Powering Traders to Achieve Elite Performance📈📈📈📘Author of 'Mastering the Mental Game of Trading'. https://t.co/qgH2nVF36z'. Gooner 🔴⚪️

7 subscribers

How to get URL link on X (Twitter) App

Perma-States are states of Being where you adopt a view that the market you are trading will be ‘Permanently Bullish’ or ‘Permanently Bearish’. This underscores all your trading activity.

Perma-States are states of Being where you adopt a view that the market you are trading will be ‘Permanently Bullish’ or ‘Permanently Bearish’. This underscores all your trading activity.

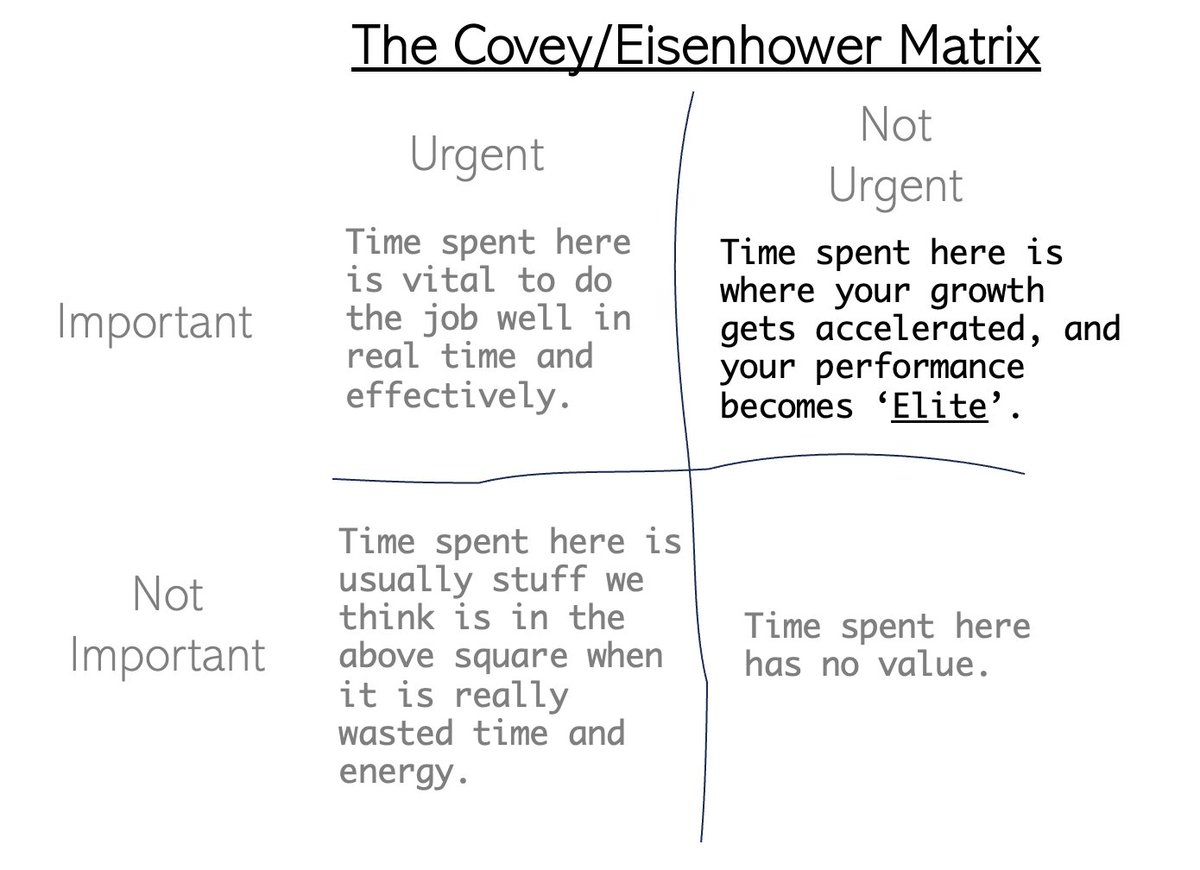

focus lies in cultivating the mindset, beliefs, and attitudes essential for achieving high performance as a trader or investor, making it a valuable resource for anyone aspiring to excel in their work as a trader or investor.

focus lies in cultivating the mindset, beliefs, and attitudes essential for achieving high performance as a trader or investor, making it a valuable resource for anyone aspiring to excel in their work as a trader or investor.