How to get URL link on X (Twitter) App

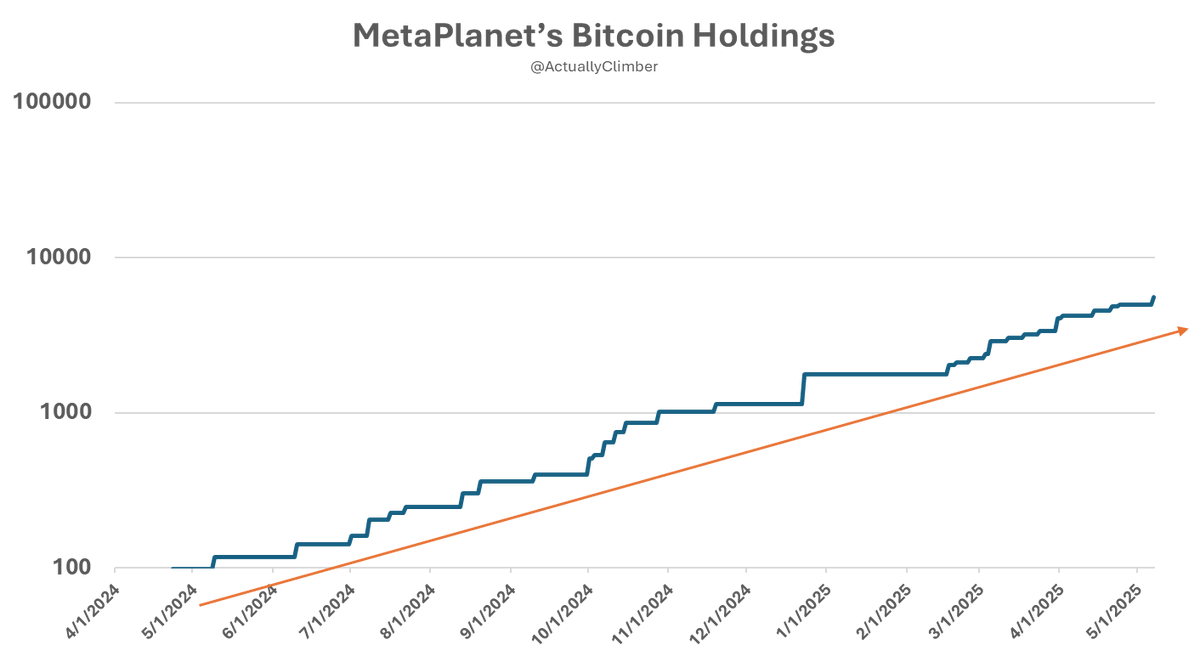

https://x.com/ActuallyClimber/status/1929750257581035831

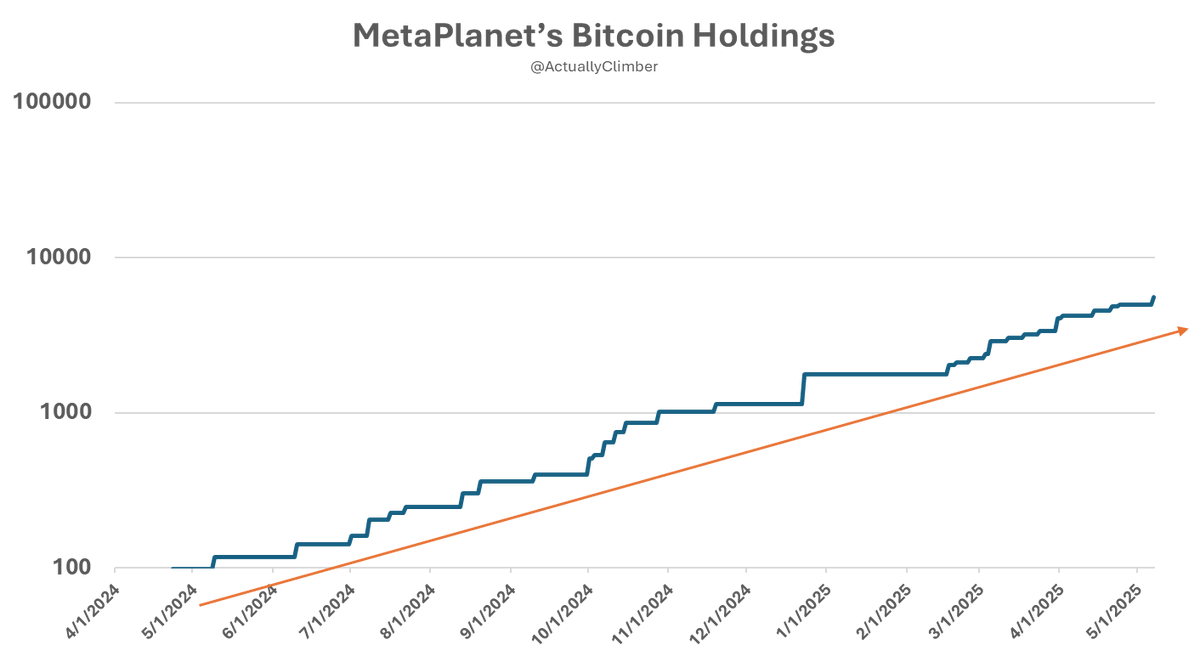

https://x.com/DylanLeClair_/status/1909278684558589974