85% of token launches in 2025 are underwater.

VC backed deals barely break even and some are deep in the red.

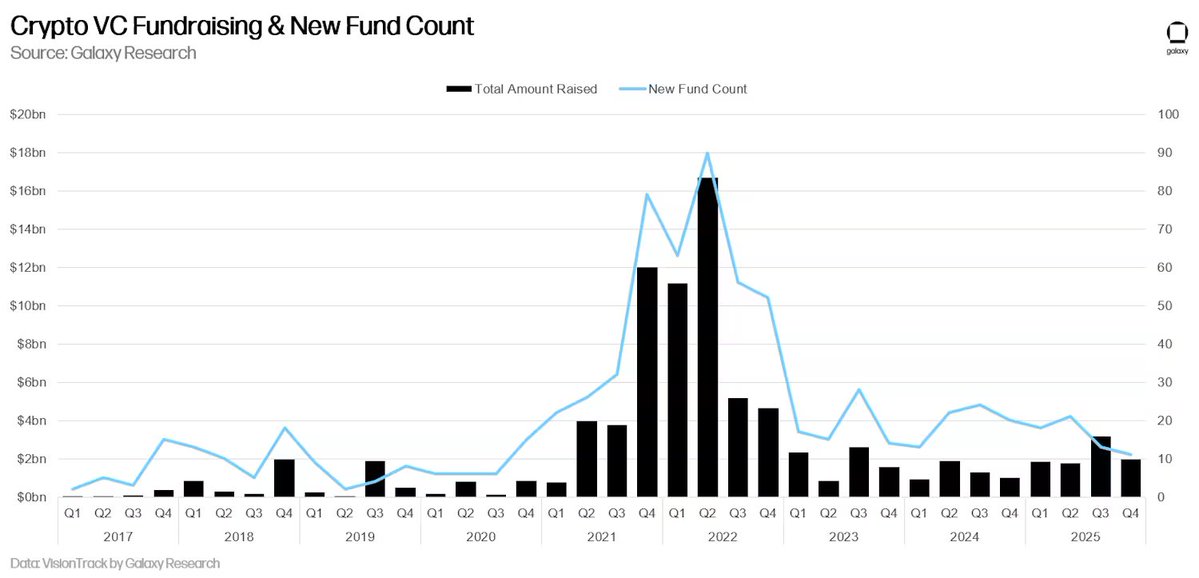

Back in the day having a "Top VC" on the cap table was a huge catalyst, but not anymore. This chart from Galaxy Research tells the story.

In Q2 2022, crypto VCs raised nearly $17 billion in a single quarter with 80+ new funds. LPs threw money at anything with "crypto" in the pitch deck.

Now...

• VC ROI has been falling since 2022

• New fund count just hit a 5 year low

• Last quarter fundraising was only 12% of Q2 2022 levels

"But VCs invested $8.5 Billion last quarter, up 84% QoQ!"

They're not deploying fresh capital, they're spending 2022 house money. The capital deployed from 2023 to 2025 is roughly equal to what they raised in 2022 alone.

The playbook of raising a round, launching a token, and dumping on retail is dying.

There is an upside...

When VC influence fades, the projects that win are the ones with real users and real revenue. Fairer launches. Less insider dumps.

Hopefully less chains, and more builders who optimize for product instead of the next raise.

VC backed deals barely break even and some are deep in the red.

Back in the day having a "Top VC" on the cap table was a huge catalyst, but not anymore. This chart from Galaxy Research tells the story.

In Q2 2022, crypto VCs raised nearly $17 billion in a single quarter with 80+ new funds. LPs threw money at anything with "crypto" in the pitch deck.

Now...

• VC ROI has been falling since 2022

• New fund count just hit a 5 year low

• Last quarter fundraising was only 12% of Q2 2022 levels

"But VCs invested $8.5 Billion last quarter, up 84% QoQ!"

They're not deploying fresh capital, they're spending 2022 house money. The capital deployed from 2023 to 2025 is roughly equal to what they raised in 2022 alone.

The playbook of raising a round, launching a token, and dumping on retail is dying.

There is an upside...

When VC influence fades, the projects that win are the ones with real users and real revenue. Fairer launches. Less insider dumps.

Hopefully less chains, and more builders who optimize for product instead of the next raise.

• • •

Missing some Tweet in this thread? You can try to

force a refresh