Chief US Economist, Bloomberg LP @economics. Former Fed/CEA/US Treasury, @uchi_economics @UCberkeley. All opinions are my own.

3 subscribers

How to get URL link on X (Twitter) App

2. Schools that didn’t hire as much in July due to uncertainty over budget (recall that ESSER expired at end September) hired in September to catch up.

2. Schools that didn’t hire as much in July due to uncertainty over budget (recall that ESSER expired at end September) hired in September to catch up.

Don’t think the 2.4 mil “other” immigrants are becoming teachers, in health care, or taking government jobs…

Don’t think the 2.4 mil “other” immigrants are becoming teachers, in health care, or taking government jobs…

We highlight two reasons why unemployed aren't apply for claims: 1) eligibility is at all time low pre-recession. and 2) UI benefits not catching up with inflation, opportunity cost of collecting benefits higher than ever before.

We highlight two reasons why unemployed aren't apply for claims: 1) eligibility is at all time low pre-recession. and 2) UI benefits not catching up with inflation, opportunity cost of collecting benefits higher than ever before.

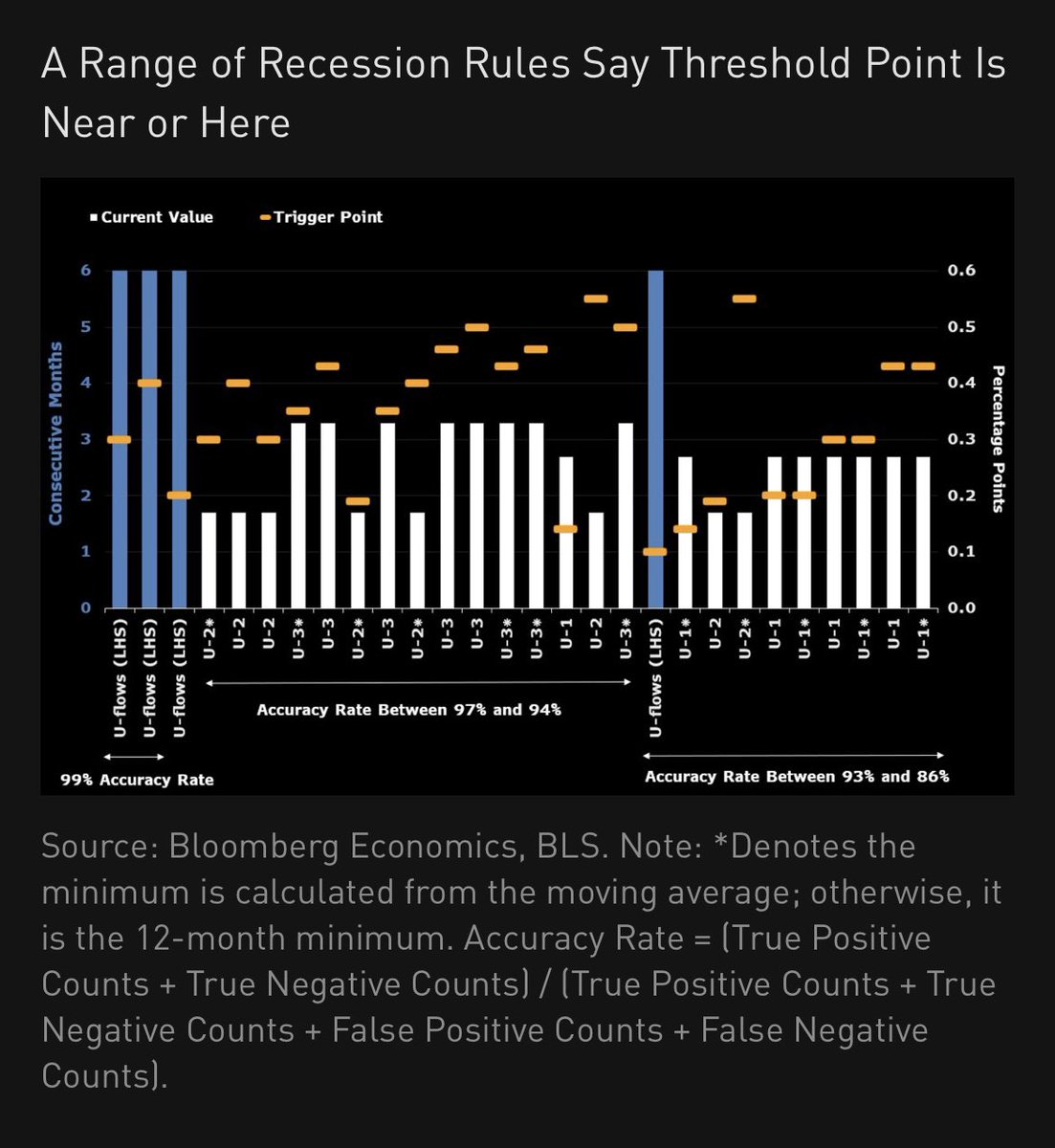

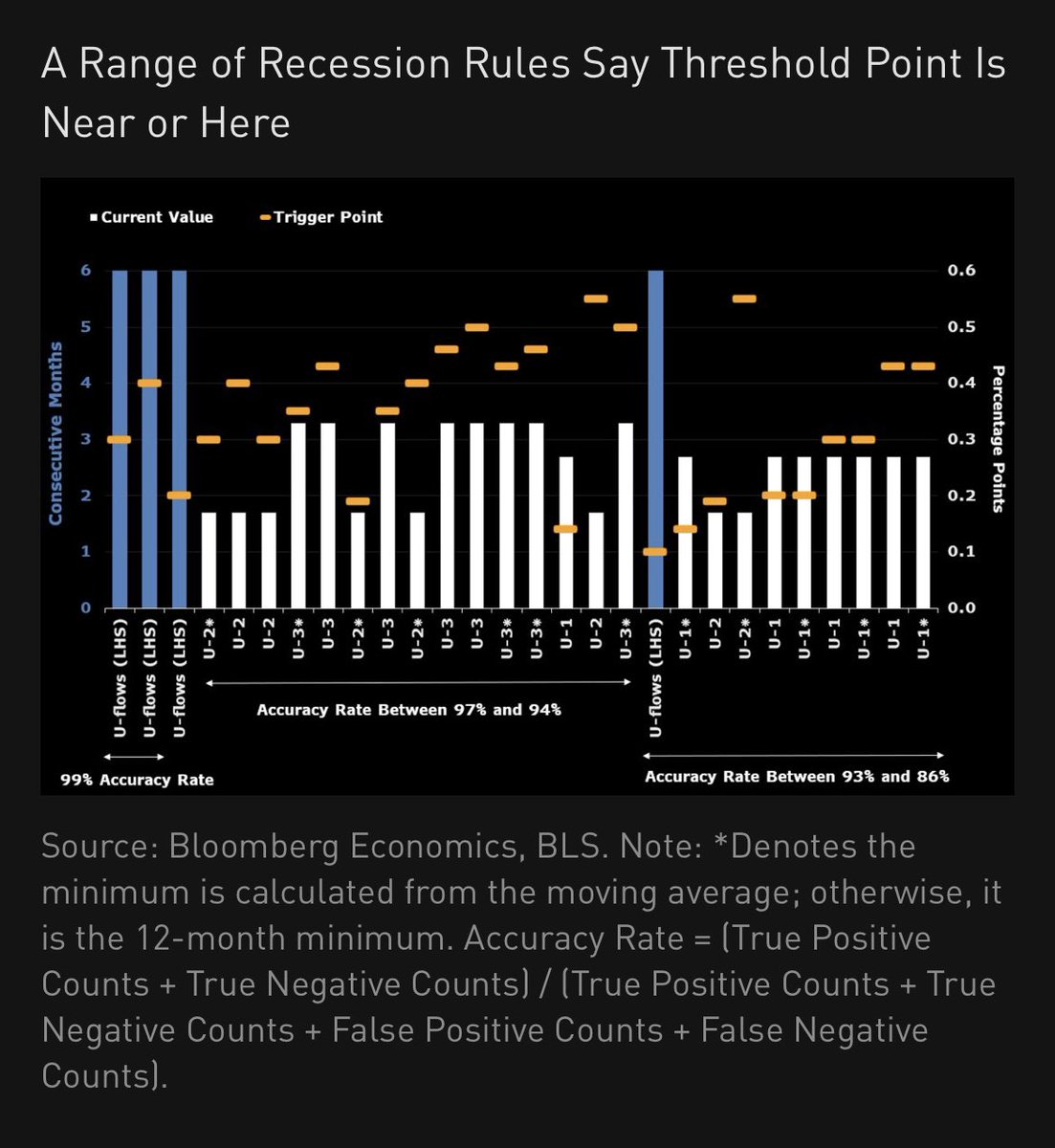

All those rules are highly accurate. Since wwii, unemployment from trough to peak either rise by less than 0.5ppt, or more than 1.9 ppt (recessions). No intermediate values. Plausible argument for why this time is different next (2/5)

All those rules are highly accurate. Since wwii, unemployment from trough to peak either rise by less than 0.5ppt, or more than 1.9 ppt (recessions). No intermediate values. Plausible argument for why this time is different next (2/5)