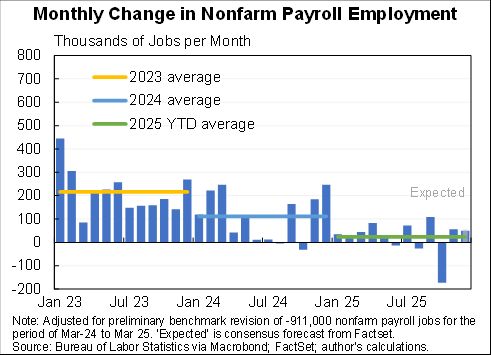

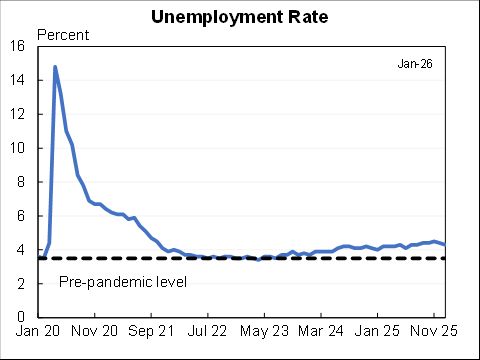

On the surface a strong jobs report (130K jobs & unemployment falls to 4.3%).

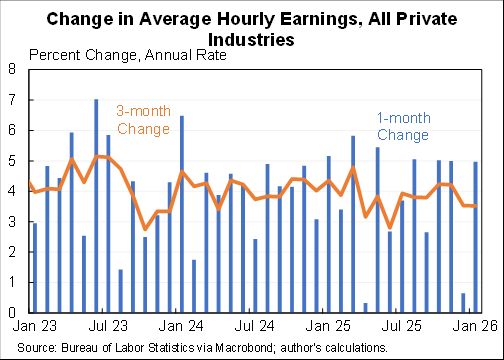

And just about every detail makes it even stronger: participation up, involuntary part-time down, hours up, wages up.

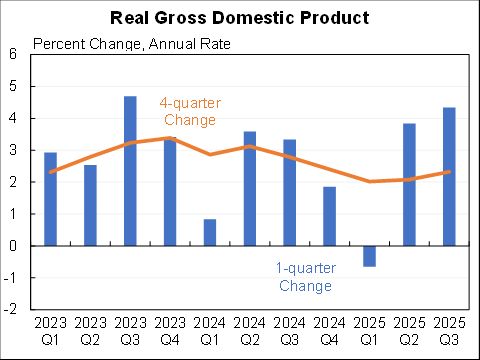

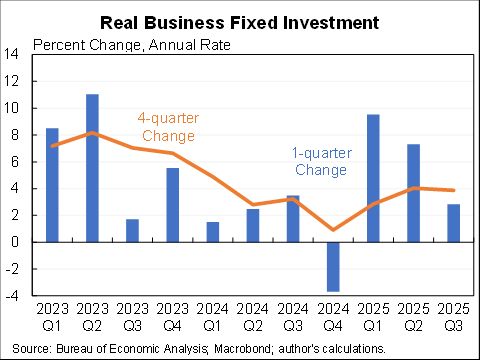

The mystery of strong GDP and weak jobs is being resolved in the direction of GDP.

And just about every detail makes it even stronger: participation up, involuntary part-time down, hours up, wages up.

The mystery of strong GDP and weak jobs is being resolved in the direction of GDP.

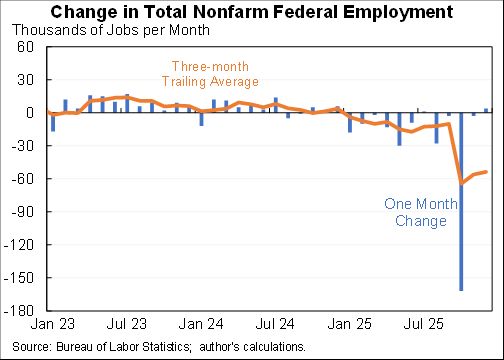

The job growth happened despite further cuts in federal jobs. Private employment was up an impressive 172K.

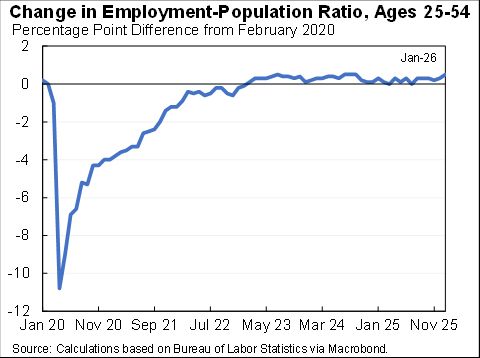

Note, breakeven job growth is currently about 25-50K because of reduced net immigration & also more fully recovered participation. So job growth has slowed but the unemployment rate now seems to have stabilized after slowly and steadily increasing since mid-2023.

FWIW, the broadest measure of labor underutilization, U-6, fell from 8.4% to 8.0%. This includes discouraged workers and also involuntary part-time, that later group fell a lot in January.

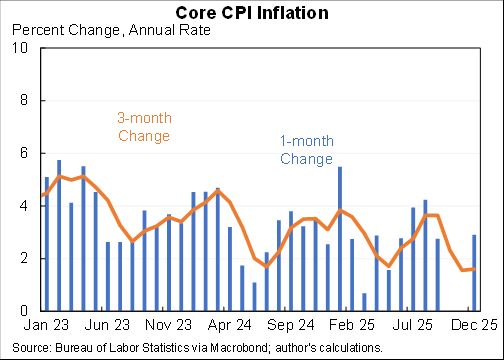

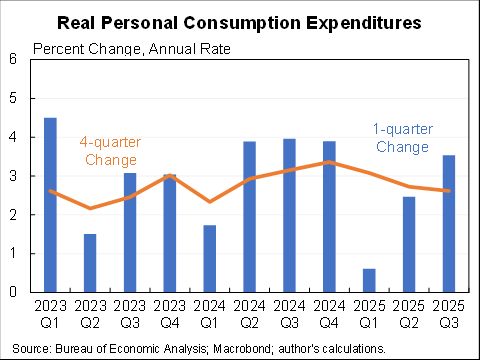

A very rapid pace of wage growth too. Might worry about this being indicative of an overly hot/inflationary economy but the fact that both the ECI and Atlanta tracker are growing less suggests this may be more about composition.

It looks like the economy has strong GDP growth momentum going into 2026, potentially some additional demand, & a stabilizing labor market .

Of course that could all change because economies are unpredictable.

But no need for rate cuts for now.

Of course that could all change because economies are unpredictable.

But no need for rate cuts for now.

• • •

Missing some Tweet in this thread? You can try to

force a refresh