Emperor of @YetAnotherValue. Part time podcast host / blogger; Full time Cookie Monster.

7 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/AndrewRangeley/status/1639239790359920640Consider 2022. Berkshire reported a *very* minor gain in intrinsic value. The price of coal doubled in 2022.

https://twitter.com/chancery_daily/status/1547288639876567041First, the opinion comes in real hot. Buyer's want out because they overpaid / nuked their own financing / claim a fake MAE. Get out of here; court ruling is a "victory for deal certainty" with all issues resolved for the seller.

https://twitter.com/AndrewRangeley/status/1483859598511587333First, @BenClaremon's interview with $TIGO's CEO (Mauricio) is required listening for background. Mauricio comes off incredibly well and thoughtful, and lays out lots of the bull case and optionality here

https://twitter.com/AndrewRangeley/status/1476263098654904320#2 is cable companies across the globe rip higher.

https://twitter.com/twebs/status/1475918412224282627?s=20

This isn't a troll or anything. $AAN's is at ~3.5x EBITDA and buying back shares, and I do understand that RTO is a massive value add for consumers living paycheck to paycheck.

This isn't a troll or anything. $AAN's is at ~3.5x EBITDA and buying back shares, and I do understand that RTO is a massive value add for consumers living paycheck to paycheck.

https://twitter.com/AndrewRangeley/status/1470815669323239427The elephant in the room here is alignment. $FTAI is externally managed, and insider ownership is extremely low. The big worry is the company is incentivized to grow assets regardless of shareholder value

https://twitter.com/AndrewRangeley/status/1470071821307465739First, I'll just say I'm angry I missed the start of this move. @hkuppy had been telling me for months to look at $LEE, and I wrote how local news could be the new "clicks to bricks" back in August

https://twitter.com/AndrewRangeley/status/1467933594970697730Honestly, this is a pretty simple value thesis. Stock's in the high $40s, so you're at ~1.2x book. ROE is currently over 20%; stocks with 20% ROE don't trade at 1.2x book for long (of course, assumes ROE is sustainable!)

https://twitter.com/AndrewRangeley/status/1460592959800369154$DFIN was spun out of $RRD a few years ago. Literally a pitch perfect example of a value accrettive spin; take a legacy biz with a lot of cash flow, let it focus on itself and pivot to a higher growth / value biz with their strategic relationships / knowledge.

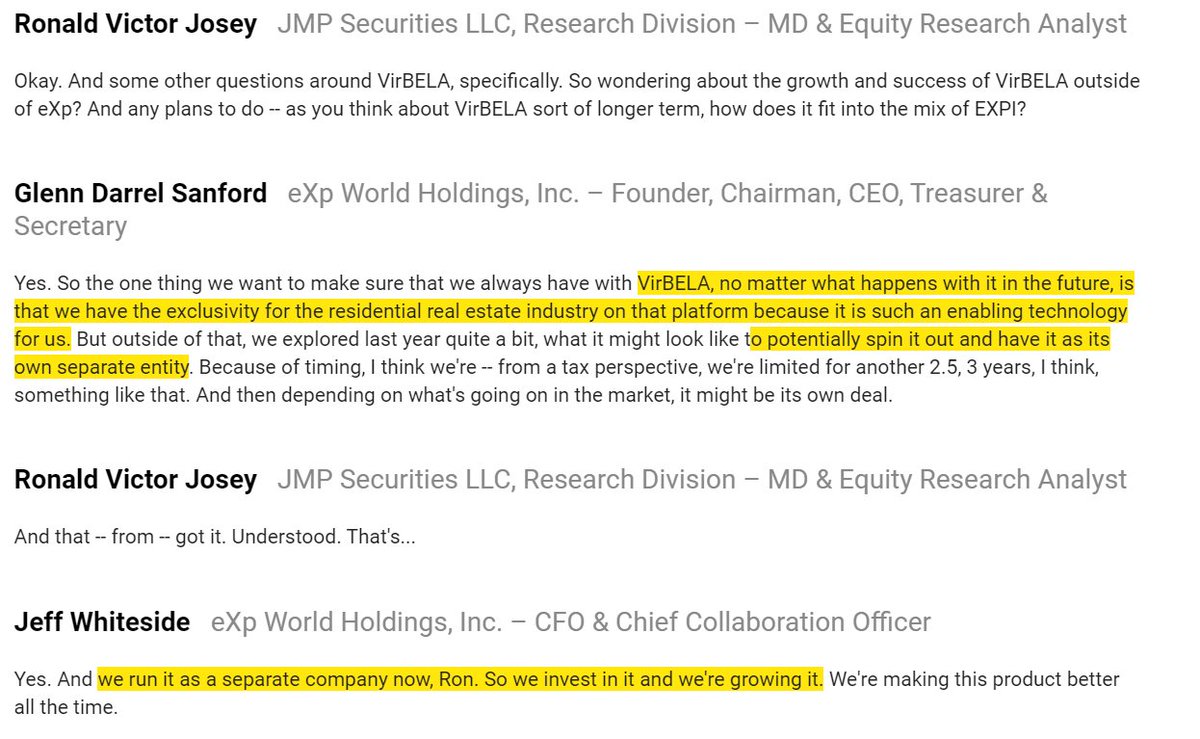

VirBELA also interests me. The stuff I see on their website (virbela.com) reminds me of the Sims from the early 2000s.... but it's a critical piece of their business and they might spin it at some point

VirBELA also interests me. The stuff I see on their website (virbela.com) reminds me of the Sims from the early 2000s.... but it's a critical piece of their business and they might spin it at some point

https://twitter.com/AndrewRangeley/status/1407669290241777666Just some general background; comping synbio to synthetic chemistry, why Ginkgo decided to focus on standardization.