CFA Level II Passed, MSc Investment Analyst, University of Stirling(UK) graduated as the top student Tweet=opinion

Equity Research currently

How to get URL link on X (Twitter) App

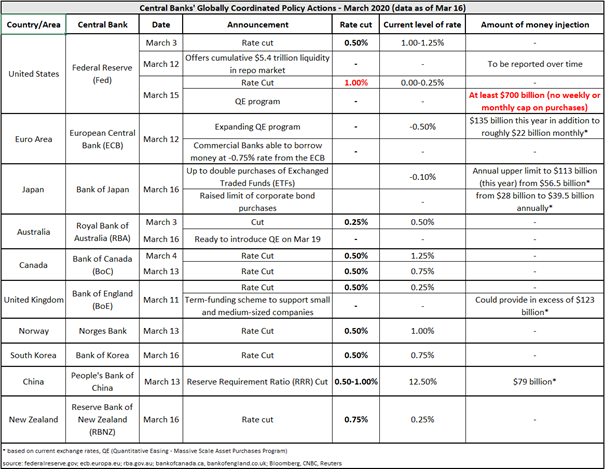

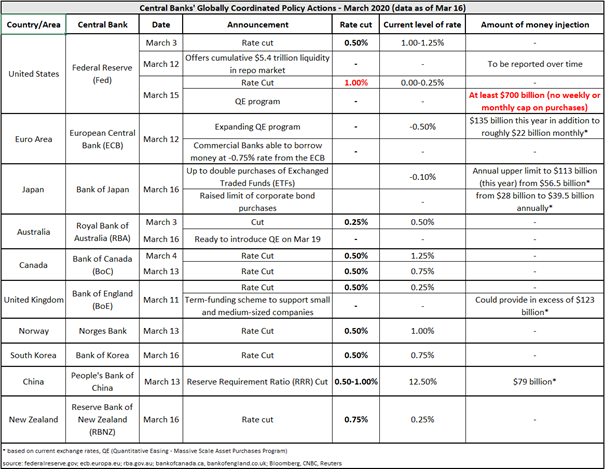

At the beginning let's remind us that it has all started on March 3 when the Reserve Bank of Australia has cut rates by 0.25% to 0.50% level. Subsequently, the Federal Reserve has cut rates by 0.50% after the first emergency meeting since October 2008 or the last fin. crisis /2

At the beginning let's remind us that it has all started on March 3 when the Reserve Bank of Australia has cut rates by 0.25% to 0.50% level. Subsequently, the Federal Reserve has cut rates by 0.50% after the first emergency meeting since October 2008 or the last fin. crisis /2