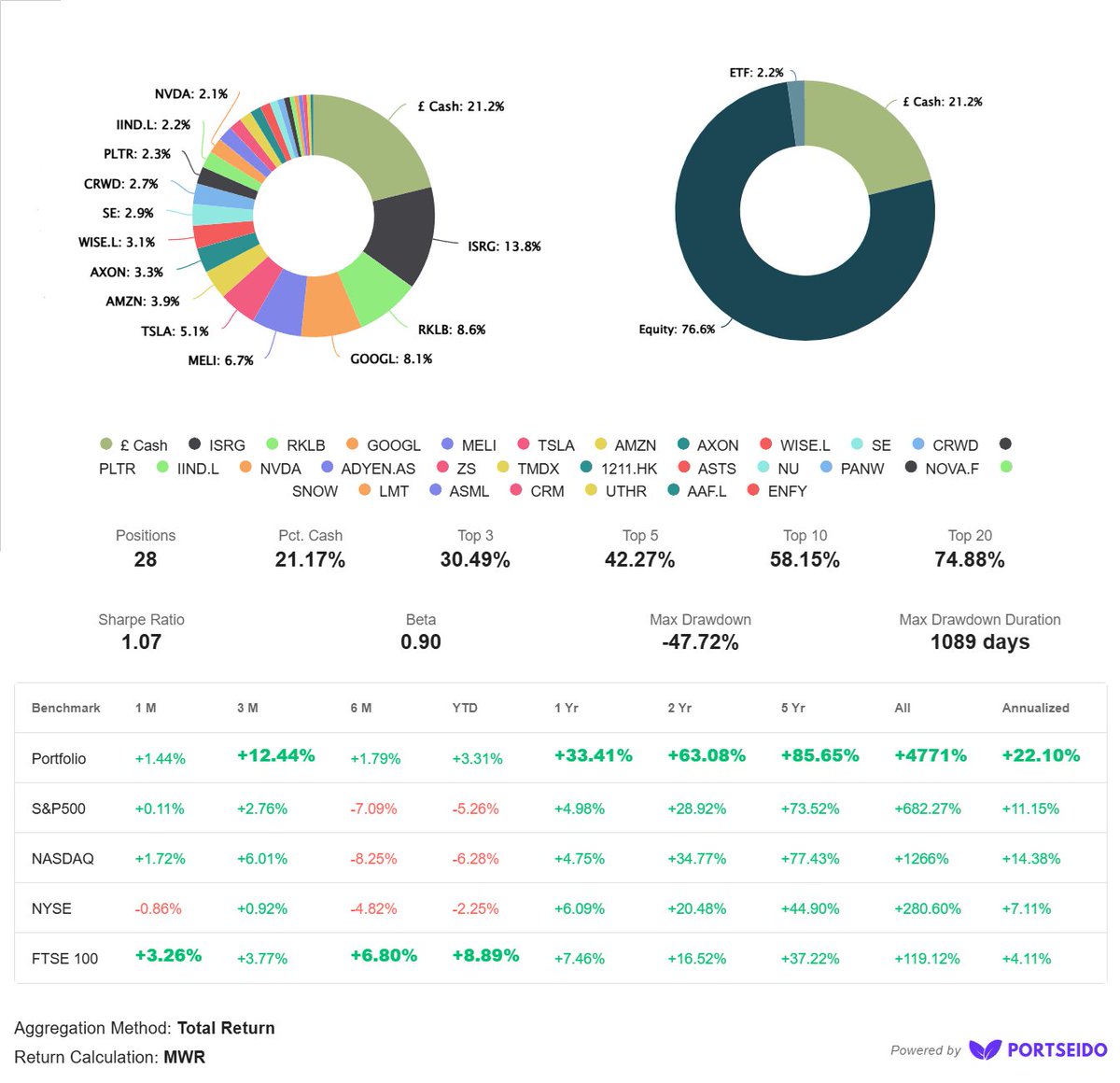

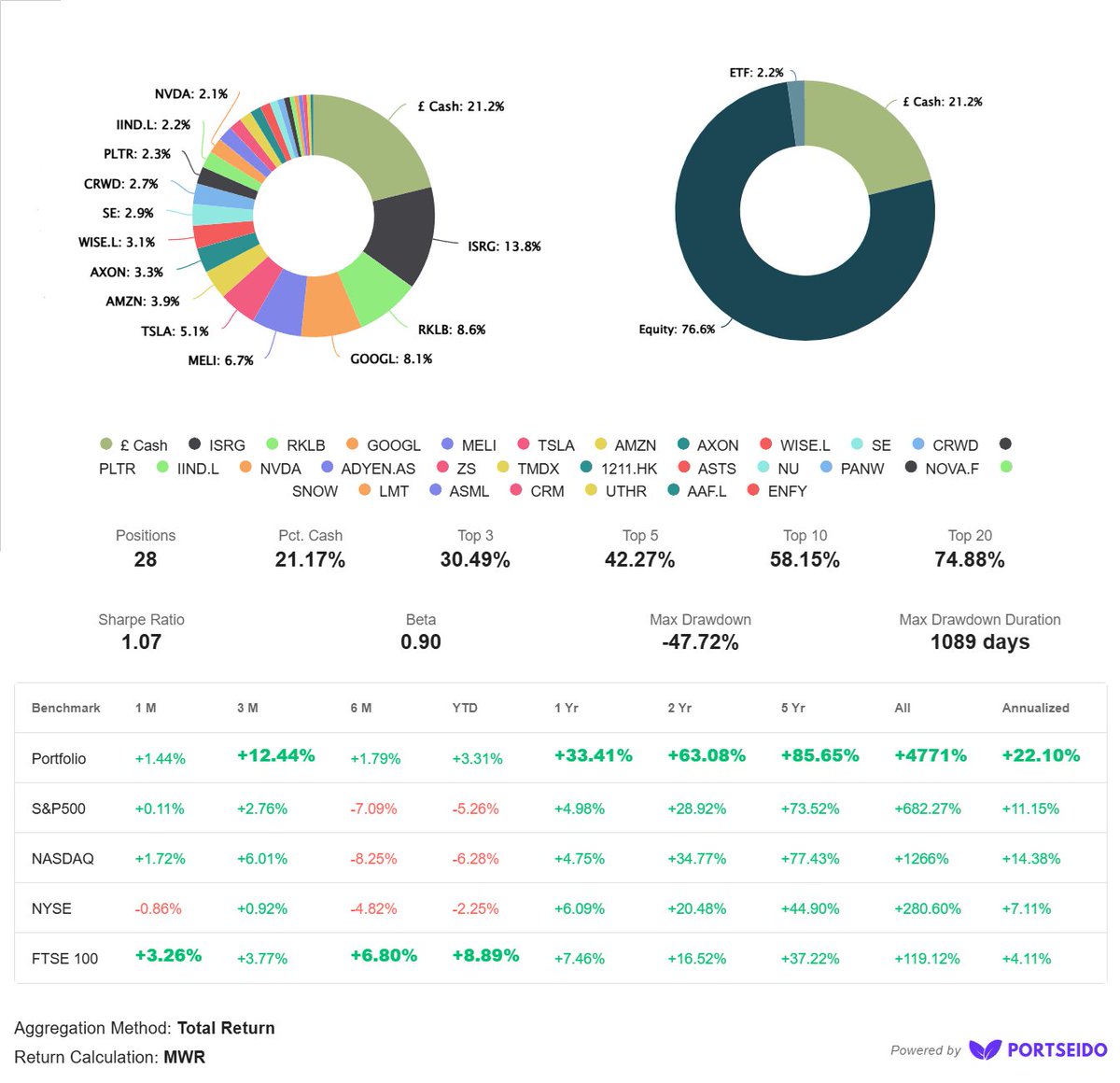

Professional investor and podcast host, spotlighting companies shaping a better future through technology and innovation. 22% CAGR over 21 years.

How to get URL link on X (Twitter) App

Two new buys this month! Greggs $GRG has been on my watchlist since 2023, and last week's price drop offered a tempting bargain. This is a 100-year-old British brand with a strong employee culture, a clear growth strategy, and a healthy, stable dividend. While I'm not expecting multi-baggers from this investment, it neatly supports my strategy of pivoting a little more towards income, so it's finally time to get onboard!

Two new buys this month! Greggs $GRG has been on my watchlist since 2023, and last week's price drop offered a tempting bargain. This is a 100-year-old British brand with a strong employee culture, a clear growth strategy, and a healthy, stable dividend. While I'm not expecting multi-baggers from this investment, it neatly supports my strategy of pivoting a little more towards income, so it's finally time to get onboard!

I trimmed Crowdstrike last month, but it already feels like time to do it again. Quarterly results were announced last week, they were decent, but there are a couple of yellow flags I'm starting to see, and combined with the continued excessive valuation, I've decided to materially reduce my exposure to this core holding, cutting $CRWD back from a 5.5% allocation to under 3%.

I trimmed Crowdstrike last month, but it already feels like time to do it again. Quarterly results were announced last week, they were decent, but there are a couple of yellow flags I'm starting to see, and combined with the continued excessive valuation, I've decided to materially reduce my exposure to this core holding, cutting $CRWD back from a 5.5% allocation to under 3%.

I've not touched my portfolio since late January, so there are no buys or sells to report, but the shape of the portolio has changed materially as a consequence of the complex and volatile investing environment.

I've not touched my portfolio since late January, so there are no buys or sells to report, but the shape of the portolio has changed materially as a consequence of the complex and volatile investing environment.

https://x.com/7LukeHallard/status/1763577662130557155