1/13

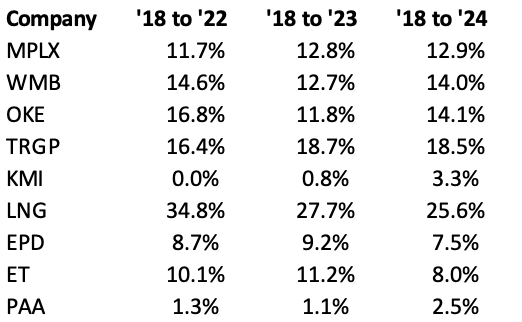

Long overdue annual update on Midstream returns on capital deployed.

Period covered: 2018 to 2025

Companies Covered: $KMI, $OKE, $LNG, $WMB, $TRGP, $EPD, $ET, $MPLX, $PAA

Last year's Analysis/Thread below for reference:

Long overdue annual update on Midstream returns on capital deployed.

Period covered: 2018 to 2025

Companies Covered: $KMI, $OKE, $LNG, $WMB, $TRGP, $EPD, $ET, $MPLX, $PAA

Last year's Analysis/Thread below for reference:

https://x.com/Suicide95518428/status/1856094278809788684?s=20

2/13

Methodology:

a) Compute ∆ EBITDA b/w Q3'25 & Q3'18

b) Annualize change in (a) = cumulative EBITDA growth

c) Calculate Total Capital Deployed b/w 2018 and 2024 = CAPEX + Acquisitions (incl. stock-for-stock) - Divestitures

Return = ∆ Annualized EBITDA ÷ Capital Deployed

Methodology:

a) Compute ∆ EBITDA b/w Q3'25 & Q3'18

b) Annualize change in (a) = cumulative EBITDA growth

c) Calculate Total Capital Deployed b/w 2018 and 2024 = CAPEX + Acquisitions (incl. stock-for-stock) - Divestitures

Return = ∆ Annualized EBITDA ÷ Capital Deployed

3/13

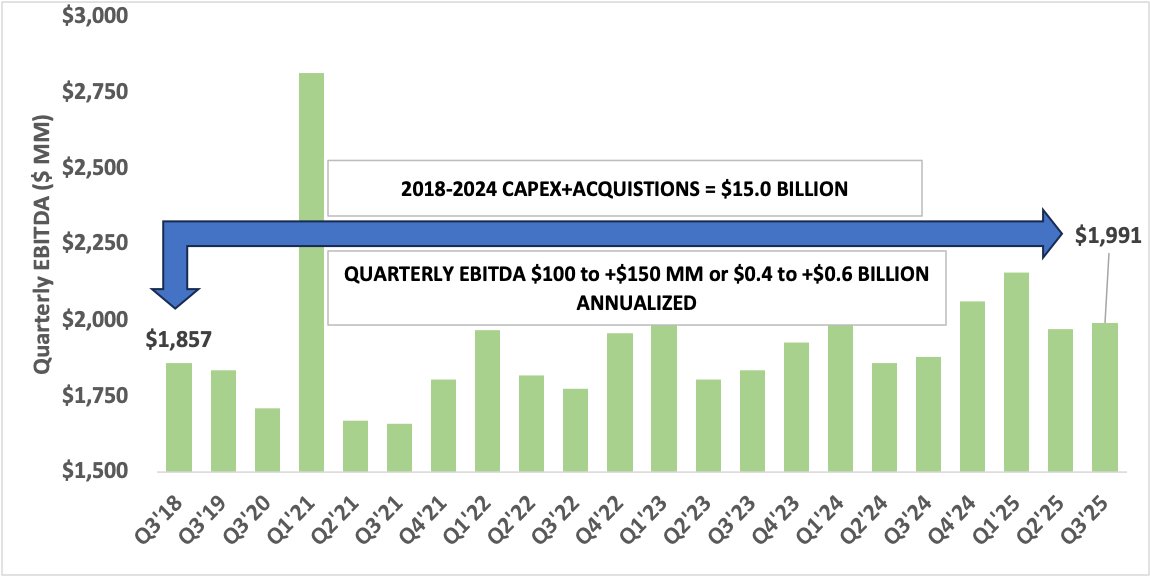

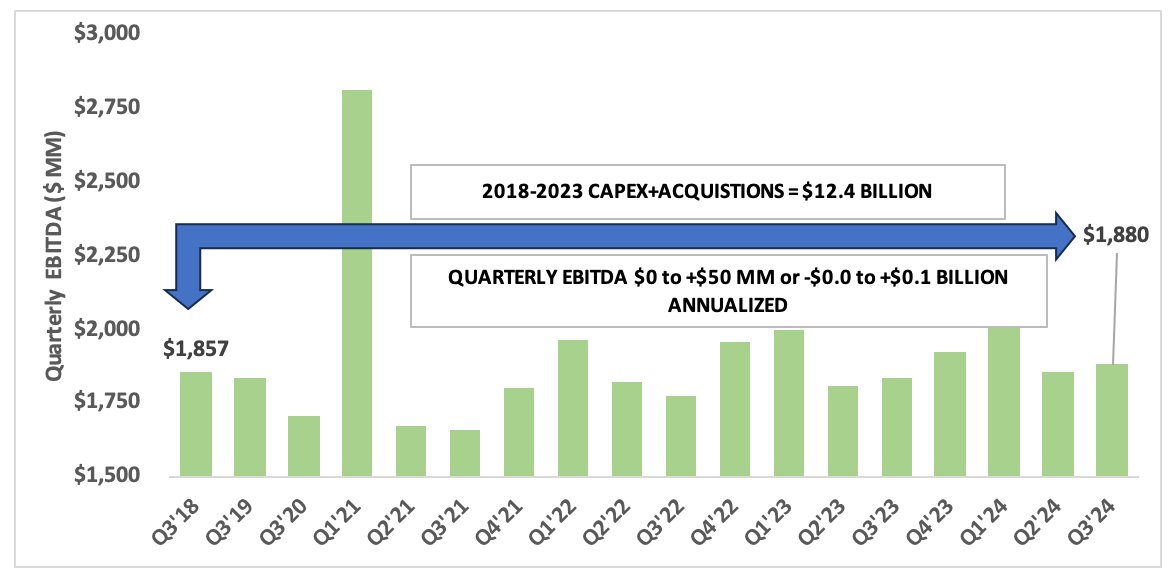

Starting with $KMI, between 2018 and 2024:

Capital Deployed = $15 billion

∆ EBITDA = $400 $600 million

Return = 2.7% to 4.0%

Return for the 2018 to 2023 period = 0% to 1.6%

Improving trajectory for sure...let's see if this can continue

Starting with $KMI, between 2018 and 2024:

Capital Deployed = $15 billion

∆ EBITDA = $400 $600 million

Return = 2.7% to 4.0%

Return for the 2018 to 2023 period = 0% to 1.6%

Improving trajectory for sure...let's see if this can continue

4/13

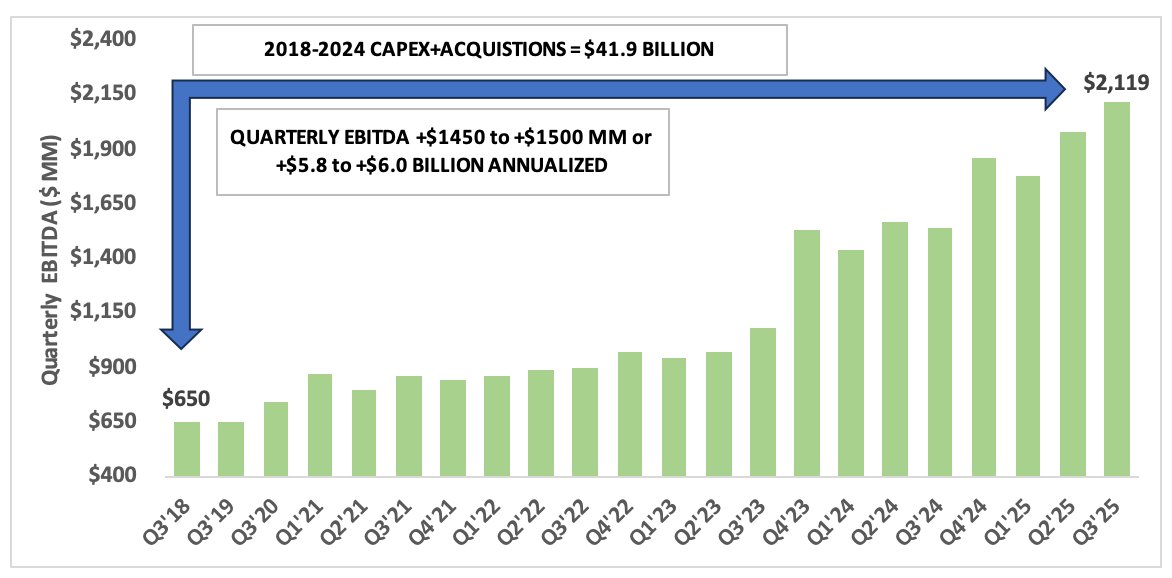

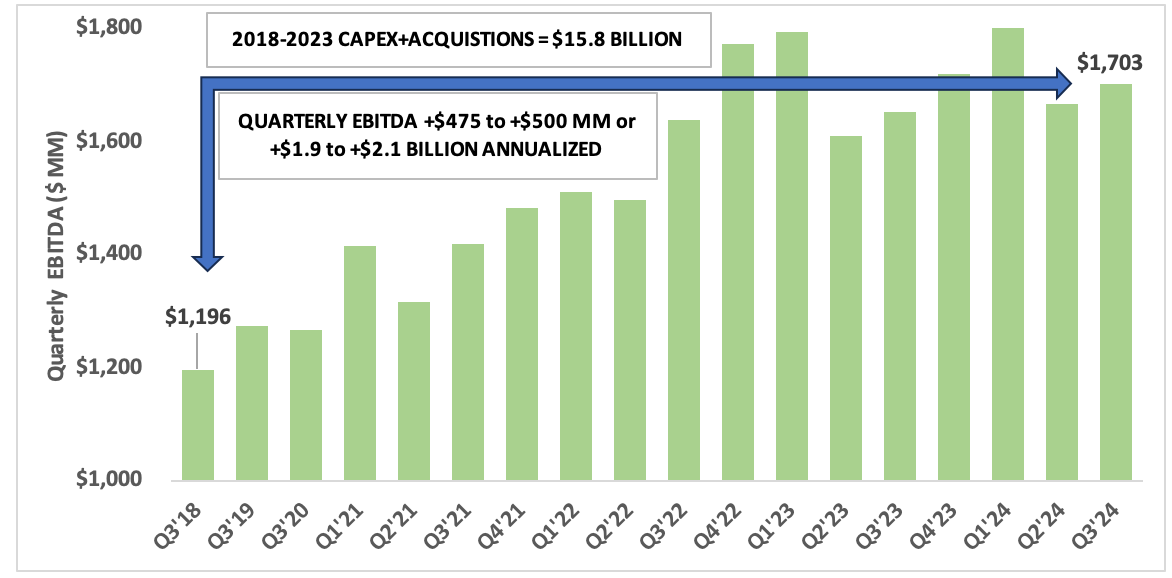

Looking at $OKE next, b/w 2018 & 2024:

Capital Deployed = $41.9 billion (includes $ENLC purchase which closed in Q1'25)

∆ EBITDA = $5.8 to $6.0 billion

Return = 13.8% to 14.3%

Return during 2018-2023 = 11.5% to 12.1%

Looks like $MMP synergies are coming through

Looking at $OKE next, b/w 2018 & 2024:

Capital Deployed = $41.9 billion (includes $ENLC purchase which closed in Q1'25)

∆ EBITDA = $5.8 to $6.0 billion

Return = 13.8% to 14.3%

Return during 2018-2023 = 11.5% to 12.1%

Looks like $MMP synergies are coming through

5/13

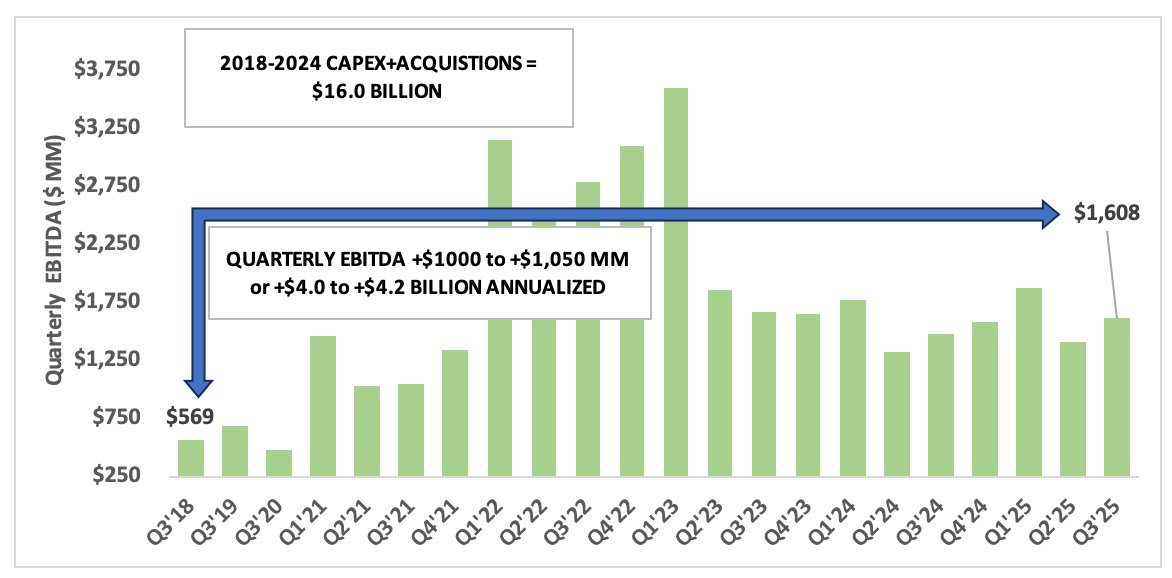

Next up $LNG. Between 2018 and 2024:

Capital Deployed = $16 billion

∆ EBITDA = $4.0 to $4.2 billion

Return = 25.0% to 26.3%

Return during 2018-2023 = 26.2% to 29.2%

Continued weakening of TTF & JKL pricing has reduced marketing margins

Next up $LNG. Between 2018 and 2024:

Capital Deployed = $16 billion

∆ EBITDA = $4.0 to $4.2 billion

Return = 25.0% to 26.3%

Return during 2018-2023 = 26.2% to 29.2%

Continued weakening of TTF & JKL pricing has reduced marketing margins

6/13

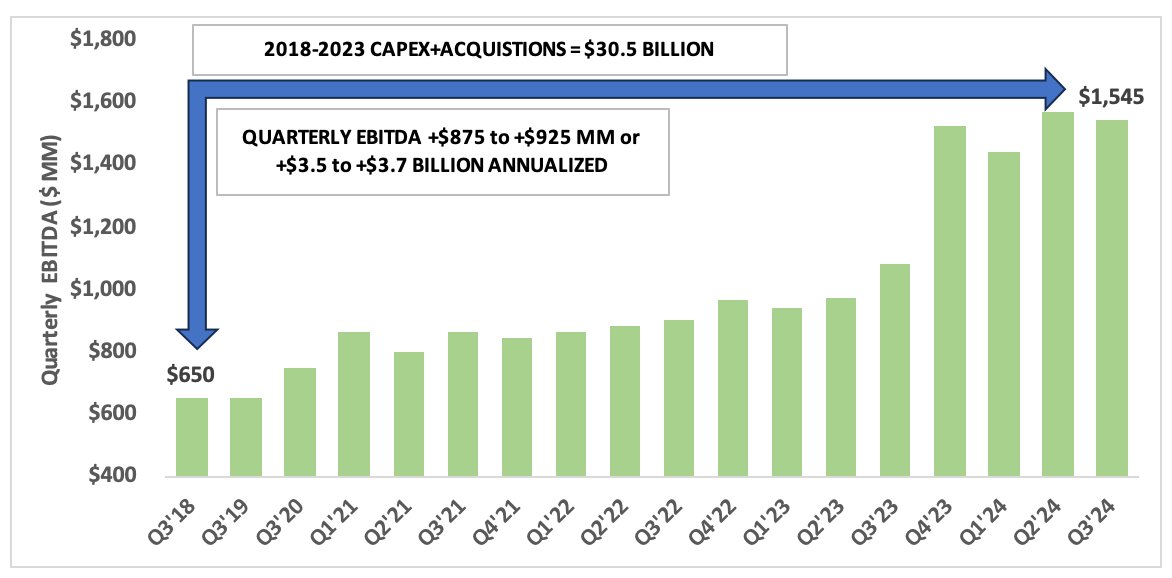

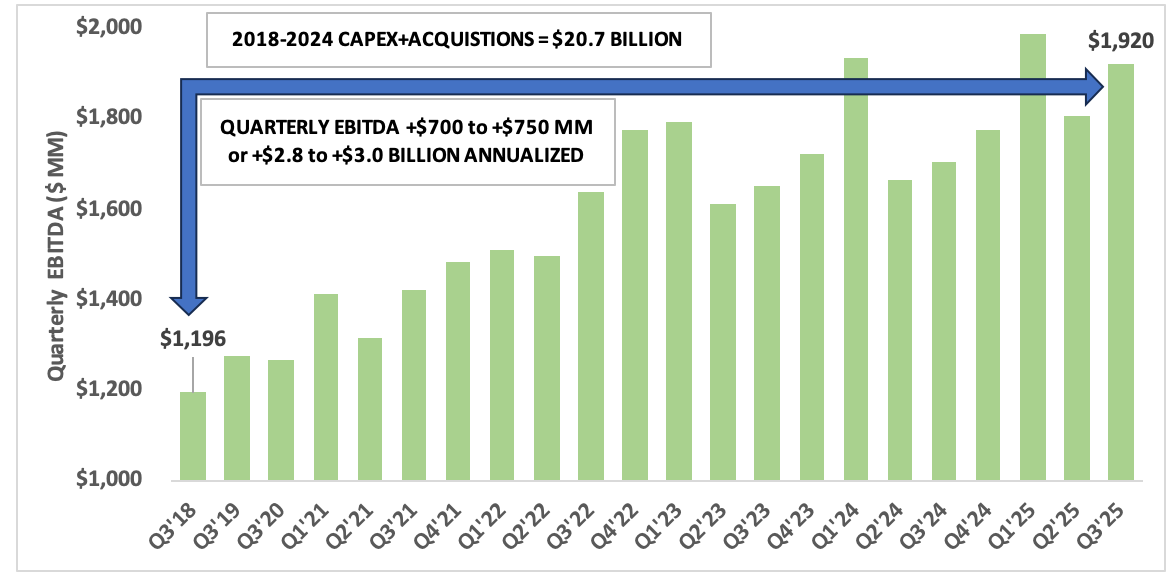

Let's check $WMB next. Between 2018 & 2024:

Capital Deployed = $20.7 billion

∆ EBITDA = $2.8 to $3.0 billion

Return = 13.5% to 14.5%

Return during 2018-2023 = 12.0% to 13.3%

Nice comeback in returns - driven by projects coming online especially Deepwater GoM

Let's check $WMB next. Between 2018 & 2024:

Capital Deployed = $20.7 billion

∆ EBITDA = $2.8 to $3.0 billion

Return = 13.5% to 14.5%

Return during 2018-2023 = 12.0% to 13.3%

Nice comeback in returns - driven by projects coming online especially Deepwater GoM

7/13

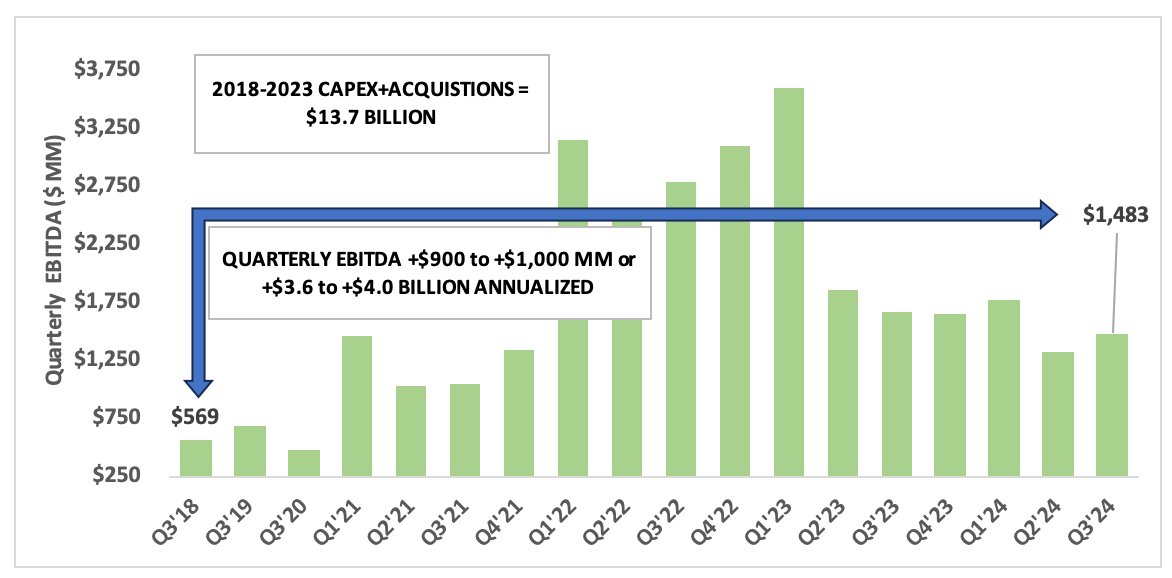

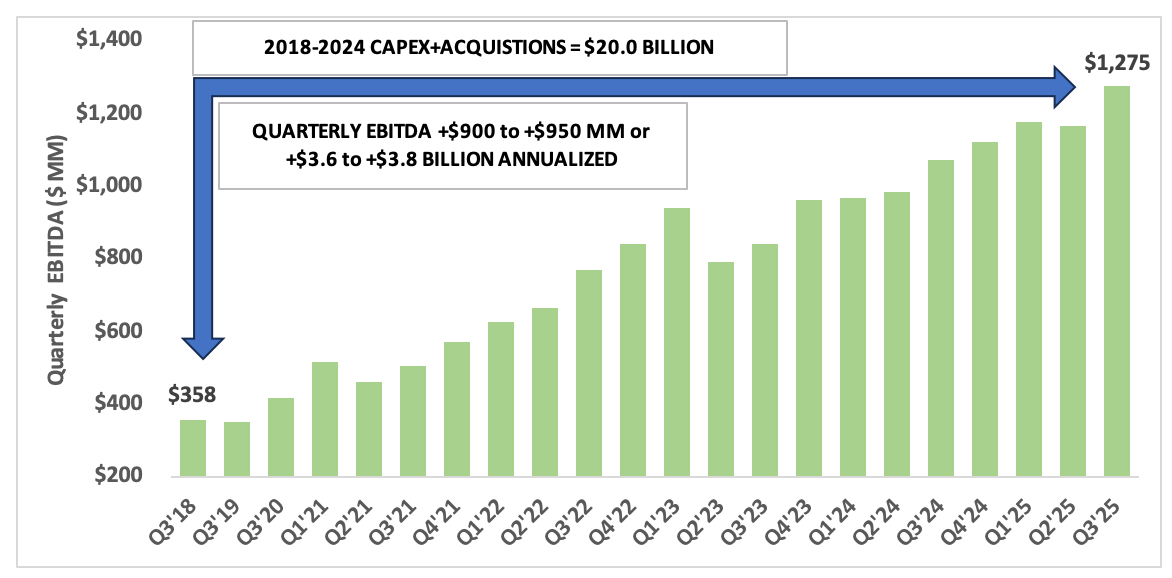

Let's finish the C-corps with $TRGP. Between 2018 & 2024:

Capital Deployed = $20 billion (incl. purchase of Badlands stake from Blackstone)

∆ EBITDA = $3.6 to $3.8 billion

Return = 18.0% to 19.0%

Return during 2018-2023 = 18.0% to 19.3%

Maintaining strong returns

Let's finish the C-corps with $TRGP. Between 2018 & 2024:

Capital Deployed = $20 billion (incl. purchase of Badlands stake from Blackstone)

∆ EBITDA = $3.6 to $3.8 billion

Return = 18.0% to 19.0%

Return during 2018-2023 = 18.0% to 19.3%

Maintaining strong returns

8/13

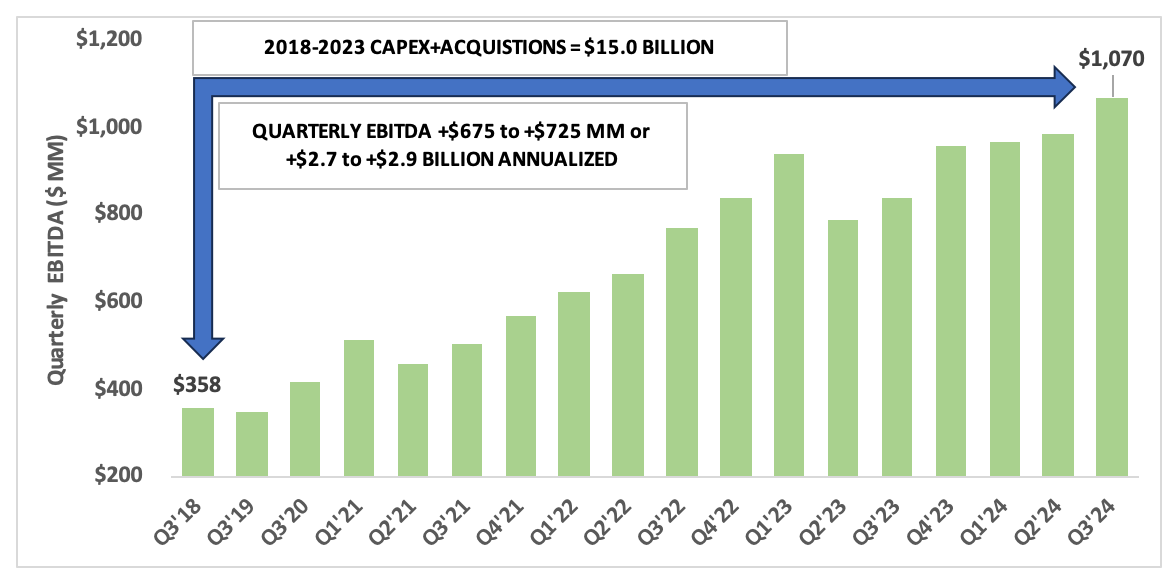

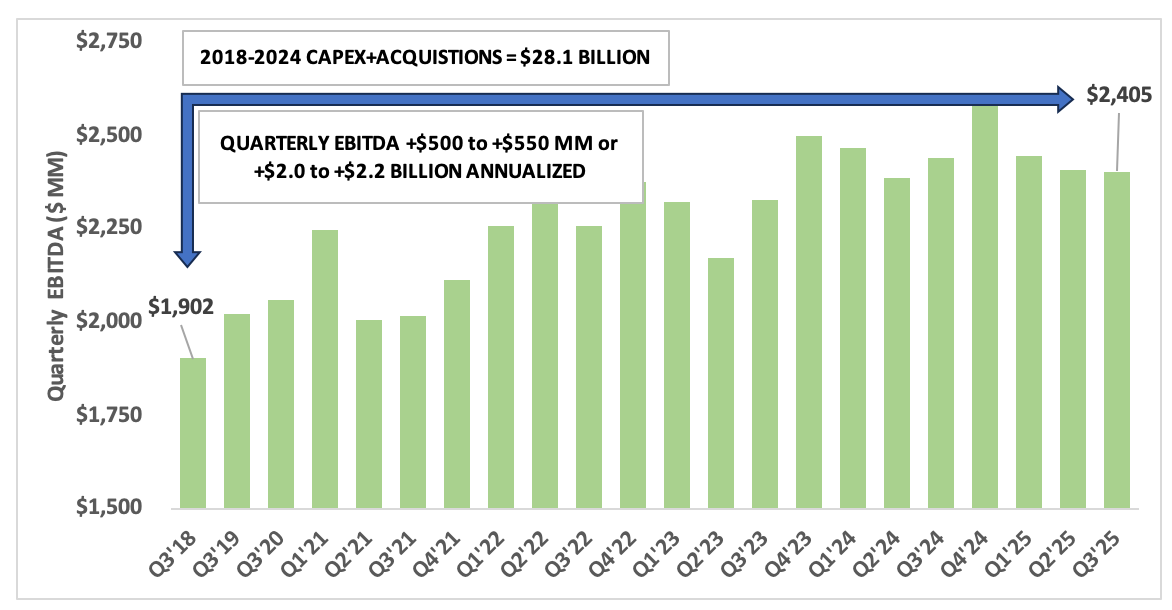

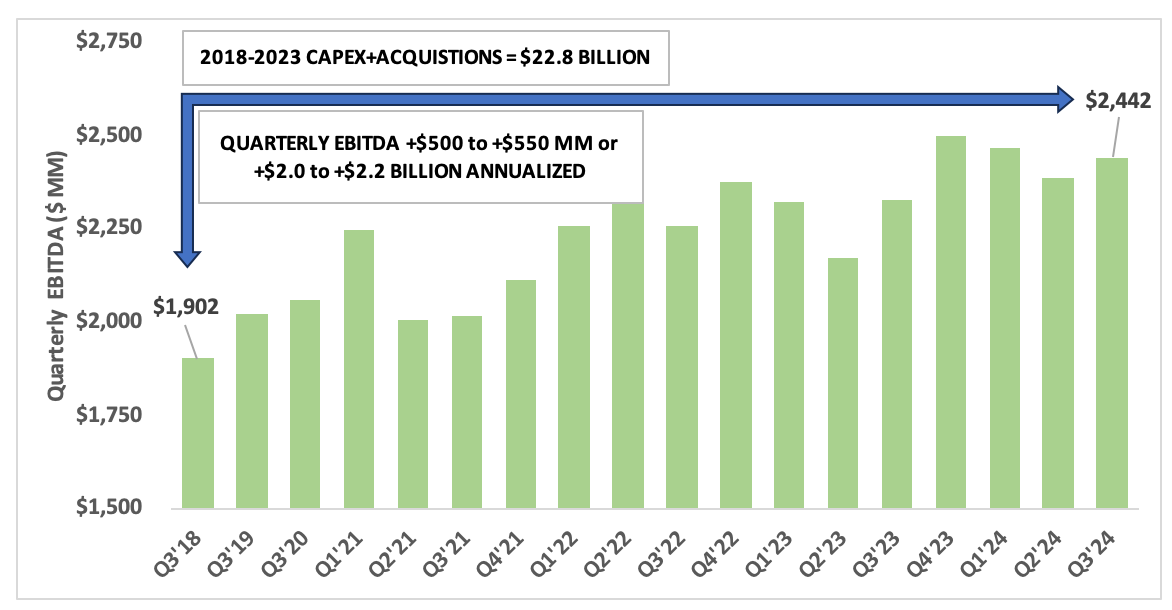

Turning to MLPs, first up $EPD. Between 2018 and 2024:

Capital Deployed = $28.1 billion

∆ EBITDA = $2.0 to $2.2 billion

Return = 7.1% to 7.8%

Return during 2018-2023 = 8.8% to 9.6%

All is not well in the base business - more competition in the Permian

Turning to MLPs, first up $EPD. Between 2018 and 2024:

Capital Deployed = $28.1 billion

∆ EBITDA = $2.0 to $2.2 billion

Return = 7.1% to 7.8%

Return during 2018-2023 = 8.8% to 9.6%

All is not well in the base business - more competition in the Permian

9/13

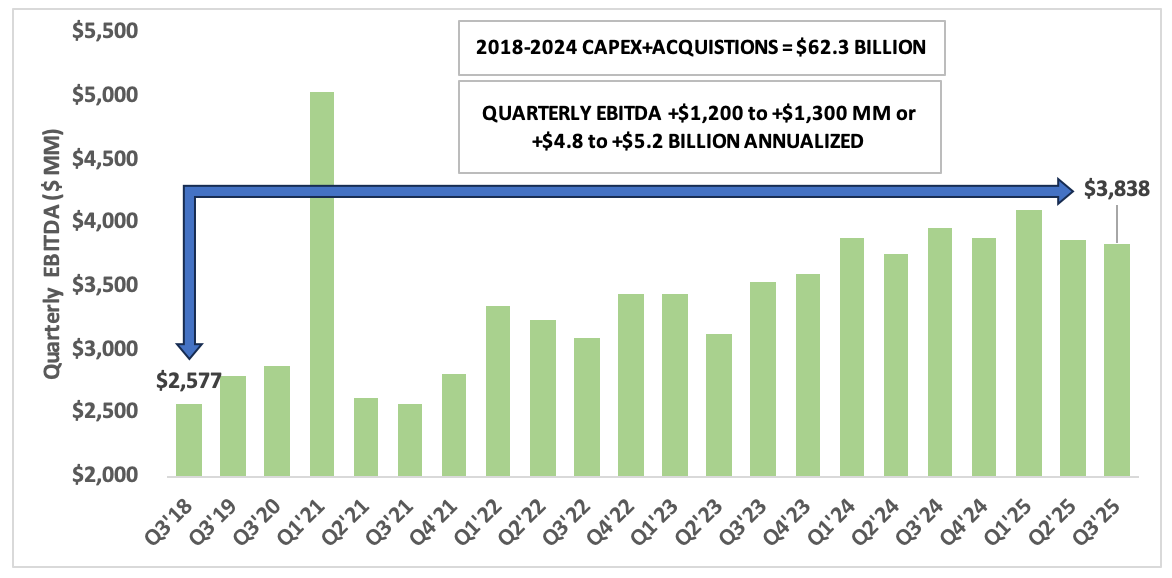

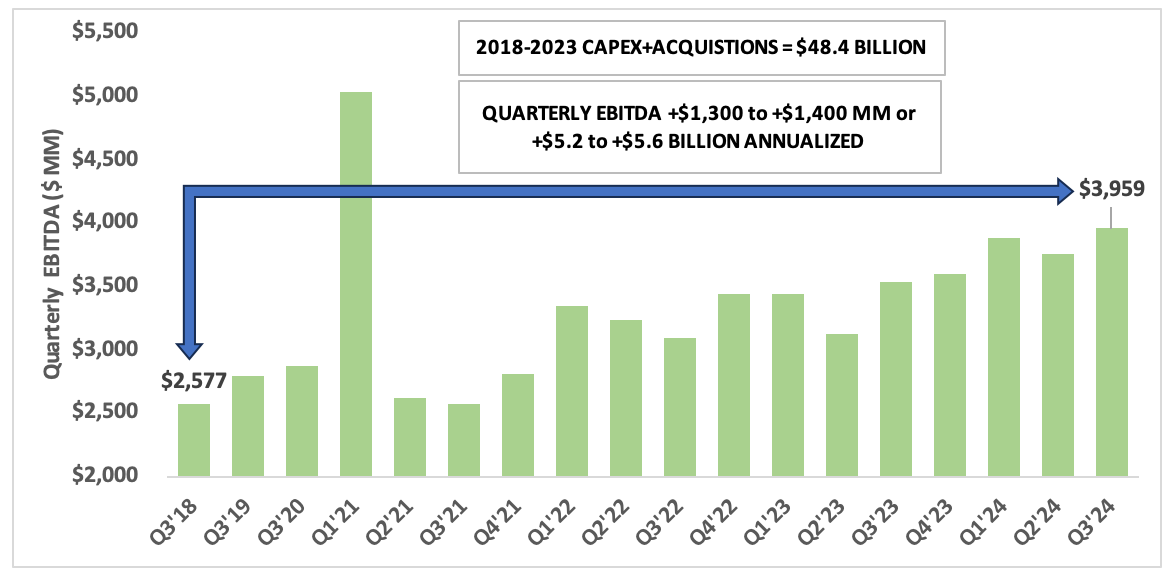

Now for $ET - the biggest of them all. Between 2018 & 2024:

Capital Deployed = $62.3 billion (incl. NuStar purchase by $SUN)

∆ EBITDA = $4.8 to $5.2 billion

Return = 7.7% to 8.3%

Return during 2018-2023 = 10.7% to 11.6%

Competition hurting base business esp. Permian

Now for $ET - the biggest of them all. Between 2018 & 2024:

Capital Deployed = $62.3 billion (incl. NuStar purchase by $SUN)

∆ EBITDA = $4.8 to $5.2 billion

Return = 7.7% to 8.3%

Return during 2018-2023 = 10.7% to 11.6%

Competition hurting base business esp. Permian

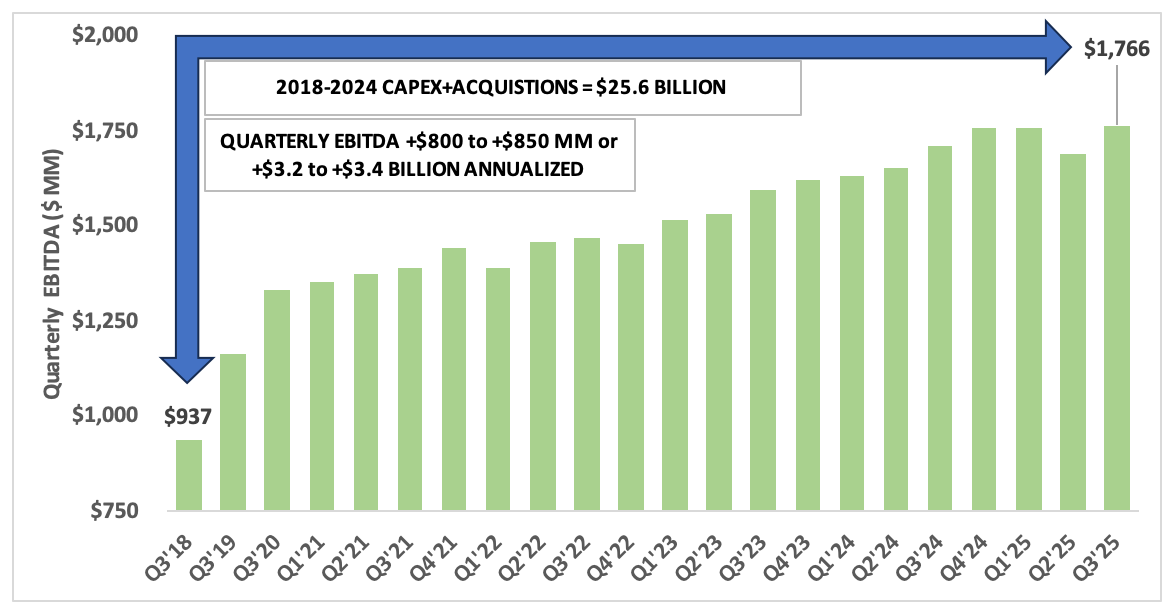

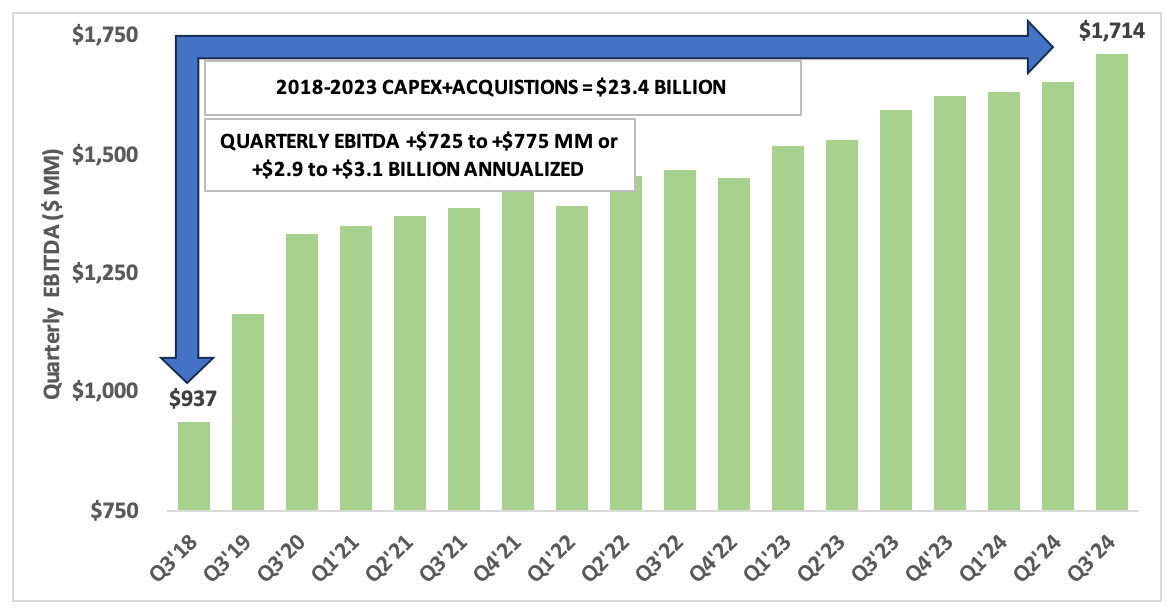

10/13

Next, let's look at $MPLX. Between 2018 & 2024:

Capital Deployed = $25.6 billion

∆ EBITDA = $3.2 to $3.4 billion

Return = 12.5% to 13.3%

Return during 2018-2023 = 12.4% to 13.2%

Returns holding steady but acquisitions jumped in 2025. So let's see...

Next, let's look at $MPLX. Between 2018 & 2024:

Capital Deployed = $25.6 billion

∆ EBITDA = $3.2 to $3.4 billion

Return = 12.5% to 13.3%

Return during 2018-2023 = 12.4% to 13.2%

Returns holding steady but acquisitions jumped in 2025. So let's see...

11/13

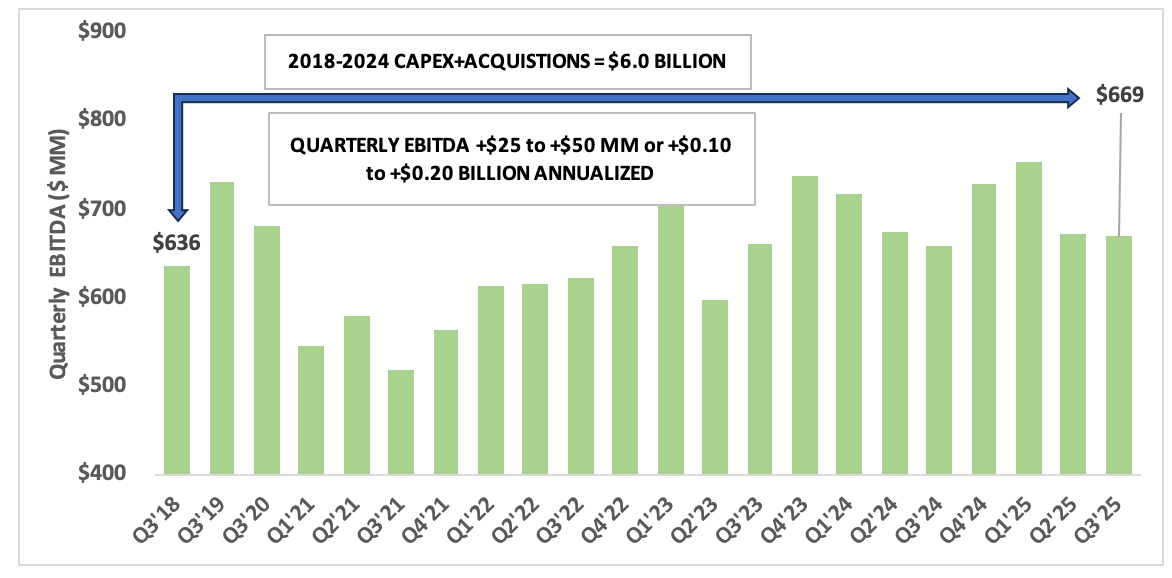

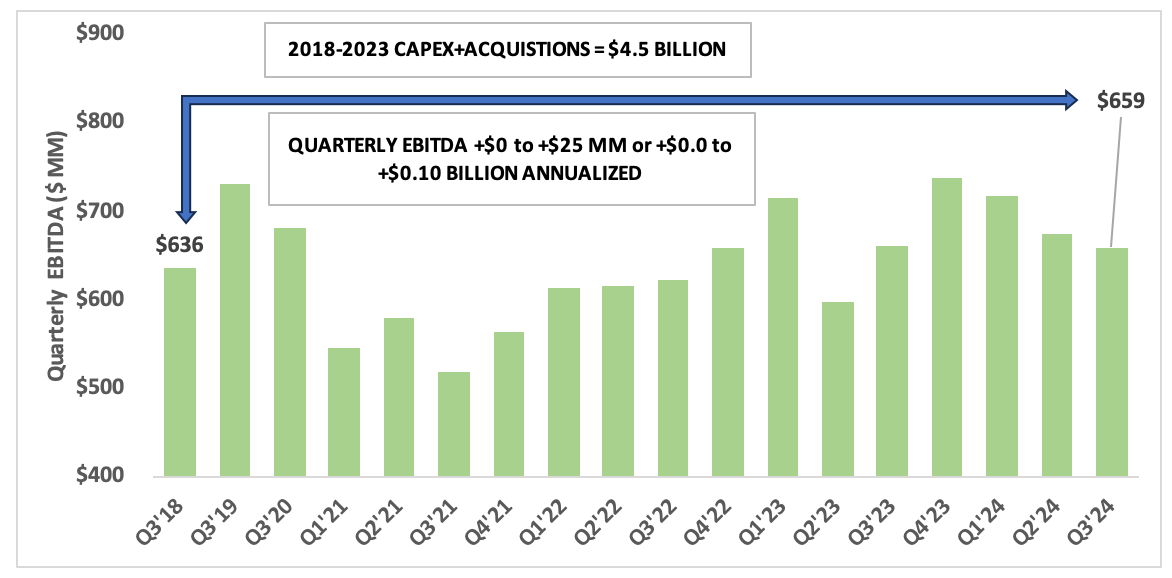

Finally, let's look at $PAA. Between 2018 & 2024:

Capital Deployed = $6 billion

∆ EBITDA = $100 mm to $200 mm

Return = 1.7% to 3.3%

Return during 2018-2023 = 0.0% to 2.2%

Slight improvement but a long way to go still...

Finally, let's look at $PAA. Between 2018 & 2024:

Capital Deployed = $6 billion

∆ EBITDA = $100 mm to $200 mm

Return = 1.7% to 3.3%

Return during 2018-2023 = 0.0% to 2.2%

Slight improvement but a long way to go still...

13/13

$TRGP and $LNG are tops

$WMB and $OKE - strong returns despite high M&A activity - indicates good synergy capture

$ET and $EPD - Disappointing drop in returns - perhaps undercutting each other

$MPLX - Solid but recent M&A bears watching

$KMI - Improving

$PAA - Weak

$TRGP and $LNG are tops

$WMB and $OKE - strong returns despite high M&A activity - indicates good synergy capture

$ET and $EPD - Disappointing drop in returns - perhaps undercutting each other

$MPLX - Solid but recent M&A bears watching

$KMI - Improving

$PAA - Weak

• • •

Missing some Tweet in this thread? You can try to

force a refresh