Engineer by choice, writer by passion, and full-time gambler by heart.

DeFi Research.

@tokemakXYZ

How to get URL link on X (Twitter) App

2/ Autopilot - pool allocator that optimizes yield across all assets and DEXs present in an LMP - no need to monitor yields or hop between pools, let Autopilot do the heavy lifting without worrying about gas costs;

2/ Autopilot - pool allocator that optimizes yield across all assets and DEXs present in an LMP - no need to monitor yields or hop between pools, let Autopilot do the heavy lifting without worrying about gas costs;

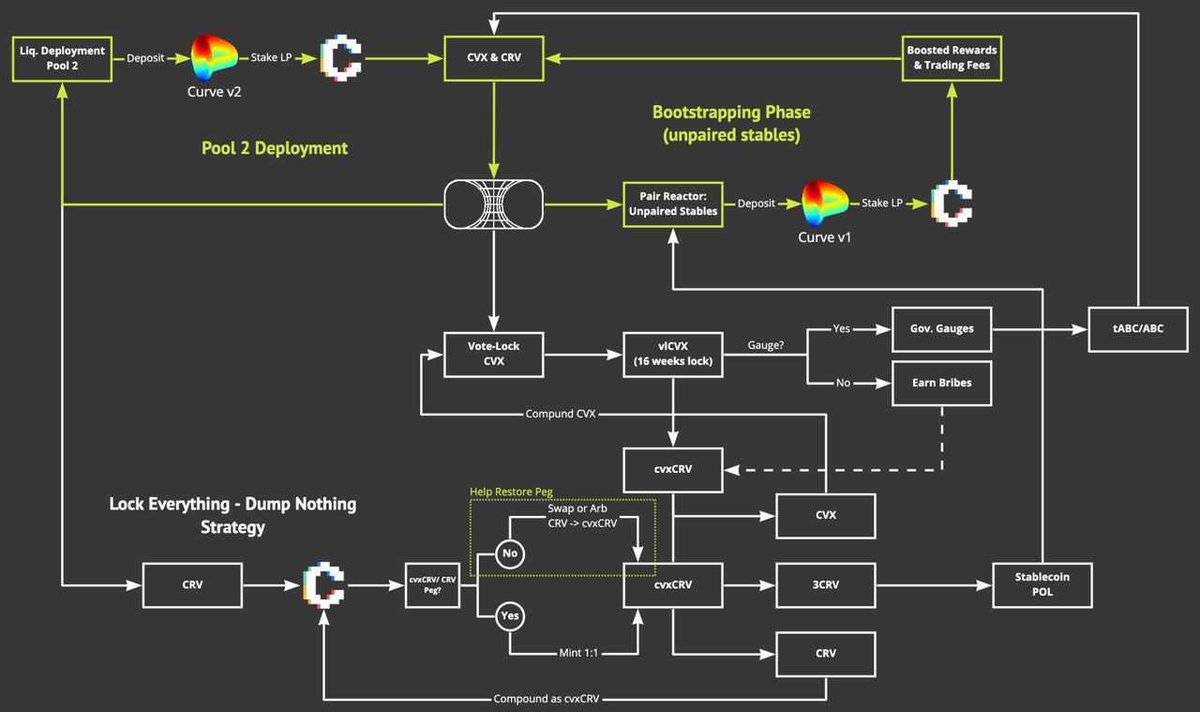

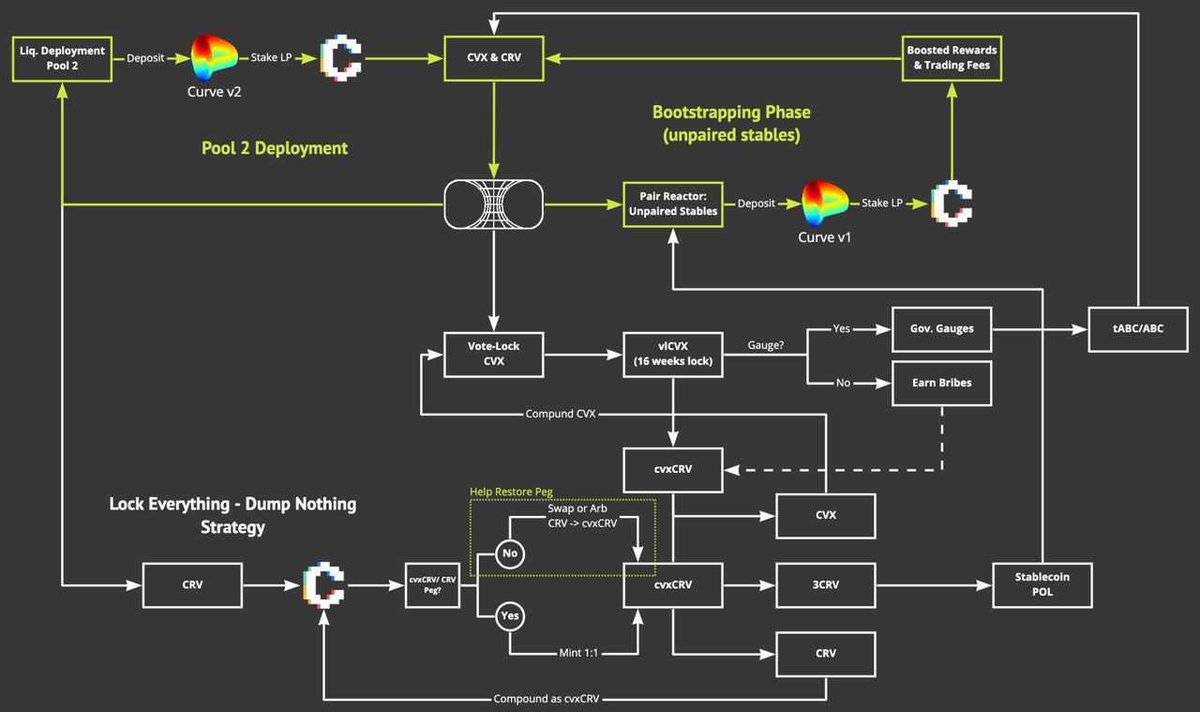

2) Both extremes of the bell curve understand that the goal is for Tokemak to become DeFi's LP governed by TOKE. As a decentralized market maker, Tokemak is a dual-sided system (Token & Pair Reactors) that aggregates liquidity with single-sided exposure and mitigated IL risks.

2) Both extremes of the bell curve understand that the goal is for Tokemak to become DeFi's LP governed by TOKE. As a decentralized market maker, Tokemak is a dual-sided system (Token & Pair Reactors) that aggregates liquidity with single-sided exposure and mitigated IL risks.

https://twitter.com/wvaeu/status/14256968893457448982) Instead of directly buying TOKE, protocols are empowered with a "borrow to bootstrap" model. As long as borrow interest rates are lower than the reactor's LD TOKE yield, the protocol is able to increase its treasury while simultaneously directing liquidity to its pools.