Bitcoin as the world's biggest game of hot potato: prestonbyrne.com/2017/11/26/the… @prestonjbyrne

Liquidity crunch catalyzed by any disruption in the price would cause a bank run.

Liquidity crunch catalyzed by any disruption in the price would cause a bank run.

Bitcoiners think that they're structurally immune to bank runs because they repeat "we are not fractional reserves" as an article of faith. That is almost certainly false.

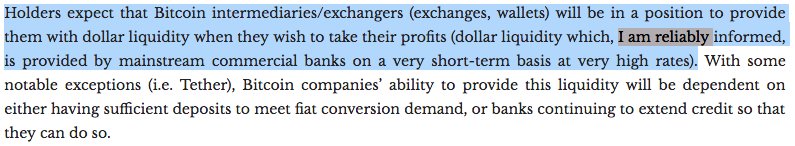

Most distressing bit in that article, which I cannot verify but which I do not find implausible:

Most distressing bit in that article, which I cannot verify but which I do not find implausible:

• • •

Missing some Tweet in this thread? You can try to

force a refresh