How to get URL link on X (Twitter) App

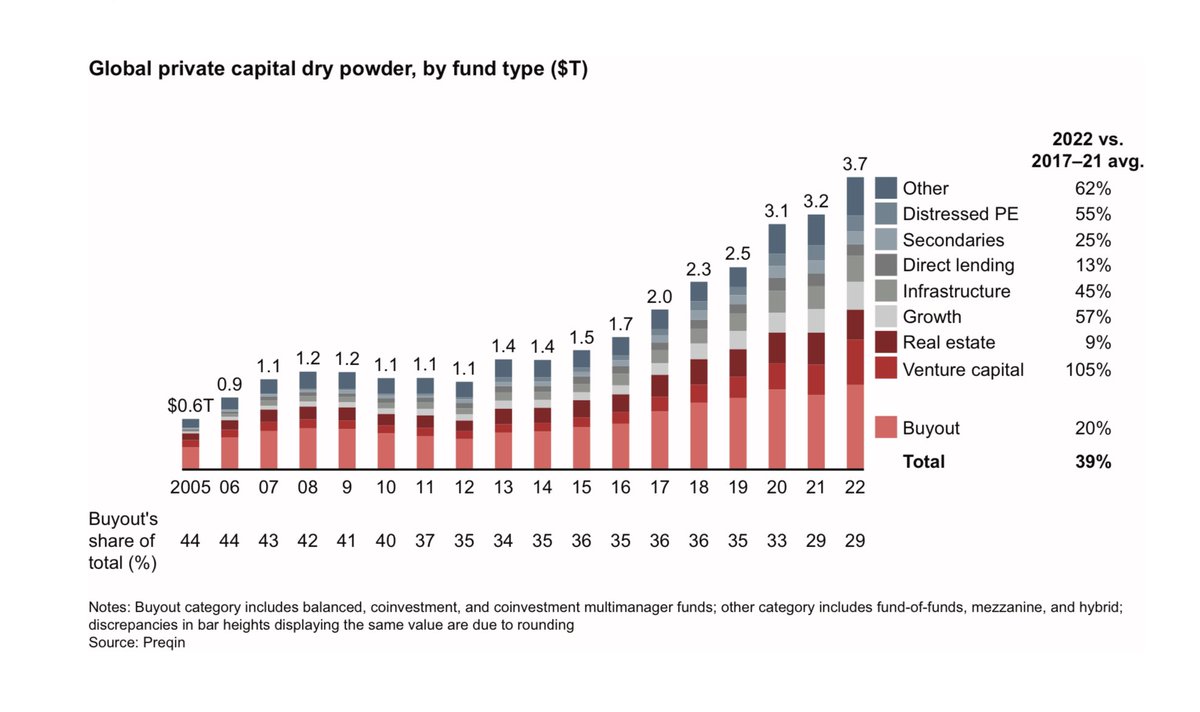

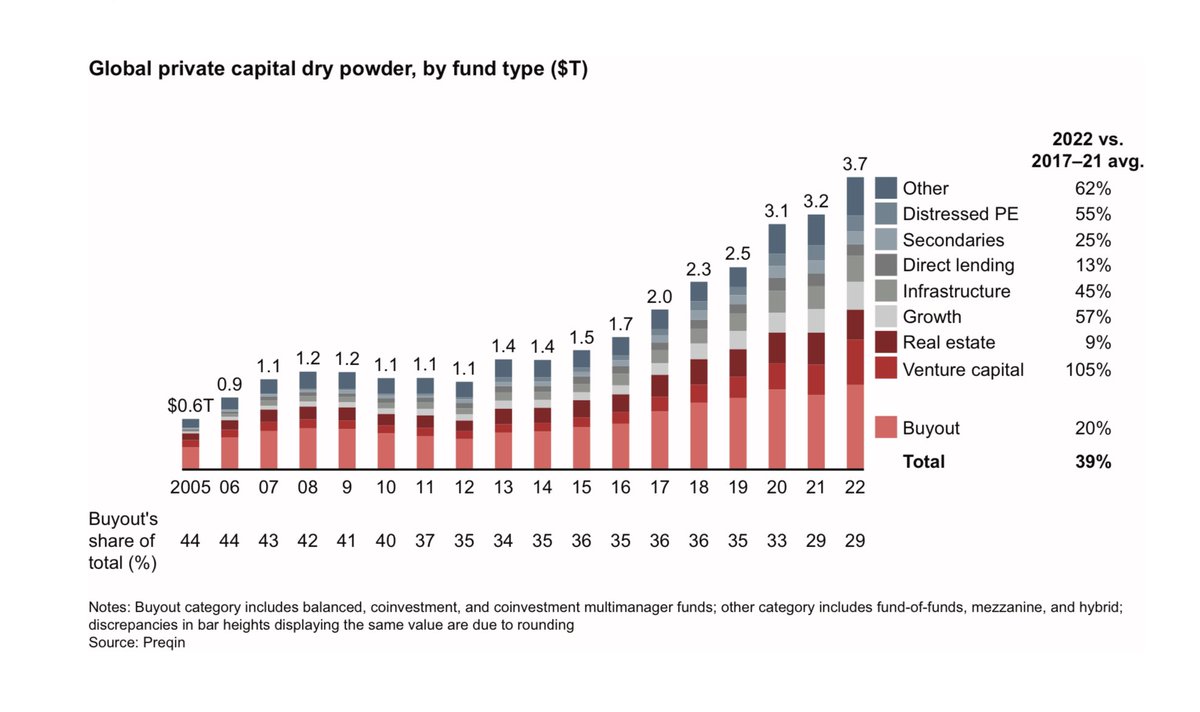

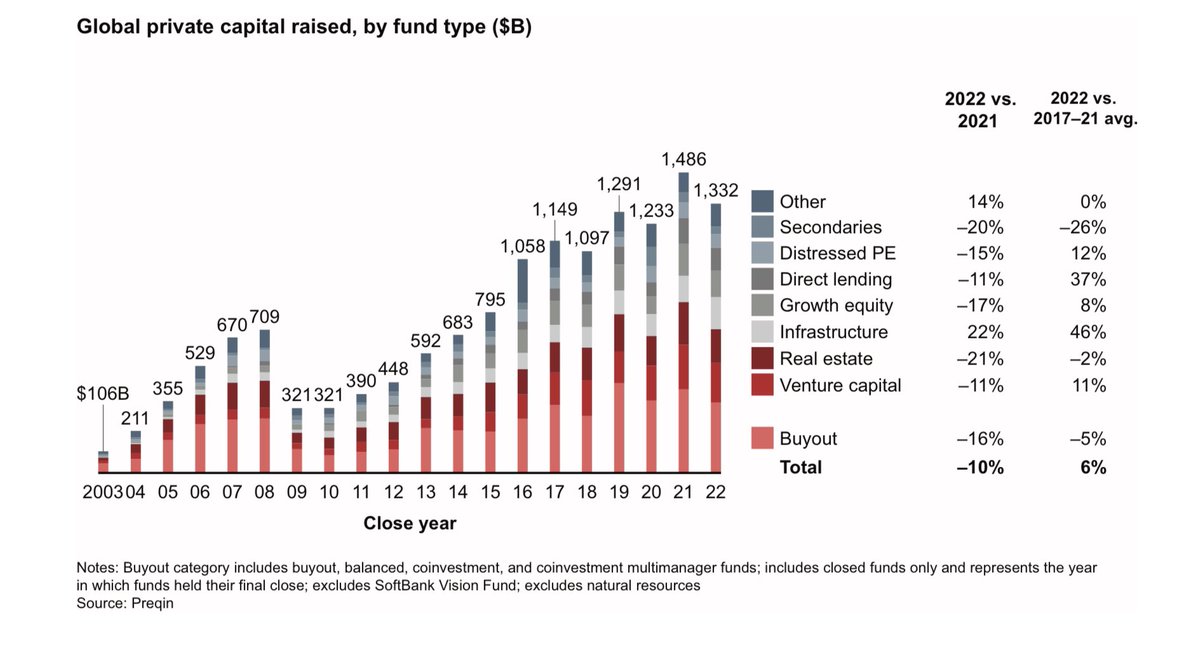

$1.3 trillion of that powder was raised in 2022 alone

$1.3 trillion of that powder was raised in 2022 alone

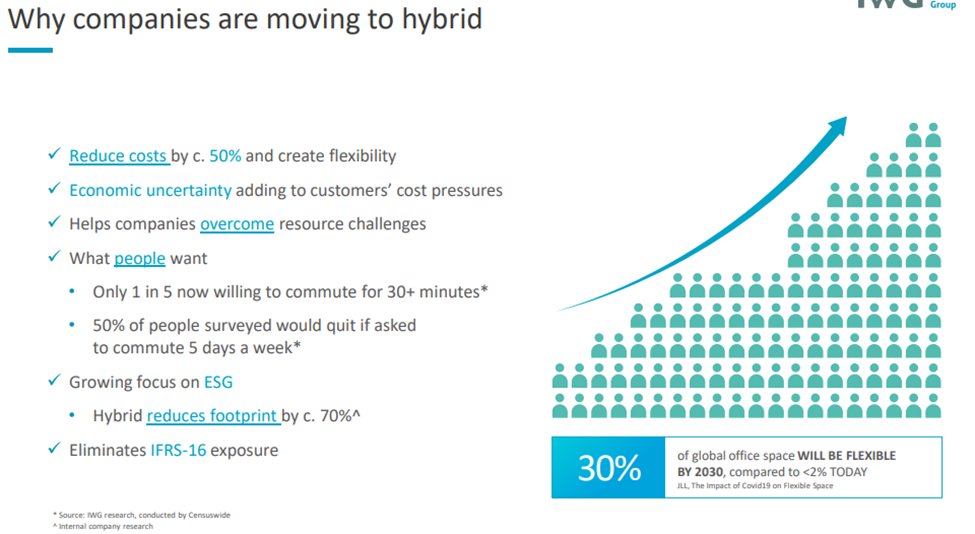

https://twitter.com/AndrewRangeley/status/1630198070695567360In the Q4'21 call, CEO highlighted path to getting managed / franchised EBITDA to £200m+ by 2024: "roughly 2,000 centers at an avg of about £1 million rev per center..the drop-through is net-net somewhere in the 10% range and that's where you're getting the £200 million from."

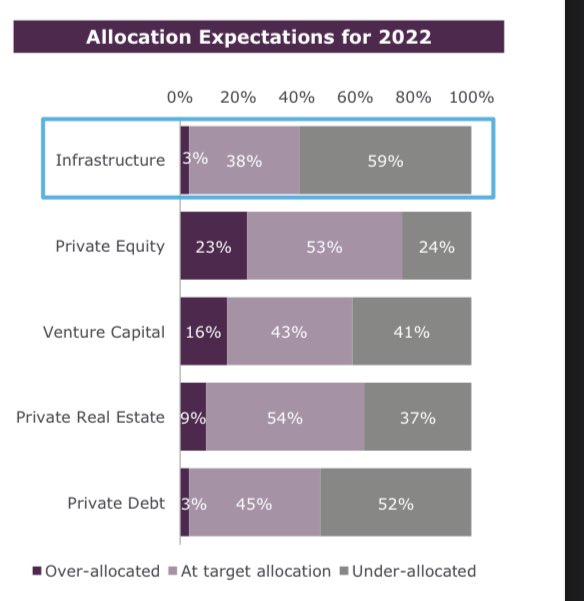

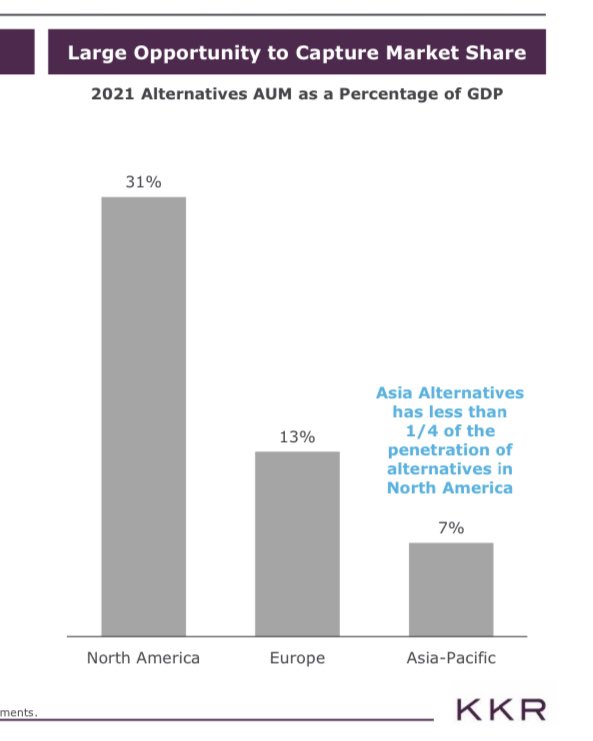

It also established its infrastructure business in 2008. Since then, it has scaled it to $50bn of AUM. Brookfield is well over $100bn of AUM in infra and still growing that biz quite rapidly. Most institutional investors feel under allocated to infra. Nice growth market for them.

It also established its infrastructure business in 2008. Since then, it has scaled it to $50bn of AUM. Brookfield is well over $100bn of AUM in infra and still growing that biz quite rapidly. Most institutional investors feel under allocated to infra. Nice growth market for them.