How to get URL link on X (Twitter) App

2/ Motivations

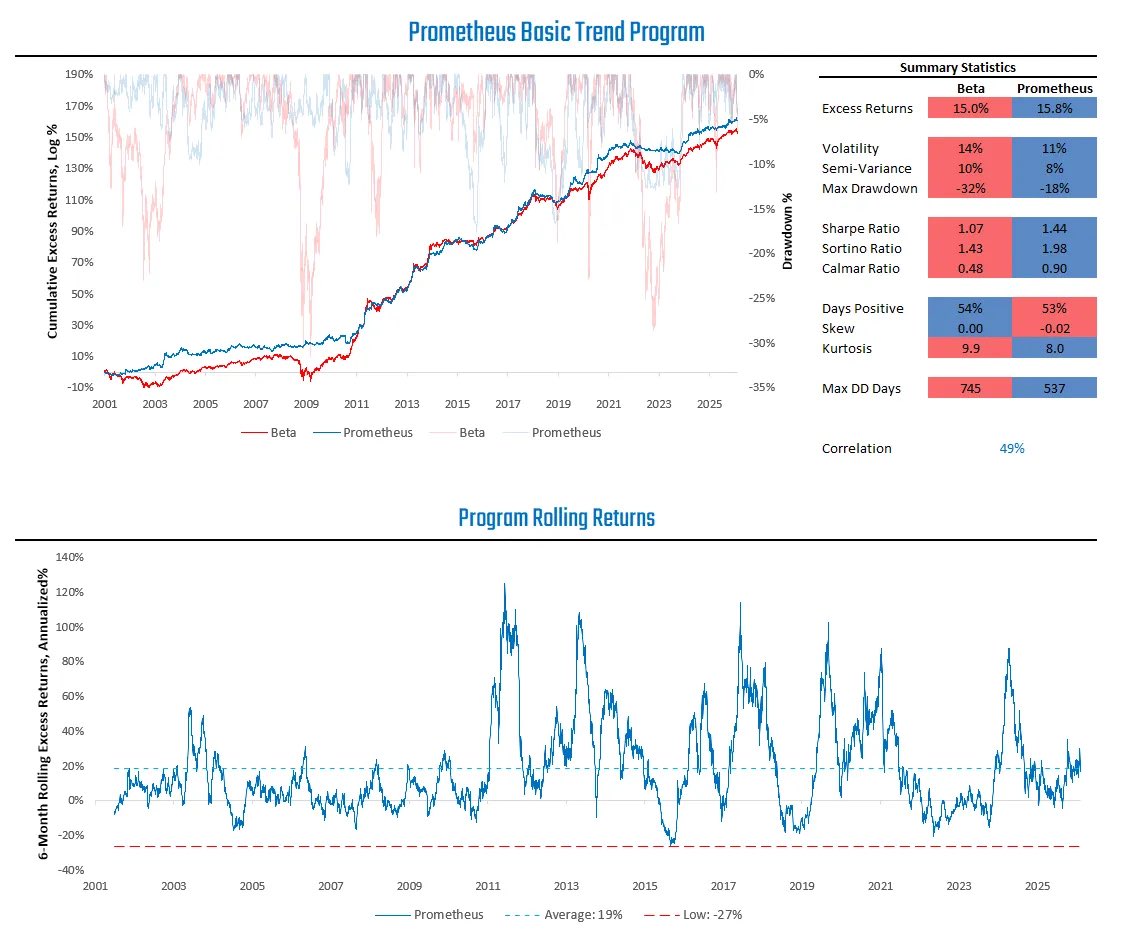

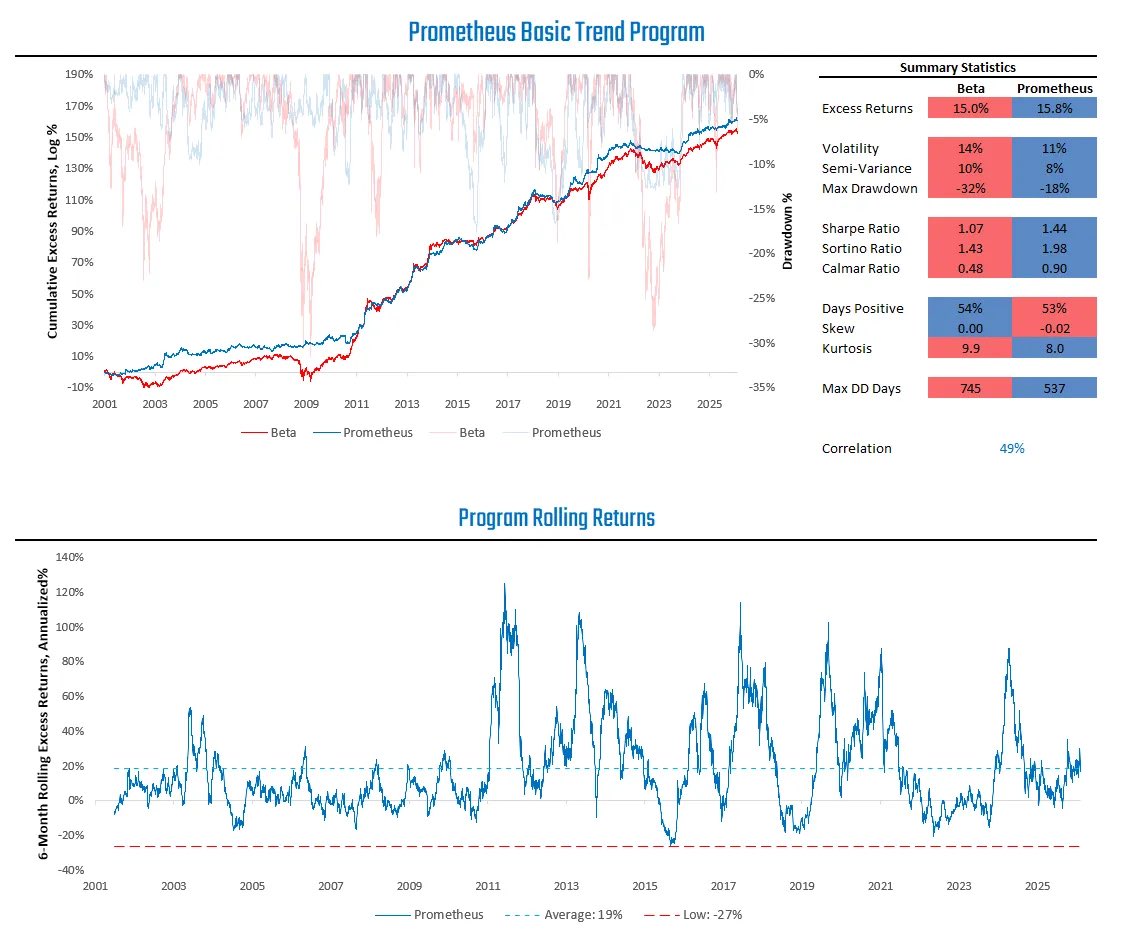

2/ Motivations

https://twitter.com/aahanprometheus/status/2012566452314787962

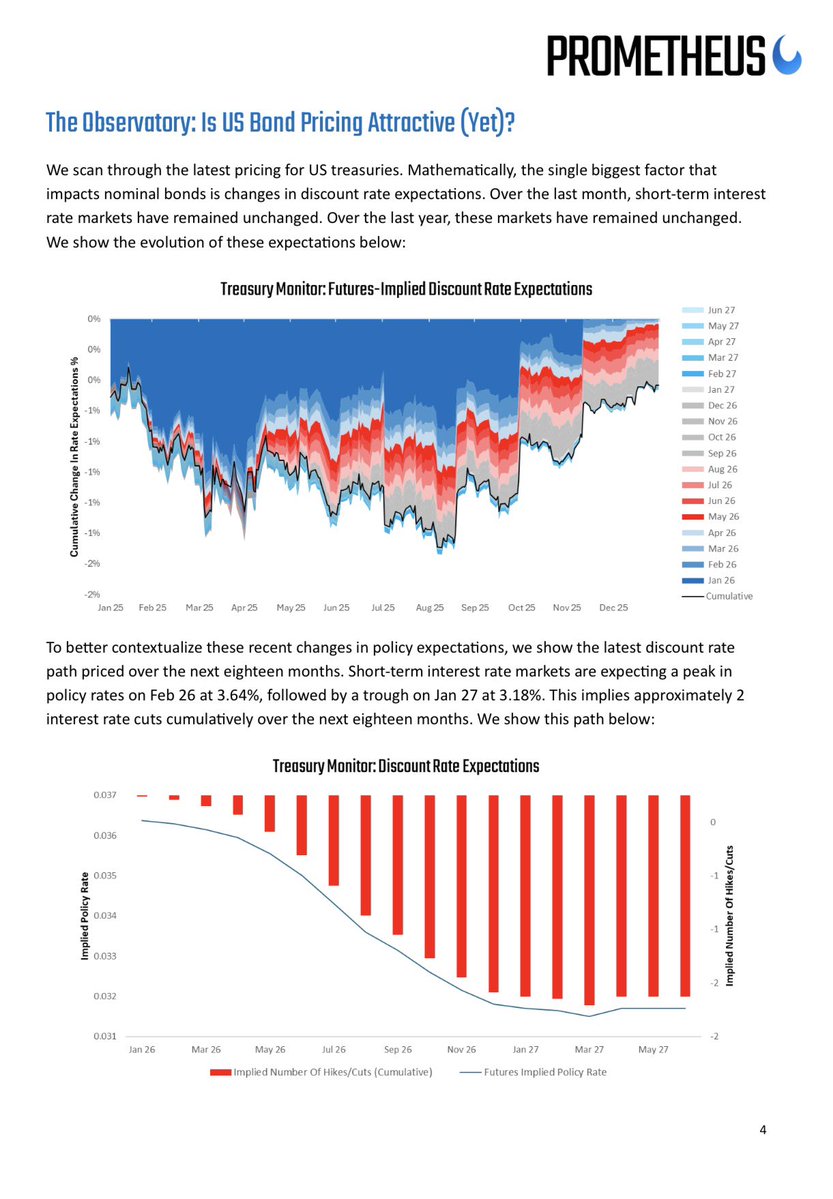

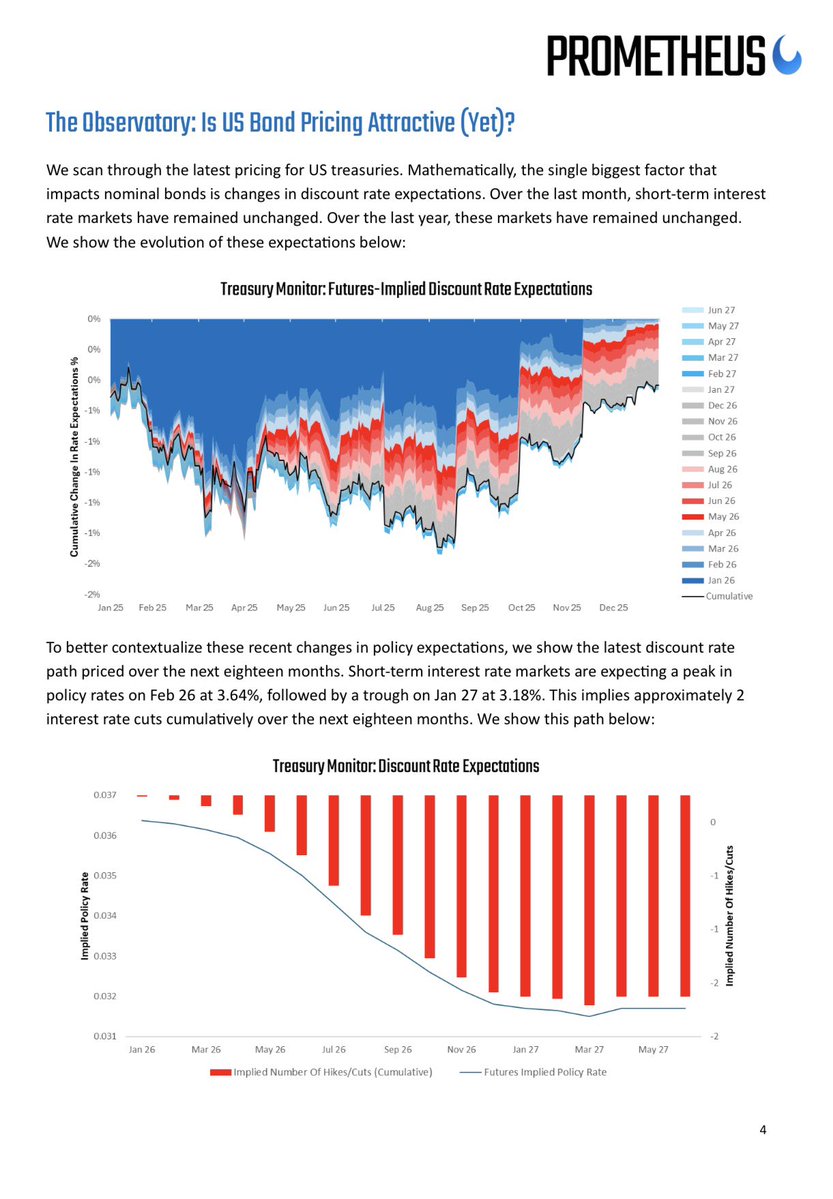

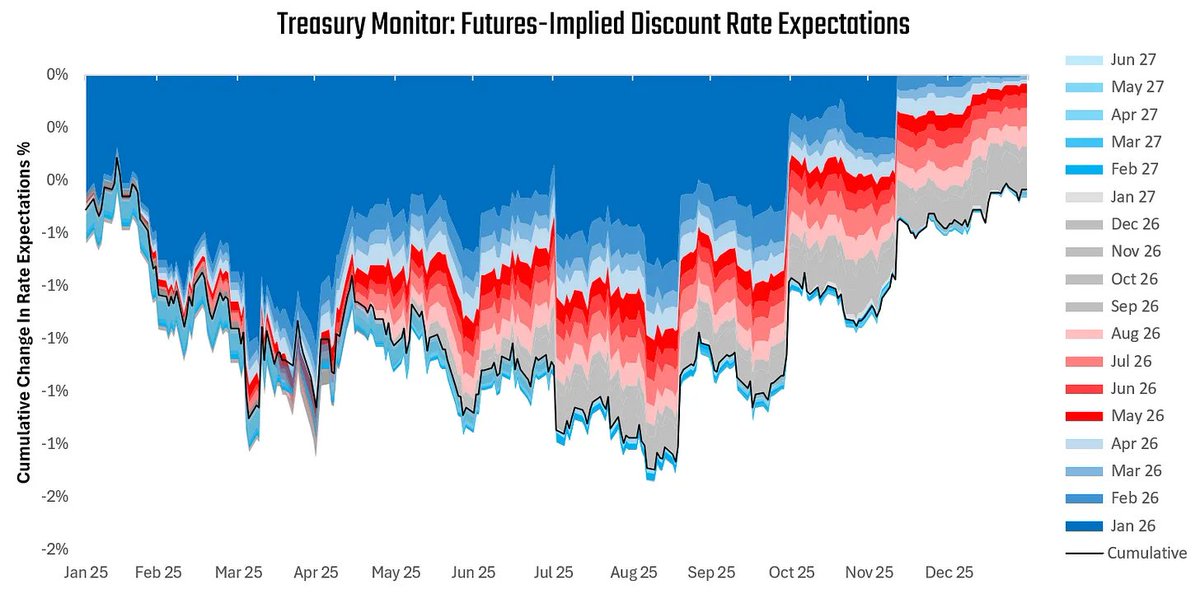

1/ Over the last month, short-term interest rate markets have remained unchanged. Over the last year, these markets have remained unchanged. We show the evolution of these expectations below:

1/ Over the last month, short-term interest rate markets have remained unchanged. Over the last year, these markets have remained unchanged. We show the evolution of these expectations below:

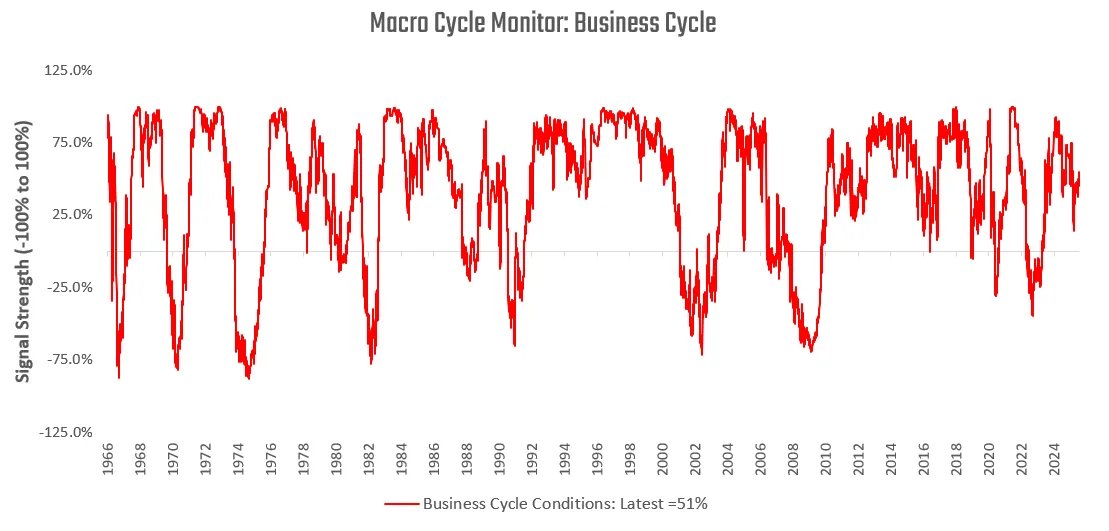

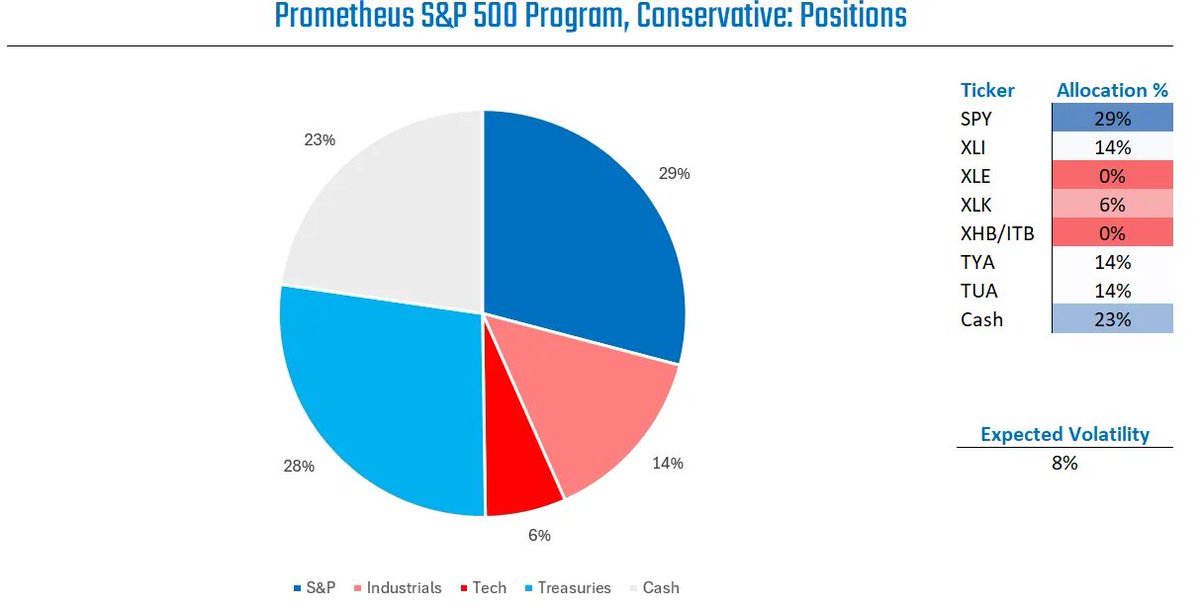

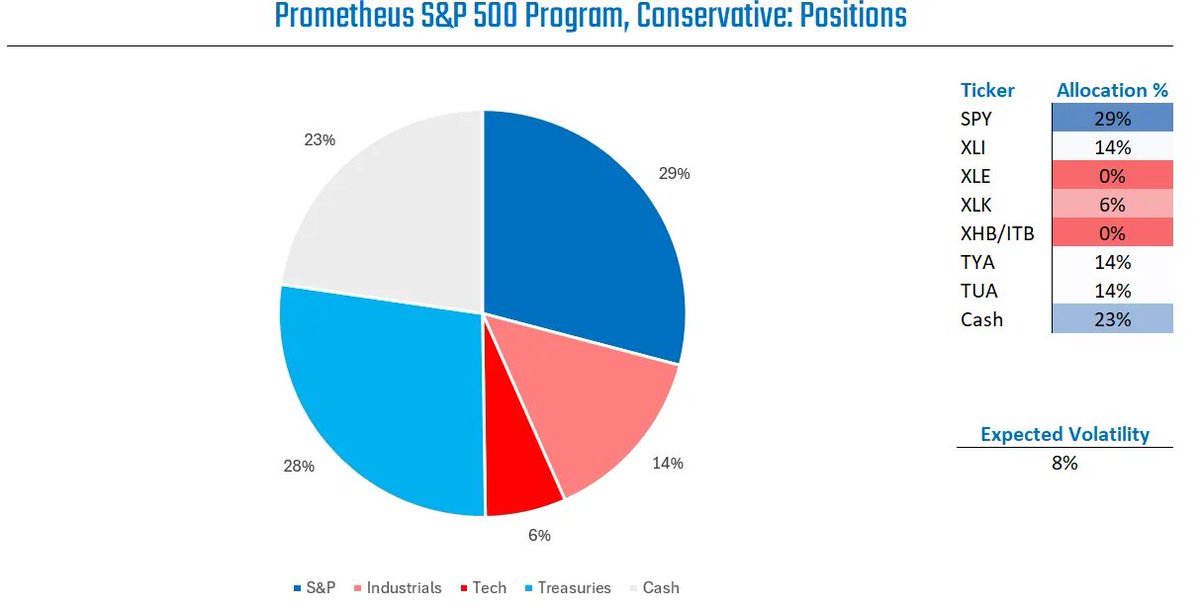

2/ I look at this through three levels:

2/ I look at this through three levels:

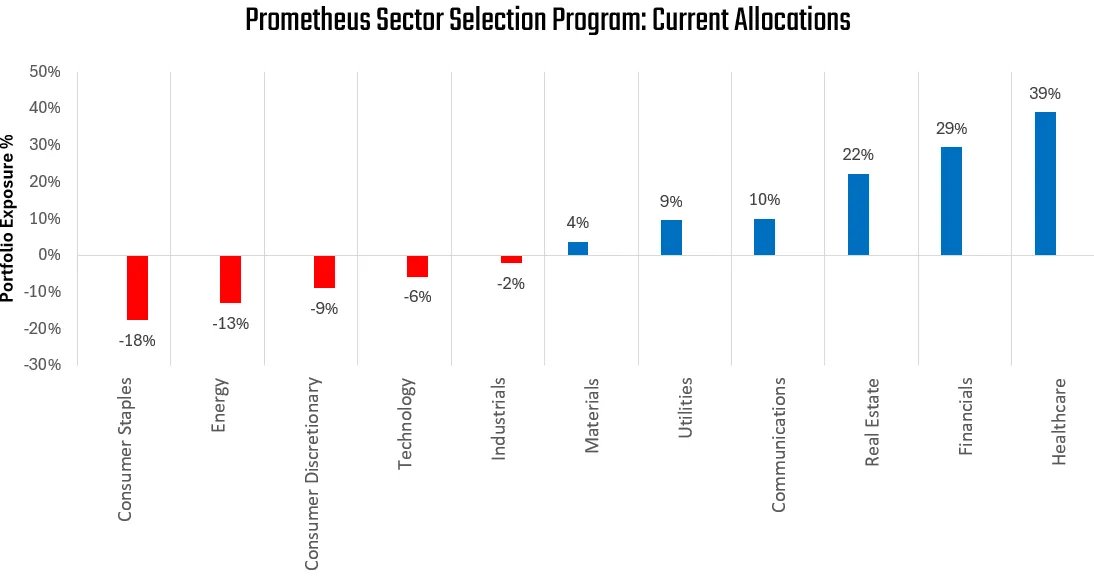

2/Let's start with asset price trends, which give a nice context.

2/Let's start with asset price trends, which give a nice context.

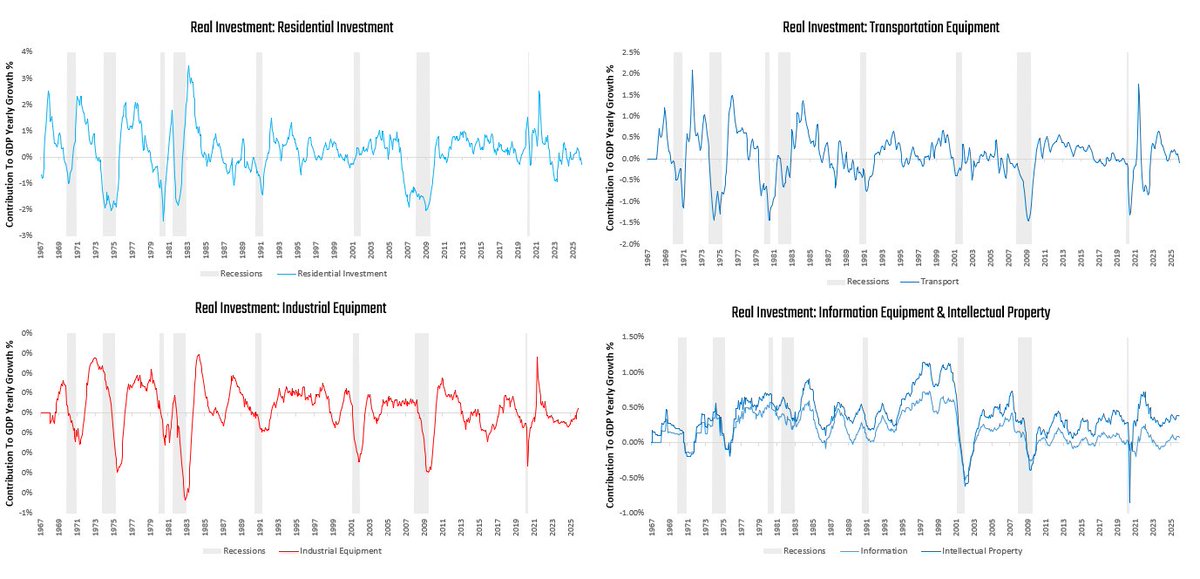

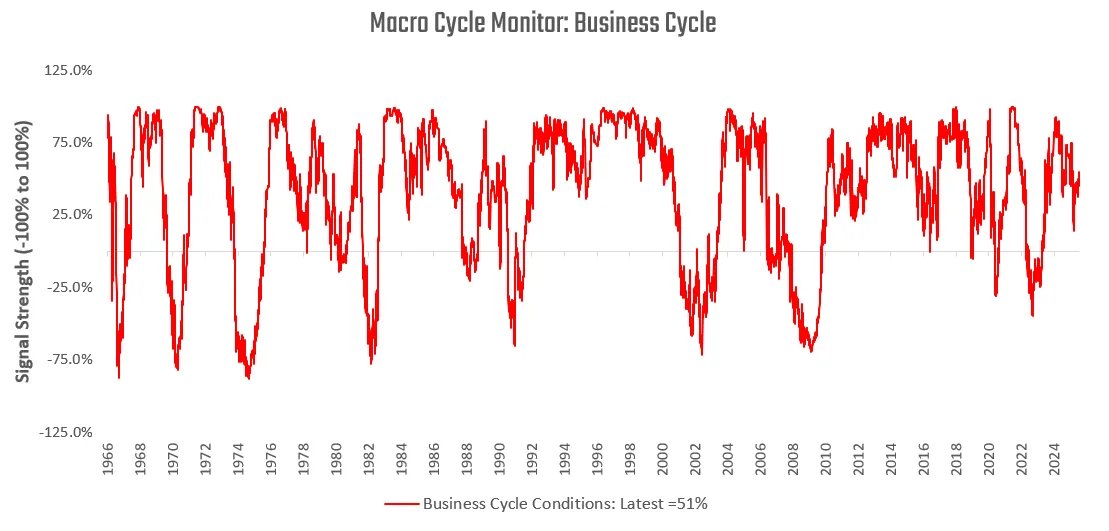

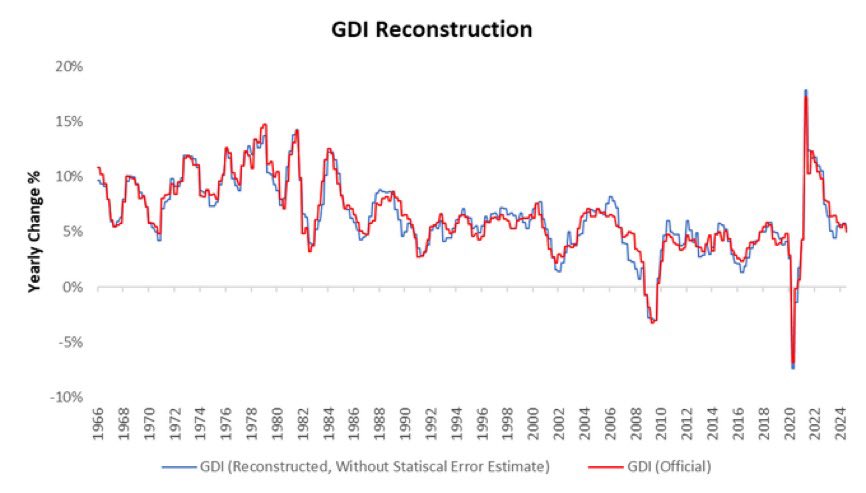

1/ Let's start with the macro view.

1/ Let's start with the macro view.

https://twitter.com/aahanprometheus/status/1865140624363794939