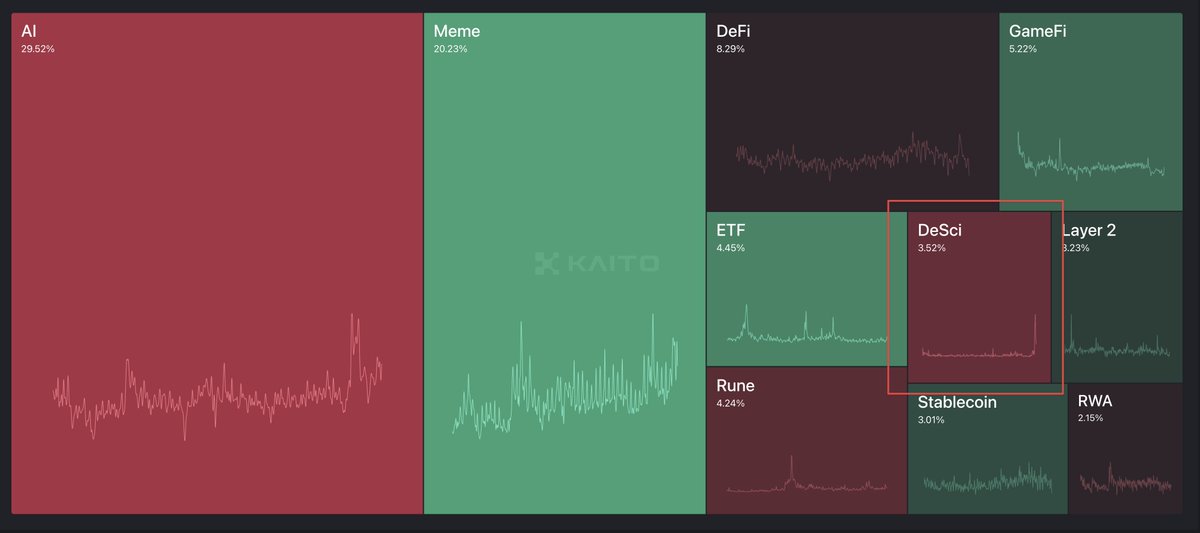

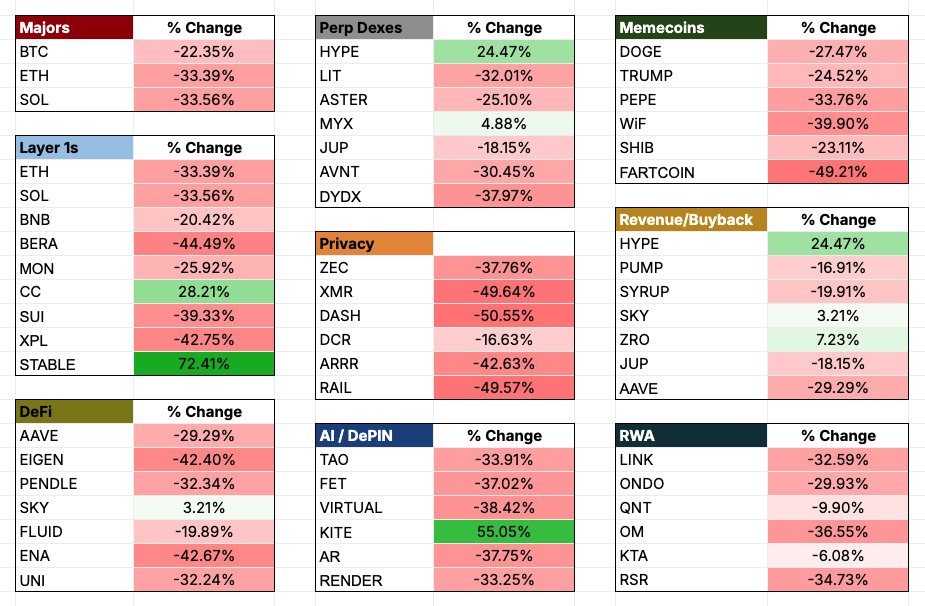

Only 7 out of 51 tokens finished green this week.

Everyone panics during corrections but this is actually when you spot the best long term plays.

Everything's kinda cooked but holds the strongest has the best chance of bouncing back.

Some observations:

• Revenue/buyback tokens only dropped -7.05% while 86% of everything else went red. The sector with actual cash flows and token sinks barely got scratched. Fundamentals give you a floor when everything else falls apart.

• Bitcoin down 22.35% sounds rough but it’s not doing too bad compared to everything else. ETH lost 33.4%, SOL dropped 33.6%, average altcoin fell around 30%. BTC’s the king for a reason.

• $STABLE, $KITE, $CC, and $HYPE were basically the only winners. $STABLE up over 72%. They don't share a sector but they all had their own specific catalyst. Revenue mechanics, protocol upgrades, unique positioning.

• AI/DePIN averaged -36% if you take out the $KITE outlier. That’s worse than memecoins. KITE at +55% covers up how bad the rest did.

• Memecoins dropped -33% on average. Worse than every sector except privacy. FARTCOIN at -49.2% :-(. Hard to call these "cheap fun bets" when the average memecoin gave back a third of its value.

(Data is over the past 7 days)

Corrections show you what's real. Pay attention to what barely moved because those are usually the ones that rip the hardest on the way back up.

Everyone panics during corrections but this is actually when you spot the best long term plays.

Everything's kinda cooked but holds the strongest has the best chance of bouncing back.

Some observations:

• Revenue/buyback tokens only dropped -7.05% while 86% of everything else went red. The sector with actual cash flows and token sinks barely got scratched. Fundamentals give you a floor when everything else falls apart.

• Bitcoin down 22.35% sounds rough but it’s not doing too bad compared to everything else. ETH lost 33.4%, SOL dropped 33.6%, average altcoin fell around 30%. BTC’s the king for a reason.

• $STABLE, $KITE, $CC, and $HYPE were basically the only winners. $STABLE up over 72%. They don't share a sector but they all had their own specific catalyst. Revenue mechanics, protocol upgrades, unique positioning.

• AI/DePIN averaged -36% if you take out the $KITE outlier. That’s worse than memecoins. KITE at +55% covers up how bad the rest did.

• Memecoins dropped -33% on average. Worse than every sector except privacy. FARTCOIN at -49.2% :-(. Hard to call these "cheap fun bets" when the average memecoin gave back a third of its value.

(Data is over the past 7 days)

Corrections show you what's real. Pay attention to what barely moved because those are usually the ones that rip the hardest on the way back up.

• • •

Missing some Tweet in this thread? You can try to

force a refresh