Arby's Freedom Beacon 🥈🦅🛠

Lighting the path to your independence: silver stacking, IRA rollovers, blue-collar skills, troubleshooting, health & more.

How to get URL link on X (Twitter) App

Cruise in the highest gear possible at 45–55 mph whenever safe/legal. My 9-speed drops into 9th gear around 50–52 mph. RPM falls to ~1300–1500. Instantaneous mpg jumps to 40+.🔑⚙️

Cruise in the highest gear possible at 45–55 mph whenever safe/legal. My 9-speed drops into 9th gear around 50–52 mph. RPM falls to ~1300–1500. Instantaneous mpg jumps to 40+.🔑⚙️

Their LIES:

Their LIES:

That fire in my gut isn't just about charts or ounces; it's about the bigger picture I see crystal clear.

That fire in my gut isn't just about charts or ounces; it's about the bigger picture I see crystal clear.

First, the specs:🔋Samsung's silver-carbon (Ag-C) anode crushes lithium-ion. Energy density hits 500 Wh/kg—nearly double today's batteries. Charges to 80% in 9 mins, lasts 20 years (2,000 cycles = 1.2M miles). Safer, no flammables. Prototypes ready; mass production 2026-2027. Buckle up!

First, the specs:🔋Samsung's silver-carbon (Ag-C) anode crushes lithium-ion. Energy density hits 500 Wh/kg—nearly double today's batteries. Charges to 80% in 9 mins, lasts 20 years (2,000 cycles = 1.2M miles). Safer, no flammables. Prototypes ready; mass production 2026-2027. Buckle up!

Grok-

Grok-

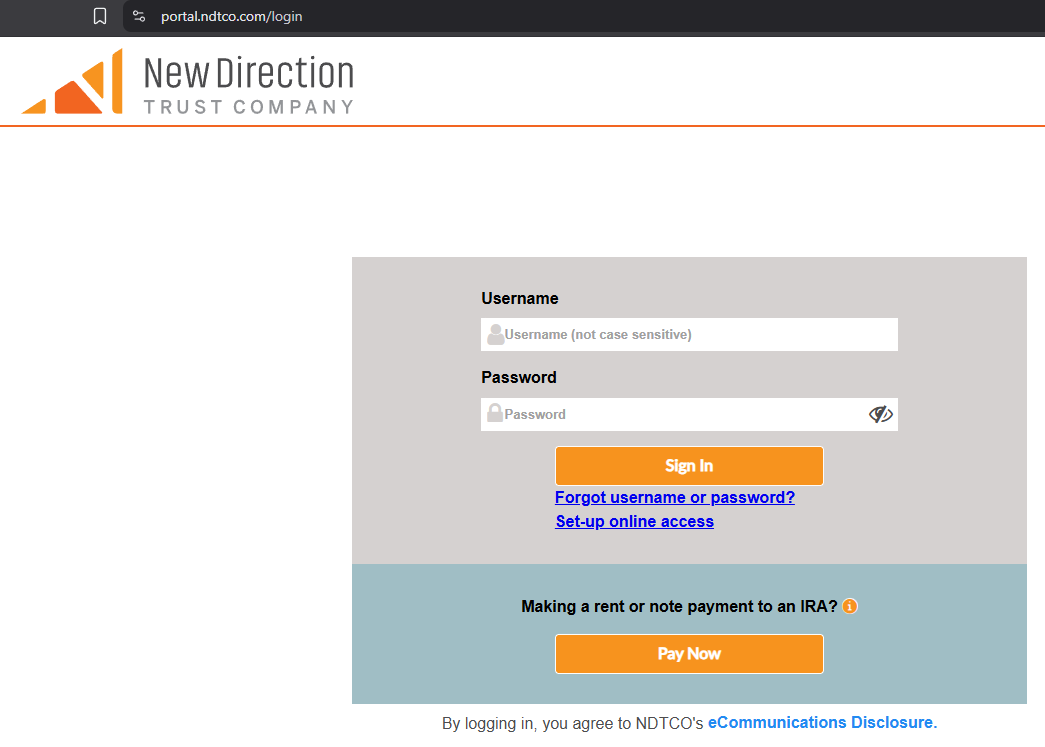

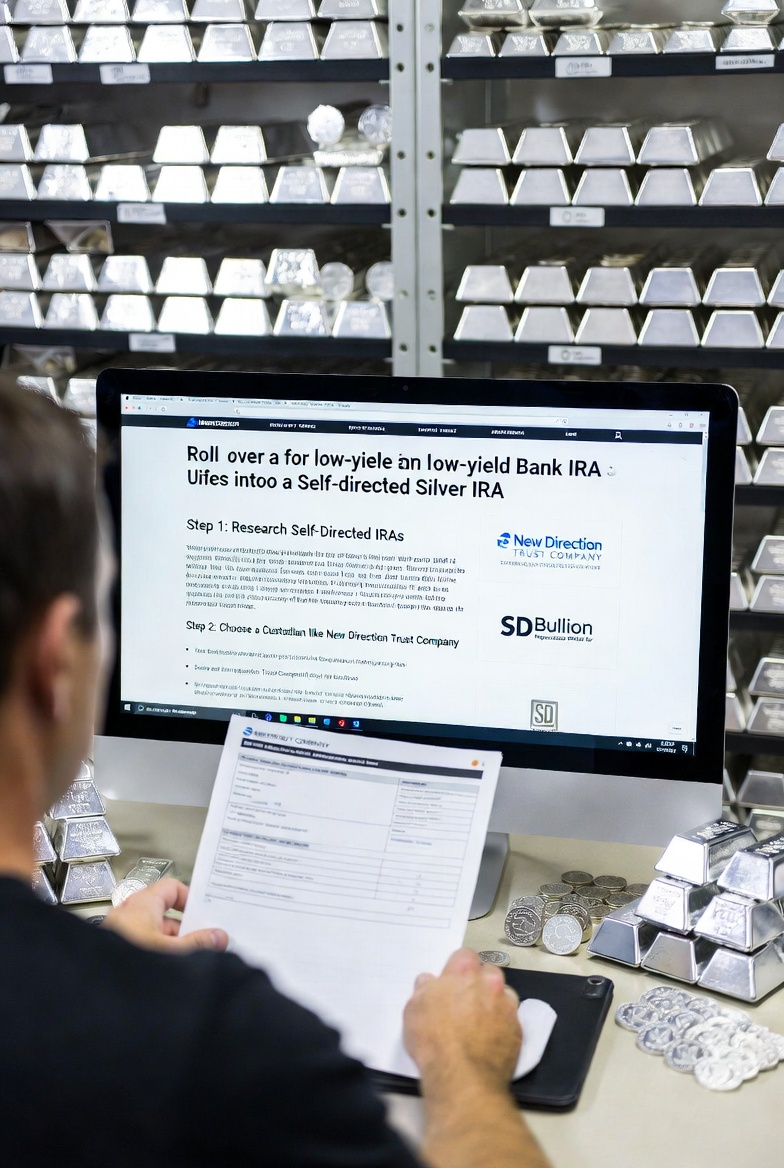

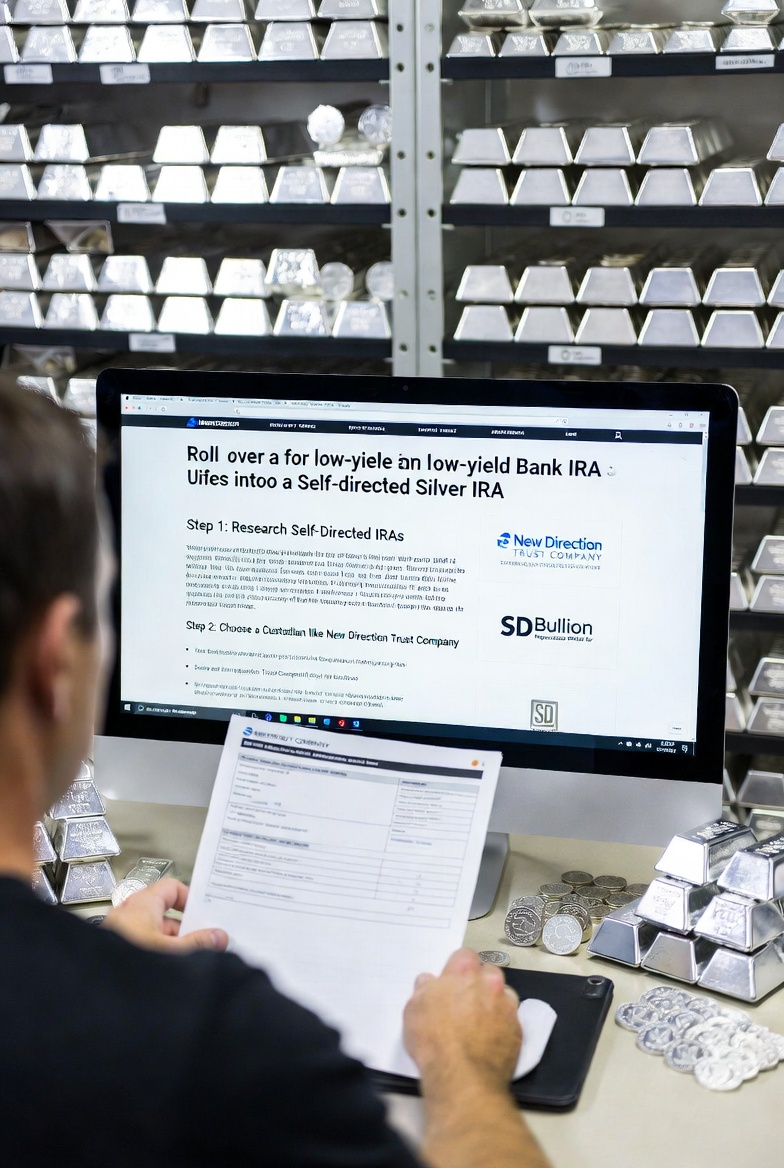

First, log into your NDTCO portal. Easy peasy.

First, log into your NDTCO portal. Easy peasy.

Step 1: Research & Choose Custodian

Step 1: Research & Choose Custodian

@myhiddenvalue 2/10 (poll at end)

@myhiddenvalue 2/10 (poll at end)