What is happening in crypto?

Since October 10th, crypto markets are now down -50%, erasing $2.2 TRILLION worth of market cap.

Bitcoin has officially erased ALL of its post-election rally, now down -10% since Trump's election.

Why is it crashing? Let us explain.

(a thread)

Since October 10th, crypto markets are now down -50%, erasing $2.2 TRILLION worth of market cap.

Bitcoin has officially erased ALL of its post-election rally, now down -10% since Trump's election.

Why is it crashing? Let us explain.

(a thread)

As of 8:00 AM ET today, Bitcoin has officially erased its post-election rally.

Yet, over the last 60 days, the fundamental picture for crypto is actually vastly unchanged.

This is why many investors are confused.

Why is crypto crashing if the fundamental picture is unchanged?

Yet, over the last 60 days, the fundamental picture for crypto is actually vastly unchanged.

This is why many investors are confused.

Why is crypto crashing if the fundamental picture is unchanged?

The answer to this question requires going back to October 10th.

The most recent TOP in crypto came on October 6th, just 4 days before the -$19.5 billion record liquidation.

Something structural appears to have shifted on October 10th.

And, markets never truly recovered.

The most recent TOP in crypto came on October 6th, just 4 days before the -$19.5 billion record liquidation.

Something structural appears to have shifted on October 10th.

And, markets never truly recovered.

Then, between Nov. 15th and Jan. 15th, Bitcoin was entirely rangebound.

However, we would see brief periods of liquidations with "gaps" in both directions.

This was yet another sign of the structural collapse in crypto.

Finally, the range broke to the downside on Jan. 16th.

However, we would see brief periods of liquidations with "gaps" in both directions.

This was yet another sign of the structural collapse in crypto.

Finally, the range broke to the downside on Jan. 16th.

As price action deteriorated, so did sentiment.

If previous crypto cycles have taught us anything, it's the sentiment is ALL that matters.

As seen below, sentiment has traded in a near straight-line lower since October 10th.

Even relief rallies failed to shift sentiment.

If previous crypto cycles have taught us anything, it's the sentiment is ALL that matters.

As seen below, sentiment has traded in a near straight-line lower since October 10th.

Even relief rallies failed to shift sentiment.

The result is a massive virtuous cycle, shifting from liquidations to sentiment deterioration, and back.

Since January 24th, we have seen $10 billion worth of levered positions liquidated.

That's ~55% of the record amount seen on October 10th.

It's a structural decline.

Since January 24th, we have seen $10 billion worth of levered positions liquidated.

That's ~55% of the record amount seen on October 10th.

It's a structural decline.

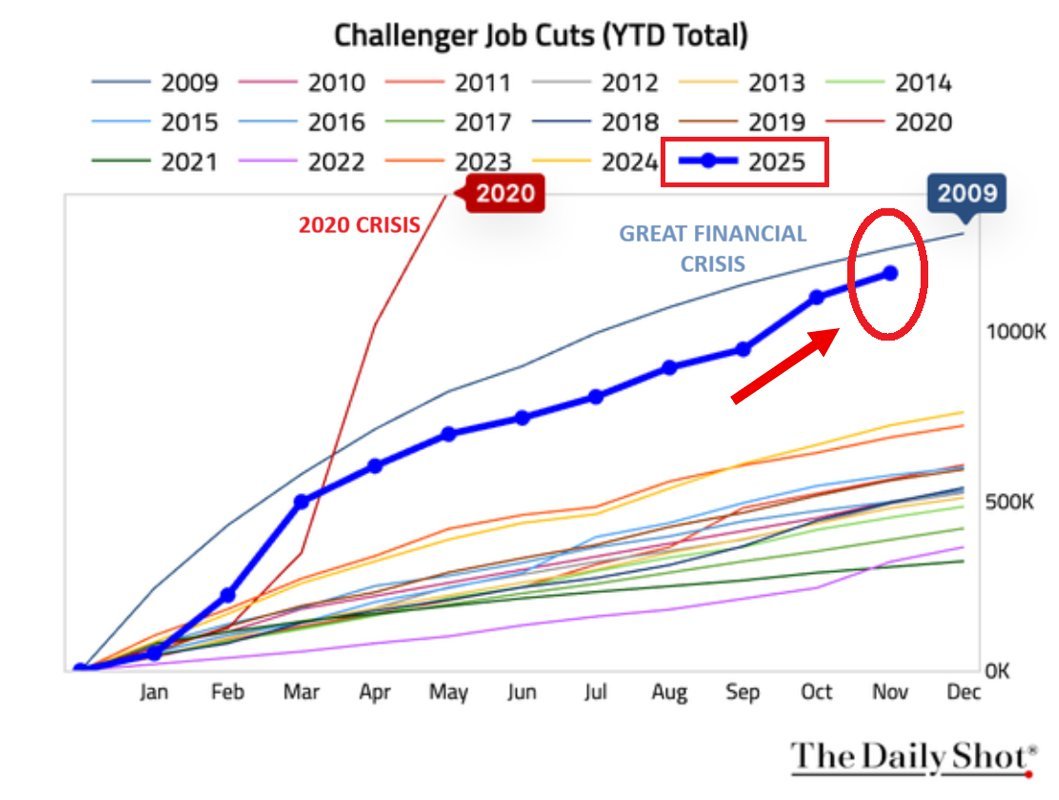

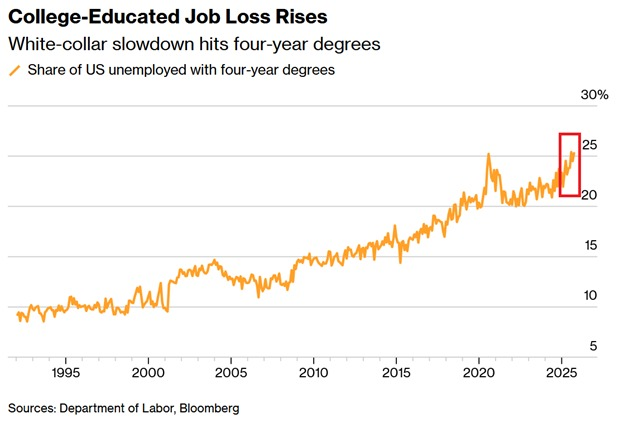

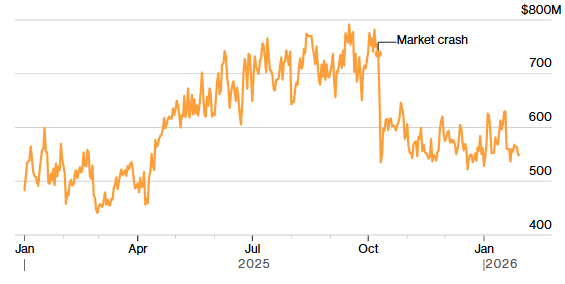

Further evidence of this being a structural decline is the spread of selling pressure into other asset classes.

Large cap tech stocks are dropping sharply, despite stronger earnings and little fundamental change.

Liquidation gaps in crypto are carrying over into equities.

Large cap tech stocks are dropping sharply, despite stronger earnings and little fundamental change.

Liquidation gaps in crypto are carrying over into equities.

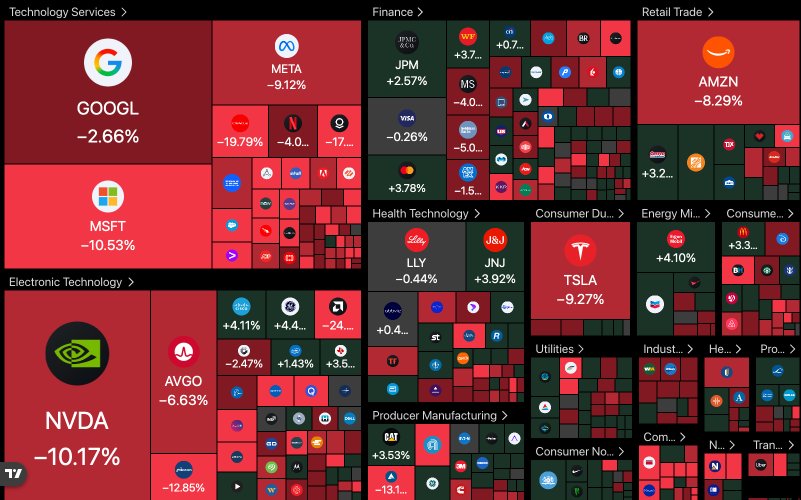

Even more evidence that this is liquidity-induced and structural in nature is market depth.

Bitcoin’s market depth, the capital available to absorb large orders, is still more than 30% below its October peak.

Last time this happened was after the FTX collapse in 2022.

Bitcoin’s market depth, the capital available to absorb large orders, is still more than 30% below its October peak.

Last time this happened was after the FTX collapse in 2022.

Today's decline was particularly noteworthy as Bitcoin fell over -$9,000 and selling pressure was constant.

At times, Bitcoin would fall $2,000+ in a matter of minutes.

It seems that a large player, perhaps an institutional investor, sold/liquidated during today's session.

At times, Bitcoin would fall $2,000+ in a matter of minutes.

It seems that a large player, perhaps an institutional investor, sold/liquidated during today's session.

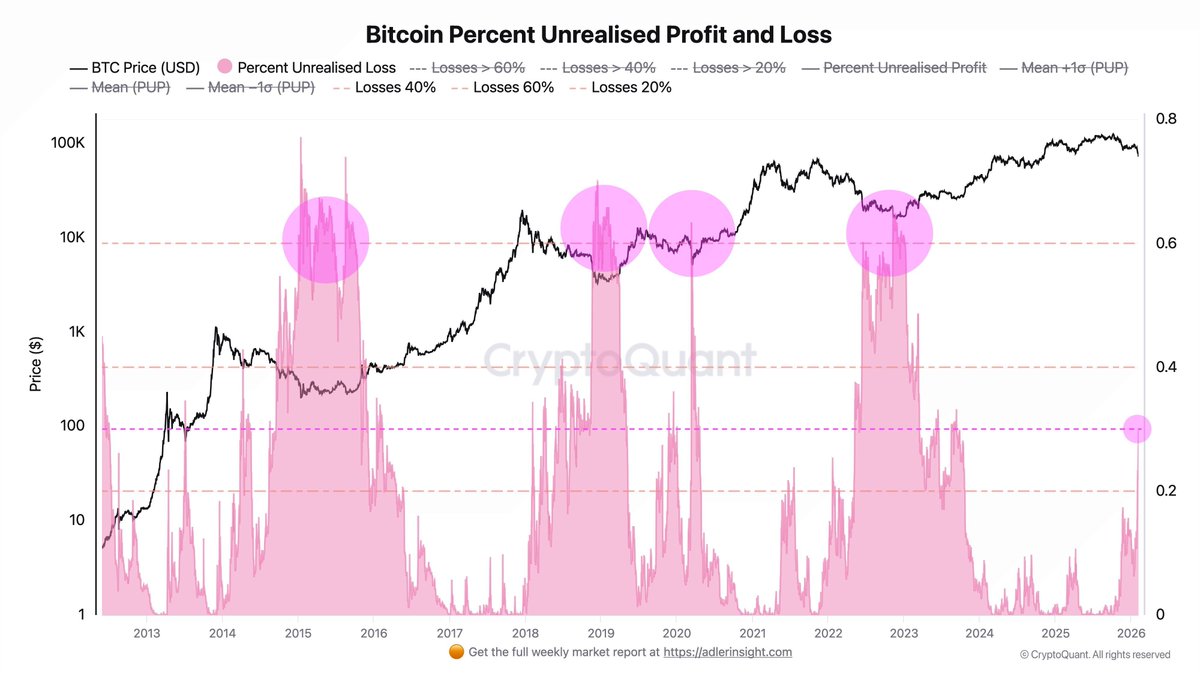

So, the question becomes, when will crypto bottom?

The answer to this question is when structural liquidity is restored.

This will be a combination of both capitulation in price and leverage, as well as maximum bearish sentiment.

We seem to be somewhat near that point.

The answer to this question is when structural liquidity is restored.

This will be a combination of both capitulation in price and leverage, as well as maximum bearish sentiment.

We seem to be somewhat near that point.

Extreme volatility is here to stay as uncertainty has elevated yet again.

The macroeconomy is shifting and stocks, commodities, bonds, and crypto will move.

Want to receive our premium analysis?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

The macroeconomy is shifting and stocks, commodities, bonds, and crypto will move.

Want to receive our premium analysis?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

Ultimately, Bitcoin and broader crypto are not new to massive 50%+ drawdowns.

If you zoom out far enough, every bear market and crash becomes a rounding error.

We think Bitcoin remains promising long-term.

Follow us @KobeissiLetter for real time analysis as this develops.

If you zoom out far enough, every bear market and crash becomes a rounding error.

We think Bitcoin remains promising long-term.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh