macro, Fed, fiscal. creator of the Sahm rule, a recession indicator.

13 subscribers

How to get URL link on X (Twitter) App

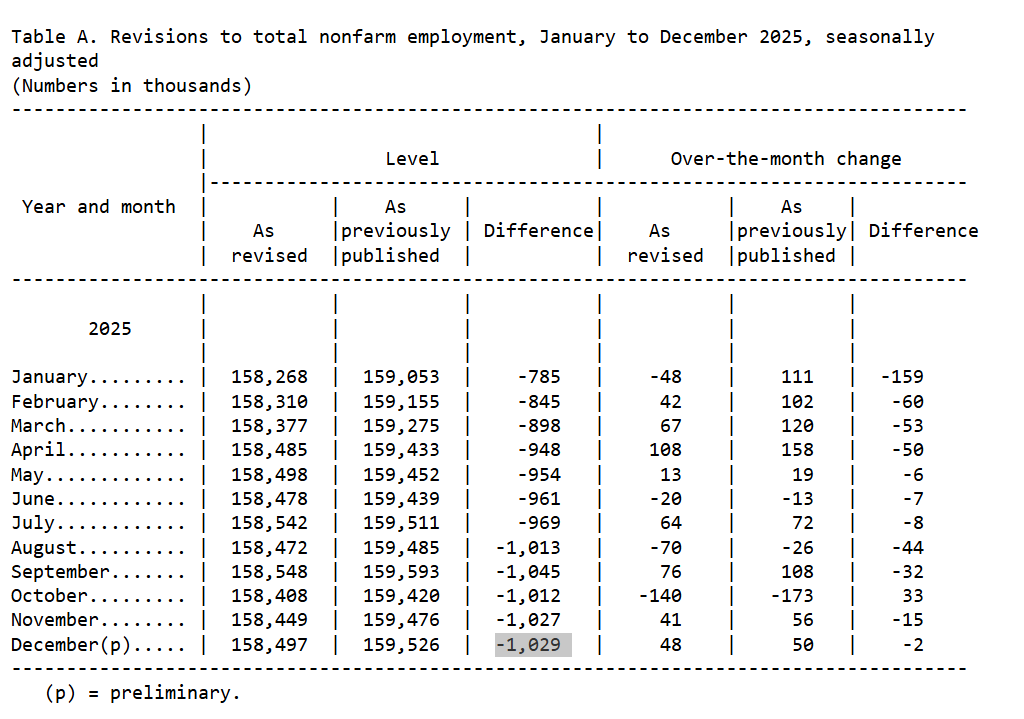

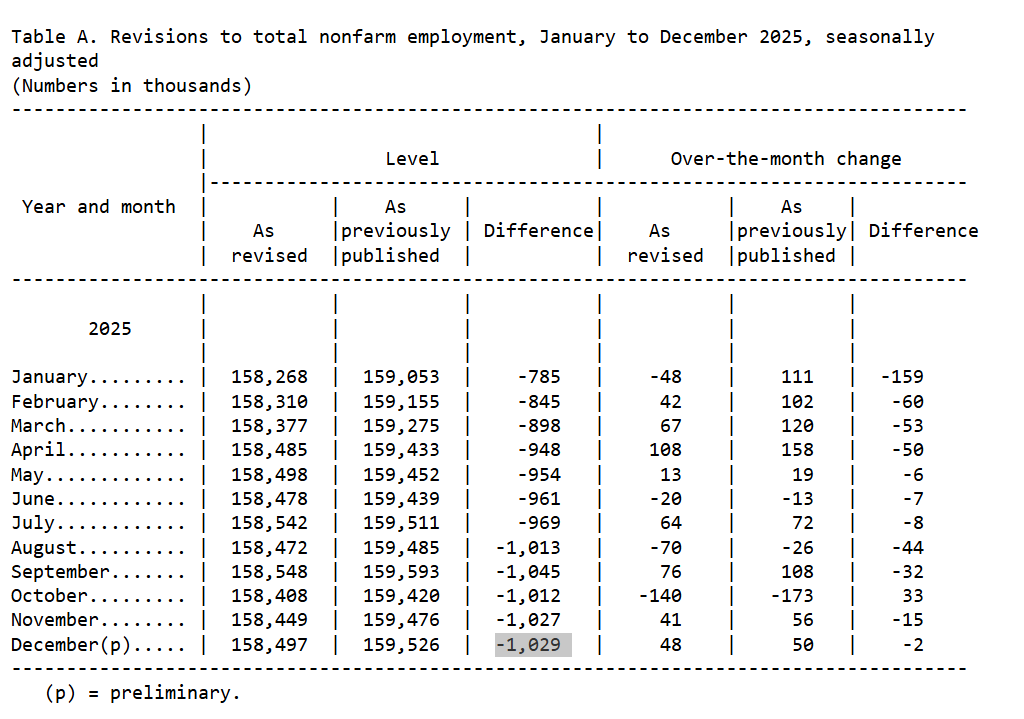

Last year, the US created 181,000 jobs, on net. That's basically nothing relative to total jobs of 158 million.

Last year, the US created 181,000 jobs, on net. That's basically nothing relative to total jobs of 158 million.

There are many lessons to learn from the election, but I see a wrong lesson circulating that must be nipped in the bud. Here is an example from @BetseyStevenson, a professor of economics who served in the Obama Administration:

There are many lessons to learn from the election, but I see a wrong lesson circulating that must be nipped in the bud. Here is an example from @BetseyStevenson, a professor of economics who served in the Obama Administration: https://x.com/BetseyStevenson/status/1854879503102685396

Comment (continued):

Comment (continued):

Today’s post may start too heavy for some with its look back on four years ago at the start of the pandemic. It’s important because it gives us context for where we are now, but if it's too much, skip ahead to the sections on the present and future; they are more optimistic.

Today’s post may start too heavy for some with its look back on four years ago at the start of the pandemic. It’s important because it gives us context for where we are now, but if it's too much, skip ahead to the sections on the present and future; they are more optimistic.

That simple chart has so many things going on under the hood. But let's step back from the immigrant vs US-born debate, which often gets xenophobic.

That simple chart has so many things going on under the hood. But let's step back from the immigrant vs US-born debate, which often gets xenophobic.

🧵(long) draws on my new Stay-At-Home Macro (SAHM) Sub.st@ck post. (Google it). I explain why the Fed should cut the federal funds rate now and why they are unlikely to do so before May.

🧵(long) draws on my new Stay-At-Home Macro (SAHM) Sub.st@ck post. (Google it). I explain why the Fed should cut the federal funds rate now and why they are unlikely to do so before May.

The thread is on today's Sub.st@ck post, so if you prefer a long form instead of a long Twitter thread, that's your place.

The thread is on today's Sub.st@ck post, so if you prefer a long form instead of a long Twitter thread, that's your place.

https://twitter.com/briancalbrecht/status/1741942671915049113Also, the reference to “primitive peoples” or anyone talking about pricing power as “ignorant” is offensive and counterproductive.

What did the Fed do?

What did the Fed do?

🧵based on my Sub.st@ack post is a how-to on calculating the Sahm rule. It’s for anyone who wants to apply it themselves or apply the logic to other data.

🧵based on my Sub.st@ack post is a how-to on calculating the Sahm rule. It’s for anyone who wants to apply it themselves or apply the logic to other data.

https://twitter.com/thestalwart/status/1730740783190298713I back it up. I pulled together my ‘top ten’ posts. Fiscal relief to families, workers, and small businesses was successful. There was no recession, and inflation is coming back down.

Here are the facts:

Here are the facts:https://twitter.com/jstein_wapo/status/1724072565746831824I won’t tell people how to feel but when you ask them about their jobs, spending (after inflation), paychecks, bank accounts, debt payments, wealth, etc. they are better off. Democrat or Republican.

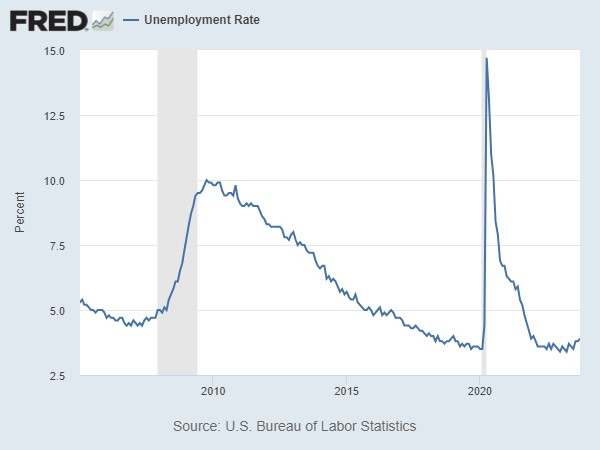

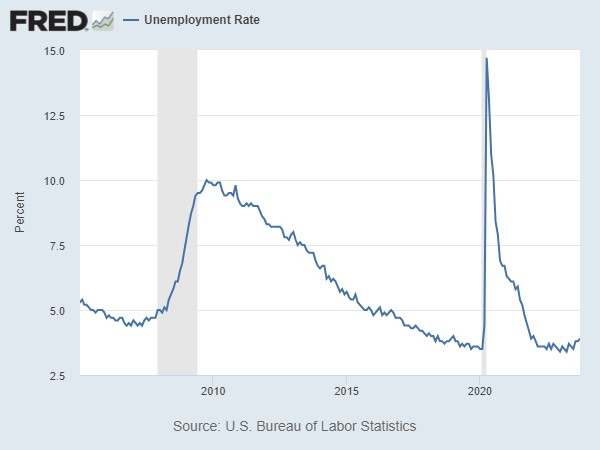

https://twitter.com/opinion/status/1721952132943765840Alarm bells sounded Friday -- my phone blew up at 830am -- when we learned that the US unemployment rate rose to 3.9% for October, well above the 50-year low of 3.4% that it hit earlier in the year.

https://twitter.com/elerianm/status/1721883623606104240

"one quick word" has gotten macro into trouble time and again.

"one quick word" has gotten macro into trouble time and again.

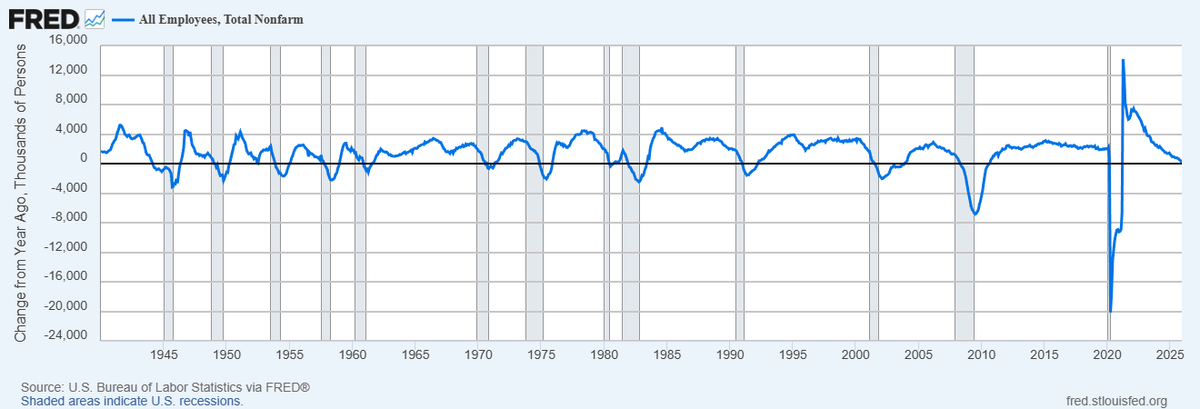

Recent economic news, with few exceptions, has been great. Eye-popping numbers like 300,000+ payrolls in September or what's likely to be over 3% real GDP growth in the 3rd quarter won't likely repeat. Even so, the labor market and growth look solid, and inflation is coming down.

Recent economic news, with few exceptions, has been great. Eye-popping numbers like 300,000+ payrolls in September or what's likely to be over 3% real GDP growth in the 3rd quarter won't likely repeat. Even so, the labor market and growth look solid, and inflation is coming down.