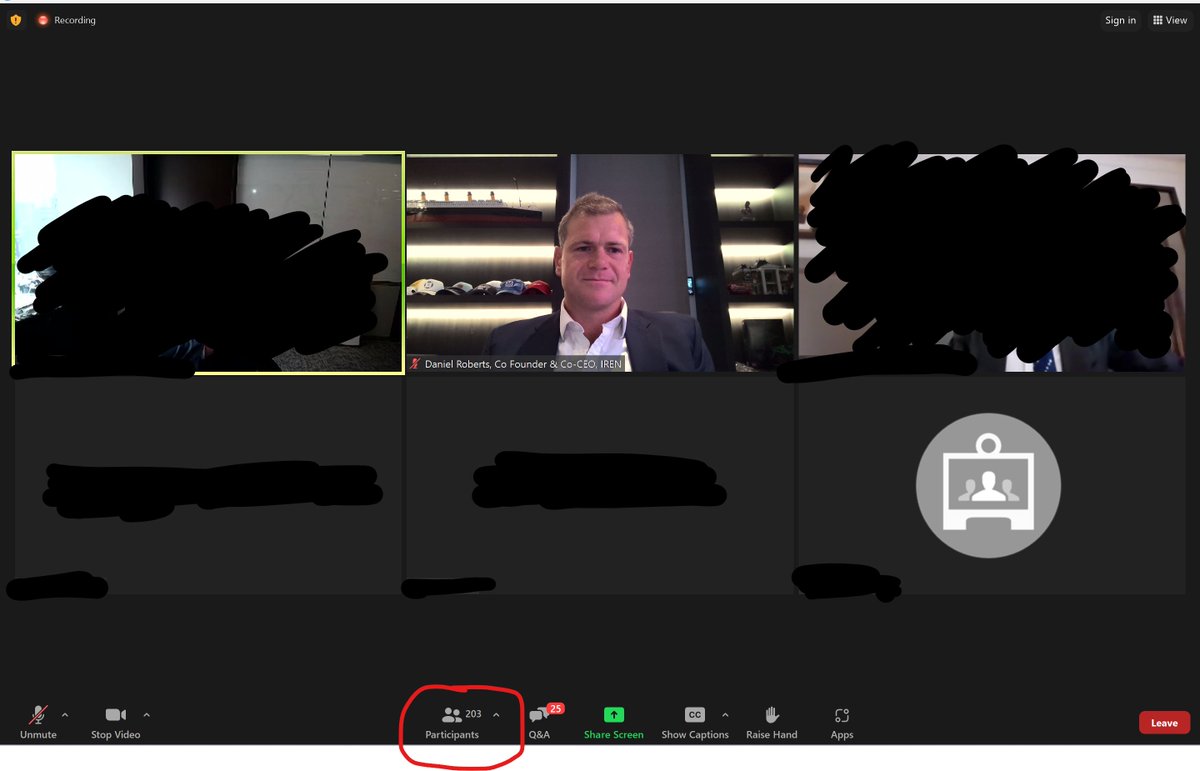

Another quarterly update completed for $IREN.

We published our Q2 update earlier today, and interest was strong enough to briefly overwhelm the site at release. If you missed the deck, it’s available here:

👉 iren.gcs-web.com/static-files/0…

The past few months have seen continued progress across capacity, customers, and capital. Demand remains the strongest we’ve seen and, importantly, we’re building the infrastructure and capital structure required to deliver against it.

We’re still at an early stage of our AI Cloud build-out, but have already scaled ARR under contract to more than $2.3bn. Our $3.4bn ARR target utilizes only a portion of our now 4.5GW secured power portfolio.

More detail below 👇

We published our Q2 update earlier today, and interest was strong enough to briefly overwhelm the site at release. If you missed the deck, it’s available here:

👉 iren.gcs-web.com/static-files/0…

The past few months have seen continued progress across capacity, customers, and capital. Demand remains the strongest we’ve seen and, importantly, we’re building the infrastructure and capital structure required to deliver against it.

We’re still at an early stage of our AI Cloud build-out, but have already scaled ARR under contract to more than $2.3bn. Our $3.4bn ARR target utilizes only a portion of our now 4.5GW secured power portfolio.

More detail below 👇

1/ Capital

We secured $3.6bn of committed GPU financing for the Microsoft contract at <6% p.a. Combined with the $1.9bn Microsoft prepayment, that covers ~95% of GPU-related capex at an average interest cost just over 3%.

We secured $3.6bn of committed GPU financing for the Microsoft contract at <6% p.a. Combined with the $1.9bn Microsoft prepayment, that covers ~95% of GPU-related capex at an average interest cost just over 3%.

2/ Expansion

Deployment of 140k GPUs remains on track, supporting our $3.4bn ARR target by the end of 2026. Demand across hyperscale and enterprise customers continues to build.

Deployment of 140k GPUs remains on track, supporting our $3.4bn ARR target by the end of 2026. Demand across hyperscale and enterprise customers continues to build.

3/ Execution

Construction across Horizon 1–4 remains aligned with Microsoft deployment timelines. Ongoing sequencing of data center delivery and GPU installs continues to be a focus.

Construction across Horizon 1–4 remains aligned with Microsoft deployment timelines. Ongoing sequencing of data center delivery and GPU installs continues to be a focus.

4/ British Columbia

Fit-outs for NVIDIA B200/B300 deployments at Prince George are complete and awaiting remaining GPU deliveries. The ASIC-to-GPU transition at Mackenzie and Canal Flats is progressing alongside active customer discussions.

Fit-outs for NVIDIA B200/B300 deployments at Prince George are complete and awaiting remaining GPU deliveries. The ASIC-to-GPU transition at Mackenzie and Canal Flats is progressing alongside active customer discussions.

5/ Power portfolio

We added a new 1.6GW site in Oklahoma, taking total secured power to 4.5GW. Fully secured power remains scarce, and this scale supports ongoing customer engagement.

We added a new 1.6GW site in Oklahoma, taking total secured power to 4.5GW. Fully secured power remains scarce, and this scale supports ongoing customer engagement.

6/ Consistency

What’s been consistent for us is execution. We’ve delivered data center capacity on time and at scale over multiple cycles, and customers continue to value reliability as much as performance.

What’s been consistent for us is execution. We’ve delivered data center capacity on time and at scale over multiple cycles, and customers continue to value reliability as much as performance.

• • •

Missing some Tweet in this thread? You can try to

force a refresh