Hedge Fund manager specialized in commodities. GLORY_WS founder and chairman. Life long learner. 7 MSc. Oxford, Columbia, LSE, JHU, INSA and HEC alumnus

7 subscribers

How to get URL link on X (Twitter) App

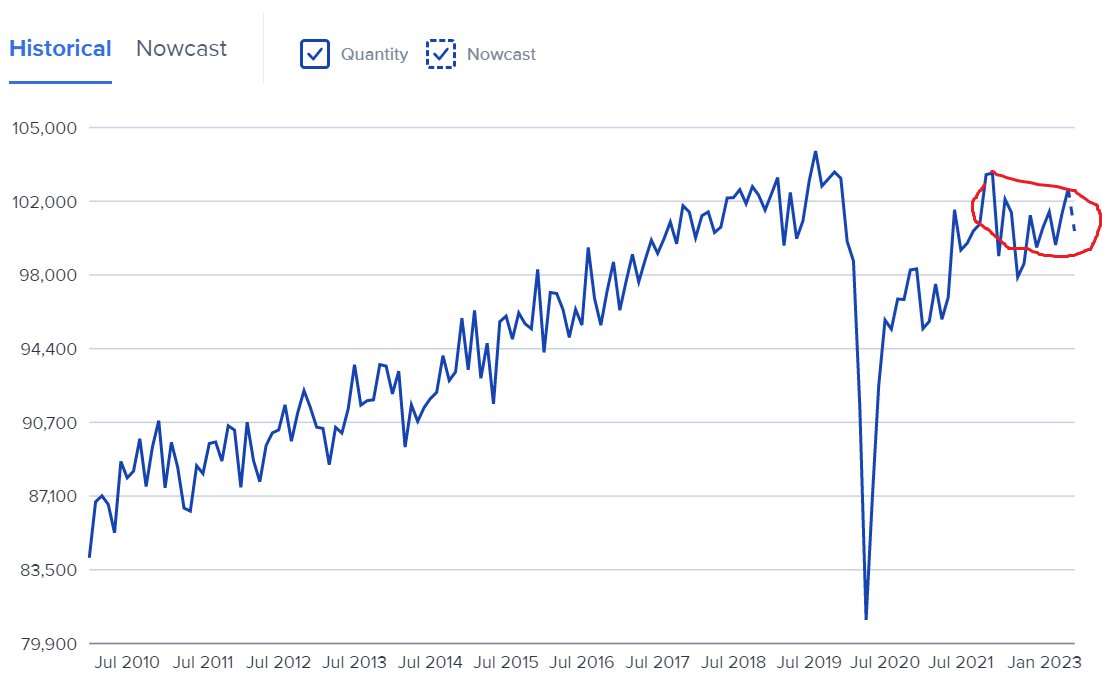

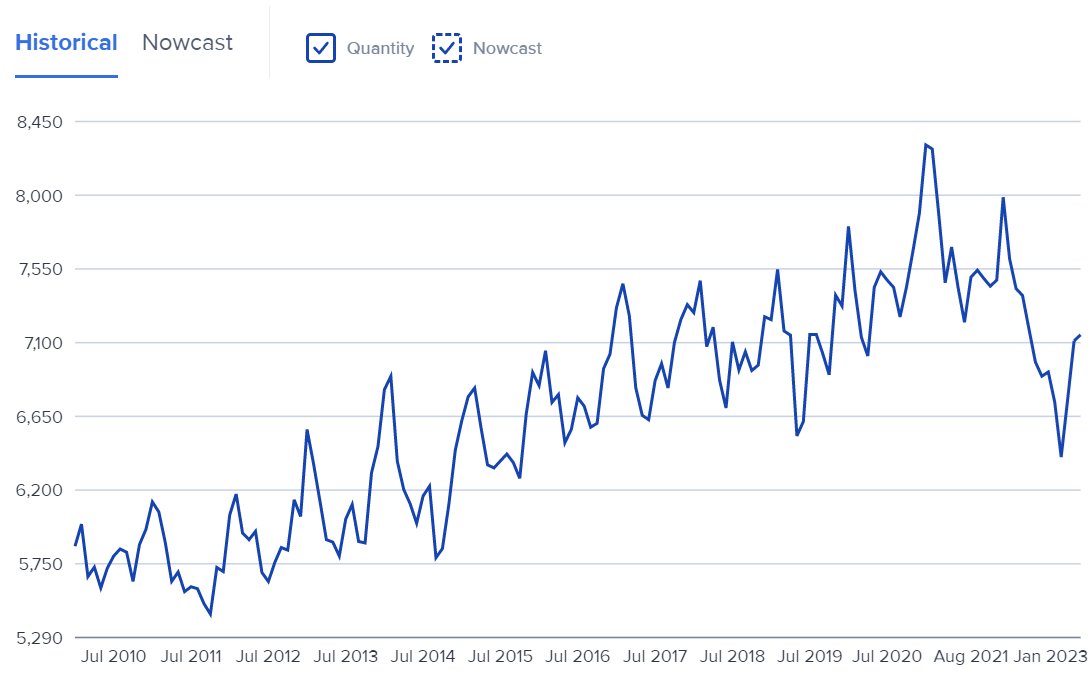

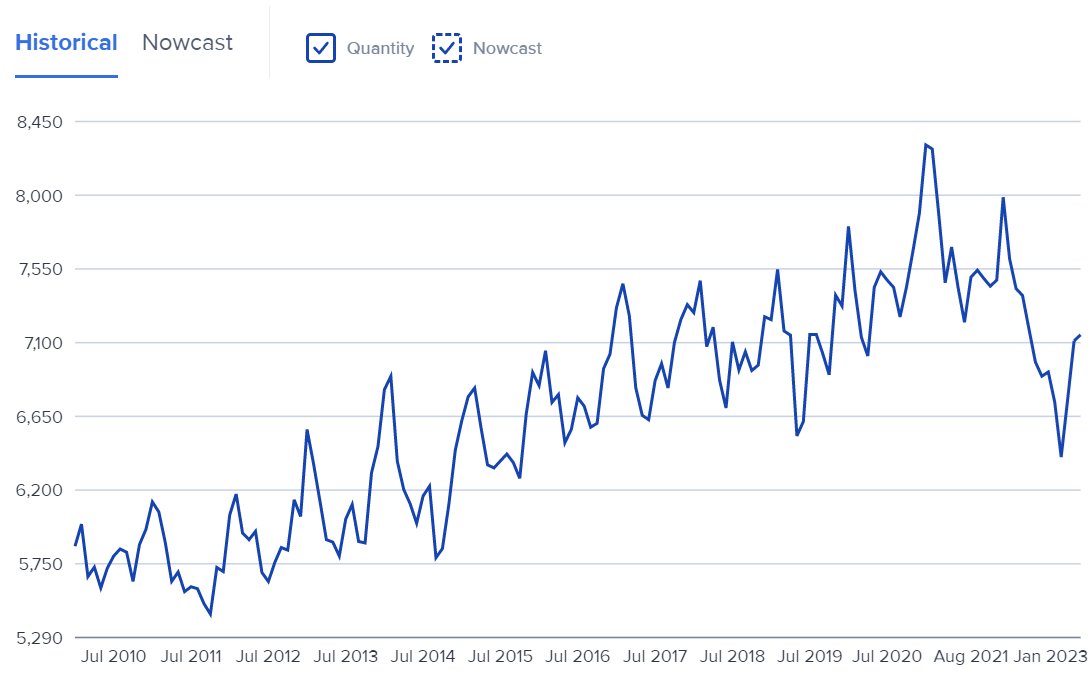

(close to 3.5mbd over 3-4 months) and SPR releases (1mbd+). The demand weakness came mainly from Russia and Ukraine - where demand dropped 600kbd between 2h and q1 - and from China due to rolling lockdowns. Macroeconomic worries, the Fed raising rates, and 2/5

(close to 3.5mbd over 3-4 months) and SPR releases (1mbd+). The demand weakness came mainly from Russia and Ukraine - where demand dropped 600kbd between 2h and q1 - and from China due to rolling lockdowns. Macroeconomic worries, the Fed raising rates, and 2/5