1/

At the IMF & World Bank Annual Meeting (Oct 2025), Erica Payne, president of Patriotic Millionaires, proposed a Global Asset Registry.

The goal?

Track who owns what. Everywhere. 🌍

Let’s unpack this.

At the IMF & World Bank Annual Meeting (Oct 2025), Erica Payne, president of Patriotic Millionaires, proposed a Global Asset Registry.

The goal?

Track who owns what. Everywhere. 🌍

Let’s unpack this.

2/

Her three proposals:

• A global registry of assets (who owns what, how much, and where it came from)

• A global debate on what is “enough” wealth

• Stronger taxation that actively reduces extreme wealth

This isn’t fringe. It’s gaining traction in elite policy circles.

Her three proposals:

• A global registry of assets (who owns what, how much, and where it came from)

• A global debate on what is “enough” wealth

• Stronger taxation that actively reduces extreme wealth

This isn’t fringe. It’s gaining traction in elite policy circles.

3/

The intellectual roots go back to economists like Thomas Piketty and Gabriel Zucman.

Organizations such as Tax Justice Network and ICRICT have been pushing this since 2017–2019.

It’s not law yet.

But the architecture is being discussed.

The intellectual roots go back to economists like Thomas Piketty and Gabriel Zucman.

Organizations such as Tax Justice Network and ICRICT have been pushing this since 2017–2019.

It’s not law yet.

But the architecture is being discussed.

4/

Important:

There is no official implementation date.

No binding adoption by the International Monetary Fund, World Bank, G20, European Union, or United Nations.

But the conversation is happening.

And policy conversations have a habit of becoming reality.

Important:

There is no official implementation date.

No binding adoption by the International Monetary Fund, World Bank, G20, European Union, or United Nations.

But the conversation is happening.

And policy conversations have a habit of becoming reality.

5/

What is a Global Asset Registry really about?

Transparency? Yes.

Tax enforcement? Yes.

But also:

📌 Centralized visibility of private wealth

📌 Cross-border data sharing

📌 Reduced financial privacy

That changes the game.

What is a Global Asset Registry really about?

Transparency? Yes.

Tax enforcement? Yes.

But also:

📌 Centralized visibility of private wealth

📌 Cross-border data sharing

📌 Reduced financial privacy

That changes the game.

6/

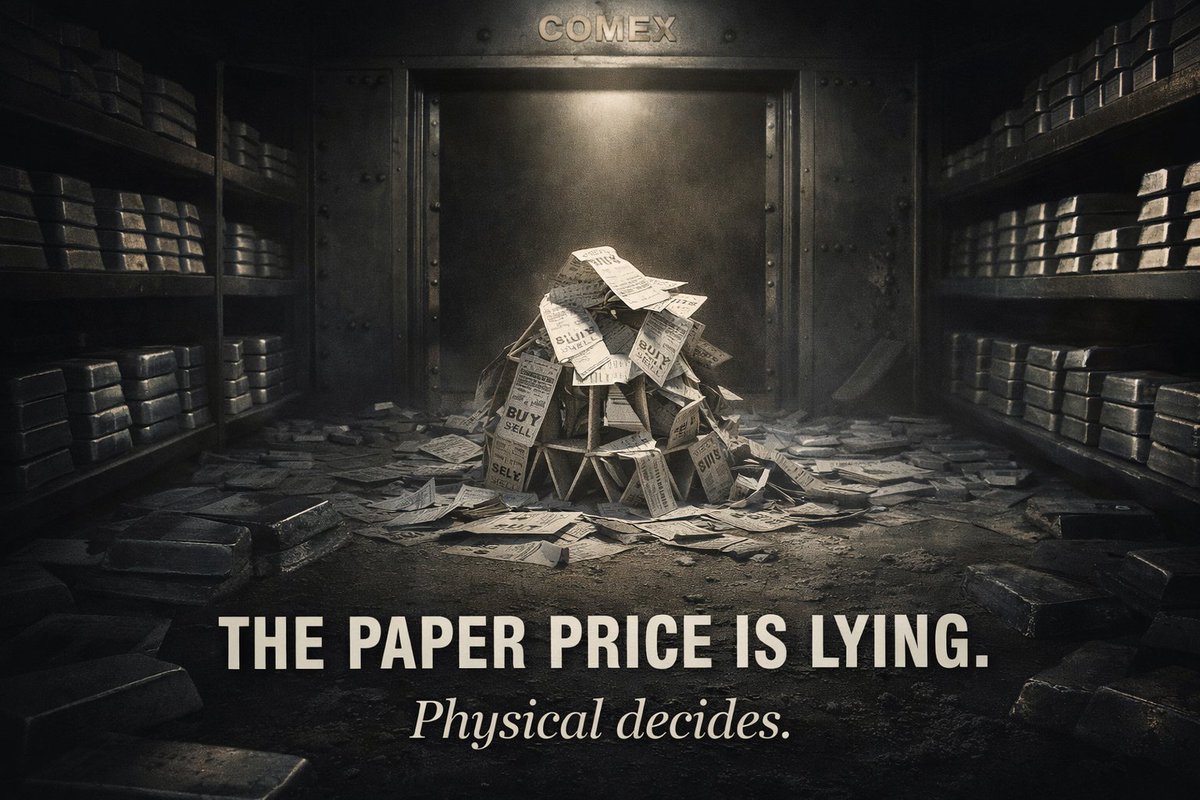

Now let’s bring this home for stackers.

If wealth becomes globally traceable,

digitally registered,

centrally reported…

What happens to assets outside the digital system?

Now let’s bring this home for stackers.

If wealth becomes globally traceable,

digitally registered,

centrally reported…

What happens to assets outside the digital system?

7/

Physical silver in personal possession:

• No counterparty

• No centralized ledger

• No broker statement

• No digital custody trail

• No ETF wrapper

It exists because you hold it.

That distinction becomes powerful in a registry world.

Physical silver in personal possession:

• No counterparty

• No centralized ledger

• No broker statement

• No digital custody trail

• No ETF wrapper

It exists because you hold it.

That distinction becomes powerful in a registry world.

8/

A Global Asset Registry targets:

• Bank accounts

• Securities

• Real estate titles

• Offshore structures

• Corporate holdings

All of which are recorded somewhere.

But private physical bullion stored personally?

That’s structurally different.

A Global Asset Registry targets:

• Bank accounts

• Securities

• Real estate titles

• Offshore structures

• Corporate holdings

All of which are recorded somewhere.

But private physical bullion stored personally?

That’s structurally different.

9/

This isn’t about evasion.

It’s about resilience.

When policy shifts toward global coordination and wealth compression, owning part of your savings in tangible form reduces systemic exposure.

Diversification isn’t just financial.

It’s jurisdictional.

This isn’t about evasion.

It’s about resilience.

When policy shifts toward global coordination and wealth compression, owning part of your savings in tangible form reduces systemic exposure.

Diversification isn’t just financial.

It’s jurisdictional.

10/

History shows:

Wealth concentration triggers reform.

Reform increases transparency.

Transparency expands enforcement.

Physical silver is not a rebellion.

It’s a hedge against systemic overreach.

In a world debating global registries…

ownership matters.

Stay diversified.

Stay informed.

Stay sovereign. 🪙

#Silver #Wealth #AssetRegistry #FinancialFreedom #PhysicalSilver

History shows:

Wealth concentration triggers reform.

Reform increases transparency.

Transparency expands enforcement.

Physical silver is not a rebellion.

It’s a hedge against systemic overreach.

In a world debating global registries…

ownership matters.

Stay diversified.

Stay informed.

Stay sovereign. 🪙

#Silver #Wealth #AssetRegistry #FinancialFreedom #PhysicalSilver

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh