How to get URL link on X (Twitter) App

In 17th century England, explosive economic growth brought new demands for financing.

In 17th century England, explosive economic growth brought new demands for financing.

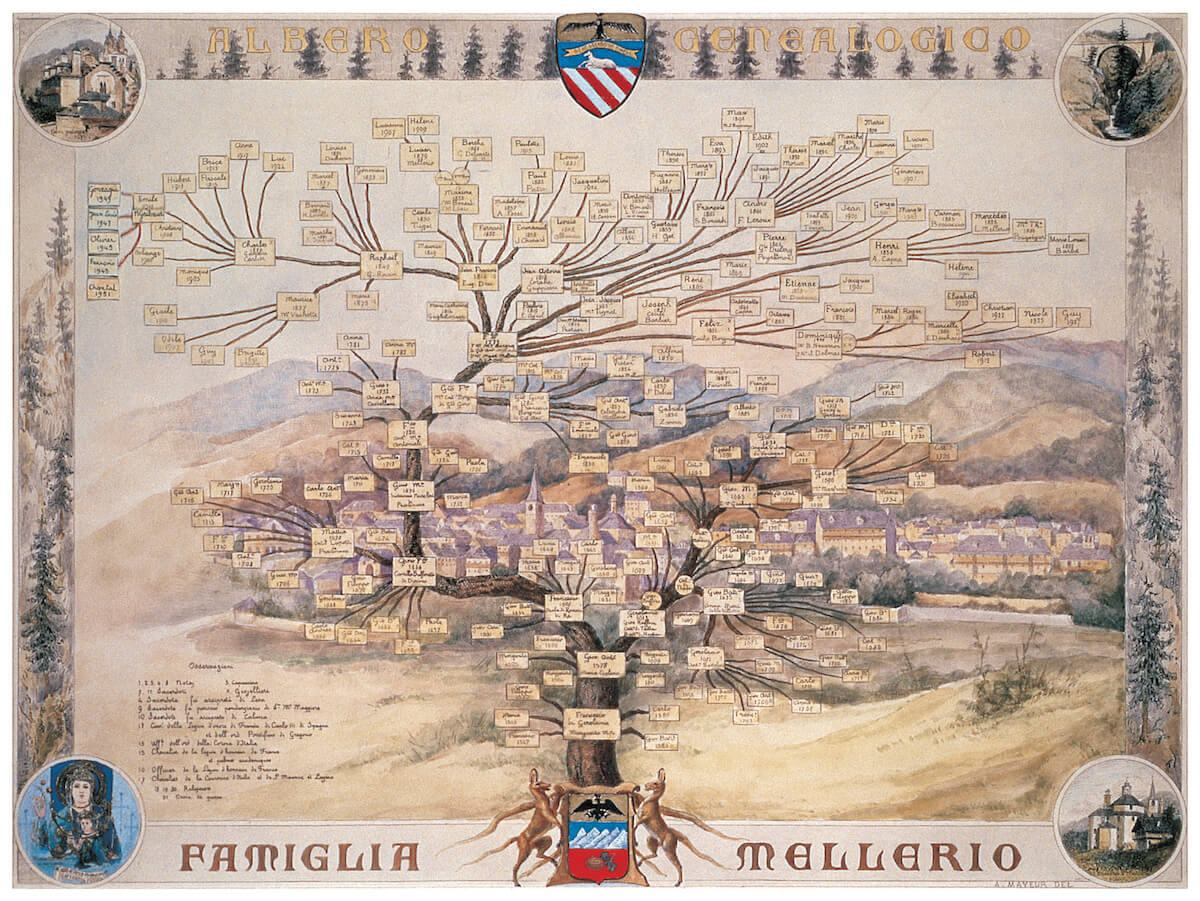

Mellerio dits Meller, the family enterprise, enjoys lofty status as a premier bespoke jeweler.

Mellerio dits Meller, the family enterprise, enjoys lofty status as a premier bespoke jeweler.

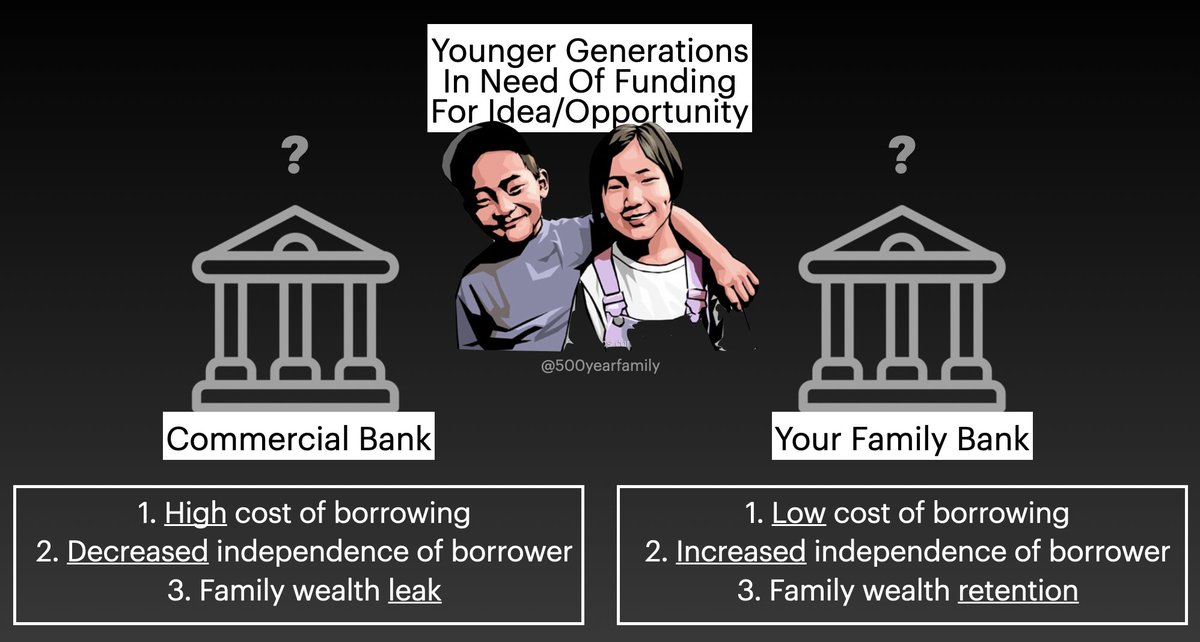

Ultra-long term thinking is the ability to think in terms of generations.

Ultra-long term thinking is the ability to think in terms of generations.

The Hugel story takes place in the French village of Riquewihr.

The Hugel story takes place in the French village of Riquewihr.

The Zildjian story is a mixture of Old World charm and New World opportunity.

The Zildjian story is a mixture of Old World charm and New World opportunity.https://twitter.com/500YearFamily/status/1595414106831470599?s=20&t=aaLF9yVAVbidi10CVYTwUA

The story of the Dumas family & the story of Hermès are intertwined.

The story of the Dumas family & the story of Hermès are intertwined.

The Klebergs hold a unique place in US history.

The Klebergs hold a unique place in US history.