How to get URL link on X (Twitter) App

2/ This is commonplace as most PvP traders still alive believe that they are superior than the market.

2/ This is commonplace as most PvP traders still alive believe that they are superior than the market.

https://twitter.com/Blockanalia/status/15330702171227463732/ Value add from the investor is optional. It can come in the form of advisory, research, marketing etc.

https://twitter.com/0xWangarian/status/1322576536571060224?s=20&t=ZZtB4m8qBQy-XVbdJAJXNA

https://twitter.com/bottomd0g/status/14670983125661409371/

https://twitter.com/AlphaFinanceLab/status/14479215433555066971/ Alpha Staking

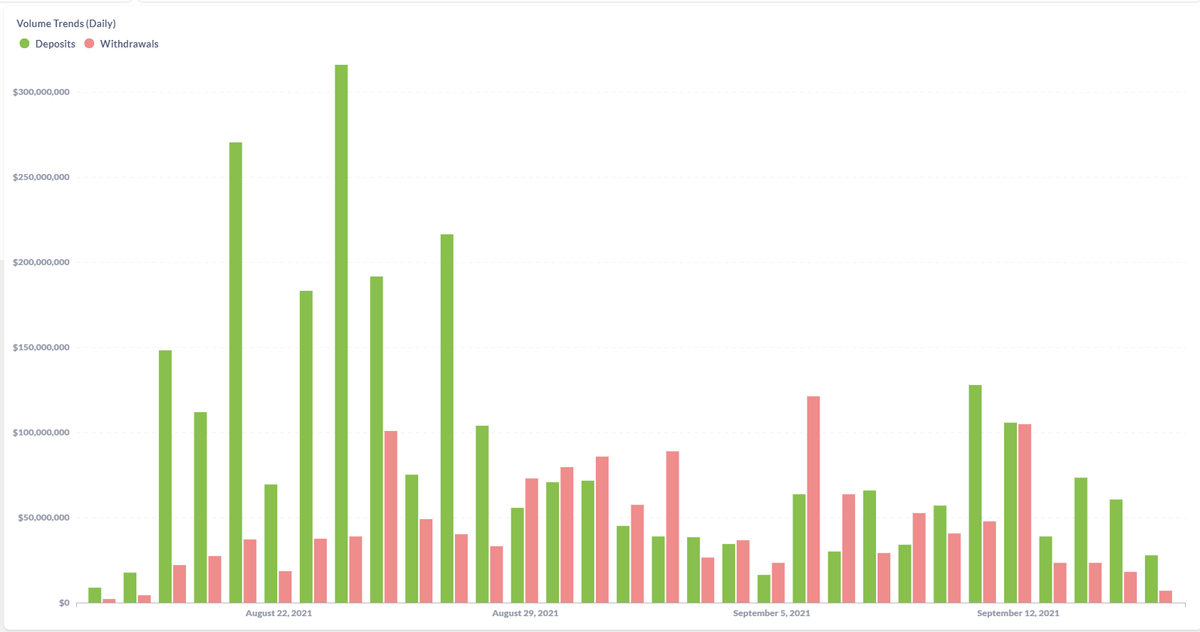

2/ Bridge inflows:

2/ Bridge inflows:

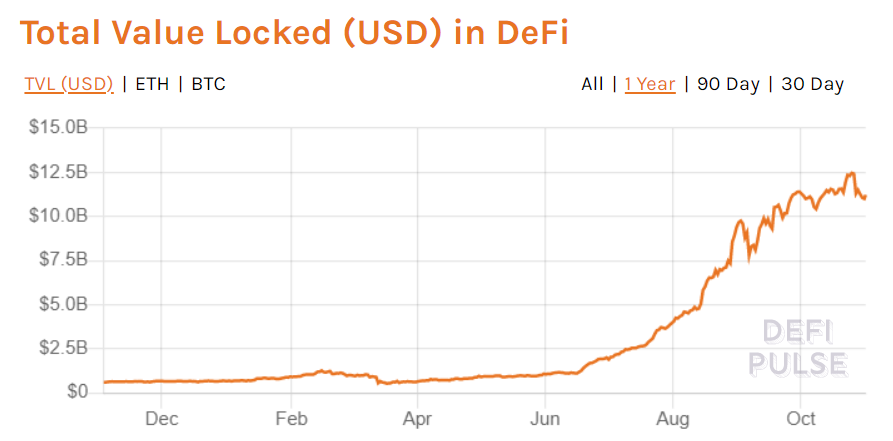

1/ Story so far

1/ Story so far

https://twitter.com/Wangarian1/status/1317670107091406850?s=20

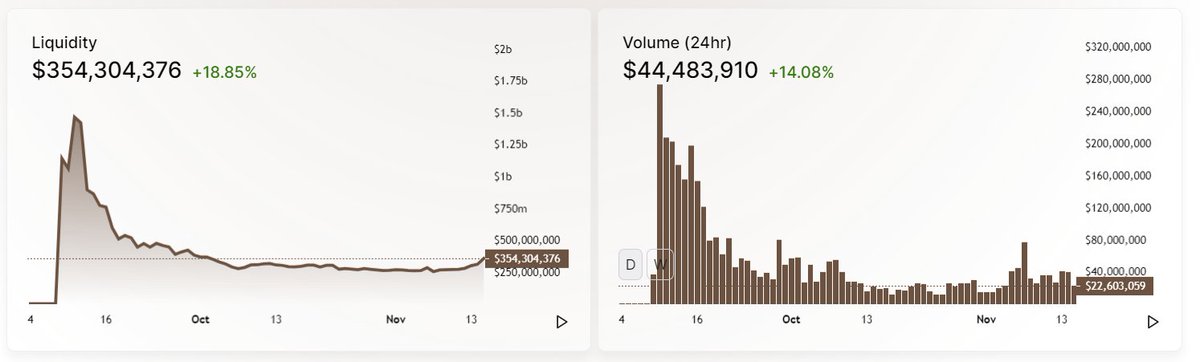

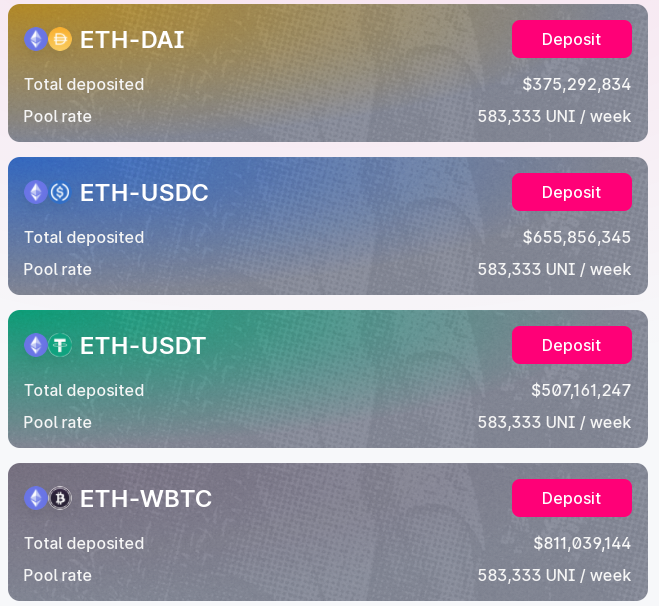

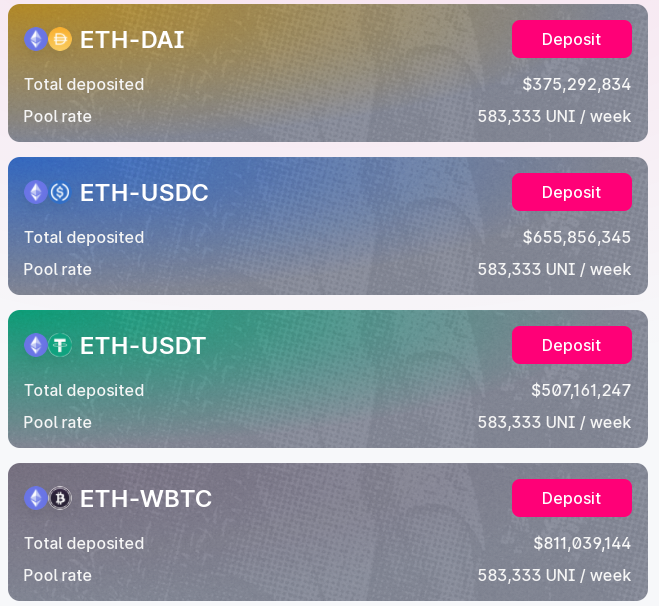

2/ Whilst a large portion of current TVL will stay in the same pools (fees generated are juicy), I posit a reasonable amount of ETH will leave the Uniswap system in search of higher yields.

2/ Whilst a large portion of current TVL will stay in the same pools (fees generated are juicy), I posit a reasonable amount of ETH will leave the Uniswap system in search of higher yields.