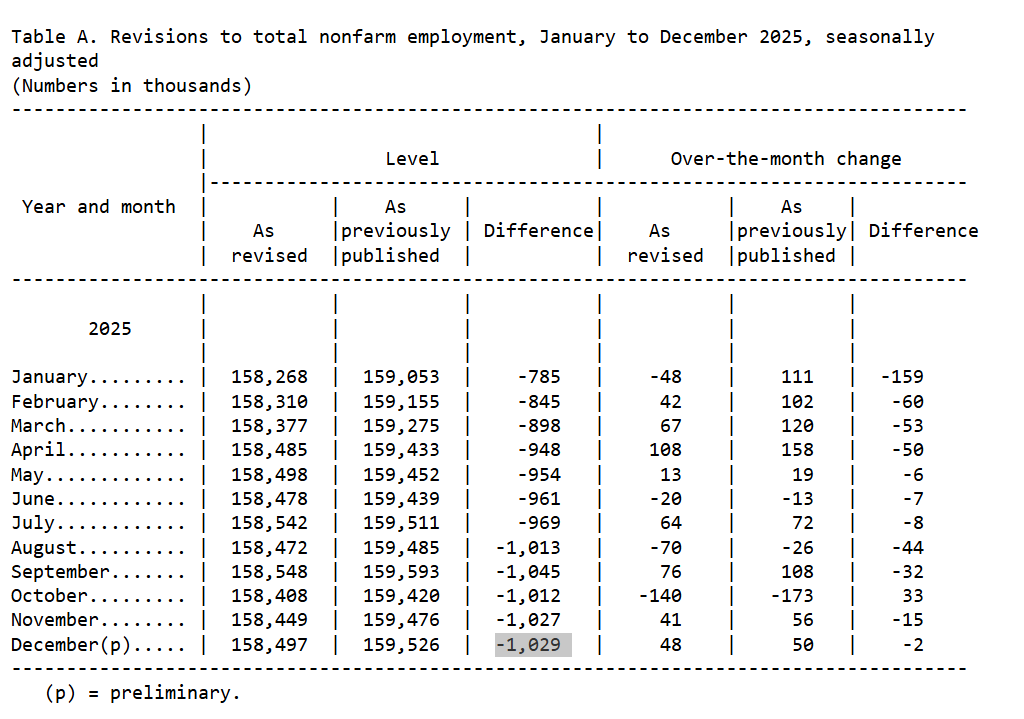

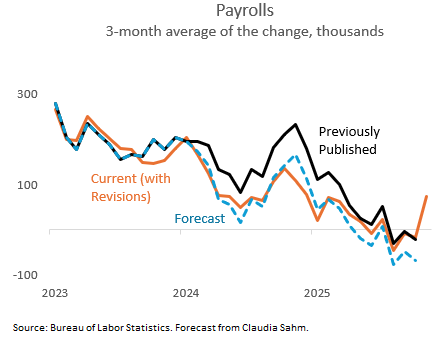

Good news in January, but the downward revisions are huge. More than a million fewer jobs than previously estimated by the end of 2025. And four months last year with outright declines in payrolls. bls.gov/news.release/e…

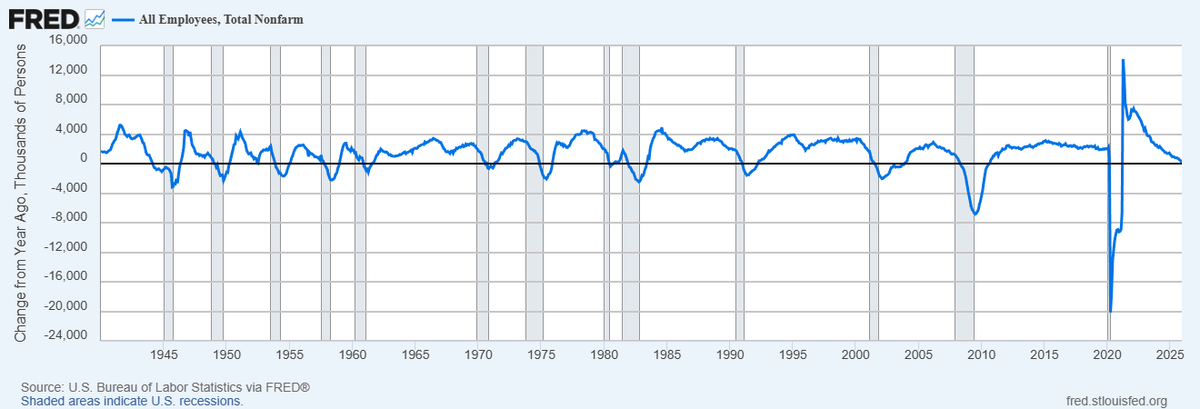

Last year, the US created 181,000 jobs, on net. That's basically nothing relative to total jobs of 158 million.

Such a low year-over-year change in jobs is very rare outside of a recession. We are not in a recession, making it even more notable.

Such a low year-over-year change in jobs is very rare outside of a recession. We are not in a recession, making it even more notable.

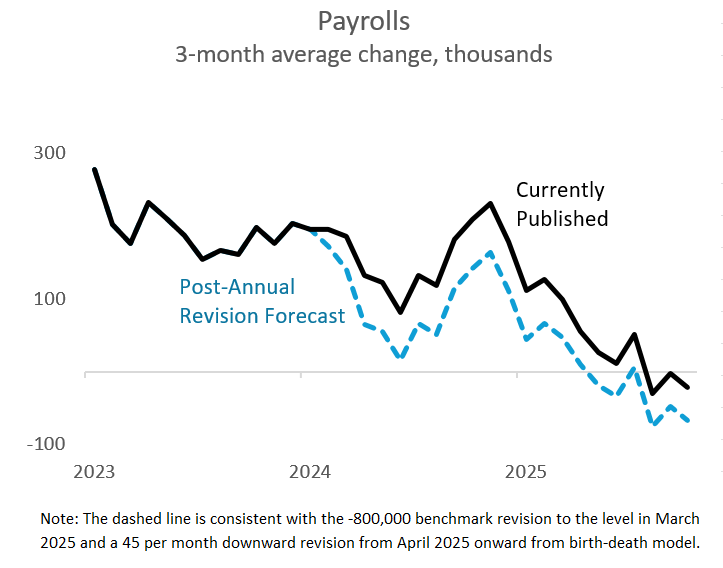

Updated my chart. Orange line is data published today. You can see the news today was the relatively upbeat January. My forecast of revisions (dashed blue) was fairly accurate. Where did I learn to forecast? The Fed. The news today at the Fed was January--adding to signs of stabilization.

"[The revisions are] not a sign that the @BLS_gov is asleep at the wheel. We just have some major dynamics in the economy, and it's really tough to measure in real time. We've got better data today, and that's a great starting point for understanding where we are going!" #JobsDay

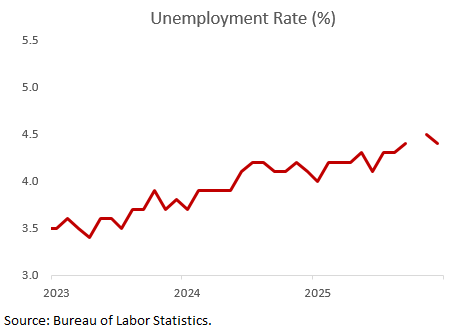

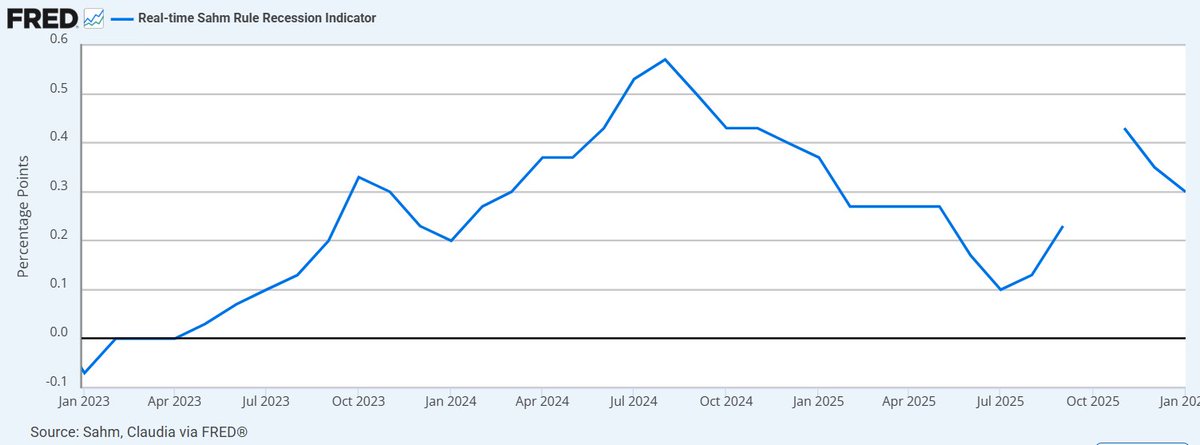

@BLS_gov Oh and that rule ... With a tick down in the unemployment rate its well below the 0.5 trigger. fred.stlouisfed.org/series/SAHMREA…

• • •

Missing some Tweet in this thread? You can try to

force a refresh