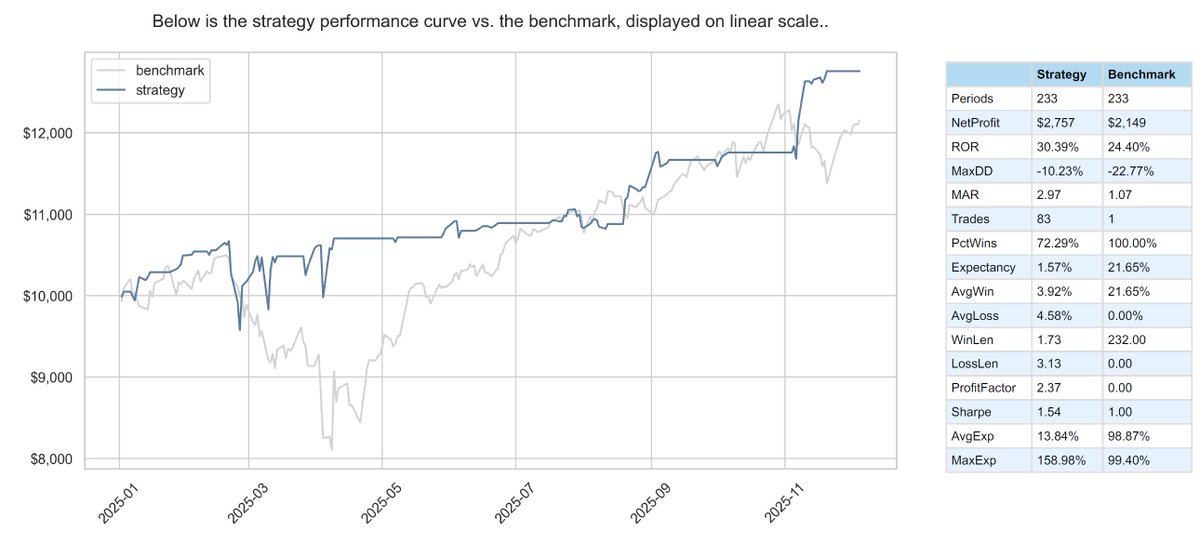

2/ The setup:

2/ The setup:

1/ The Philosophy

1/ The Philosophy

1/ What is a "Swing"?

1/ What is a "Swing"?

The idea is simple:

The idea is simple:

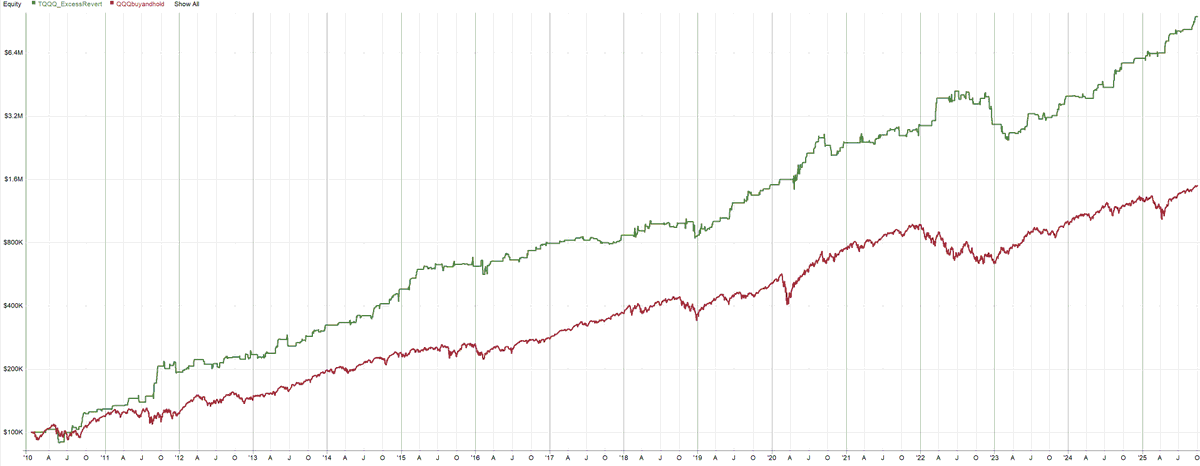

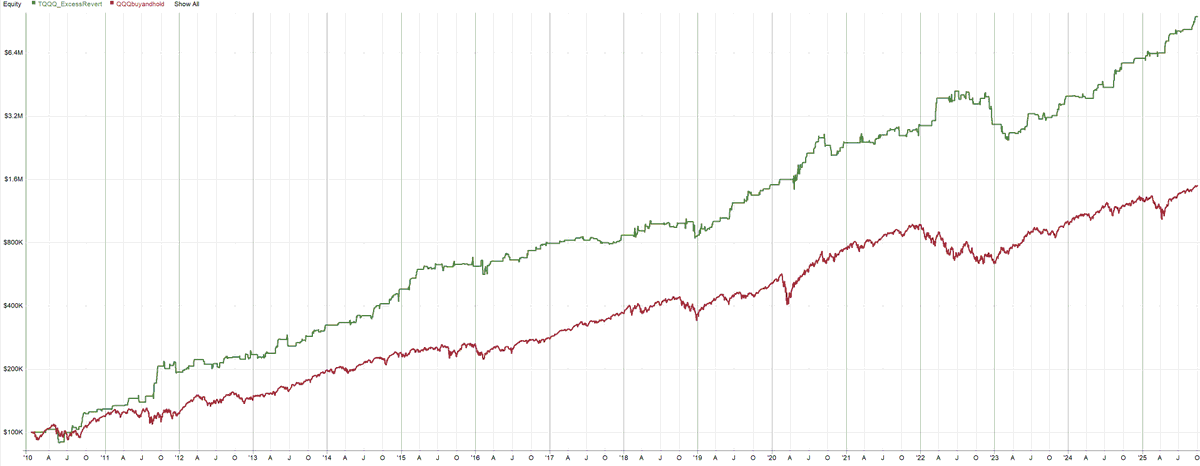

Leveraged ETFs (like $TQQQ, 3× $QQQ) don’t perfectly track their target.

Leveraged ETFs (like $TQQQ, 3× $QQQ) don’t perfectly track their target.

2/6

2/6

1/

1/

2/5 My personal game-changer?

2/5 My personal game-changer?

(2/7) The Allure & Danger of Raw Profit

(2/7) The Allure & Danger of Raw Profit