Foreign stock investing 101

Us naive Americans dont think about currency returns as part of our portfolios as we have the biggest and for decades best place to invest in equities.

Every other global investor cares about currency returns at basic level for their investing

Us naive Americans dont think about currency returns as part of our portfolios as we have the biggest and for decades best place to invest in equities.

Every other global investor cares about currency returns at basic level for their investing

The basic idea for investors or all nationalities should be simple and obvious to all. But we Americans just haven't had to care. Maybe we still don't but at least we should be aware. This 101 will explain what is obvious to all non Americans and then show how it works

The goal of all investors is simple. We want to maximize the risk adjusted return of our investments in the currency we expect to spend in the future.

As Americans we want to maximize our USD returns

If we are Japanese we want to maximize our Yen returns

Etc.

As Americans we want to maximize our USD returns

If we are Japanese we want to maximize our Yen returns

Etc.

When Americans buy a $SPY we receive the return of SPY and its prepackaged in USD. But SPY is not the only equity market in the world (albeit a great one for decades)

We could also buy an index fund of Japanese stocks like the MSCI Japan Index.

We could also buy an index fund of Japanese stocks like the MSCI Japan Index.

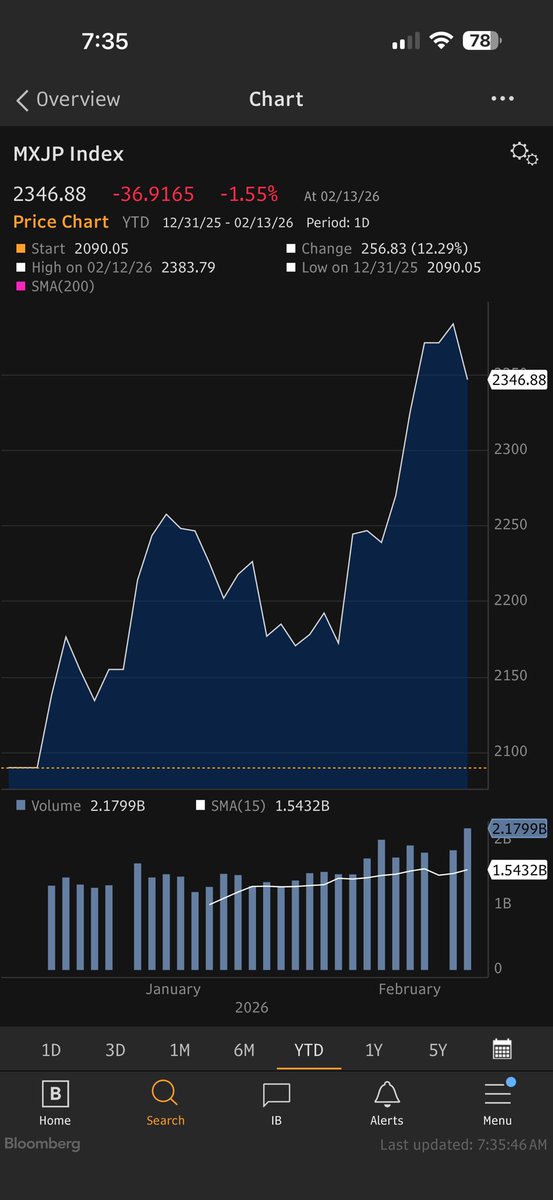

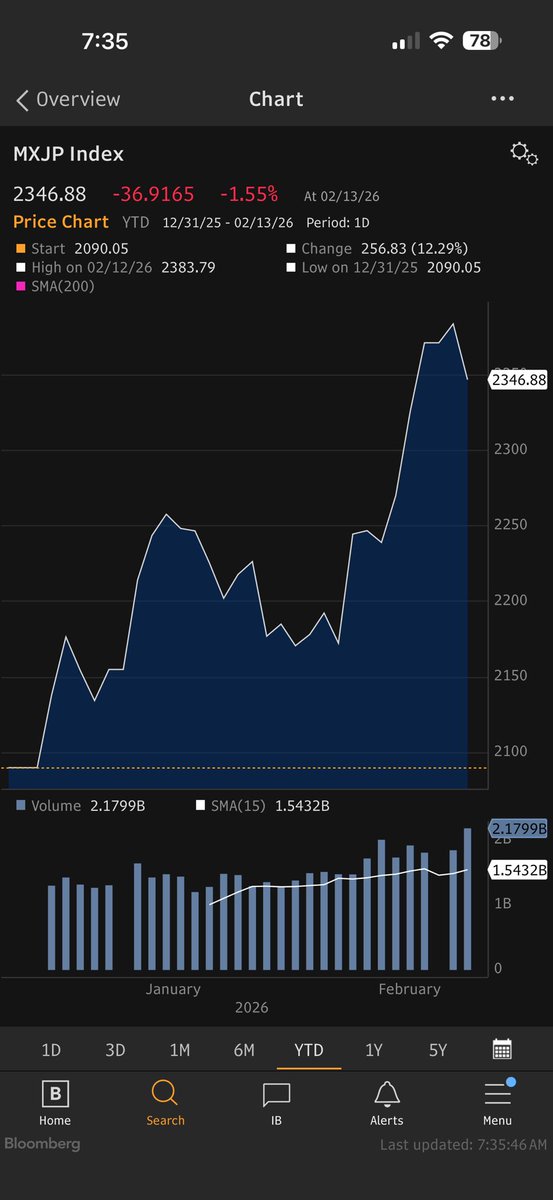

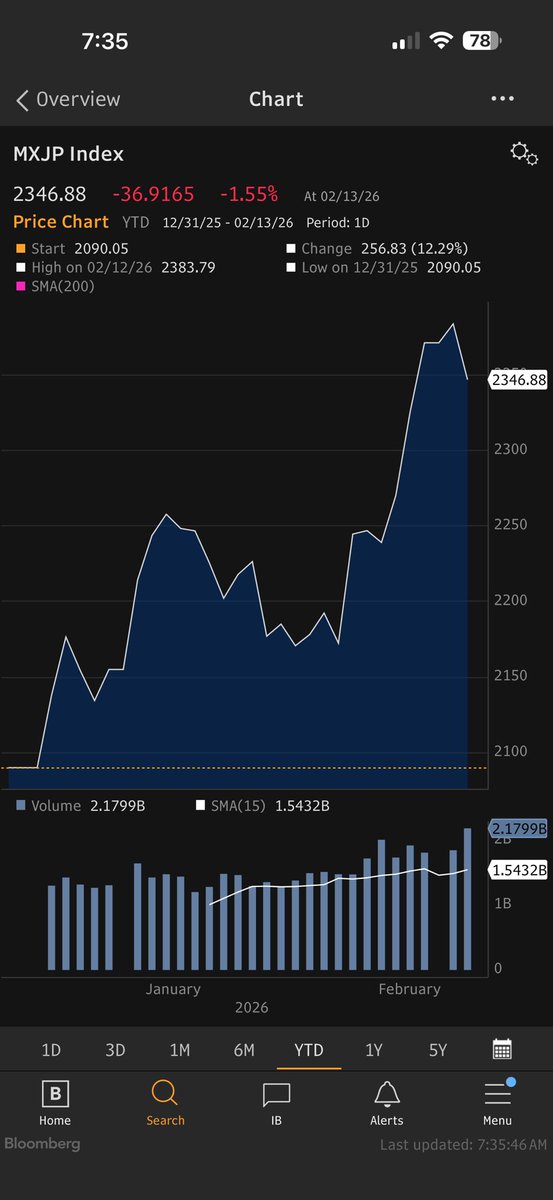

YTD the MSCI Japan index is 12.29%. Meaning if you were a Japanese person buying this in Japan you made 12.29%. As compared to a U.S. person buying SPY has lost 0.02%

But the question then is how can a U.S. person buy Japanese stocks.

Let's just describe this at a basic level ignoring the practical issues for the moment. A US person could take US savings and buy Japanese equities by first converting their USD into Yen just like if they

Let's just describe this at a basic level ignoring the practical issues for the moment. A US person could take US savings and buy Japanese equities by first converting their USD into Yen just like if they

were taking a trip to Tokyo and wanted to buy something locally when they arrived. The U.S. investor hands the yen to a Japanese stock seller and now owns a Japanese stock. One day when they decide to sell the stock they get yen and then they convert the Yen back to USD

But let's calculate the investment return they got on their investment. They got the yen return of the stock (the 12.29%) shown above but they also bought yen and then sold yen and so were exposed to the change in the exchange rate.

Not only do they get the 12.29% Yen return but while holding Yen assets they get the 2.56% Yen appreciation as well

Let's do the math to buy 1 of the index at the starting price of 2090 with JPY at 156.71 they needed 2090/156.71=13.337 USD

Let's do the math to buy 1 of the index at the starting price of 2090 with JPY at 156.71 they needed 2090/156.71=13.337 USD

Today the thing they own is 2345 and the Yen is 152.70. If they sold it and converted back to yen they have 2345/152.7=15.357 USD

Their return is 15.357/13.337-1=0.151 or 15.1% in USD vs the 0.02% loss on SPY

Ok let's be practical

Their return is 15.357/13.337-1=0.151 or 15.1% in USD vs the 0.02% loss on SPY

Ok let's be practical

You can't buy local shares in Japan. For decades financial institutions have created ways for a U.S. person to do the above trade. ADR's work exactly this way. You give a U.S. trustee your USD they convert it into Yen and buy a share. The market price of the ADR is

arbitraged such that you always get the USD price of the Japanese local equity converted from yen to USD

ETF's like EWJ are simply baskets of Japanese stocks which hold the same currency exposure as all these things.

ETF's like EWJ are simply baskets of Japanese stocks which hold the same currency exposure as all these things.

EWJ gives you the return of the MSCI Japan index and exposure to exchange rates of USDJPY. Notice EWJ has outperformed local MSCI Japan by roughly the change in the USDJPY rate.

The bottom line is please check your ETF's or mutual funds for specifics but unless the fund specifically says they hedge out FX exposure you have currency exposure!

You may think that you bought something with USD so you don't have exposure. That's just naive. Hopefully this helps

You may think that you bought something with USD so you don't have exposure. That's just naive. Hopefully this helps

• • •

Missing some Tweet in this thread? You can try to

force a refresh