How to get URL link on X (Twitter) App

2. Currently they are in 13 states, 10,000 active retailers,50 distributors, 300000 carpenter

2. Currently they are in 13 states, 10,000 active retailers,50 distributors, 300000 carpenter

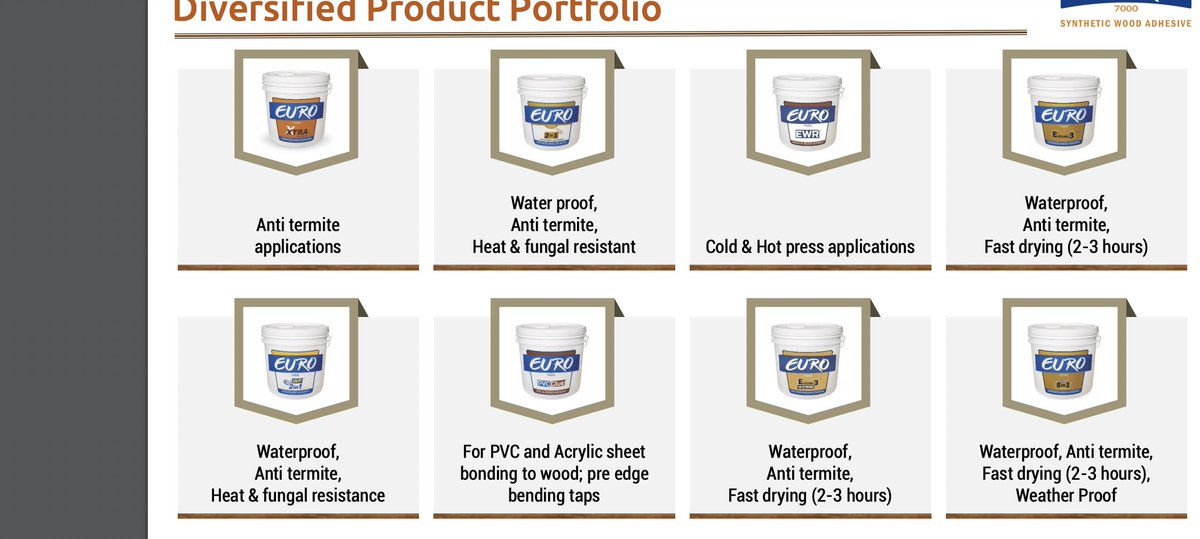

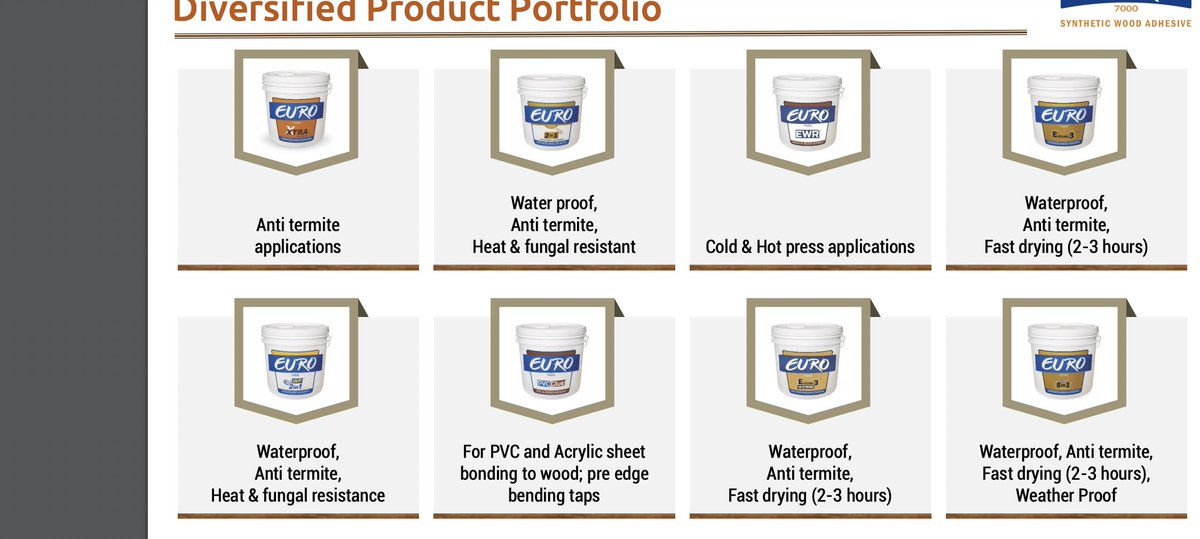

3. They have huge and diversified clientele across sectors. They also have wide variety of packaging products.

3. They have huge and diversified clientele across sectors. They also have wide variety of packaging products.

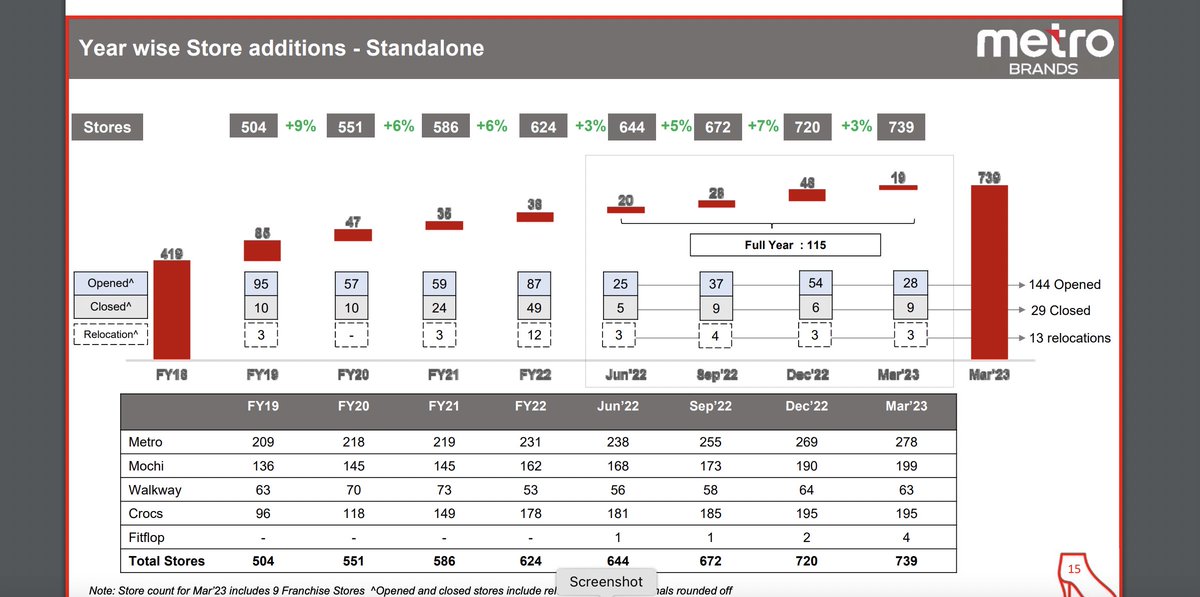

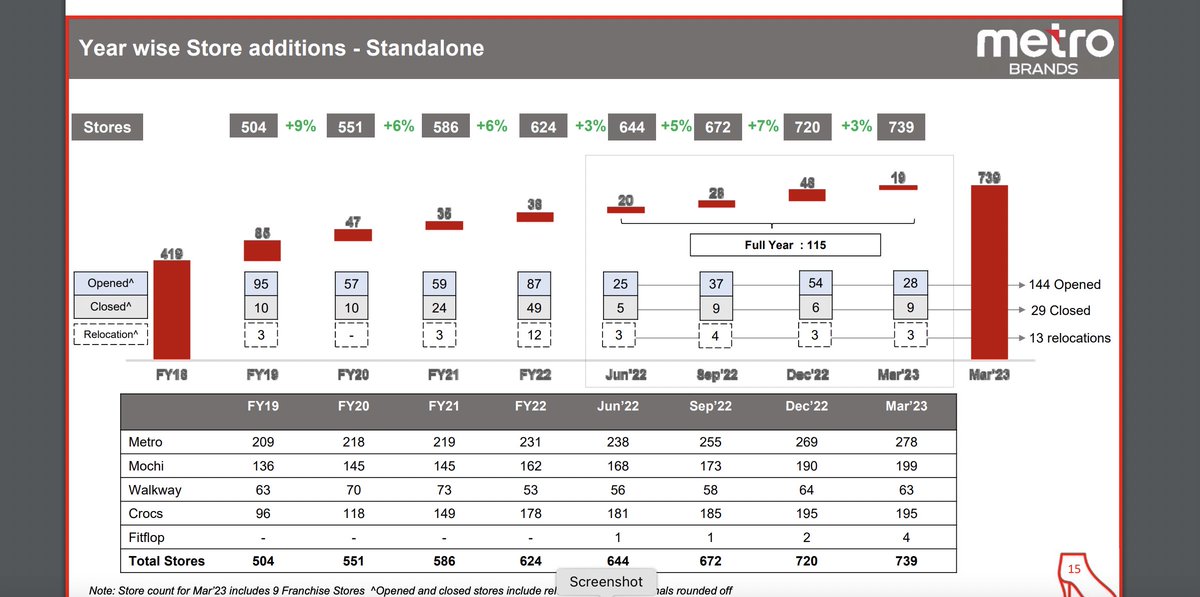

4. The company is well on track to achieve the goal of 900 stores by FY25.

4. The company is well on track to achieve the goal of 900 stores by FY25.

3. I believe the expansion in margins and boost in PAT is due to falling RM price and not by selling more shoes (volume growth).

3. I believe the expansion in margins and boost in PAT is due to falling RM price and not by selling more shoes (volume growth).

2. The company doesn't just make gears and have introduced new product portfolio. Since these are high precision, complex models the margins are high.

2. The company doesn't just make gears and have introduced new product portfolio. Since these are high precision, complex models the margins are high.